Bitcoin Treasury Companies Feel the Squeeze as Market Cap Halves

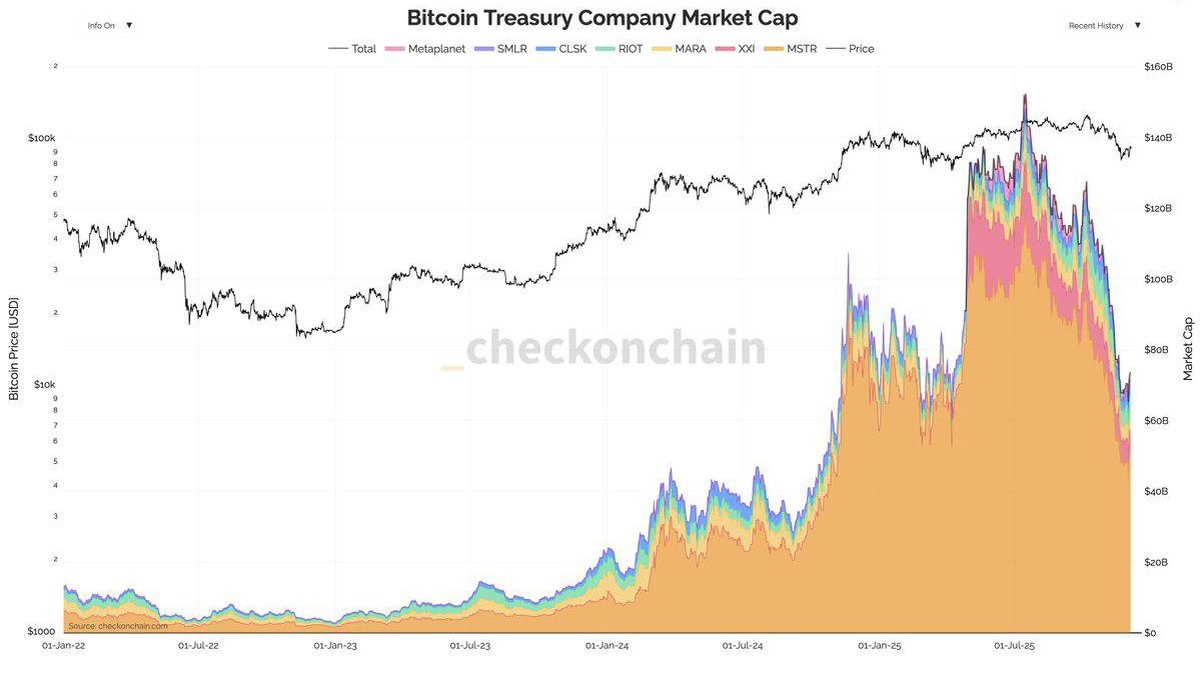

The latest leg down in Bitcoin has not only hurt token holders; it has also put visible pressure on the listed companies that decided to put BTC at the centre of their balance sheets. A recent chart from analytics platform checkonchain shows that the combined market capitalisation of major Bitcoin treasury companies — including Strategy (formerly MicroStrategy), Metaplanet, and a cluster of other firms with large on-balance-sheet holdings — has fallen to around $73.5 billion, roughly half the peak levels seen earlier in the year.

On the graphic, the black line traces Bitcoin’s price over the past few years. Beneath it, stacked coloured areas represent the market caps of individual treasury names: an orange block for Strategy, bands of purple, blue and green for miners such as Marathon, Riot and CleanSpark, and newer treasury entrants like Metaplanet or Twenty One. As BTC climbed toward six-figure territory, those coloured bands swelled dramatically. When price reversed, they shrank even faster.

At first glance this looks like a simple story: Bitcoin goes down, so the companies that hold it go down more. But the mechanics behind that relationship are more subtle — and understanding them helps explain what this drawdown really signals about the health of the broader digital-asset ecosystem.

1. What Exactly Is a Bitcoin Treasury Company?

The phrase 'Bitcoin treasury company' is relatively new. It describes firms whose primary differentiator, at least in the eyes of investors, is that they hold large quantities of BTC on their balance sheets as a strategic reserve. Strategy is the archetype: since 2020 the firm has accumulated hundreds of thousands of coins and repeatedly stated that Bitcoin is its core treasury asset, not just a side investment.

