Fidelity Expands Crypto ETF Offerings Amid Institutional Demand: In-Depth Analysis

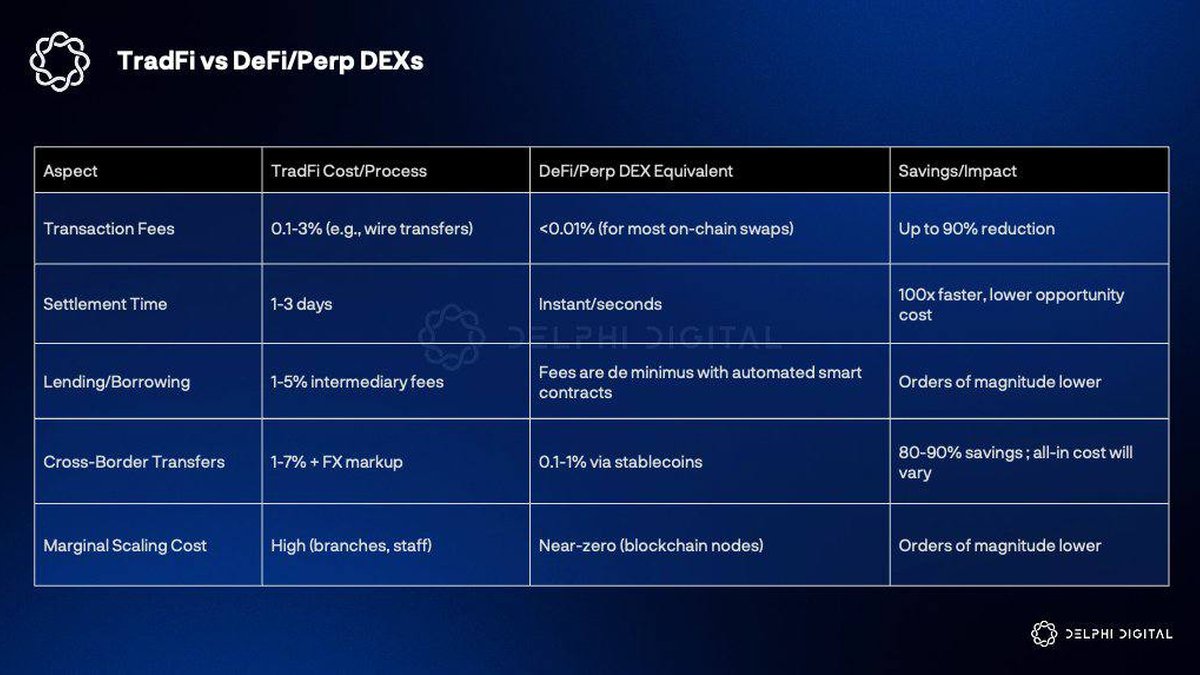

Fidelity's expansion of crypto ETF offerings represents a pivotal moment in institutional crypto adoption. As the cryptocurrency market continues to mature, traditional financial institutions are seeking regulated, transparent, and accessible investment vehicles. ETFs (Exchange-Traded Funds) designed for digital assets bridge the gap between traditional finance and blockchain innovation, offering institutions exposure without the complexities of direct custody.

Historical Context and Market Evolution

The concept of crypto ETFs has evolved alongside broader market trends. Initially, institutional investors were hesitant due to regulatory ambiguity, volatility, and custody risks. However, as exchanges improved security protocols, and regulators provided clearer guidance, interest in crypto ETFs surged. Fidelity’s offerings aim to capitalize on this institutional appetite, providing diversified exposure to key cryptocurrencies while maintaining compliance with financial regulations.

Historically, Bitcoin ETFs were the first to gain traction, with Ethereum-focused products emerging later. Fidelity's strategy incorporates multiple cryptocurrencies, leveraging the performance of diversified digital assets to reduce portfolio risk and enhance potential returns.

Key Features of Fidelity’s Crypto ETFs

Fidelity’s crypto ETFs stand out due to several critical features:

- Institutional-Grade Security: Assets are safeguarded through robust custody solutions, mitigating the risk of theft or loss.

- Diversification: ETFs can include multiple cryptocurrencies, balancing exposure to mitigate volatility.

- Regulatory Compliance: Designed to align with SEC and other global regulatory frameworks, reducing legal risk for institutional investors.

- Transparency and Reporting: Detailed reporting allows investors to track holdings, performance, and exposure to various crypto assets.

Use Cases and Applications

Fidelity’s crypto ETFs serve multiple purposes for institutional investors:

Portfolio Diversification

By including crypto assets in a broader investment portfolio, institutions can reduce correlation with traditional markets and potentially enhance returns. ETFs offer a simplified vehicle for this diversification without requiring direct management of wallets or private keys.

Hedging and Risk Management

ETFs allow investors to hedge positions in volatile markets. Institutional investors can allocate a controlled percentage of capital to crypto exposure while maintaining adherence to risk management policies.

Liquidity Access

Unlike direct crypto holdings, ETFs offer liquidity through traditional trading platforms, making it easier for institutions to enter and exit positions efficiently.

Comparisons with Other Investment Vehicles

Compared to direct cryptocurrency investments, ETFs reduce operational and regulatory complexity. While Bitcoin and Ethereum holdings require secure custody, manual tracking, and compliance oversight, ETFs streamline these processes. Alternative platforms like SEC Coin focus on regulatory compliance but may not offer the same diversity or institutional integration.

Risks and Considerations

Despite the benefits, crypto ETFs carry inherent risks:

- Market Volatility: Prices of underlying cryptocurrencies can fluctuate significantly, impacting ETF value.

- Regulatory Uncertainty: Changes in laws or SEC policies may affect trading and adoption.

- Counterparty Risk: ETF providers and custodians must maintain rigorous security and compliance standards.

Investors should conduct thorough due diligence, including evaluating the ETF’s underlying assets, custodian security protocols, and regulatory standing.

Investment Outlook

Institutional demand for regulated crypto exposure is expected to grow, driven by technological adoption, increasing acceptance of blockchain solutions, and macroeconomic factors favoring alternative assets. Fidelity’s ETFs position investors to benefit from crypto’s growth potential while leveraging traditional finance infrastructure. Strategies such as dollar-cost averaging, sector diversification, and careful risk allocation can optimize returns.

Further Reading and Resources

Frequently Asked Questions

What is Fidelity's crypto ETF offering? It is a regulated investment vehicle providing institutional exposure to multiple cryptocurrencies without direct custody.

How does it differ from Bitcoin and Ethereum investments? ETFs diversify exposure and simplify management compared to direct holdings, reducing operational and compliance complexities.

Is it suitable for institutions? Yes, designed specifically for institutional investors seeking regulated, transparent, and liquid crypto exposure.