Optimism Whales Move 24.8M OP to Coinbase: Strategy Reset or Quiet Distribution?

Layer-2 networks have spent the last two years competing for users, developers and narratives. Optimism (OP) has been at the centre of that race, building a rollup ecosystem, funding public goods and courting enterprises. But in recent weeks, the project’s leadership has taken a more introspective tone. On 27 November, the founder publicly acknowledged that Optimism had tried to do too many things at once, lacked a sharp strategy, and is now streamlining its team while designing a cleaner roadmap.

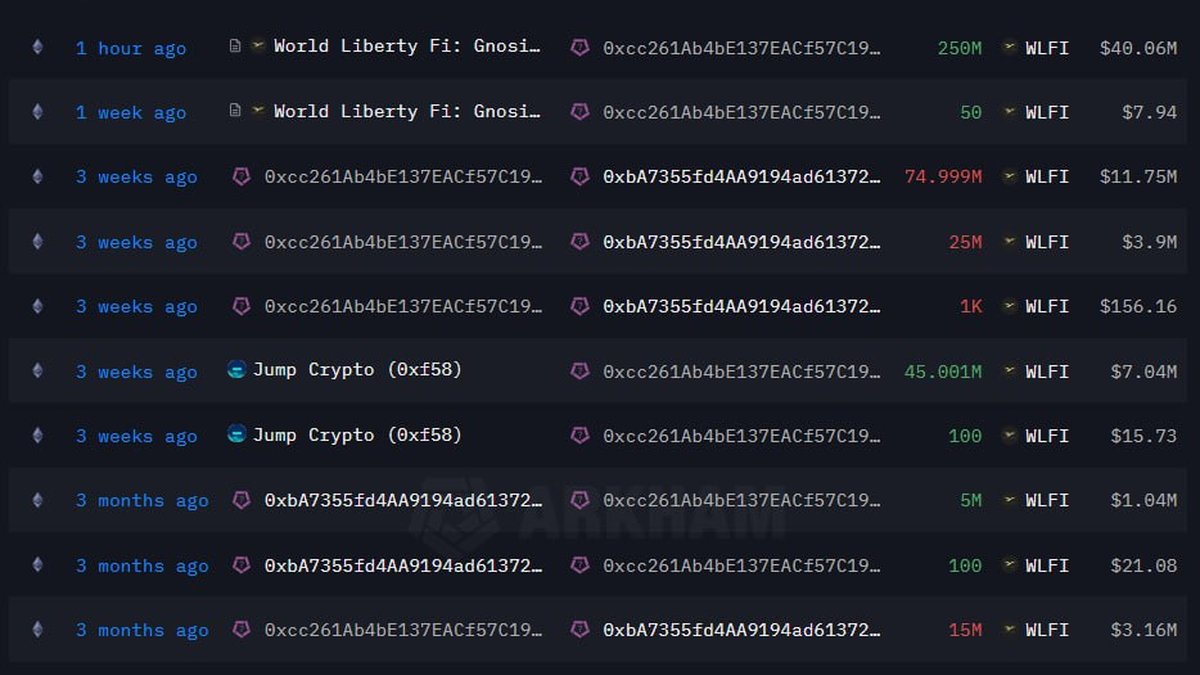

Only a few days later, on-chain data captured another notable development: two whale wallets moved a combined 24.870 million OP, worth roughly 7.46 million USD, to Coinbase Prime. From there, the tokens flowed into a Coinbase hot wallet and are now being distributed across a web of smaller addresses that have been quietly accumulating OP for months.

For observers, the coincidence is hard to ignore. Are insiders taking advantage of renewed liquidity to reposition? Is this distribution part of a longer-term accumulation plan among many smaller holders? Or is it simply operational housekeeping that happens to line up with a big public statement?

As always, on-chain data cannot give definitive answers. But it can narrow the range of plausible stories and help investors think more clearly about risk, opportunity and market structure. The goal of this article is not to predict short-term price moves, but to unpack what we can reasonably infer from the data in a brand-safe, educational way.

1. The Transactions: What Actually Happened On-Chain?

Let us start with the basic facts. Around two hours before the time of writing, two large wallets, both long-time OP holders, sent sizeable transfers to Coinbase Prime:

- Whale wallet A:

0xb8e4481EcF0A763fFCb1809c553f1fa517c7b81d - Whale wallet B:

0x618d9aed6D366D6fcbA0ad8F51D32bf2254D01cC

Together, they deposited 24.870 million OP to Coinbase Prime, an institutional-grade platform used by funds, corporates and high-net-worth clients. Shortly after, those tokens were forwarded to a standard Coinbase hot wallet:

- Coinbase distribution wallet:

0xC8373EDFaD6d5C5f600b6b2507F78431C5271fF5

From this address, the OP is being split into multiple smaller transfers that are landing in a cluster of wallets. Many of these recipient wallets have an interesting history: they have been accumulating OP gradually over the past two months, often via smaller purchases or transfers from other exchanges.

