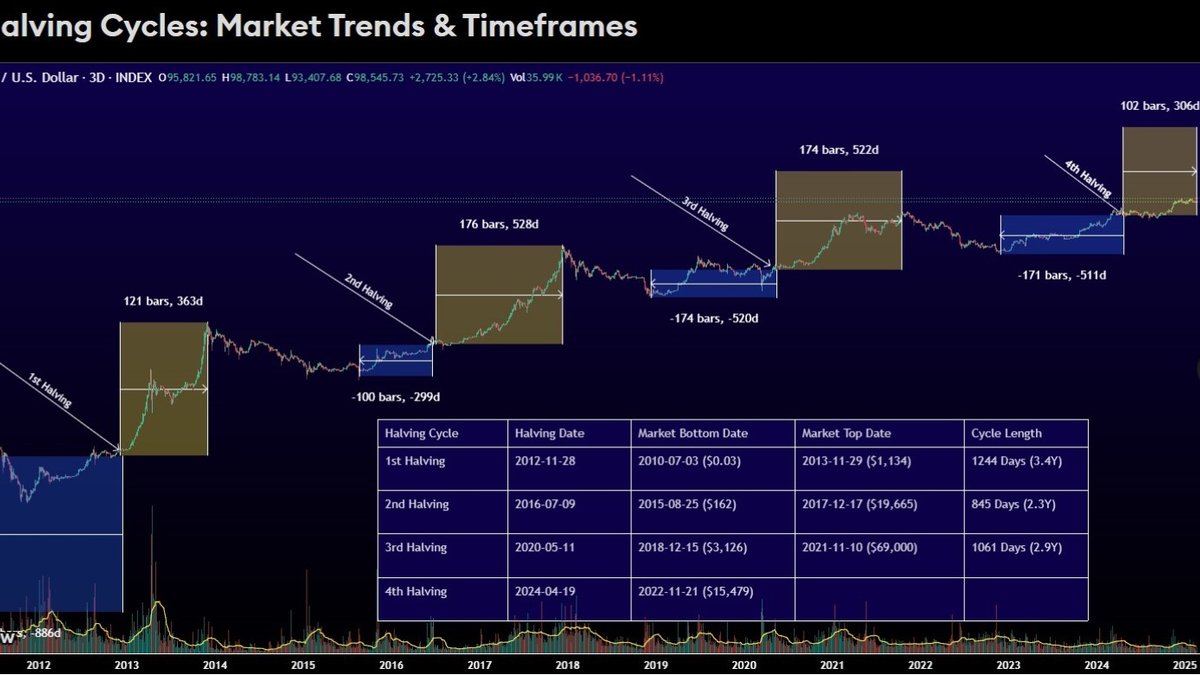

When Whales Step Back: What a Neutral Stance Says About the Cycle

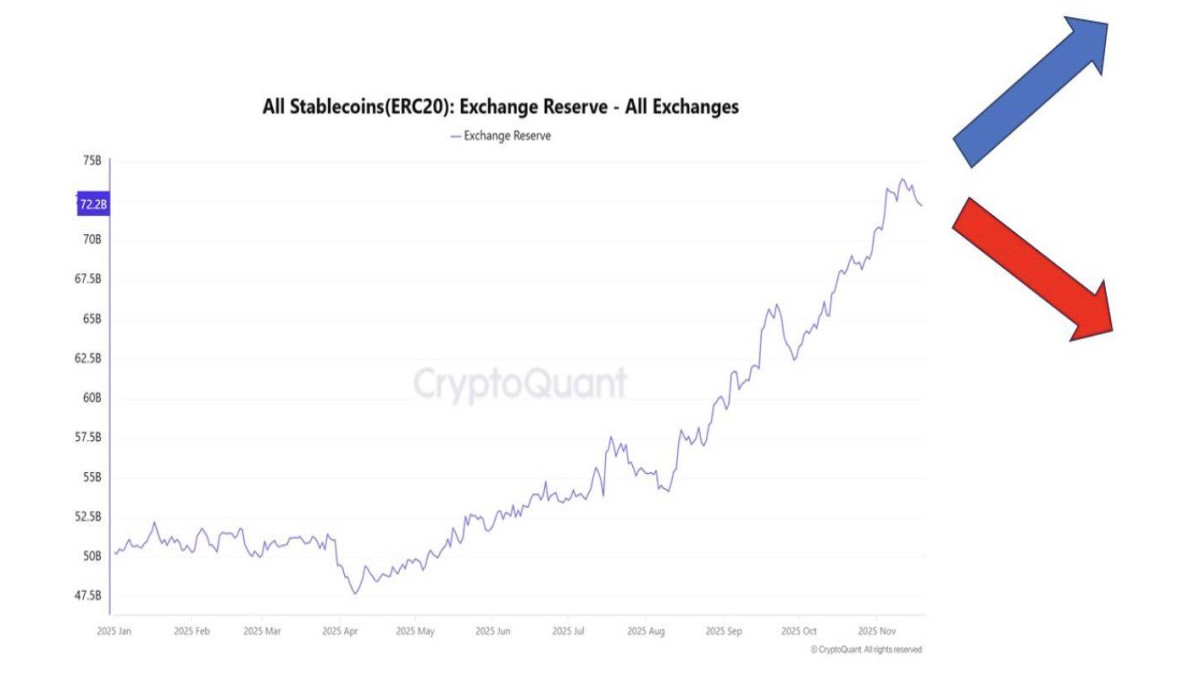

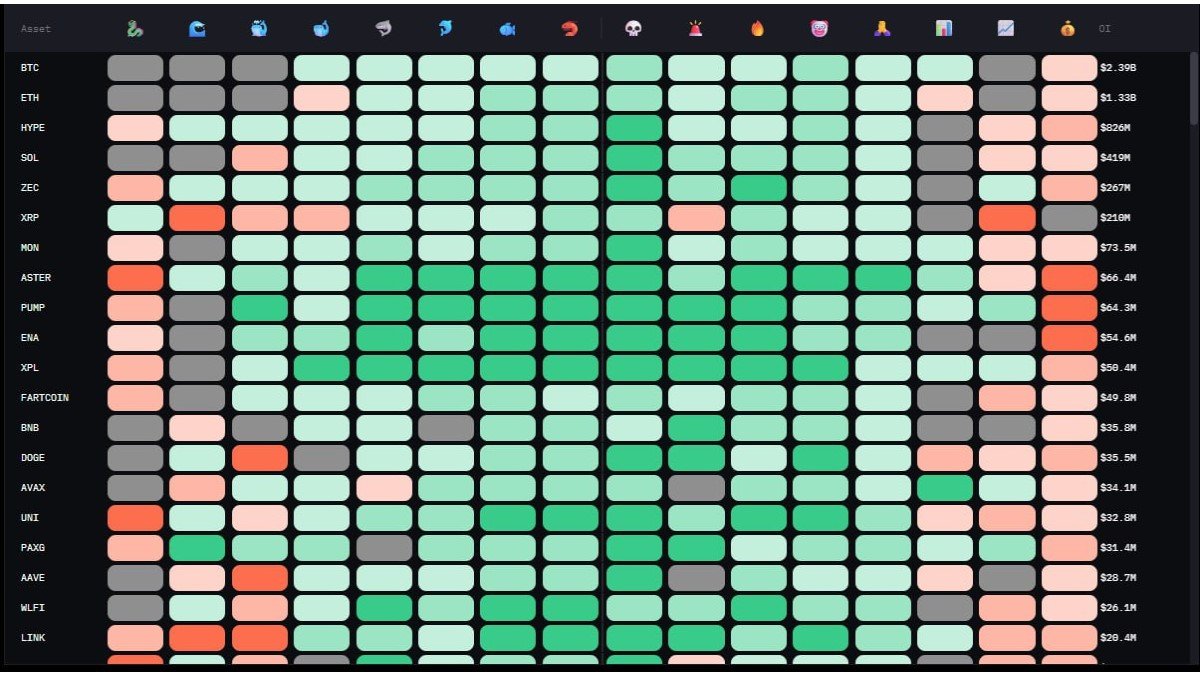

At the end of November, Bitcoin reclaimed the 90K area and Ether revisited 3K—but the whale cohort quietly moved from confidently long to almost perfectly neutral. A closer look at futures positioning shows why large holders may be stepping back and what that means for the next phase of the cycle.

Read more →