After a weekend cascade that erased billions and clipped BTC dominance under ~59%, the market is asking the same question: is this the reset that precedes a broad altcoin cycle, or just another head fake? Here’s a no-hype framework to tell the difference—plus the signals to watch

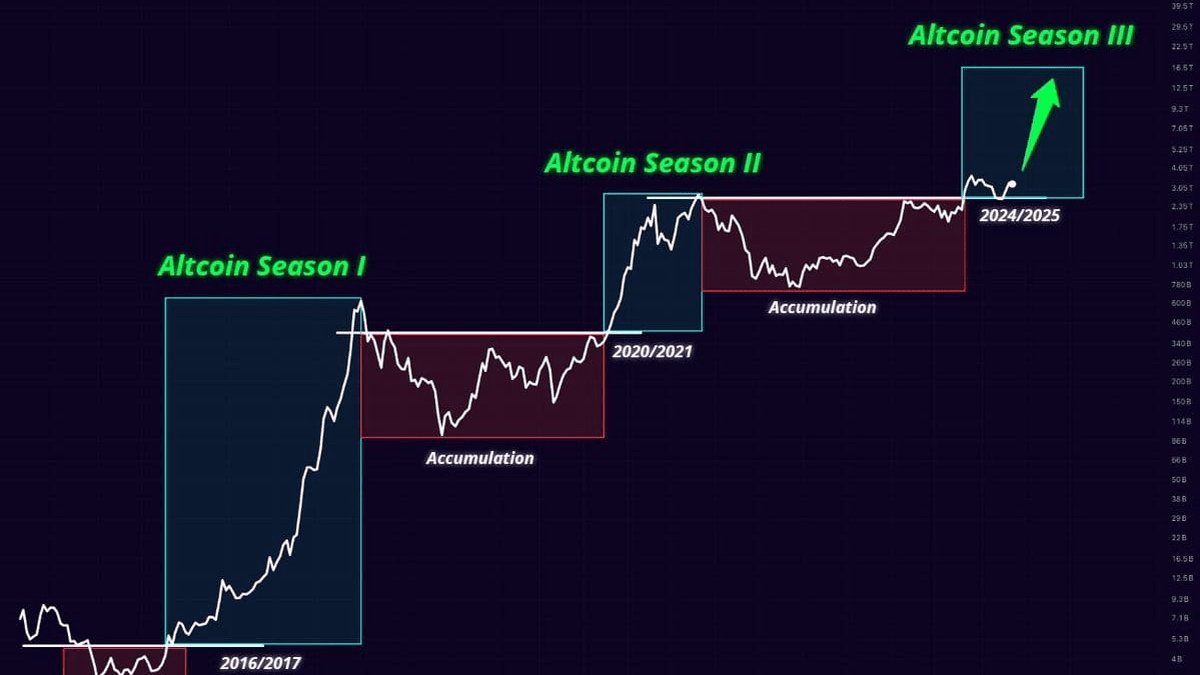

Every major crypto advance has a chapter where the crowd swears it’s over. That chapter usually follows a violent reset, the sort that forces out leverage, dents confidence, and leaves prices looking statistically cheap but emotionally expensive. The latest flush checked those boxes: double-digit drawdowns across large caps, a sharp pickup in liquidations, and—crucially—a slip in BTC dominance below ~59%. Coupled with early stabilization in select alt pairs, the tape is starting to whisper the phrase many don’t dare say aloud: Altseason. The question isn’t whether that word trends on CT; it’s whether the underlying plumbing supports a durable rotation or merely a reflex bounce.

Why resets are a prerequisite, not a paradox

Big rotations rarely begin at euphoria. They start when marginal buyers disappear and forced sellers do the dirty work of cleaning the book. The weekend cascade wiped out crowded longs, compressed perpetual funding, and shaved open interest. That’s painful—but it turns down the noise from speculative leverage and refocuses the market on spot demand. If BTC dominance rolls over after a leverage purge—rather than before—it often signals that sidelined capital is sniffing opportunity beyond the benchmark.

Rotation math: how capital actually moves

An “altseason” isn’t mystical; it’s a flow rotation. Three pipes matter most:

- Stablecoin inflows: Fresh fiat → stables → spot alts. Positive net issuance and rising exchange stablecoin balances are the raw material for alt bids.

- Benchmark recycling: BTC (and to a lesser extent ETH) profits get redeployed down the risk curve once trend confidence returns. The tell: BTC ranges while alt/BTC pairs grind up.

- ETF/ETP bleed-through: Even if the ETFs target BTC/ETH, their volatility regime sets the appetite for beta elsewhere. Calmer BTC vol is fertilizer for alt risk.

The tape today: 5 constructive tells

• Dominance dipped post-flush: BTC.D slipping under ~59% after a liquidation wave suggests rotation is organic, not leverage-led.