This pattern stands out for two reasons:

- The size of the initial deposits is firmly in whale territory, pointing to large holders or entities rather than retail traders.

- The eventual recipients are not brand-new wallets; they show a track record of buying or receiving OP before this episode.

In other words, we are not just seeing a one-way transfer from whales to a centralised exchange. We are watching a multi-step redistribution: whales → Coinbase Prime → Coinbase hot wallet → a ring of smaller, previously active OP addresses.

2. Four Plausible Interpretations of the Flows

Because blockchains are transparent but not fully annotated, we need to be honest about what we can and cannot infer. The same pattern of transfers can support several explanations. Here are four that make sense in this case:

2.1. Classic Distribution: Large Holders Taking Profit or Reducing Exposure

The simplest explanation is often the default: whales may be moving OP onto Coinbase to reduce or rebalance exposure. Coinbase Prime typically caters to institutional or high-volume clients, so these deposits could be part of an over-the-counter arrangement or a structured sale to multiple buyers. The subsequent distribution to many smaller addresses would then reflect those counterparties receiving their allocations.

In this scenario, the key point is that supply is changing hands. Early, concentrated holders are passing some of their OP to a wider base of investors. That does not automatically imply a negative outcome; sometimes, redistributing supply from a few large wallets to many smaller ones can make a token’s ownership structure healthier. But it does mean that the market may need to digest additional float in the short term.

2.2. Treasury Operations: Moving Tokens Into Structured Custody

A second possibility is that the wallets are linked to team, foundation or ecosystem allocations rather than external whales. In that case, routing OP through Coinbase Prime and a central hot wallet could be part of a broader treasury strategy: setting up custodial accounts for partners, liquidity providers or ecosystem programs.

The pattern of recipient wallets having accumulated OP over the last two months fits with this idea. They could belong to funds or projects building on Optimism that are receiving staged allocations. Moving funds via a reputable prime platform and then dispersing them to counterparties is a common operational practice.

Under this interpretation, the transfers are less about exiting and more about organising the holdings to match the updated roadmap, partnerships and incentive structures born from the recent strategy reset.

2.3. Market-Making and Liquidity Management

A third reading focuses on liquidity rather than pure ownership. Large deposits to Coinbase Prime can be associated with professional market-making arrangements. In those setups, whales or foundations provide inventory to specialists who supply liquidity across spot and derivatives markets. The subsequent redistribution to multiple addresses might then reflect inventory being spread across trading systems or hedging venues.

This would align with a goal of keeping OP markets deep and orderly during a volatile period when the project is publicly revisiting its strategy. Strong liquidity can help smooth price discovery and reduce the impact of single large orders, which is valuable for both the project and its holders.

2.4. Internal Re-Structuring After a Strategy Admission

Finally, the timing with the founder’s comments suggests another angle: Optimism is rethinking its focus, simplifying its team and clarifying its mission. That kind of internal shift often comes with changes to how tokens are allocated, how incentive programs are funded and how much treasury risk the project is willing to carry.

From this perspective, the whale wallets could be moving tokens out of older structures (for example, legacy multisigs or grant programs) and into a new setup managed through Coinbase Prime and a fresh set of custodial or operational wallets. The fact that many recipient addresses show accumulation patterns over the last two months could indicate that this process has been in motion for some time and is now entering a more visible phase.

None of these scenarios can be confirmed without official communication. The responsible stance is to treat them as hypotheses rather than certainties. Yet spelling them out helps avoid the common trap of assuming that any large exchange deposit is purely bearish or purely bullish.

3. The Founder’s Admission: What Changed in the Optimism Narrative?

The on-chain story cannot be separated from the public one. On 27 November, the Optimism founder made a candid statement: the project, in their own words, had been attempting too many things at once and suffered from a lack of clear strategic focus. They acknowledged that this led to mistakes and that the team is now being streamlined while a sharper, more enterprise-oriented strategy is developed.

This kind of self-critique is unusual in crypto communications, which often lean toward relentless optimism. It has several implications:

• Short-term uncertainty: Admitting that past efforts were unfocused can unsettle some holders and partners. They may wonder which initiatives will survive the strategy reset and which will be sunset.

• Long-term potential: At the same time, a willingness to acknowledge mistakes can be a positive sign for governance culture. In technology, many successful turnarounds start with exactly this kind of frank assessment.

