Binance Review 2025: Is It Still the Top Exchange?

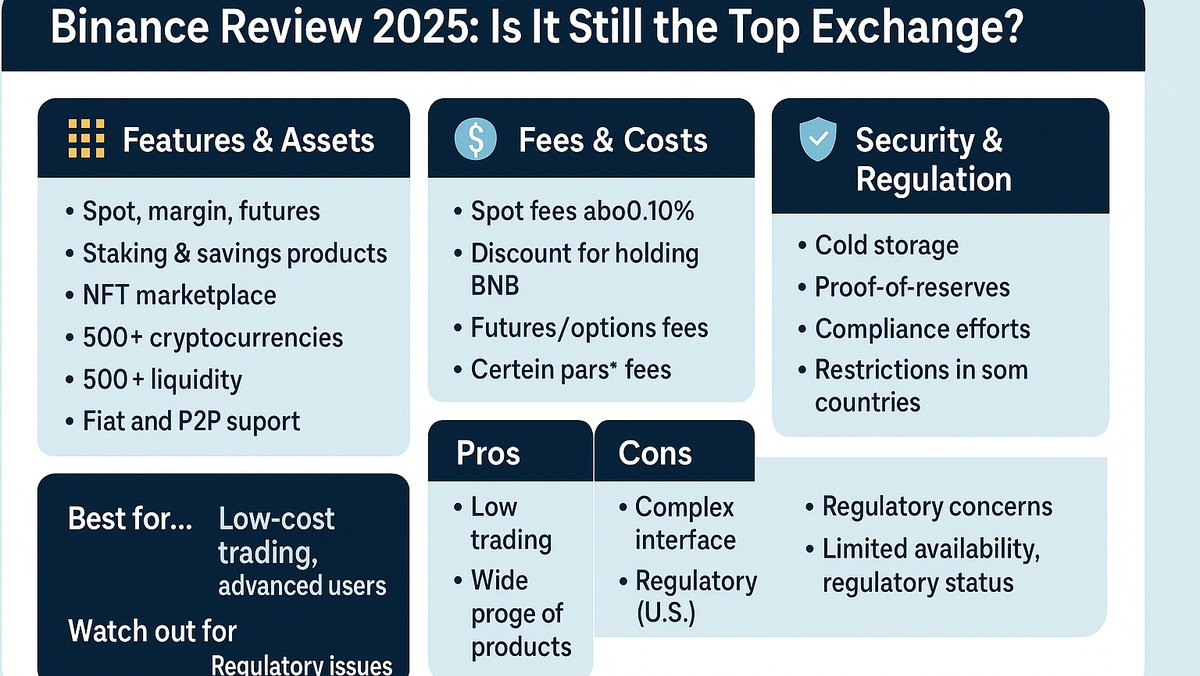

Bottom line: Binance remains the liquidity leader for spot and derivatives. Fees start low, depth is top tier, and product coverage is broad. Regulatory baggage persists, and access is restricted in several markets. For most non-US traders who prioritize depth and fees, it is still a default choice; for users in tightly regulated regions, alternatives may fit better.

What’s new since 2023

- Governance & enforcement: Binance resolved major U.S. enforcement actions in Nov 2023 with a multibillion-dollar settlement; founder Changpeng Zhao later received a short custodial sentence. Richard Teng became CEO with a compliance-first posture.

- Regional retrenchment: Exits and onboarding limits in several jurisdictions (e.g., Netherlands, Canada, UK promotions regime) tightened market access.

Fees: current schedules

Binance uses VIP tiers by 30-day volume and BNB balance. BNB fee discounts and periodic zero-fee campaigns may apply; always check the live schedule.

| Market | Pair (example) | Maker | Taker | Notes |

|---|---|---|---|---|

| Spot | BTC/USDT | 0.10% | 0.10% | VIP tiers reduce; BNB discount available. |

| Spot | ETH/USDT | 0.10% | 0.10% | Promos can alter certain pairs. |

| Spot | SOL/USDC | 0.10% | 0.10% | VIP/BNB rules apply. |

| USDT-M Perps | BTCUSDT | 0.020% | 0.050% | VIP tiers; maker rebates possible. |

Head-to-head fee snapshot

| Exchange | Spot Maker | Spot Taker | Derivatives (base) | Source |

|---|---|---|---|---|

| Binance | 0.10% | 0.10% | Perps 0.020% / 0.050% | Fee schedule |

| Bybit | 0.10% | 0.10% | Published separately | Bybit fees |

| Kraken Pro | 0.25% | 0.40% | Futures separate | Kraken pricing |

| Coinbase Advanced | Tiered | Tiered | N/A | Coinbase fees |

Interpretation: Binance and Bybit are lowest headline spot fees; Kraken Pro narrows with volume; Coinbase Advanced discloses inside account UI.

Liquidity & product coverage

- Depth/liquidity: Independent trackers often place Binance at or near the top in spot and derivatives share and order-book depth; month-to-month varies.

- Products: Spot, margin, perps, options, launchpad, earn, copy-style features, and BNB Chain connectivity.

Security posture

- Proof-of-Reserves: Public Merkle-tree PoR with wallet sets and attestation notes. Dashboard.

- SAFU fund: Exchange-backed protection pool; disclosures on help/blog pages. SAFU overview.

- Operational risk: Past enforcement actions are material; remediation and monitoring are ongoing.

Regional availability & restrictions

- EU/EEA: The Netherlands — exited in 2023 after VASP licensing issues.

- UK: Since Oct 2023, firms marketing to UK retail must meet FCA financial-promotions rules; onboarding is constrained.

- Canada: Exited in 2023; later received a FINTRAC penalty related to historical AML controls.

- US: Binance.com isn’t for US persons; Binance.US operates separately with fewer assets/features.

Pros & cons in 2025

Pros

- Low base fees with VIP/BNB discounts; frequent promos.

- Deep liquidity across spot and perps; broad asset coverage.

- PoR disclosures and SAFU framework published.

Cons

- Ongoing regulatory scrutiny; regional blocks reduce accessibility.

- Interface complexity for first-time users.

- Some features unavailable on regional platforms (e.g., US/UK variants).

Competitor matchups

- vs. Coinbase: Strong US access and fiat ramps; fees often higher; narrower asset list for some categories.

- vs. Kraken: Emphasis on compliance/security; higher entry-level fees; robust staking where permitted.

- vs. Bybit: Similar low spot fees and competitive perps; Binance typically wins on breadth/liquidity.

Editor’s screenshot checklist (add before publish)

- Fee schedule (spot & futures) with VIP tiers.

- PoR dashboard overview (asset coverage, last attestation date).

- UK domain banner showing FCA promotions notices (if visible).

- Order book depth for BTC/USDT at a liquid hour vs. a peer exchange.

Methodology & reproducible checks

- Verify live fee tables on Binance’s official pages before quoting.

- Confirm regional access via official notices/regulator pages.

- Cross-reference enforcement history with DOJ/CFTC releases and mainstream coverage.

Verdict

If you need depth + low fees and you’re in an eligible region, Binance remains a top pick in 2025. If you’re in the US/UK/CA/NL or prioritize maximum regulatory clarity over product breadth, weigh Kraken or Coinbase, or a regional specialist.