Bitcoin’s Fragile Range: When the Market Feels Heavy but Not Broken

Bitcoin is once again in one of those phases that feel uncomfortable from almost every angle. Price is holding in a relatively tight band below the all-time high, but the foundation under that band looks fragile: realized losses are increasing, long-term holders are distributing more aggressively than earlier in the year, and new demand channels such as spot ETFs and fresh liquidity are noticeably quieter. At the same time, options markets are starting to price in a burst of short-term volatility around the Federal Reserve’s upcoming FOMC meeting, even as spot and futures volumes stay muted.

It is tempting to summarise this as 'price stuck, market tired' and move on. But the underlying mechanics are more nuanced. A fragile range is still a range – a temporary balance between supply and demand – and reading that balance correctly often matters more than guessing the next move. In this article, we break down the key moving parts: loss realization, long-term holder behaviour, ETF and liquidity trends, derivatives positioning, and the macro layer that hangs over everything.

1. Losses Are Rising – But What Does That Really Mean?

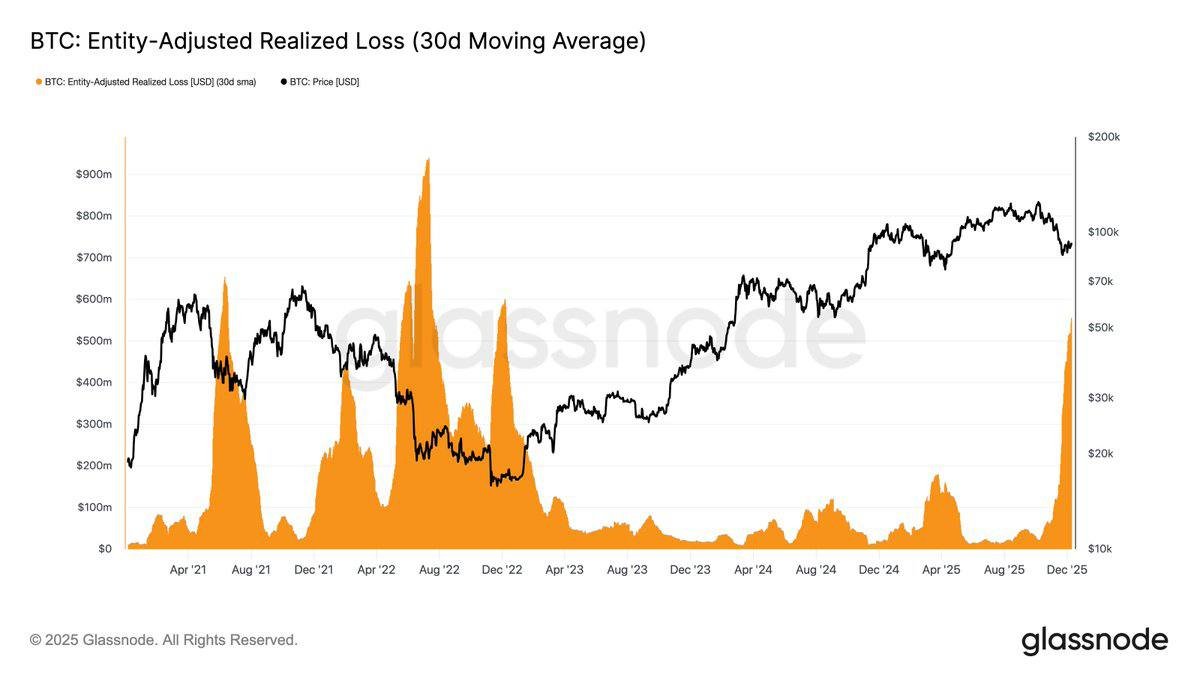

When analysts say that 'losses are rising,' they usually refer to on-chain metrics such as realized loss: the total dollar value of coins that move on-chain at a price below their last on-chain cost basis. In simple terms, it shows how much pain is being crystallised by participants who decide to sell at a loss rather than sit through volatility.

