Bitcoin Clears 90,000 USD as Funding Spikes: Constructive Breakout or Crowded Trade?

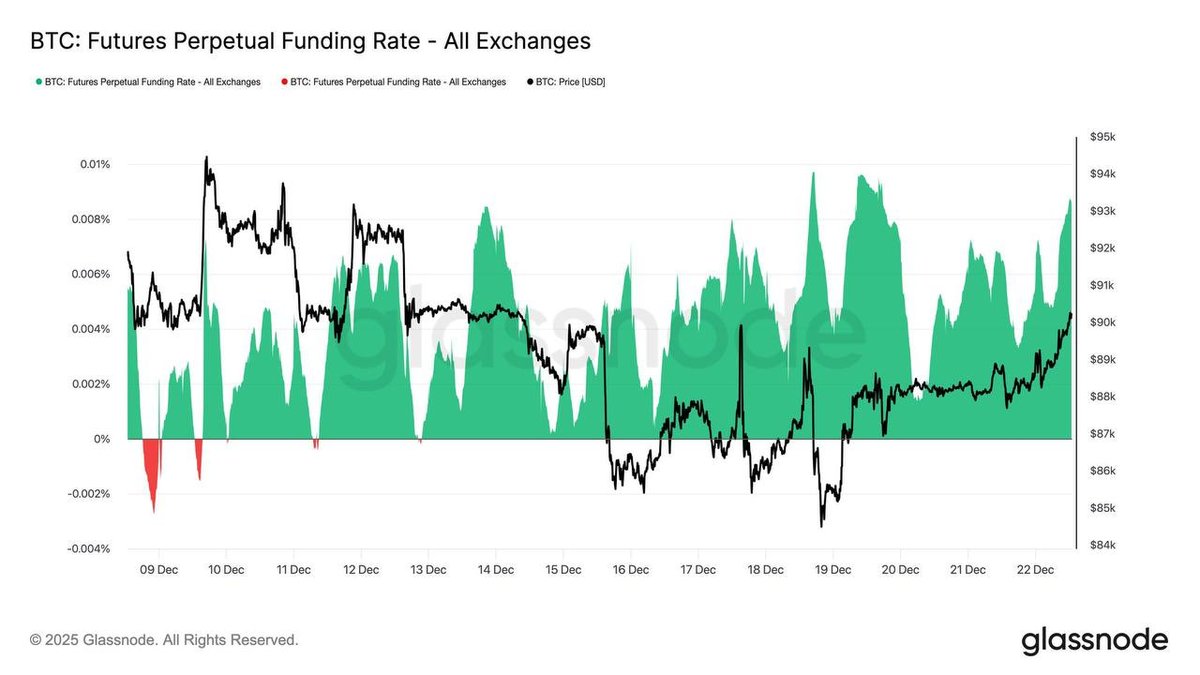

Bitcoin has reclaimed the 90,000 USD handle, and the mood in derivatives markets is shifting quickly. On perpetual futures across major exchanges, the funding rate has climbed from around 0.04% lên 0.09%, while total futures open interest has risen roughly 2% to the area of 310,000 BTC.

On the surface, this looks like a classic pre-breakout setup: price grinding higher, leveraged long positions building, and a growing consensus that the year might end with a strong upward move. Many traders are adding size with the expectation that a clean push above recent highs will force short positions to close and spark a rapid extension higher.

But high conviction and high leverage are not the same thing. The same dynamics that can fuel an explosive rally can also amplify a reversal if expectations are not met. To make sense of the current environment, it helps to step back and ask three questions:

- What exactly does a jump in perpetual funding from 0.04% to 0.09% tell us?

- How does this move fit into Bitcoin's broader market structure at 90,000 USD?

- How should different types of participants interpret this – from short-term traders to long-term allocators?

In what follows, we treat funding not as a trading signal on its own, but as a window into the incentives and risks that are quietly accumulating beneath the price chart.

Understanding Funding: The Pulse of Perpetual Futures

Perpetual futures have become the dominant derivative instrument for Bitcoin. Unlike traditional futures, they do not expire. Instead, they use a funding mechanism – a small payment exchanged between long and short positions at regular intervals – to keep the futures price anchored to the spot price.

The basic logic is simple:

- When the perpetual contract trades above spot, the funding rate turns positive. Longs pay shorts. This incentivises sellers and discourages excessive long positioning.