• Capital allocation changes: A new strategy almost always implies a new funding mix: some programs get more support, others less. Token movements, treasury deployments and grant structures are likely to evolve alongside the roadmap.

When we overlay this context onto the whale deposits, one reasonable interpretation is that Optimism’s internal and external stakeholders are repositioning around a new thesis. That could mean reducing exposure for some, increasing it for others, or simply rearranging custody to match a different organisational structure.

4. Do Investors Still Believe in Layer-2? A Broader Perspective

The closing question many community members are asking is simple: do people still believe in Layer-2 networks like Optimism? It is a fair question after a year of intense competition between rollups, sidechains and alternative base layers.

From a structural standpoint, the Layer-2 thesis has not gone away. Ethereum’s roadmap still leans heavily on rollups for scaling, and the next generation of upgrades is explicitly designed to make data availability cheaper for L2s. At the same time, usage across Optimism, Arbitrum, Base and other rollups has shown that users are willing to bridge assets if the trade-offs make sense.

Where the debate has shifted is in differentiation. A few themes stand out:

• Specialisation vs. general purpose: Some L2s are pivoting toward particular verticals such as gaming, enterprise or high-frequency DeFi. Optimism’s recent comments about refocusing on infrastructure and clear strategy should be viewed through this lens.

• Governance and funding models: How tokens are used — to fund public goods, reward sequencers, or backstop risk — will influence both perception and sustainability. Whale activity and treasury moves are part of this story.

• Interoperability and shared security: As more rollups appear, users care about how easy and safe it is to move between them, and whether they inherit the security guarantees of Ethereum.

In that context, whale moves in OP are less a referendum on the entire Layer-2 idea and more a reflection of how capital is repositioning within that segment. Some investors may choose to rotate between L2s; others may double down on teams they believe can execute through the noise. The key is that capital is not disappearing from the category — it is reallocating.

5. Reading Whale Behaviour Without Overreacting

Large wallets are fascinating to watch, but they can also be misleading if interpreted too literally. A few guidelines can help keep analysis grounded:

1. Direction of transfer matters, but context matters more. Tokens moving to an exchange increase the possibility of sales, but they are not proof of immediate selling. When those tokens are then redistributed to many addresses, the story becomes more complex.

2. Time horizon varies. A whale could be reducing a short-term trading position while still believing in the long-term potential of the project. Not every move reflects a complete change of view.

3. Operational needs are real. Foundations, market makers and institutional participants routinely move assets to meet operational, custodial or regulatory requirements. These flows can look dramatic on-chain without implying a strong directional bet.

4. Look for patterns, not one-off events. A single deposit is less informative than a multi-week trend. In our case, the fact that recipient wallets have been accumulating OP for two months hints at an ongoing redistribution process rather than a sudden change of heart.

For individual readers, the healthiest approach is to treat whale data as one input among many. It can provide useful context about market structure, but it should not override basic principles such as diversification, independent research and clear risk limits.

6. Key Takeaways From the OP Whale Episode

Putting the pieces together, what can we reasonably conclude from the recent Optimism activity?

• Two large wallets moved 24.870 million OP (about 7.46 million USD) to Coinbase Prime, which then forwarded the tokens to a Coinbase hot wallet.

• From there, the OP holdings are being distributed to a web of smaller addresses, many of which have a track record of accumulating OP over the last two months.

• The timing coincides with the founder’s admission that the project previously lacked strategic focus and is now trimming its team while designing a clearer roadmap.

• Several interpretations make sense: partial de-risking by whales, redistribution to new holders, treasury restructuring around the new strategy, or liquidity provisioning for market-making.

• None of these interpretations, on its own, provides a definitive trading signal. Instead, they highlight the importance of understanding how ownership and liquidity evolve as projects mature.

For the broader Layer-2 ecosystem, the episode is another reminder that technology, governance and capital are all evolving at once. Optimism’s willingness to rethink its strategy and the visible movements of large token holders are not signs that the L2 thesis has failed; they are signs that the competition to define what a successful L2 looks like is very much alive.

Ultimately, the most constructive way to read these events is not as a prompt for immediate action, but as an opportunity to deepen your understanding of how protocol strategies, treasury decisions and on-chain flows interact. The more clearly you can see those connections, the better equipped you will be to make calm, informed decisions in a market that rarely sits still.

Disclaimer: This article is for informational and educational purposes only. It does not constitute financial, investment, legal or tax advice, and it should not be treated as a recommendation to buy, sell or hold any digital asset. Digital asset markets are volatile and carry risk, including the possibility of total loss. Readers should conduct their own research and, where appropriate, consult qualified professionals before making any decisions related to cryptocurrencies or other financial instruments.