In the current environment, three features stand out:

• More coins are being spent below cost. After a long stretch in which most selling came from highly profitable cohorts, we are seeing a gradual increase in transactions where coins change hands at a realized loss. That often happens after a failed breakout: late entrants who bought near the highs become impatient, especially when price moves sideways rather than snapping back quickly.

• Losses are meaningful but not extreme. The current level of realized loss is elevated relative to the euphoria phase of the run-up, but still well below historic capitulation events. This suggests a market that is under pressure, not in full panic. Many holders are tolerating drawdowns; a subset is choosing to exit.

• The distribution is uneven across cohorts. Short-term holders, who bought within the last few months, are naturally the most exposed to being under water. But on-chain data also show an uptick in older coins moving, which brings us to the next point.

On its own, rising realized loss is neither purely bearish nor purely bullish. In past cycles, some of the healthiest long-term bottoms formed in environments where losses were heavy, because they flushed out weaker hands and reset the cost basis of the market. The difference now is that we are not at obviously depressed prices; Bitcoin is consolidating at high absolute levels. That makes the current episode more about rotation and risk-management than about total capitulation.

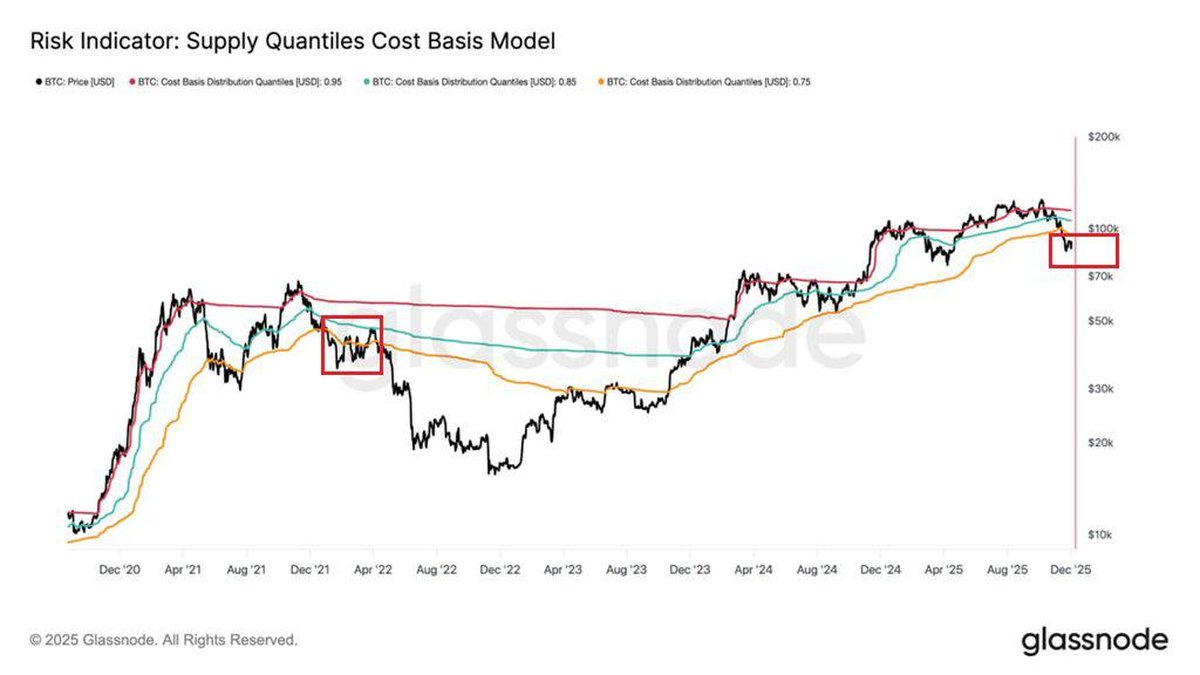

2. Long-Term Holders Are Selling More – Structural Shift or Normal Rotation?

One of Bitcoin’s most watched behavioural indicators is what long-term holders (often defined as coins unmoved for more than 155 days or 1 year) are doing. Historically, these addresses have been relatively insensitive to short-term volatility. When they start to distribute, market participants pay attention.