- When the perpetual trades below spot, the funding rate is negative. Shorts pay longs, encouraging traders to take the other side of an overly bearish market.

In practice, funding can be thought of as a real-time barometer of derivatives sentiment and leverage skew. A small positive rate is normal in an uptrend, reflecting a modest willingness to pay a premium for long exposure. Extended periods of very high or very low funding, however, often point to crowded positioning and an elevated risk of a squeeze in the opposite direction.

From 0.04% to 0.09%: Why the Latest Move Matters

At first glance, the jump from 0.04% to 0.09% per funding period might sound small. But scaled over time, it becomes more meaningful.

Depending on the exchange, funding is often paid every eight hours. A 0.09% rate per period compounds to a double-digit annualised cost for traders holding long perpetual positions. They are effectively paying an ongoing fee to keep their leverage.

This tells us several things:

- Longs dominate the derivatives book. The market is sufficiently tilted toward long positions that they are willing to compensate shorts to maintain the current balance.

- Traders anticipate continuation. Participants paying that funding cost are signalling a belief that future price appreciation will more than offset the fee.

- Shorts are shrinking or cautious. When funding rises, it typically means that short sellers are either being forced out or demanding more compensation to keep positions open.

None of this guarantees a reversal. A strong bullish trend can sustain elevated funding for long periods. But when funding rises quickly alongside a sharp price move, it often marks the transition from a healthy advance to a more fragile rally that is increasingly reliant on continued inflows and favourable conditions.

Open Interest Near 310,000 BTC: Fuel for a Squeeze

The second key component of the current setup is open interest. An estimated 310,000 BTC of notional open interest across futures markets means that a substantial volume of positions – both long and short – are now exposed to short-term price fluctuations.

Rising open interest by itself is not inherently bullish or bearish. It simply means more capital is in play. To interpret it, we need to consider who is holding those positions and in which direction.

Given the positive funding rates, the best reading is that the market currently leans toward leveraged longs. That creates two potential paths:

- Continuation scenario. If spot demand continues to absorb selling and macro conditions remain benign, those leveraged longs can drive a powerful breakout. Shorts are squeezed, liquidations cascade, and price can move several thousand dollars in a short period.

- Air-pocket scenario. If price stalls or dips unexpectedly, the same leveraged longs may rush to de-risk. Because they are paying funding and operating with borrowed capital, their tolerance for drawdowns is limited. Forced selling into a thin order book can produce sharp downside spikes.

In other words, higher open interest with positive funding loads the market with potential energy. Whether that energy is released upward or downward depends on how the next catalysts interact with this positioning.

Why Traders Are Leaning Long Into Year-End

Year-end rallies are part of market folklore, and crypto is no exception. Several narratives are feeding the current appetite for long exposure:

• Macro optimism. Expectations for lower global interest rates and more supportive liquidity conditions in 2026 have encouraged risk-taking, especially among traders who see digital assets as a high-beta expression of this thesis.

