Why Shorting Bitcoin Is Usually a Bad Idea

Shorting Bitcoin is not always irrational. In some specific situations, a disciplined trader can use short positions to manage risk, hedge exposure or express a short-term view. But there is a big difference between tactical hedging and the belief that Bitcoin is destined to fall indefinitely. When a short position turns into a long-term conviction that “this asset must collapse,” history shows that the risk–reward balance often becomes very unfavourable.

This article does not celebrate price increases or encourage speculation. Instead, it takes an educational look at why shorting Bitcoin is structurally difficult, why so many traders underestimate the risks, and how to think more carefully about both sides of the market.

1. The Basic Math: Limited Downside, Open-Ended Upside

The first problem with shorting Bitcoin is simple arithmetic. If you hold Bitcoin, the maximum you can lose is 100% of your position. If you short Bitcoin, the maximum you can lose is, in theory, unlimited, because the price has no upper bound.

Consider two investors:

- Investor A buys 1 BTC at 80,000 USD. The worst possible outcome is that Bitcoin eventually goes to zero and they lose 80,000 USD.

- Investor B shorts 1 BTC at 80,000 USD. If Bitcoin rises to 160,000 USD, their loss is 80,000 USD. If it rises to 240,000 USD, the loss is 160,000 USD, and so on. There is no natural ceiling.

In practice, margin requirements usually force short positions to be closed long before losses become infinite. But that is exactly the point: a short can blow up your account long before your long-term thesis is ever tested. You do not need to be wrong about the final destination; you only need to be early or positioned too aggressively.

Asymmetric payoff is not unique to Bitcoin, but Bitcoin’s high volatility and capacity for sharp rallies amplify this problem. An asset that can rise 30%, 50% or 100% in a relatively short time can push a short position into forced liquidation before the market has any chance to prove you “right”.

2. A Short Position Is a Bet Against Adoption and Time

A second structural issue: when you short Bitcoin for longer than a brief trading window, you are not just shorting a price. You are effectively shorting a set of long-term trends:

- Increasing awareness of digital assets among both retail and institutions.

- Gradual integration of Bitcoin into financial products, such as exchange-traded products and custodial solutions.

- Growing interest from corporates and funds in diversifying reserves or exploring digital stores of value.

- A fixed supply schedule that is not influenced by central-bank policy.

None of these factors guarantee that the price will always rise. They do, however, create a structural bias against the idea that Bitcoin will simply fade away. To maintain a large, long-term short, you must believe that adoption will stall or reverse, that infrastructure will become less robust, and that people will collectively decide this asset is no longer interesting.

This is possible, but historically it has been an expensive assumption. Many traders who shorted Bitcoin in previous cycles based on the belief that “the story is over” discovered that narratives can revive, infrastructure can improve and new participants can arrive just when sentiment looks worst.