Recently, several trends have emerged:

• Net distribution from older wallets. After a long accumulation phase, long-term holders are spending more coins than they receive. That selling tends to occur into strength, as they take profits near higher price brackets rather than waiting for a perfect top.

• Realised price for long-term supply remains low. Even with increased distribution, the average cost basis of long-term holders is still far below current spot levels. That means they can sell some portion of holdings without coming close to exhausting their profit cushion.

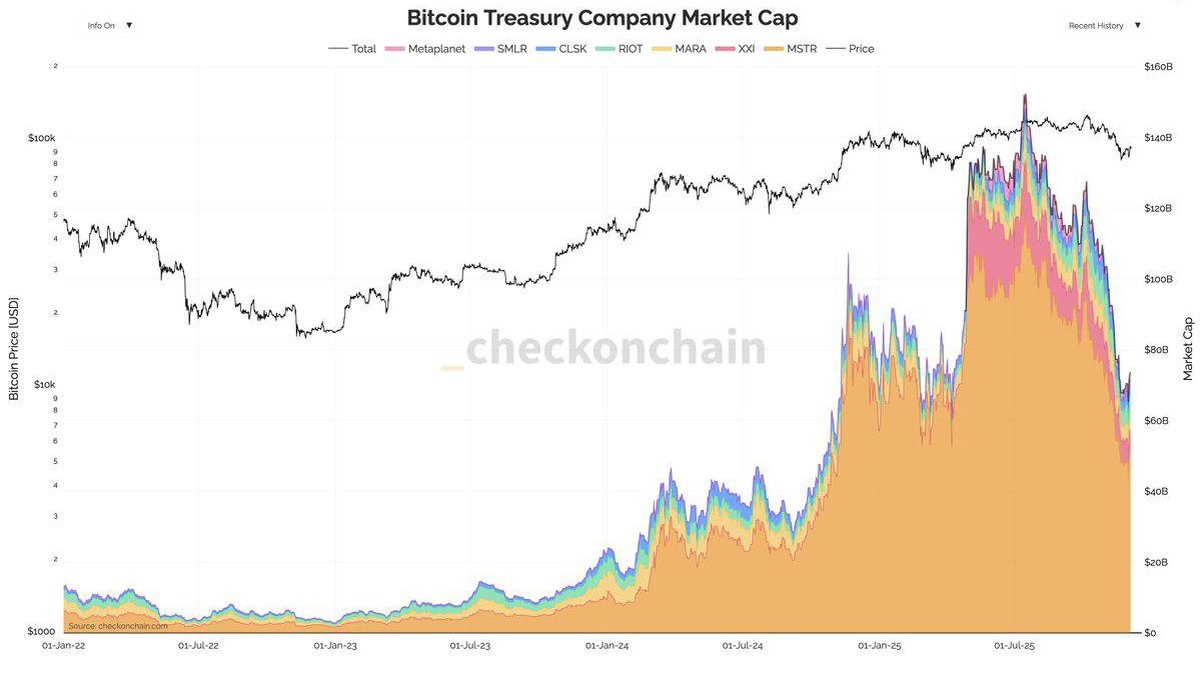

• Younger cohorts are absorbing part of the flow. Exchanges, ETFs and newer on-chain buyers are taking the other side of these sales, but less aggressively than earlier in the year. That mutes the directional impact while still allowing supply to leak into the market.