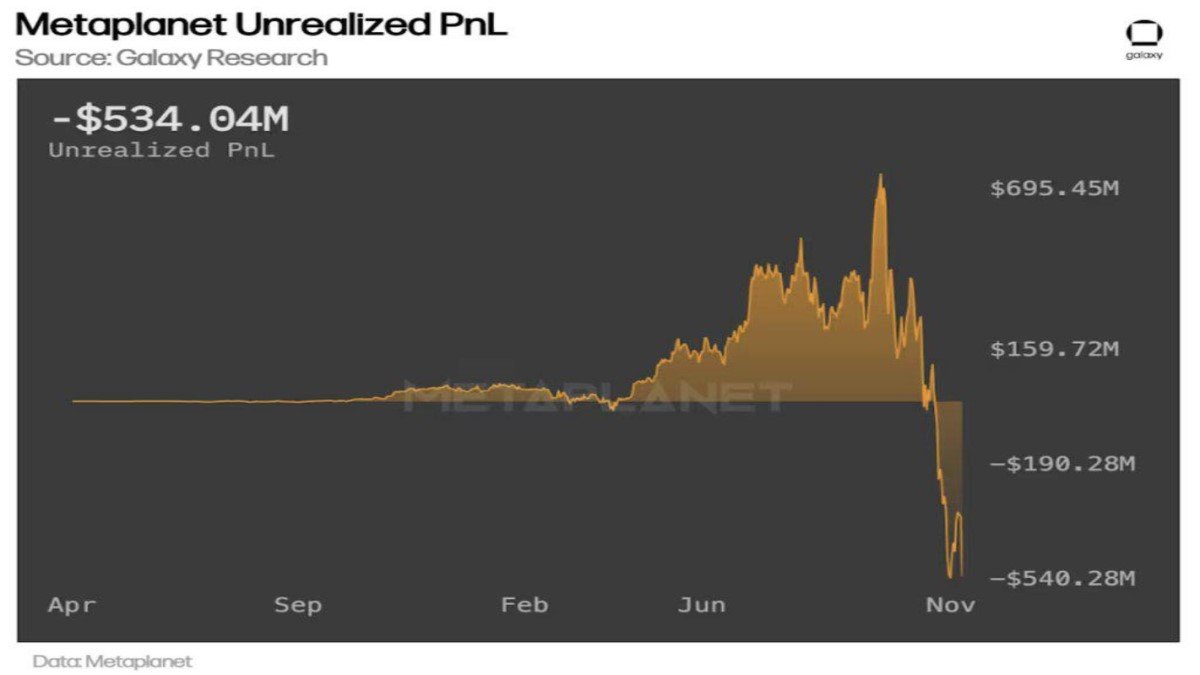

Other companies have followed versions of this playbook. Tokyo-listed Metaplanet has announced plans to steadily convert part of its corporate treasury into BTC. New ventures such as Twenty One, a joint effort involving SoftBank and Tether, are being formed with Bitcoin holdings as a central pillar from day one. In parallel, some miners and energy firms now explicitly market themselves as both infrastructure providers and long-term holders, keeping a portion of mined coins instead of selling all production.

While each company has its own operating business — software, energy, media, mining — the market often values them as leveraged proxies for Bitcoin itself. Their share prices tend to rise faster than BTC in bullish phases and fall harder when the cycle turns.

2. Why Market Caps Move More Than the Underlying Asset

To see why the chart shows such a violent swing in treasury-company value, it helps to unpack how equity pricing works when a balance sheet is dominated by a volatile asset.

At a high level, the value of a company can be broken into two parts:

- Net asset value (NAV): roughly the fair value of its Bitcoin holdings plus any other assets, minus debt.

- Equity premium or discount: the extra amount investors are willing to pay (or insist on discounting) because of management quality, growth optionality, trading liquidity and sentiment.

When Bitcoin is rallying, both components often move in the same direction. NAV increases as the coins appreciate, and investors may also assign a premium because they expect management to raise more capital, buy even more BTC, or launch profitable services around their treasury strategy. That is how Strategy’s equity managed to outperform even Bitcoin itself in some stretches of the previous bull run.

During a drawdown, however, the process runs in reverse and tends to amplify losses:

- BTC price declines, directly shrinking NAV.

- Debt becomes more burdensome in relative terms, because the collateral (Bitcoin or equity) is worth less while obligations stay fixed.

- The equity premium compresses as investors move from optimism to caution, sometimes flipping into a discount if they worry about future funding.

The result is that a 30–35% slide in BTC can easily translate into a 50% or larger compression in aggregate treasury-company market cap — precisely what the checkonchain chart now illustrates. Equity markets are not just tracking Bitcoin; they are repricing leverage, governance and future optionality at the same time.

