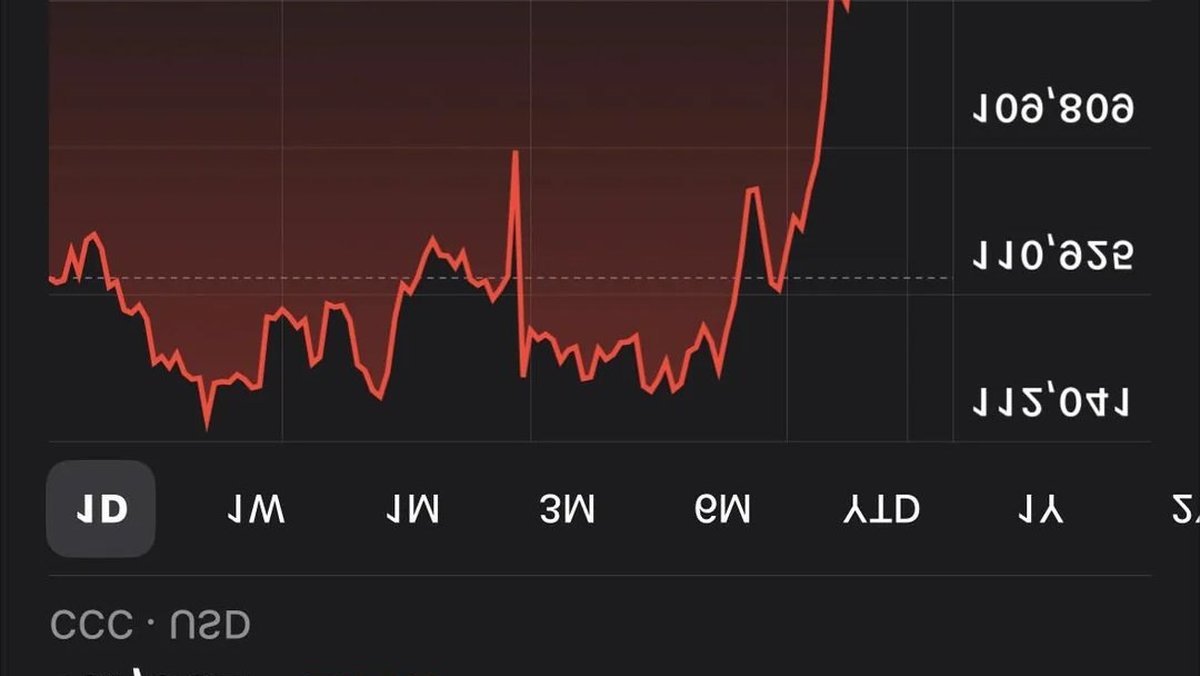

Bitcoin’s Exchange Balances Are Near Multi-Year Lows: How Real Is a $150,000 “Supply Shock”?

On-chain dashboards show exchange-held BTC at multi-year lows and trending lower—fuel for a classic supply-shock narrative. But does a thinner float automatically propel Bitcoin to $150,000? We map the plumbing behind ‘coins on exchanges,’ reconcile divergent data sources, and model three demand paths—from ETF refills to stablecoin issuance—where a squeeze becomes durable, versus scenarios where scarcity meets soft bid.

Read more →