• Funding normalized: Perp funding cooled toward flat to slightly negative on many pairs. That pulls the oxygen from one-way squeezes and invites cash buyers.

• Depth improved midweek: Top-of-book size recovered from weekend air pockets. Better depth reduces slippage and helps alt/BTC bases hold.

• Breadth green shoots: Not just one theme; multiple sectors printed early higher lows—privacy, oracles, DePIN, and selective L2s—hinting at rotation breadth.

• Pair leadership: Several alts stabilized vs BTC first, then vs USD. In prior cycles, that sequence preceded broader risk-on in alts.

What could power an Altseason 3.0 (and what could kill it)

Fuel

- Macro détente: Tariff or rates clarity cools implied vol, encourages carry, and frees allocators to climb the risk ladder.

- Spot-led demand: Evidence that bids come from wallets, treasuries, and ETFs—not just perps—supports persistence.

- Narrative catalysts: Concrete mainnet launches, protocol revenues, or token-economic upgrades (fee burns, staking, restaking sinks) that turn clicks into cash flow.

Friction

- A fresh policy shock: New export controls, surprise enforcement, or hawkish rate repricing would shove capital back into BTC, stables, or gold.

- Leverage relapse: If funding races positive and OI spikes faster than spot inflows, bounces morph into traps.

- Fragmented liquidity: If market-making depth thins again on weekends, liquidation chains can smother nascent uptrends.

Sectors most likely to lead a new rotation

1. Infrastructure with usage: L2s/L3s and high-throughput L1s that can point to fee growth and developer traction (not just TPS chest-thumping). Watch bridge risk and sequencer roadmaps.

2. Real-world asset rails (RWA): Tokens tied to on-chain treasuries, credit, or settlement. If yields compress in TradFi, “on-chain cash” narratives attract sticky allocators.

3. DePIN & AI-adjacent compute: Networks converting hardware/compute into tokenized markets. Revenues and utilization metrics beat slogans here.

4. Data & oracle layer: Mission-critical middleware that monetizes updates, proofs, or MEV mitigation via predictable fee flows.

5. Selective privacy: Assets with clear compliance modes (view keys, selective disclosure) tend to outperform blunt instruments in a policy-heavy tape.

How alt cycles actually unfold (microstructure view)

1. Phase A — Base & disbelief: Alt/BTC pairs form higher lows while Twitter swears “alphan’t.” Funding flat, OI modest, spot accumulates.

2. Phase B — Leadership narrow: A handful of narratives outrun; breadth lags. Dominance drifts lower but remains above the cycle mean. Dips get bought on leaders; laggards chop.

3. Phase C — Breadth expansion: Capital rotates to second-liners. Market cap ex-top-10 climbs faster than total crypto cap. Listings, L2 support, and integrations accelerate.

4. Phase D — Euphoria & fragility: Funding rich, OI balloons, influencers declare a “new paradigm.” This is where disciplined trimming beats diamond hands.

Checklist: is a true altseason starting or not?

- BTC in a range with declining realized vol (alts dislike BTC whipsaws).

- Stablecoin net issuance turns positive for multiple weeks, not just day-spikes.

- ETF/ETP flows stabilize or improve (risk budget returns).

- Alt/BTC pairs printing weekly higher highs across multiple sectors.

- Funding on leaders stays near neutral during advances (spot-led rallies are healthier).

Strategy notes (not investment advice)

1. Anchor to pairs, not headlines: The cleanest tells are vs BTC. If your alt bleeds on the BTC pair, the USD chart is hiding beta.

2. Stage entries: Scale in across three tranches: base, confirmation (break/retest), and momentum add. Fail fast if the pair loses the base.

3. Respect liquidity: Favor names with consistent depth and exchange coverage. Liquidity is a position size constraint, not a suggestion.

4. Pre-define exits: Place invalidation below structural levels (prior weekly lows, trendline breaks), not mental stops.

5. Rotate, don’t chase: When leaders stretch, harvest and feed lagging but confirmed setups. That’s how breadth pays without top-ticking.

What would invalidate the Altseason 3.0 thesis?

Two things: (1) BTC volatility spikes and reclaims leadership violently—dominance back above ~62% while alts make new relative lows; (2) a policy shock that forces net outflows from stablecoins and spot ETFs, draining the bid underneath higher-beta names. Either would reset the clock.

Bottom line

The ingredients for an Altseason 3.0—a leverage purge, a nudge lower in BTC dominance, normalized funding, and early pair leadership—are finally on the counter. That doesn’t guarantee a feast; it means the kitchen’s warm again. If stablecoin issuance and spot-led demand persist while BTC vol stays contained, breadth can expand and a real rotation can take hold. If not, treat every pop as a trade, not a regime change. In a market this path-dependent, process beats prediction—every time.