3. Reading the $73.5B Number in Context

On its own, '$73.5 billion' is just a large figure. To interpret it, we should compare it with two benchmarks:

- Previous peaks: Earlier in the year, the same basket of treasury companies was worth well over $140 billion. The current value therefore represents a drawdown of close to 50% in only a few months.

- Bitcoin’s total market capitalisation: Even after the latest correction, BTC’s overall market value remains in the trillion-dollar range. That means listed treasuries still account for a single-digit percentage of outstanding supply in dollar terms.

The first comparison underscores how sensitive these equities are to sentiment. The second shows that, in a global context, they are still just one piece of a much broader ownership mosaic that includes ETFs, sovereign entities, long-term self-custodial holders and private funds.

From a systemic-risk standpoint, this is reassuring. Even if some treasury companies were forced to reduce exposure, they are not — at current sizes — large enough on their own to dictate the entire Bitcoin cycle. What they can do, however, is shape narratives and act as important bellwethers for how traditional capital markets are digesting digital-asset volatility.

4. Are Treasuries Being Forced to Sell?

A natural worry when reading about collapsing market caps is that companies might be compelled to liquidate holdings at unfavourable levels. The reality appears more nuanced.

Strategy, the highest-profile treasury firm, recently raised approximately $1.4 billion in fresh capital and disclosed that it holds more than 650,000 BTC in various custody arrangements. In interviews and regulatory filings, management has emphasised that this cash buffer should cover interest and operating costs for roughly two years without needing to sell coins, while still acknowledging that extreme scenarios could require flexibility.

Other treasury companies are in different situations. Some miners, for example, rely heavily on cash flow from operations and may periodically sell portions of their holdings to finance equipment upgrades or expansion, especially after halving events reduce block rewards. Still others, like up-and-coming DAT firms, were launched with a mix of equity and debt specifically designed to acquire and hold BTC for the long term.

In short, the drop in equity value does not automatically translate into forced sales. It does, however, tighten funding conditions and raise the cost of additional leverage. Boards and risk committees are likely spending far more time stress-testing their treasury assumptions than they did at the peak of euphoria.

5. Feedback Loops Between Equity and Bitcoin Markets

One of the under-appreciated aspects of the treasury-company boom is that it creates a two-way feedback loop between Bitcoin and traditional equities.

On the way up:

- Rising BTC prices boost NAV, making it easier for firms to issue new shares or convertible notes at attractive terms.

- Proceeds from those raises are often recycled into additional Bitcoin purchases, reinforcing demand.

- Media coverage of surging treasury stocks attracts more generalist investors, some of whom are new to digital assets.

On the way down, the loop runs in reverse:

- Declining BTC prices compress NAV and depress equity valuations.

- Lower share prices make new capital raises more dilutive, discouraging further acquisition.

- Analysts and rating agencies pay closer attention to debt metrics, which can limit risk-taking.

The current $73.5B reading reflects that the system is partway through this second phase. Yet the loop is not purely mechanical. It is shaped by regulation, macro conditions and investor expectations about future policy — factors that are evolving rapidly in favour of more institutional participation.

6. Regulation, ETFs and the Institutional On-Ramp

Over the past year, several developments have changed how institutions can gain exposure to Bitcoin:

- Spot ETFs in major markets have attracted substantial assets, giving large investors a regulated, exchange-traded vehicle that does not require managing wallets directly. In the United States, some issuers now report daily volumes in the billions of dollars.

- Regulated spot trading on US futures exchanges has been authorised by the Commodity Futures Trading Commission, creating another pathway for compliant exposure.

- Banking and custody rules are gradually clarifying, enabling more traditional institutions to hold Bitcoin or Bitcoin-linked instruments on behalf of clients.

These changes cut both ways for treasury companies. On one hand, they face more competition: investors who previously saw equities like Strategy as one of the few practical ways to express a Bitcoin thesis now have multiple alternatives. On the other hand, the broader normalisation of digital assets can strengthen the narrative that BTC is an acceptable treasury asset, encouraging more corporates and funds to consider direct holdings.

In that sense, the current drawdown may mark a shift from a phase where a handful of high-beta stocks were the main 'access point' to one where they are part of a richer landscape of institutional products.

7. How Corporate Bitcoin Treasuries Manage Risk

The sharp move in the chart invites an important educational question: how do responsible treasury teams manage Bitcoin-related risk in the first place?