From a structural perspective, some level of long-term holder distribution is both inevitable and healthy. Without it, liquidity would be too thin to support institutional adoption. The key question is whether the current wave of selling represents an early, controlled rotation from patient holders into new owners, or a loss of conviction from the cohort that historically anchors market cycles.

So far, the evidence points to the former. Long-term holder supply is declining modestly from near-record levels, not collapsing. But the psychological effect is real: when on-chain dashboards flag 'LTH distribution' at the same time as ETF flows cool, the narrative easily shifts from 'strong hands in control' to 'smart money is exiting.' That narrative, in turn, weighs on risk appetite even if the actual selling pace is orderly.

3. Quiet ETFs and Thin Liquidity: The Demand Side of the Story

On the demand side, spot ETF flows and exchange liquidity have clearly downshifted compared with the hottest phases of the year. Earlier in the cycle, waves of inflows into newly launched products created a powerful, mechanical buyer that absorbed supply almost regardless of short-term headlines. Recently, those inflows have become mixed and sporadic: some days of modest net buying, others of net redemptions, and few sustained streaks of strong net inflows.

In parallel, order book depth on major venues is thinner than during the last leg toward all-time highs. Wide spreads are not the issue; rather, the quantity of resting bids and offers at each level is lighter, so a given market order can move price more. This combination of cooler ETF flows and less robust liquidity has two important consequences:

- Upside moves struggle to sustain momentum. Without a constant 'drip' of ETF demand, breakouts rely more on discretionary buyers. When those buyers hesitate, rallies fade quickly.

- Downside wicks can extend further than expected. In a thin order book, a burst of selling from long-term holders or large funds can push price through several support levels before sufficient demand appears.

The net effect is a market that feels heavier than the headline price might suggest. Even though Bitcoin is still trading near cycle highs in nominal terms, the marginal bid is not as enthusiastic as it was when the ETF narrative was fresh. That is a classic recipe for range-bound conditions: not enough capitulation for a deep reset, but not enough new capital for a breakout.