3. Volatility: Friend of the Long, Enemy of the Short

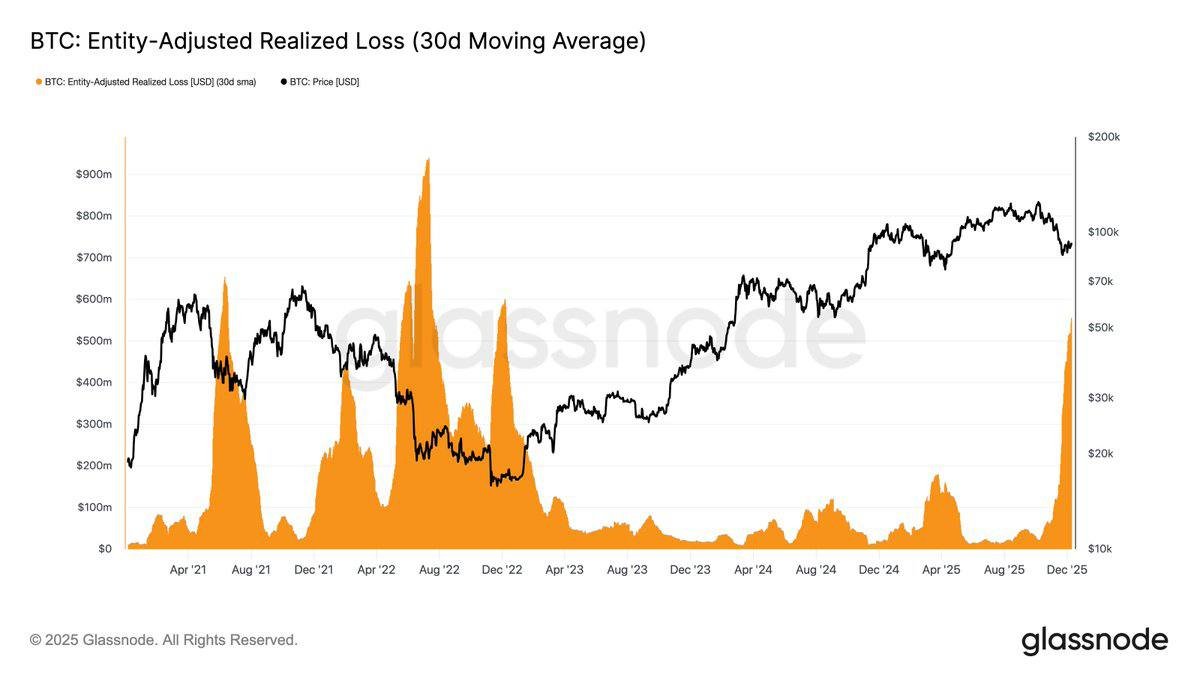

Bitcoin is one of the most volatile large-scale assets in global markets. This volatility cuts both ways, but it is particularly dangerous for short sellers.

When you hold spot Bitcoin with no leverage, volatility is uncomfortable but survivable if your time horizon is long enough and your position size is reasonable. You can choose to wait out drawdowns, reassess your thesis, or rebalance gradually.

When you are short, volatility interacts with margin and liquidation rules:

- A sharp upward move can trigger margin calls, forcing you to add collateral or close at a loss.

- If you are using high leverage, even modest rallies can liquidate your position.

- Short squeezes — rapid moves higher as shorts are forced to close — are a recurring feature of Bitcoin’s trading landscape.

The uncomfortable reality is that Bitcoin does not need to trend upward forever to hurt shorts. It only needs occasional, powerful rallies. Even in a broader sideways or downward environment, a handful of violent moves can wipe out poorly risk-managed short positions.

4. Funding, Borrow Costs and the “Time Tax” on Shorts

Shorting Bitcoin is rarely free. Depending on the venue and instrument, short sellers face various ongoing costs that act like a time tax on their thesis.

Common examples include:

• Borrow fees: If you short through margin on spot markets, you typically borrow the asset from another participant and pay a fee. When borrow demand is high, this cost can become significant.

• Perpetual contract funding: On many derivatives platforms, perpetual futures use funding payments between long and short traders to keep prices anchored to spot. In phases where the majority is positioned on one side, the minority may receive funding, but at other times shorts end up paying it.

• Roll costs: If you use dated futures, you may need to roll positions periodically, potentially paying a premium to maintain your exposure.

The net effect is that time usually works against a persistent short. If the price moves sideways, the long holder pays nothing for simply owning the asset, while the short can slowly lose capital through fees and funding. For a long-term short thesis to be successful, it must overcome not only the direction of price but also the drag from these structural costs.

5. Psychology: Conviction, Stubbornness and Narrative Traps

Shorting Bitcoin is not just a technical challenge; it is a psychological one. Once someone adopts the narrative that “this asset has no value and must eventually fall to zero,” it becomes very hard to update that view in response to new information.

There are several common traps:

- Anchoring to past prices. Traders remember a prior high or low and assume those levels must be “fair value,” ignoring changes in adoption or macro conditions.

- Selective evidence. Negative news is treated as confirmation, while positive developments in infrastructure or regulation are dismissed.

