Fidelity Crypto Wallet Review: Features, Security, and Use Cases

Fidelity’s Crypto Wallet is designed to provide secure, user-friendly access to digital assets for both retail and institutional investors. This review covers technical architecture, security protocols, and integration features, helping investors evaluate the wallet’s utility in a rapidly evolving market.

Overview of Fidelity Crypto Wallet

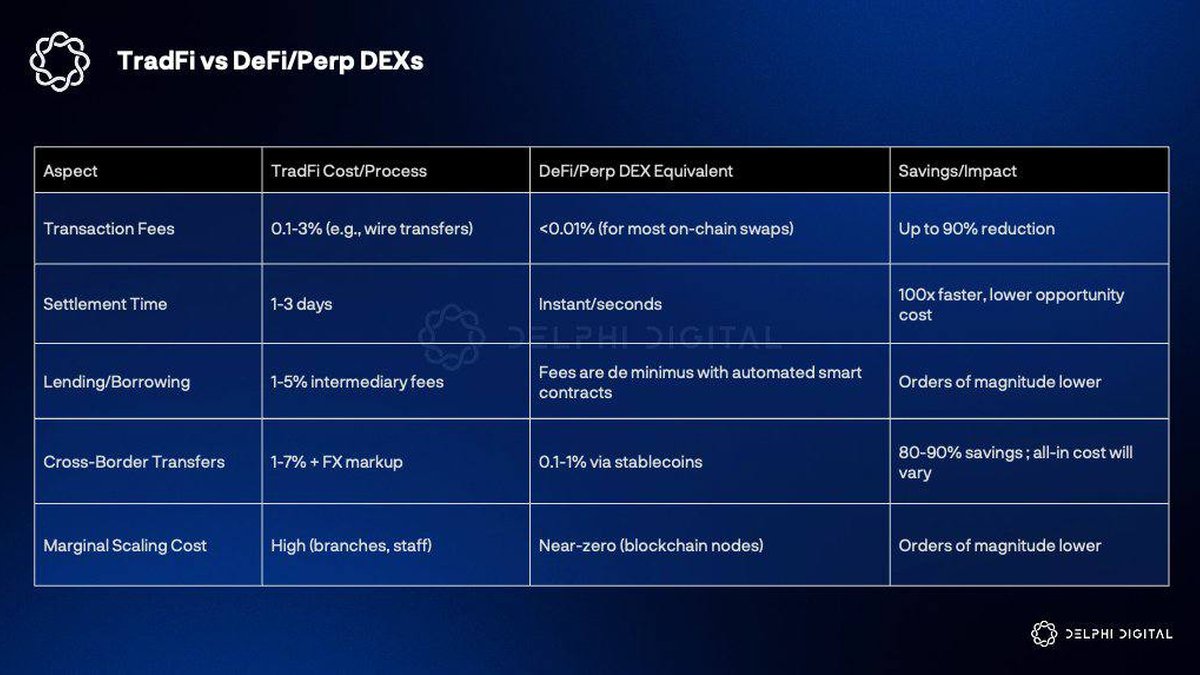

The wallet supports multiple cryptocurrencies, offering a seamless interface for managing tokens, executing transactions, and tracking portfolio performance. Key differentiators include strong regulatory compliance, integration with Fidelity accounts, and institutional-grade custody standards. As cryptocurrency adoption grows, wallets like Fidelity’s bridge the gap between traditional finance and decentralized networks.

Key Features

- Multi-Currency Support: Enables storage and management of Ether, Bitcoin, and select altcoins.

- Regulated Custody: Assets are stored with Fidelity’s institutional-grade security protocols.

- User-Friendly Interface: Provides dashboard insights, transaction history, and portfolio analytics.

- Integration: Connects to Fidelity brokerage accounts and retirement accounts for holistic financial management.

- Security Measures: Multi-signature wallets, two-factor authentication, and cold storage protect assets.

Use Cases

The wallet can be leveraged for:

- Secure storage of digital assets without managing private keys directly.

- Portfolio diversification and monitoring within a regulated ecosystem.

- Access to staking programs or DeFi opportunities through integrated protocols.

- Institutional compliance and reporting for audit purposes.

Comparisons with Competitors

Compared with Ethereum native wallets or third-party wallets like MetaMask and Coinbase Wallet:

- Security: Fidelity provides higher institutional security but less decentralization.

- Functionality: MetaMask offers DeFi interactions; Fidelity prioritizes compliance and reporting.

- Accessibility: Fidelity simplifies onboarding for users familiar with traditional finance.

Risks and Considerations

While Fidelity Crypto Wallet reduces operational risks, investors should be aware of:

- Market volatility impacting asset valuation.

- Regulatory changes that may affect wallet functionality or asset accessibility.

- Reliance on centralized custody, which contrasts with self-custody philosophies.

Investment Outlook

The wallet enhances crypto adoption by providing regulated, secure access. Investors can combine wallet usage with ETFs, staking, and diversified portfolios. Strategies such as periodic portfolio rebalancing, staking participation, and educational engagement can optimize returns and mitigate risks.

Further Reading and Resources

Crypto Tax | Crypto Exchanges | Crypto Insurance

Frequently Asked Questions

What is Fidelity Crypto Wallet? A secure digital wallet for storing multiple cryptocurrencies with institutional-grade security.

How does it compare to MetaMask? Fidelity focuses on regulated custody and portfolio integration, while MetaMask emphasizes DeFi and decentralization.

Is it suitable for institutional investors? Yes, it offers compliance, reporting, and security features tailored for institutions.

Where to learn more? Explore Fidelity Crypto, Best Crypto Apps, and SEC Coin categories.