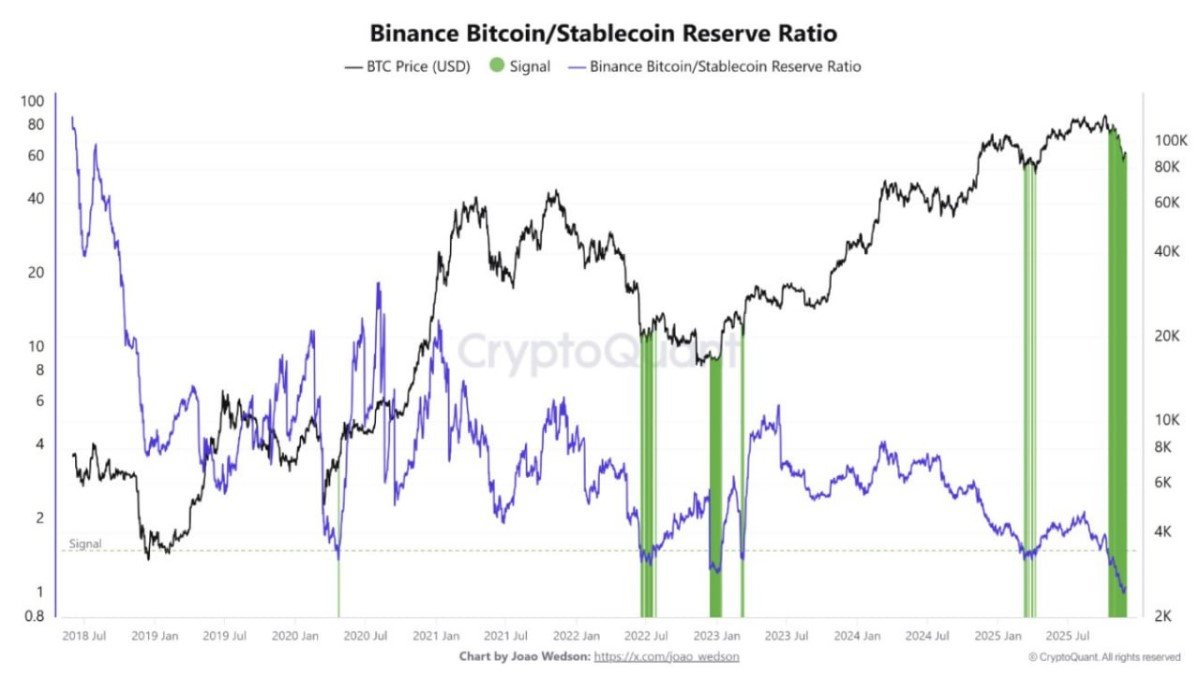

• Structural demand. Ongoing flows into spot products and accumulation by large holders create a perception of a solid floor under the market, even if day-to-day moves remain volatile.

• Psychological milestones. Numbers like 90,000 USD carry narrative weight. Breaking back above them after a correction can convince traders that a new leg of the cycle is underway.

• Fear of missing out on a potential squeeze. With short liquidations increasing and funding still below past extremes, many market participants conclude that the balance of risks favours staying long rather than waiting on the sidelines.

Put simply, a rising cohort of traders believes that the combination of structural demand and positive macro expectations will overpower any residual selling pressure, leading to a late-year surge. The funding and open-interest data show that they are willing to fund that conviction with leverage.

When Funding Becomes a Warning Sign

While the current funding level is elevated, it has not yet reached the kind of extremes seen during past euphoric peaks. That said, investors should understand how funding can evolve from a constructive indicator into a caution flag.

Historically, several patterns have tended to precede local tops:

• Persistently high positive funding. When funding stays elevated for days or weeks while price grinds higher, it usually means the majority of speculative traders are positioned on the same side.

• Funding spikes that coincide with aggressive price extensions. Vertical moves driven by liquidations and forced buying can push contracts far above spot, making it expensive to maintain long positions.