4. Futures Are Calm, Options Are Nervous

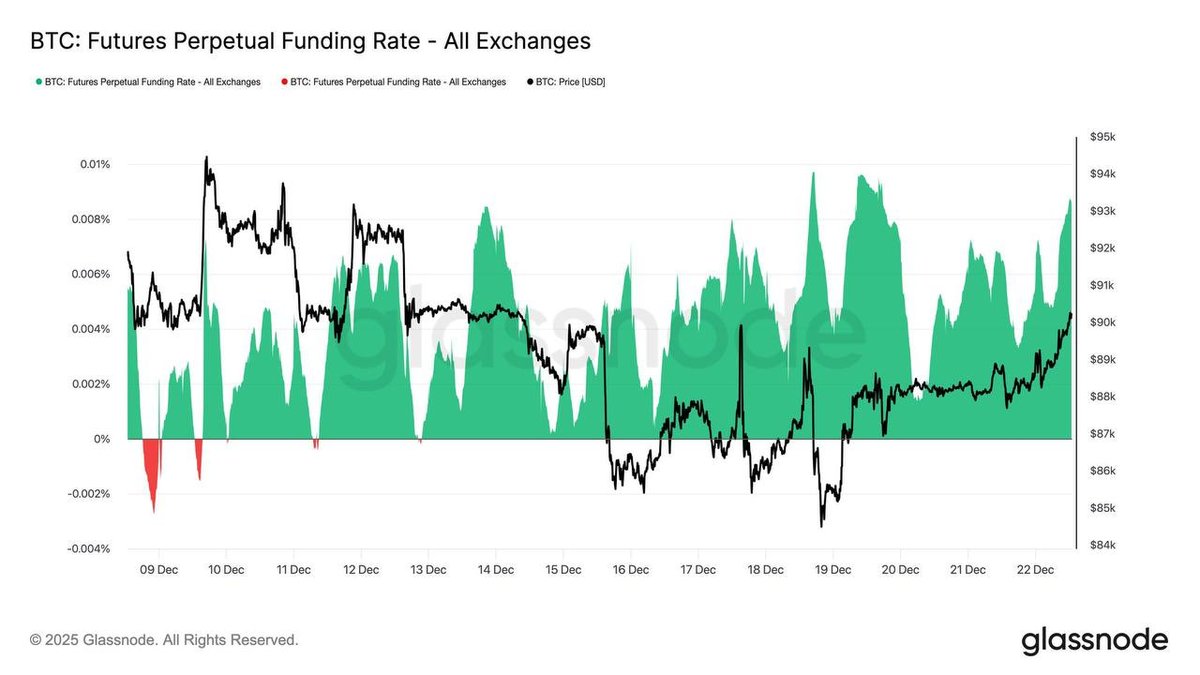

Derivatives markets add another layer to this picture. On the futures side, activity has cooled alongside spot. Open interest has stabilized rather than climbing to new extremes, and funding rates or basis spreads (the premium of futures over spot) are more modest than in earlier, more speculative phases. This suggests that leveraged directional positioning is not the primary driver of recent price action.

Options markets, however, tell a slightly different story. As the FOMC meeting approaches, implied volatility in short-dated options – especially those that expire just after the decision – has ticked higher. This is a classic pattern in liquid markets: when a major macro event looms, participants pay up for optionality to protect existing exposures or to express views on the size of the potential move.

Several details are worth highlighting:

• Term structure develops a 'kink' around the event. Implied volatility for options expiring just after the FOMC date trades above that of both very short-dated and longer-dated maturities. The market, in other words, is assigning extra uncertainty to that specific window.

• Skew can reveal directional worries. If demand for downside protection is stronger, put options may trade at a higher implied volatility than comparable calls, signalling concern about negative surprises. Conversely, if market participants fear missing a rally, call demand may dominate. The exact shape of this skew can change quickly as new information arrives.

• Volume concentrates in event-linked strikes. Activity clusters around price levels that traders view as plausible post-meeting targets, turning those strikes into reference points for short-term narrative battles.

The key takeaway is that, while spot and futures markets look sleepy, options activity indicates that participants expect the calm to break – at least briefly – around the FOMC. That does not say anything about direction by itself; options price magnitude of potential moves, not their sign. But it reinforces the idea that the current range is contingent on macro policy, not purely on crypto-native factors.

5. The Macro Overlay: Why the FOMC Matters So Much Here

Bitcoin’s relationship with macro conditions has evolved. In earlier cycles, the asset sometimes moved largely on its own narratives. In recent years, however, it has behaved more like a high-beta macro asset, sensitive to real yields, dollar liquidity and expectations around central-bank policy. As this FOMC meeting approaches, several points are front of mind for market participants:

• Rate-cut expectations. Markets are pricing a high probability that the Fed will either cut or strongly signal upcoming cuts, reflecting cooler inflation data and concerns over growth. A more accommodative stance usually supports risk assets by easing financial conditions.

• Balance sheet and liquidity. The path of quantitative tightening (QT) versus balance-sheet stabilisation matters for dollar liquidity. When the Fed slows or ends QT, it often indirectly supports valuations of assets that rely on abundant liquidity, including Bitcoin.

• Forward guidance. Even if the immediate decision matches expectations, the tone of Chair Powell’s press conference can shift the entire distribution of outcomes the market is pricing in. Hints of caution or concern about financial stability can counterbalance the mechanical impact of a single rate adjustment.

In a setting where on-chain and ETF signals show a balance between rising supply and muted demand, macro can easily tip the scales. A dovish surprise may encourage participants to re-engage with risk, boosting volumes and helping Bitcoin escape its range to the upside. A more restrictive message could do the opposite, reinforcing the case for caution and giving sellers the upper hand in a thin liquidity environment.

