SEC-Approved Crypto ETFs: Progress and Prospects

Assessing the state of SEC-approved crypto ETFs and what lies ahead.

Read more →

Assessing the state of SEC-approved crypto ETFs and what lies ahead.

Read more →

We compare SEC Coin’s compliance focus with Ethereum’s versatile ecosystem to gauge potential.

Read more →

A clear, educational breakdown of Sec Coin’s compliance-native thesis, token design, and risk map — with a focus on how the model works, not on price targets or trading calls.

Read more →

Emerging Gaming Chains: Immutable X, Gala and More

Read more →

A no-fluff 2025 look at Aptos: Move language, Block-STM parallelism, real-world throughput/fees, and how it stacks up vs Sui and Solana. We outline KPIs to watch, adoption scenarios, and a grounded verdict on APTOS competitiveness.

Read more →

Forecasting how the SEC might balance innovation with investor protection in the coming years.

Read more →

Exploring the consequences of stricter SEC enforcement on crypto exchanges.

Read more →

Evaluating how the SEC’s investor protections apply to crypto holders.

Read more →

Understanding the SEC’s position on DeFi and its implications for investors.

Read more →

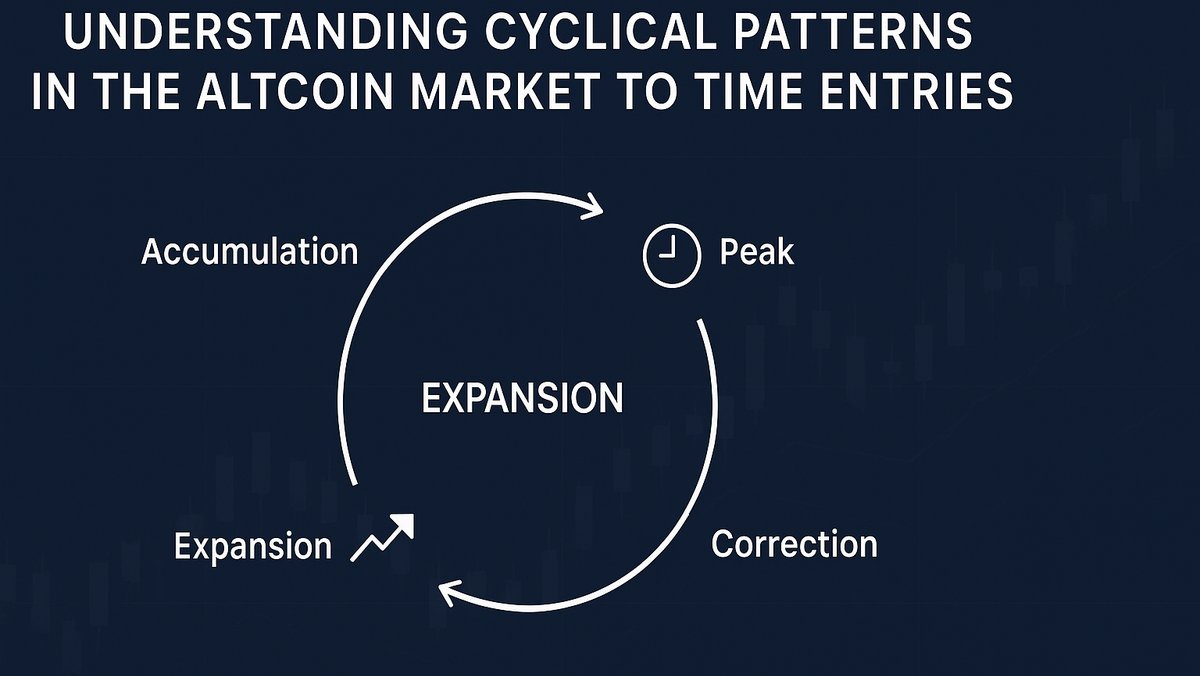

A data-driven tour of altcoin cycles: how liquidity rotates from BTC to ETH to the long tail, what 2017 and 2021 actually looked like by the numbers, which indicators matter (TOTAL2, BTC.D, ETH/BTC, stablecoin supply), and a playbook for the next phase.

Read more →

From meme to money: a data-informed look at whether DOGE can graduate into a real payments asset, with on-chain usage, merchant rails, and scenario checkpoints for 2025.

Read more →

A deep, data-driven look at the strongest crypto gaming tokens in 2025—what drives them, how to evaluate them, and where the category could go next.

Read more →

A deep, numbers-aware look at how Solana scales today—Proof of History, Sealevel, QUIC, fee markets—and what Firedancer, localized fee markets, and client diversity mean for throughput, reliability, and builder UX in 2025.

Read more →

A practical look at Lido’s liquid staking: how stETH works, what LDO governs (and does not), Lido’s ETH staking market share, plus benefits, risks, fees, and 2025 metrics to watch.

Read more →

A data-led field guide to 10 standout metaverse tokens in 2025—what they do, why they matter, key metrics, catalysts, and risks.