- Identity risk. Publicly declaring a permanent negative view on Bitcoin can make it harder to change your mind without feeling that you are abandoning your earlier stance.

These psychological factors are dangerous for any investor, but especially for short sellers, because stubbornness can turn a manageable loss into a catastrophic one. Staying open to new data and being willing to close a short position when conditions change is essential, yet emotionally difficult when the position has become part of your identity.

6. Shorting vs. Simply Not Owning

A crucial educational distinction often gets lost: you do not need to short an asset just because you are sceptical about it. For most people, the rational alternative to owning Bitcoin is simply to hold none, or to reduce exposure to a level that matches their risk tolerance.

Shorting, by contrast, is an active decision to take on additional risk. You are not merely avoiding downside; you are creating potential liabilities that can grow as the price rises. This changes the shape of your overall portfolio risk in a way that demands professional-level risk management.

If you are cautious about Bitcoin or believe it is overvalued, some lower-risk approaches might include:

- Holding a smaller allocation relative to other assets.

- Keeping a larger cash or treasury position to offset volatility.

- Rebalancing periodically instead of trying to time tops and bottoms.

All of these approaches reduce exposure without incurring the asymmetric risk profile of a short position. For many long-term savers and investors, this is a more appropriate way to reflect scepticism or caution.

7. When Does Shorting Make More Sense?

None of this means that shorting Bitcoin is inherently irrational in every context. There are specialised circumstances where it can be a legitimate tool, if used with care:

• Hedging an existing long position. A miner, business or fund that already holds significant Bitcoin exposure might short in derivatives markets to reduce risk during specific events or time windows.

• Relative-value strategies. Some professionals use market-neutral approaches, offsetting a long position in one asset with a short in another, aiming to capture differences in performance rather than a directional move.

• Short-term trading with strict risk limits. Experienced traders may take short positions around clear setups, but typically with predefined stop-loss levels and modest position sizes.

Even in these cases, the key words are discipline, position sizing and time horizon. The risk is not the existence of shorting as a tool, but the idea that a short can be safely maintained for long periods purely on the assumption that Bitcoin must eventually decline.