6. How to Read This Phase Without Trying to Predict Every Tick

From an educational standpoint, the current configuration is a useful reminder that markets are complex systems, not one-variable machines. Bitcoin’s fragile range is the intersection of at least four forces:

- Rising realized losses as some participants decide they no longer want to hold through uncertainty.

- Increased distribution from long-term holders taking profits at elevated prices.

- Cooled demand from ETFs and thinner liquidity on major venues, reducing the market’s ability to absorb large flows smoothly.

- Event-driven options positioning around macro policy, which can amplify moves around specific dates.

For individuals and institutions observing this, a few practical mental models can help:

• Separate time horizons. The factors driving Bitcoin over the next week – options expiries, FOMC wording, short-term liquidity pockets – are not necessarily the same as those driving it over the next cycle, such as supply halvings, adoption trends and structural ETF allocations.

• Distinguish between narrative and data. Headlines about 'long-term holders selling' or 'ETF demand drying up' can sound dramatic. Looking at the underlying metrics often reveals more gradual shifts: modest net outflows after a period of strong inflows, or partial profit-taking from older cohorts rather than an exodus.

• Focus on regime, not precision. Instead of trying to guess the exact next price level, it can be more informative to ask: Are we in a liquidity-expansion or liquidity-contraction regime? Is realized volatility trending higher or lower? Are structural buyers (such as ETFs) adding or pausing?

These questions do not eliminate uncertainty, but they help frame it in a way that is less reactive and more analytical.

7. Signals to Watch After the FOMC

Whatever the immediate market reaction to the FOMC decision, the more important story will be what happens in the weeks that follow. Several indicators are worth monitoring:

• ETF net flows. Do we see a renewed, sustained period of net inflows, or do redemptions continue to offset new buying? Persistent net demand would suggest that institutional allocators still view Bitcoin as attractive in the new rate environment.

• On-chain realization of profit and loss. If realized losses subside and more spending occurs in profit, it could signal that the wave of forced or discouraged sellers is fading. Conversely, a surge in realized loss after a macro disappointment would point to deeper stress.

• Long-term holder supply. A stabilisation in long-term holder distribution would imply that the most patient cohort is content with current prices and macro signals. Continued acceleration in their selling would warrant caution.

• Order book depth and futures basis. Improvements here would indicate healthier two-way interest and a better capacity to handle large trades without outsized price moves.

• Options implied volatility. If implied volatility remains elevated long after the event, it may reflect a regime shift toward more persistent uncertainty rather than a single data point.

By watching how these pieces move together, observers can form a more grounded view of whether Bitcoin is simply pausing before another structural leg higher, transitioning into a longer distribution phase, or something in between.

Conclusion: A Delicate Balance, Not a Binary Moment

Bitcoin’s current consolidation is uncomfortable precisely because it does not fit neatly into bullish or bearish extremes. Prices remain historically high, yet the underlying support is less robust than it was at earlier stages of the cycle. Losses are rising, long-term holders are lightening up, ETF demand is quieter and liquidity is thinner – all against the backdrop of an important macro decision that could alter the path of interest rates and global liquidity.

At the same time, none of these signals point to a system under severe stress. Long-term holders retain substantial unrealised gains, derivatives markets are functioning normally, and there is no sign of the kind of forced deleveraging that has characterised past crises. Instead, Bitcoin finds itself in a kind of 'honest' market environment: participants are re-evaluating risk and reward in real time, without the overwhelming push of one-way flows.

For those studying or participating in digital-asset markets, this phase offers an opportunity to refine analytical frameworks. It is a reminder that understanding Bitcoin today means integrating on-chain data, ETF flows, liquidity conditions, derivatives signals and macro policy into a single, coherent picture. No single data point decides the outcome, but together they shape the probabilities.

Educational note: This article is for information and analysis only. It does not constitute financial, investment, legal or tax advice, and it should not be used as the sole basis for any financial decisions. Digital assets are volatile and involve risk; readers should conduct their own research and consult qualified professionals where appropriate.