Jump Trading Steps In as a Major WLFI Counterparty: Reading a $40M On-Chain Signal

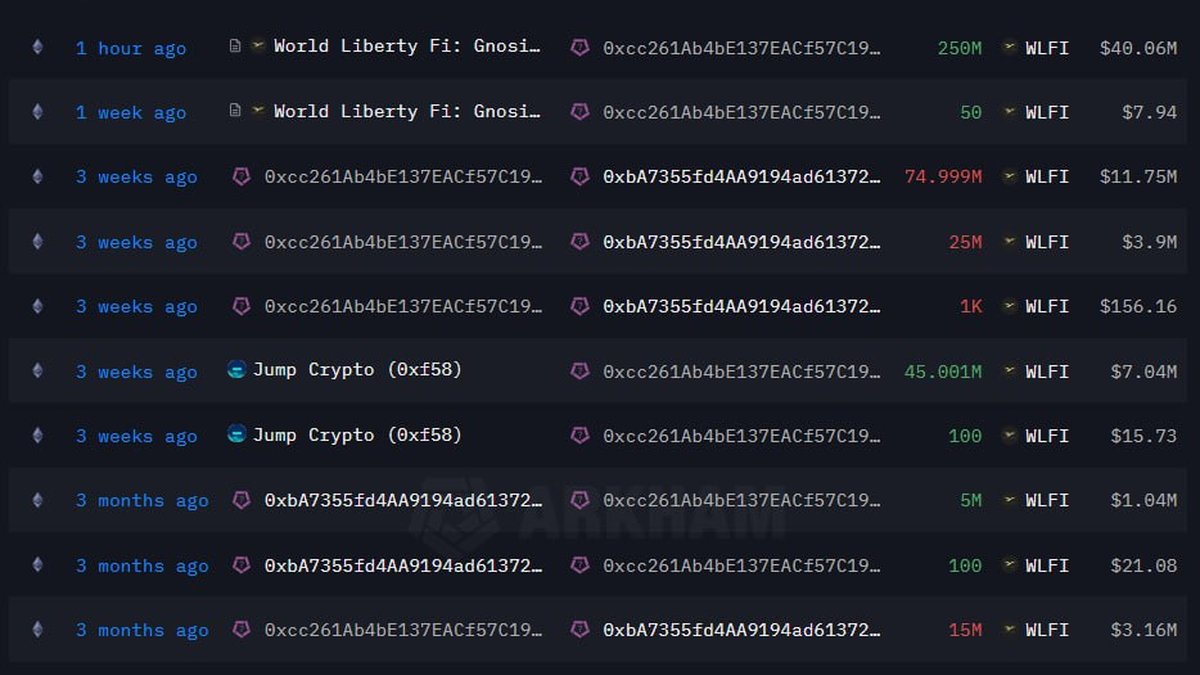

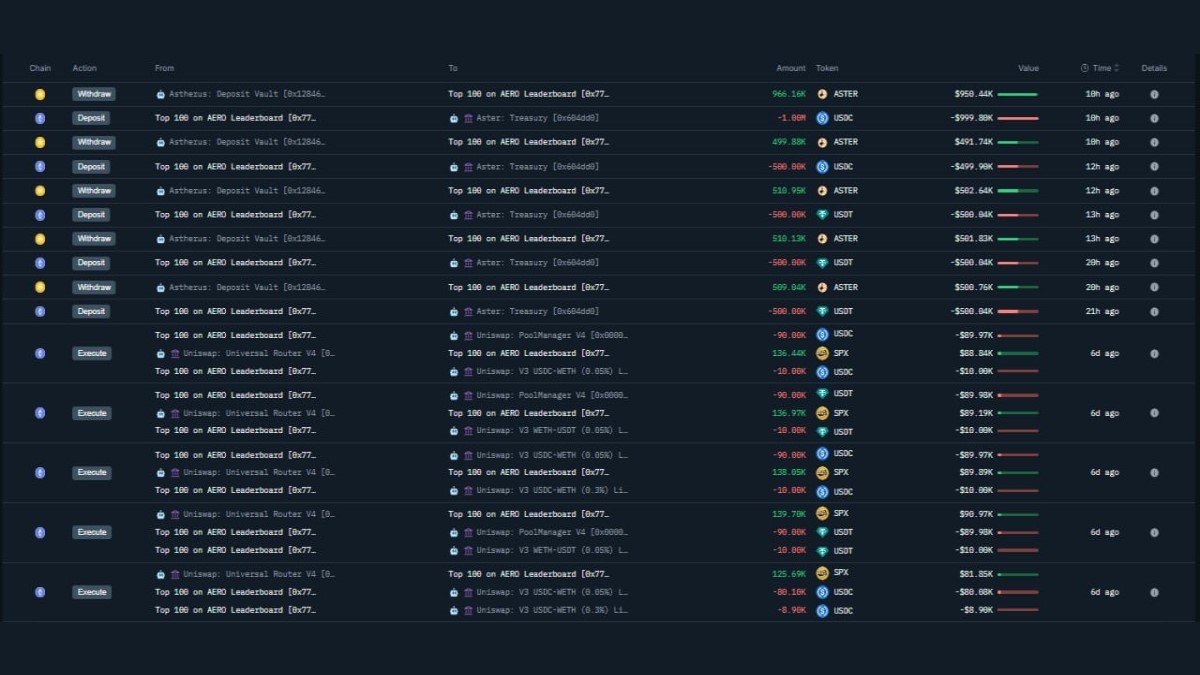

On-chain dashboards lit up overnight with a striking transaction: 250 million WLFI, worth roughly $40 million, moved from a World Liberty Finance treasury wallet to an address widely attributed to Jump Trading (0xcc261Ab4bE137EACf57C19ed97c186b4d88004Ca). It is not the first time these two parties have interacted, but it is by far the largest single batch of WLFI sent to that wallet.

Zooming out, the transfer sits at the end of a months-long trail. Three weeks ago the same wallet received multiple tranches of WLFI in the 25–75 million range, along with a 45 million token transfer from a Jump-branded address. Earlier still, we can see WLFI flowing onward from that cluster of wallets into two main destinations: a Chainlink-powered bridge and what appear to be exchange hot wallets. In other words, the address is not a dormant vault. It is an active hub in the WLFI logistics network.

So what should observers make of a professional trading firm suddenly holding hundreds of millions of a relatively new token? Is this a straightforward sign of institutional confidence, an early warning of increased selling pressure, or something more nuanced? As usual, the most useful answer is: it depends on context.

1. Reconstructing the Flow: From Treasury to Jump

The transaction history of the Jump-linked wallet tells a layered story. Reading from the bottom of the screenshot upwards, we see:

• Three months ago: transfers of 15 million and 5 million WLFI from a World Liberty Finance-controlled address to what looks like a bridge or intermediary wallet.

• Three weeks ago: several new batches: 74.999 million WLFI, 25 million WLFI and smaller test-size transfers, again originating from the project side but converging on the Jump-linked wallet.