Read more →

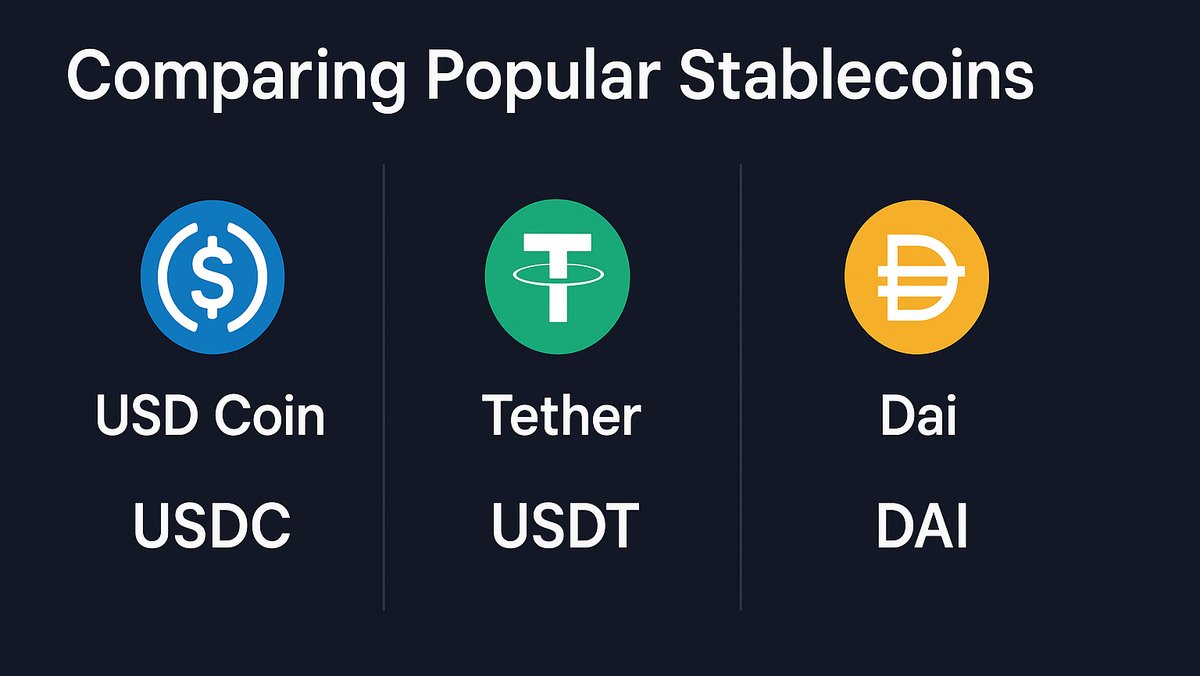

A practical, numbers-first comparison of USDT, USDC, DAI, FRAX, PYUSD, and more—collateral design, decentralization, market share, resilience, and the trade-offs that matter for traders and DeFi.

Read more →

Our deep-dive defines 'blue-chip' in DeFi and ranks leading tokens by business model durability, cash-flow quality, decentralization, and ecosystem pull. Includes side-by-side comparisons, on-chain signals, and risk notes for 2025.

Read more →

A rigorous, numbers-aware comparison between Polkadot’s Relay Chain model and Cosmos’s hub-and-zone Interchain—tech design, security assumptions, interoperability (XCM vs IBC), governance, and where builders and investors should place their speculative positions in 2025.

Read more →

Polygon leverages Ethereum security via L2s (plus the legacy Polygon PoS sidechain); Avalanche is a high-throughput L1 with customizable Subnets. Here is a side-by-side, number-driven comparison to decide which stack fits your app or portfolio.

Read more →

From the 2023 summary judgment to the 2025 closure: programmatic XRP sales were not securities, institutional sales triggered securities rules, and the final civil penalty settled at nine figures. Here is the timeline, the legal nuances, and the practical investor playbook.

Read more →

Pure Proof-of-Stake versus Nightshade sharding, real-world block times and finality, fee models, EVM paths, and where liquidity and apps actually live in 2025.

Read more →

A forward-looking, data-backed view of Ethereum’s 2025: what Pectra changed, how EIP-4844 rewired L2 economics, where account abstraction is heading, and how ETFs and staking shape the next leg.

Read more →

A numbers-first comparison: consensus, latency, fees, client diversity, and ecosystem health. We cut through vague claims and show where Ethereum and Solana actually differ—and what those differences mean for builders and investors.

Read more →

A head-to-head comparison of Uniswap and SushiSwap: AMM design, fees, LP incentives, governance, decentralization, and where each DEX fits for traders, LPs, and tokenholders.

Read more →

High-profile SEC lawsuits affect market sentiment and adoption of SEC Coin.

Read more →

Learn how to stake your SEC Coin holdings to earn rewards while supporting network security.

Read more →

Regulators are crafting policies that could shape the future adoption of SEC Coin and similar tokens.

Read more →

A practical, data-informed guide to DAO tokens: how governance value accrues, which models work in the wild (UNI, AAVE, MKR, LDO, ARB, OP, CRV), how to value and monitor them, and the legal, liquidity and execution risks that matter in 2025.

Read more →

A field guide to 2025’s meme-asset class: who’s leading (DOGE, SHIB, PEPE, WIF, BONK, FLOKI), why they matter, the data that actually moves them, and how to separate signal from pure vibes.

Read more →

A 2025 field guide to the leading Ethereum Layer-2 tokens—how each network scales, what the on-chain data says, and where the upside and risks really are.

Read more →