8. Historical Context: Cycles, Drawdowns and Recoveries

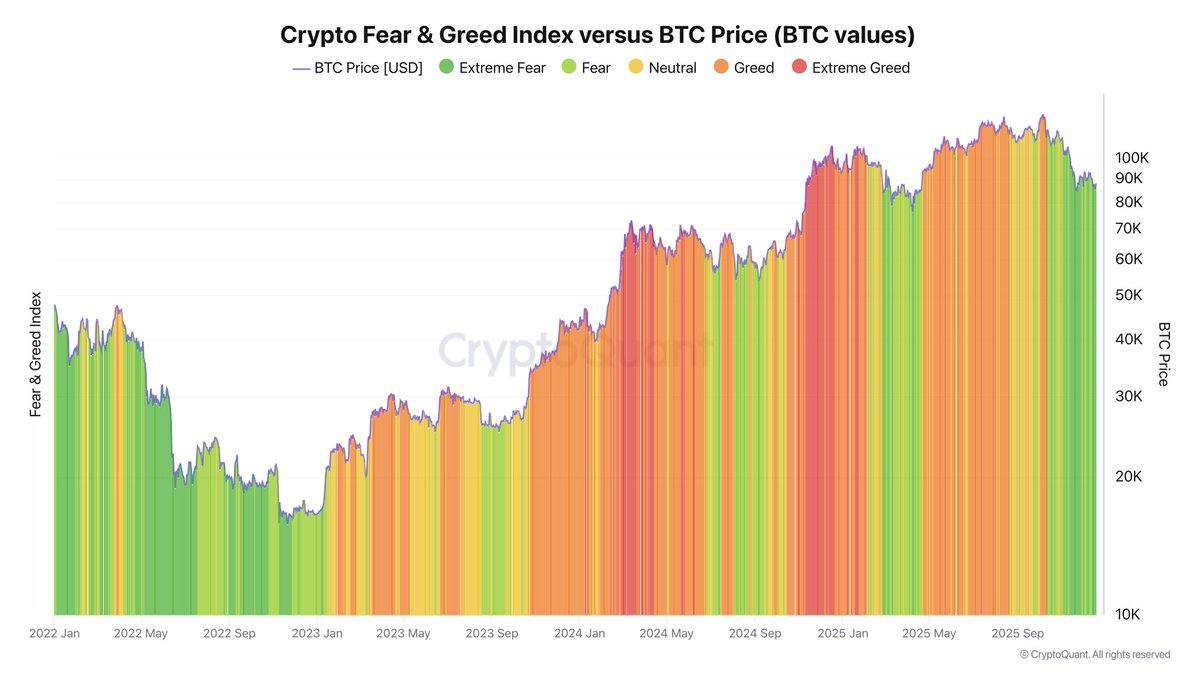

Looking back at Bitcoin’s history, we see repeated cycles of strong rallies, deep corrections and eventual recoveries. Each major drawdown has generated a wave of predictions that “this time, it is over.” Yet so far, each cycle has also brought:

- Higher levels of infrastructure maturity (custody, compliance, analytics).

- New institutional participants and product offerings.

- Broader cultural awareness of digital assets as a concept.

This does not mean that past performance will replicate forever, nor that every cycle will behave the same. It does, however, illustrate why structural, long-term short positions have historically struggled. Each time the narrative of permanent decline gains momentum, improvements in technology, policy and adoption have tended to re-build the case for ongoing relevance.

From an educational standpoint, the lesson is humility: markets can stay irrational longer than traders expect, and assets with strong communities and evolving use cases are hard to dismiss entirely, even after severe drawdowns.

9. Aligning Strategy with Knowledge and Time

Shorting Bitcoin successfully over time requires three things that are far from trivial:

- Deep understanding of market structure. This includes funding dynamics, liquidity pockets, derivatives flows and typical behaviour around major macro events.

- Robust risk management systems. Clear rules about leverage, maximum loss, and when to exit positions are essential.

- Emotional resilience. The ability to stay calm during sharp moves, adjust when wrong and avoid turning conviction into inflexibility.

Most individual participants do not have the time, tools or experience to manage all of these consistently. That is why, for many people, shorting Bitcoin is less an opportunity and more an unnecessary layer of complexity and risk.

10. Key Takeaways: Why Shorting Bitcoin Is Usually a Bad Idea

Bringing the main points together, we can summarise the case as follows:

• Asymmetric risk: Losses on a short can grow without a natural upper limit, while gains are capped at 100% if the asset goes to zero.

• Structural headwinds: Adoption trends, product development and integration into financial markets create ongoing challenges for long-term negative theses.

• Volatility risk: Sudden rallies can liquidate short positions even if the broader trend later turns down.

• Cost of carry: Borrow fees, funding and roll costs mean time usually works against short sellers in the absence of a clear downward move.

• Psychological pitfalls: Narrative attachment and identity can make it harder to exit losing shorts, increasing the chance of large losses.

• Simpler alternatives exist: If you are sceptical about Bitcoin, holding less or none is often more rational than maintaining a large, leveraged short.

None of this implies that Bitcoin will always go up, or that caution is unnecessary. It simply means that being cautious does not require shorting. Risk can be managed through diversification, sensible position sizing and clear time horizons, rather than through strategies that expose you to open-ended loss.

Ultimately, the question is not whether shorting Bitcoin is “good” or “bad” in a moral sense. The better question is: does this strategy realistically fit my knowledge, tools, risk tolerance and time? For many participants, the honest answer is no — and that is perfectly acceptable. You do not need to fight an asset to manage your exposure to it.

Disclaimer: This article is for educational and informational purposes only and does not constitute investment, trading, legal or tax advice. Digital assets are volatile and involve risk, including potential loss of principal. Always conduct your own research and consult a qualified professional before making financial decisions.