• Also three weeks ago: inbound WLFI from an address labelled Jump Crypto, followed by outbound flows from the same cluster toward a Chainlink bridge contract.

• One week ago: a tiny 50 WLFI transfer—likely a housekeeping transaction or permission test—sent back from World Liberty Finance to the Jump wallet.

• One hour ago (the headline event): a jump in scale: 250 million WLFI, about $40.05 million at prevailing prices, credited from a World Liberty Finance Gnosis-style treasury to the same Jump address.

What makes this sequence particularly noteworthy is not just the size of the latest transfer, but the fact that earlier batches were already routed along two clear paths:

- From the Jump-linked wallet to a Chainlink bridge, presumably to position WLFI on other networks or to facilitate cross-chain liquidity.

- From the Jump-linked wallet to Jump trading accounts and onward to exchanges, where WLFI can trade against stablecoins or major assets.

This pattern is typical of a professional liquidity partner onboarding a new asset: initial test transfers, followed by moderate-size batches to calibrate systems, and then a larger allocation once everything is functioning as intended.

2. What Role Do Firms Like Jump Usually Play?

Jump Trading is known in digital-asset circles primarily as a market-structure specialist. Rather than acting like a long-only fund, it tends to provide liquidity, connect fragmented venues and help new tokens trade with tighter spreads. While specific strategies are proprietary, the broad categories of activity are relatively well understood:

• Inventory management. A trading firm may hold a working inventory of tokens so it can quote two-sided markets on multiple exchanges without constantly moving assets on-chain.

• Cross-venue arbitrage. By buying where a token is cheaper and selling where it is more expensive, the firm helps align prices and reduce dislocations between venues.