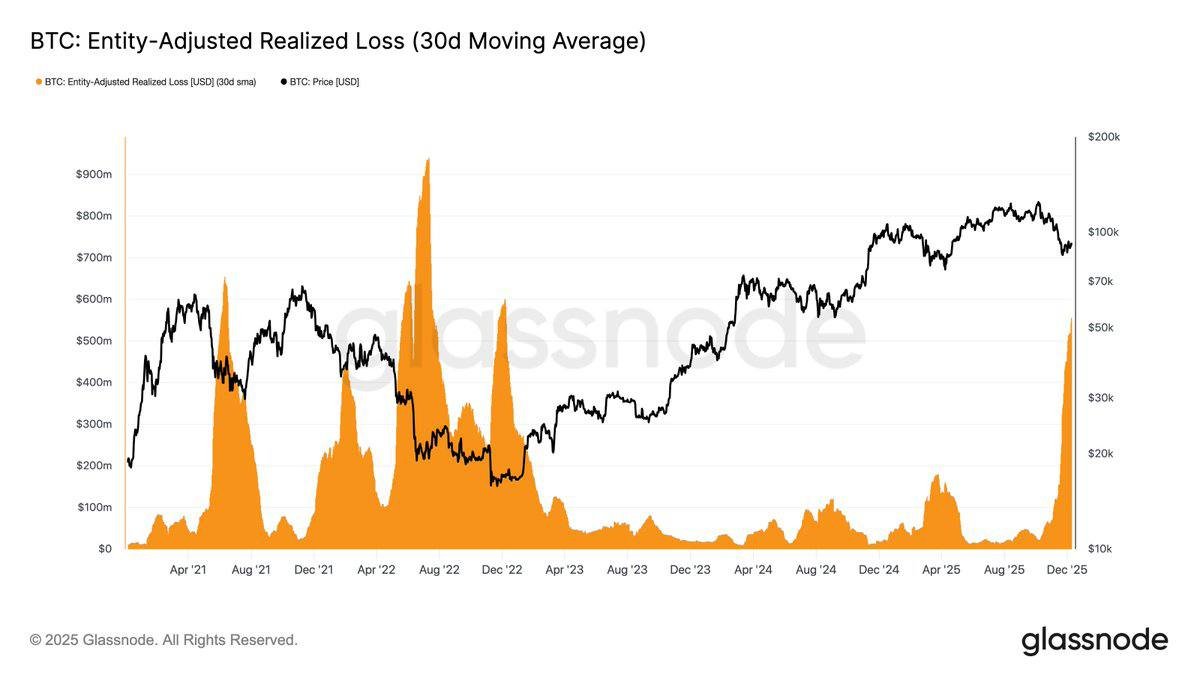

• Divergence between spot and derivatives flows. If open interest and funding keep rising while spot volumes stagnate or flows from large holders turn net negative, it can indicate that the rally is being supported more by leverage than by fresh capital.

In such environments, price does not have to reverse immediately, but the margin of safety for leveraged longs shrinks. Even modest negative catalysts – a macro headline, a regulatory comment, or a simple loss of momentum – can trigger a wave of position reduction.

Spot vs. Leverage: Who Is Really Driving the Move?

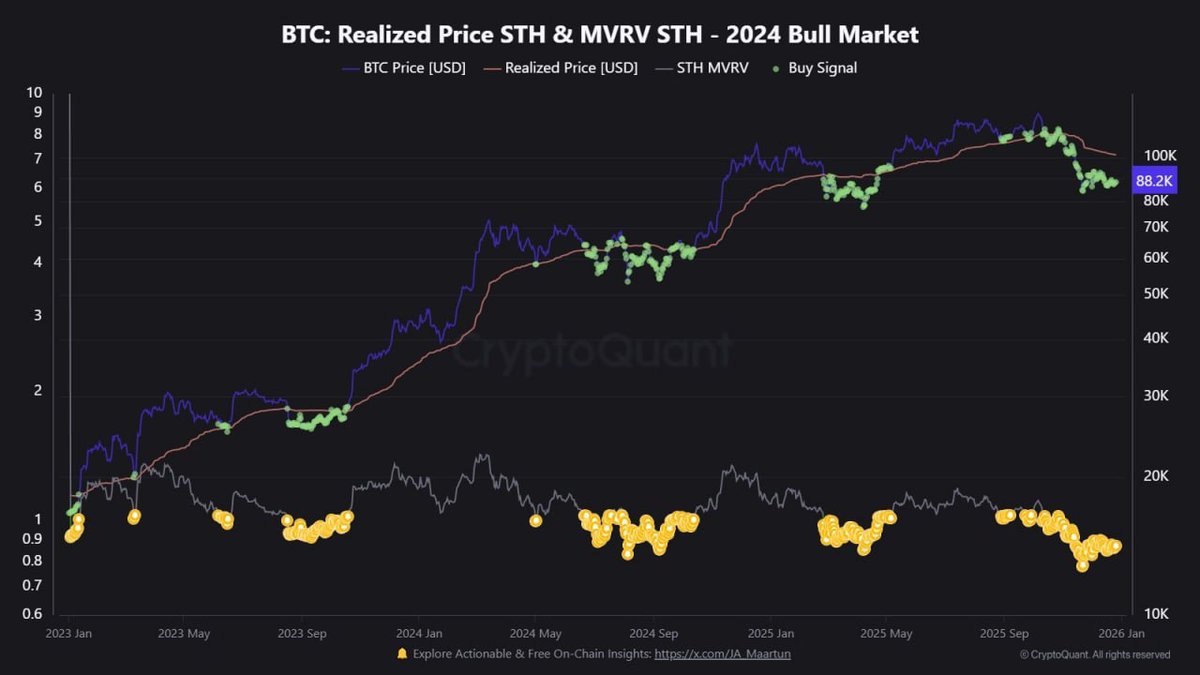

One useful way to think about the current situation is to separate structural holders from tactical traders.

Structural holders include long-term investors, funds with multi-year mandates, and entities that hold Bitcoin as part of a broader treasury strategy. They tend to accumulate during weakness and are less sensitive to short-term funding costs. Their actions often show up in on-chain metrics such as net outflows from exchanges and the growth of long-dormant supply.