Common tools include:

• Duration management for liabilities. Many firms try to match the maturity of their debt with their risk appetite, using longer-dated notes instead of short-term borrowing so they are not forced into quick decisions by market swings.

• Diversified custody arrangements. Coins are often spread across multiple custodians, sometimes including segregated accounts and multi-signature arrangements, to reduce operational risk.

• Scenario analysis. Boards typically review stress tests that model BTC at much lower prices, higher interest rates or both, and consider how these paths would affect covenants and liquidity.

• Clear communication with shareholders. Because Bitcoin strategies are still relatively new, companies that explain their approach, risk limits and decision criteria tend to earn more stable support during turbulent periods.

These practices do not eliminate volatility, but they can reduce the likelihood that individual companies need to make abrupt moves solely because of short-term market stress.

8. Bullish and Cautious Interpretations of the Drawdown

So what should observers make of the fact that Bitcoin treasury company market cap has roughly halved?

The bullish interpretation emphasises that even after the drop, tens of billions of dollars in market value remain attached to businesses whose identity is closely tied to Bitcoin. New entrants like Twenty One and regional treasury plays such as Metaplanet indicate that interest is global, not confined to a single market. As more institutions become comfortable holding BTC directly or via ETFs, corporate treasuries may look less like outliers and more like the leading edge of a structural shift in how balance sheets are constructed.

The cautious interpretation focuses on concentration and cyclicality. Equity valuations that double or triple on the way up and then halve on the way down can be challenging for risk-averse investors who are used to steadier cash-flow-driven names. Some critics worry that aggressive treasury strategies could encourage excessive leverage, especially if boards rely too heavily on favourable scenarios when issuing new debt.

Both lenses capture part of the reality. The key is to recognise that Bitcoin treasury companies are neither simple tracking instruments nor guaranteed engines of outperformance. They sit at the intersection of corporate finance, macroeconomics and digital-asset technology, which makes their risk–reward profile unique.

9. Practical, Brand-Safe Takeaways for Readers

For individuals trying to make sense of this space — whether they hold BTC, own treasury stocks, or are simply curious — a few practical lessons stand out:

1. Differentiate between Bitcoin and Bitcoin proxies. Owning BTC directly, buying a spot ETF and purchasing shares in a treasury company are three distinct forms of exposure. Each has its own benefits, risks and regulatory treatment.

2. Study balance sheets, not just headlines. For any company that actively uses Bitcoin as a treasury asset, it is worth understanding how much debt it carries, what the maturities look like and how management has communicated its risk tolerance.

3. Acknowledge the leverage effect. The recent halving of aggregate treasury-company market cap is a reminder that these equities can magnify both upside and downside moves. Position sizes should reflect that reality.

4. Watch policy and product developments. Regulatory changes, new ETF launches and evolving custody rules can all influence how attractive treasury strategies appear relative to other forms of Bitcoin exposure.

5. Keep time horizon and diversification in view. Whether one is optimistic or cautious about Bitcoin, concentrating too much risk in a single mechanism — be it a coin, a stock or a fund — can make portfolios vulnerable to surprises.

10. Conclusion: A Stress Test for the Corporate Bitcoin Experiment

The swift drop in the combined market capitalisation of Bitcoin treasury companies to around $73.5 billion is more than a statistic; it is a live stress test of the corporate Bitcoin experiment. After several years in which holding BTC on the balance sheet looked straightforwardly rewarding, treasury teams are now navigating the harder half of the cycle: defending strategies in the face of volatility, managing leverage and maintaining shareholder confidence.

How they respond will shape not only their own fortunes but also the broader narrative about whether Bitcoin can serve as a durable long-term reserve asset for corporations. If treasury firms manage through the downturn with prudent funding and clear communication, they may emerge as stronger case studies for mainstream adoption. If, instead, the pressure proves too great for highly leveraged players, regulators and boards may become more conservative about similar strategies in the future.

Either way, the current episode offers valuable data. It shows how traditional markets translate on-chain volatility into equity prices, highlights the importance of risk management and underlines that Bitcoin’s integration into corporate finance is still a work in progress. For observers and participants alike, the most constructive stance is to stay informed, maintain realistic expectations and treat these developments as part of a long-running process rather than a final verdict.

Disclaimer: This article is for informational and educational purposes only. It does not constitute financial, investment, legal or tax advice, and it should not be treated as a recommendation to buy, sell or hold any digital asset, security or financial product. Digital assets and related equities are volatile and carry risks, including the possibility of significant loss of principal. Readers should conduct their own research and, where appropriate, consult qualified professionals before making any financial decisions.