• Launch and listing support. When a new token like WLFI lists on a large exchange, liquidity providers ensure that there are bids and offers available from the first minute, which helps avoid erratic prints on low volume.

• Cross-chain routing. If a token exists on several networks, a professional desk can move liquidity through bridges and keep depth balanced, so that users on different chains face similar trading conditions.

When a project team sends a substantial portion of its native token to a firm of this kind, it is often part of a broader liquidity and infrastructure partnership. The tokens may be used as inventory for quoting markets, as collateral for hedging instruments or as part of structured agreements tied to long-term ecosystem support.

3. Three High-Level Scenarios for the WLFI–Jump Relationship

From the outside, we cannot see the contract that governs these transfers. However, by combining on-chain movements with typical industry practices, we can sketch three broad scenarios that help frame expectations.

Scenario A: Liquidity Provision With Aligned Incentives

In this interpretation, World Liberty Finance is allocating WLFI to Jump primarily as working capital for liquidity provision. The firm holds inventory across exchanges and possibly on-chain pools, hedges directional risk with derivatives or offsetting baskets, and earns a spread from facilitating trades. The project benefits from healthier markets: narrower spreads, more consistent pricing and the ability for larger holders to adjust positions without severe slippage.

Key characteristics of this setup would include:

- Tokens are actively moving between exchanges, but net balances in Jump custody may remain relatively stable.

- There is no abrupt spike in on-chain transfers back to project wallets, suggesting that inventory is being used rather than returned.

- Over time, additional allocations may be made as trading volumes grow and more venues list WLFI.

From a market-structure perspective, this scenario is generally constructive. While short-term volatility can still occur, the presence of professional liquidity can reduce the likelihood of thin-order-book swings.

Scenario B: Strategic Treasury Collaboration and Cross-Chain Expansion

The second scenario emphasises the Chainlink bridge route visible in the transaction history. Here, Jump is not just a liquidity provider on centralised exchanges but also a partner in expanding WLFI across networks. The desk receives WLFI from the World Liberty Finance treasury, routes a portion through Chainlink's bridge contracts, and helps populate liquidity on additional chains or decentralised venues.

In this case, the transfer serves multiple purposes at once:

- Jump can quote WLFI pairs on the new network from day one, using its cross-chain visibility to keep prices consistent.

- World Liberty Finance benefits from faster ecosystem rollout, since a single infrastructure partner can handle much of the heavy lifting.

- Institutional clients who operate primarily on specific chains may gain easier access to WLFI without having to manage cross-chain transfers themselves.

This scenario aligns with the recent trend of protocols relying on established trading firms to handle multi-chain logistics. It can be positive for long-term adoption, though it also concentrates operational control over large token flows in a small number of hands.

Scenario C: Potential Supply Overhang

The third scenario is the one that naturally worries some holders: a large block of WLFI sitting with a sophisticated trading firm could eventually translate into additional sell-side pressure if overall demand fails to keep up. Even if Jump's primary mandate is to provide liquidity rather than to take a directional view, inventory that is not needed for day-to-day operations may be gradually recycled through the market.

Under this interpretation:

- Monitoring exchange order-book depth and net flows becomes crucial. A steady increase in WLFI available on multiple venues without corresponding growth in user adoption could weigh on price.

- Transparent communication from World Liberty Finance about the purpose and time horizon of the allocation becomes even more important.

- Analysts would pay close attention to whether future unlocks, incentives or treasury movements add to circulating supply on a similar scale.

It is important to stress that this scenario is not a prediction; it is simply one of the possibilities that careful observers should keep on the radar when a single counterparty receives a very large token allocation.

4. Why This Transfer Matters for WLFI's Market Structure

Regardless of which scenario dominates, the 250 million WLFI transaction clearly marks a shift in how the token is integrated into the broader market. Several implications are worth highlighting.

4.1. From Retail-Heavy Trading to Professional Market Infrastructure

Newly launched tokens often go through an initial phase where most volume comes from smaller participants and early ecosystem contributors. Order books can be thin and decentralised exchange pools shallow. The involvement of a firm like Jump often indicates that the project is graduating to a more professional market infrastructure, where liquidity is managed continuously across venues rather than appearing in bursts.

4.2. Increased Cross-Venue Connectivity

The earlier transfers to the Chainlink bridge suggest that WLFI is being positioned to move fluidly between chains. Market makers with cross-chain capabilities can help ensure that prices remain aligned across ecosystems, reducing the incentive for opportunistic cross-chain arbitrage and making it easier for long-term users to transact without worrying about inconsistent valuations.