Tactical traders, by contrast, operate on shorter horizons. They use perpetual futures, options and margin products to express directional views. The current rise in funding and open interest is mainly about this group.

Recent data suggest that both groups are active:

- Outflows from exchanges and increased holdings by long-term wallets indicate a continued structural bid.

- The funding spike and higher open interest show that tactical traders are layering leverage on top of that structural demand.

This combination can be powerful. When structural holders are not selling aggressively, the presence of leveraged longs can accelerate upside moves. At the same time, it means that if structural demand temporarily fades, the market is more exposed to rapid short-term corrections.

What This Means for Different Market Participants

1. Short-term traders

For active traders, the message from the funding chart is straightforward: the market is tilting long, and the cost of joining the crowd is rising. That does not automatically argue for the opposite stance, but it does call for more precise risk management.

Practical considerations include:

- Being mindful of position size relative to account equity, given the possibility of sharp intraday swings.

- Recognising that when funding is high, holding large leveraged positions for many days erodes returns through funding payments.

- Using clear invalidation levels rather than relying solely on the narrative of an imminent year-end surge.

Some traders use spikes in funding as an opportunity to reduce leverage or switch part of their exposure from perpetual futures to spot holdings, avoiding the ongoing funding cost while still participating in potential upside.

2. Long-term investors

For long-horizon participants, short-term funding movements tend to matter less directly. Instead, they provide context for evaluating the quality of a move.

If price rises on the back of modest funding and steady spot inflows, the advance is often more durable. If price surges while funding and open interest explode, it may still signal strong demand, but it also suggests that part of the move is being driven by leverage that can reverse quickly.

From this vantage point, a reasonable approach is to:

- Use funding and derivatives data as a sentiment tool rather than a timing tool.

- Be cautious about making large allocation changes in the middle of highly leveraged moves, preferring to act during calmer periods or after shake-outs when funding normalises.

- Focus on fundamental drivers – adoption, regulatory clarity, integration into portfolios – while treating funding spikes as part of the market's day-to-day noise.

Could This Be the Start of a New Leg Higher?

With Bitcoin holding above 90,000 USD and derivatives markets leaning bullish, the obvious question is whether this is the opening chapter of a major extension or a late-cycle push that will soon need to cool down.

Arguments in favour of continuation include:

- Structural supply constraints from long-term holders and institutional vehicles.

- Growing integration of digital assets into traditional financial products.

- Macro conditions that, while uncertain, are generally shifting toward a more supportive stance for risk assets compared with previous tightening cycles.

Arguments for caution focus on:

- Rising funding and leverage that make the market more sensitive to negative surprises.

- The possibility that some of the recent move reflects short-term positioning rather than new long-term capital.

- The tendency for markets to over-price good news when prices approach or exceed prior highs.

Both sets of arguments can be true at once. It is entirely possible for Bitcoin to remain in a long-term structural uptrend while still delivering sharp, sentiment-driven corrections along the way. Funding data does not settle the debate, but it highlights when the balance of risks is shifting toward greater sensitivity.

Key Takeaways

Bitcoin's move above 90,000 USD, combined with a rise in perpetual funding from 0.04% to 0.09% and open interest near 310,000 BTC, paints a picture of a market that is confident and increasingly leveraged. Traders are positioning for a strong year-end finish, and the derivatives complex is leaning in the same direction.

For participants, the main lessons are:

- Funding is a powerful sentiment gauge, not a guarantee of future price moves. Elevated funding means longs are paying to stay in the trade; it does not ensure they will be rewarded.

- Higher open interest with positive funding increases the potential for both upside squeezes and downside air pockets. Flexibility and disciplined risk management become even more important.

- Long-term investors can view this as another step in Bitcoin's maturation, but may prefer to make major allocation decisions during periods when derivatives positioning is less extreme.

As the year closes, the market's enthusiasm is easy to see on the chart. The challenge is to distinguish between momentum that can carry for months and leverage-driven moves that may reverse quickly. Funding rates, open-interest dynamics and on-chain flows together offer one of the clearest windows into that distinction.

Disclaimer: This article is for educational and informational purposes only and does not constitute investment, trading, legal or tax advice. Digital assets are volatile and can involve significant risk, including the potential loss of principal. Always conduct your own research and consider seeking guidance from a qualified professional before making financial decisions.