4.3. Opacity vs. Transparency

One side effect of channeling large token flows through professional intermediaries is an increase in opacity. Tokens that sit inside multi-client custodial arrangements or proprietary trading accounts are harder to track individually on public block explorers. This does not imply anything negative by itself, but it does mean that traditional on-chain heuristics—such as counting "whale addresses"—become less informative.

For WLFI, the 250 million token allocation could mark the start of a phase where effective supply in active markets is shaped more by institutional arrangements than by individual wallets. That evolution is natural as an asset matures, but it places a premium on clear communication from both the project and its partners.

5. How Should Observers Interpret This Without Overreacting?

It is easy to fall into binary thinking: either a large transfer to a professional firm is a guaranteed catalyst for sustained appreciation, or it is an ominous sign of looming sell pressure. In reality, the truth usually lies somewhere in between. A balanced, brand-safe interpretation might follow these principles:

• Separate flow from narrative. The on-chain data shows that World Liberty Finance has entrusted Jump with a substantial quantity of WLFI and that this address has historically routed tokens to both bridges and exchanges. That is a factual description, not an automatic endorsement of any price view.

• Recognise the dual nature of liquidity. Professional market makers can dampen volatility and improve user experience, but they can also accelerate price discovery when sentiment shifts. Their role is to keep markets functioning, not to permanently hold every token they receive.

• Focus on fundamentals. Over multi-year horizons, the trajectory of WLFI is more likely to depend on product adoption, fee generation, governance quality and risk management than on any single wallet transfer.

6. A Practical Checklist for Monitoring WLFI After the Jump Transfer

For readers who follow WLFI or similar projects, here is a structured way to keep an eye on developments without relying on speculation or sensationalism.

1. Watch official communications. Does World Liberty Finance explain the purpose of the Jump allocation? Are there references to market-making agreements, cross-chain expansion or ecosystem incentives?

2. Track exchange listings and liquidity depth. Over the coming weeks, do more platforms list WLFI pairs? Are spreads narrowing and order books thickening, suggesting that the inventory is being used to support trading?

3. Monitor bridge activity. If more WLFI appears on other networks via Chainlink or similar infrastructure, look at how quickly decentralised exchanges and applications on those chains integrate the token.

4. Compare circulating supply estimates. Public dashboards may revise their view of WLFI's circulating supply as treasury movements and exchange balances change. Understanding these revisions can clarify whether the effective float is expanding or staying relatively stable.

5. Align any personal strategy with risk tolerance and time horizon. Even if the transfer ultimately proves beneficial for WLFI's ecosystem, the path may involve volatility. No on-chain signal should override a considered assessment of portfolio risk.

7. Bigger Picture: Institutional Liquidity and the Next Phase of Crypto Markets

The WLFI–Jump story is also part of a broader theme. As digital-asset markets mature, institutions are increasingly central to how liquidity is organised. Token teams partner with professional firms for listings, cross-chain deployment and treasury optimisation. Users who simply see price charts may not always notice this infrastructure layer, but it plays a growing role in how risk and opportunity are transmitted through the system.

For long-term observers, these developments highlight both promise and responsibility. On one hand, deeper institutional involvement can make markets more resilient, reduce fragmentation and help innovative projects reach a global audience. On the other hand, it underscores the need for thoughtful governance, clear disclosures and risk-aware participation from all sides.

Conclusion

The latest 250 million WLFI transfer from World Liberty Finance to a Jump Trading-linked wallet is more than just a big number on a block explorer. It is a visible marker of WLFI's transition into a phase where professional liquidity providers and cross-chain infrastructure play a central role in its market structure.

Whether this proves to be the starting point of a sustained growth chapter for WLFI, a routine step in treasury logistics, or a precursor to a more complex supply dynamic will depend on factors that extend well beyond a single transaction. By treating on-chain data as context rather than as a prediction engine, readers can use signals like this to ask better questions, calibrate expectations and stay grounded in a fast-moving environment.

Disclaimer: This article is for informational and educational purposes only. It does not constitute financial, investment, legal or tax advice, and it should not be treated as a recommendation to buy, sell or hold WLFI or any other digital asset. Cryptoassets are volatile and involve risk, including the possible loss of principal. Readers should conduct their own research and consider consulting qualified professionals before making investment decisions.