ASTER Whale Returns With a $3M Re-Entry: How to Read the Signal Without Copying It Blindly

Large on-chain moves always attract attention, especially when they come from a wallet that has already been active in the same token. That is exactly what is happening now with ASTER.

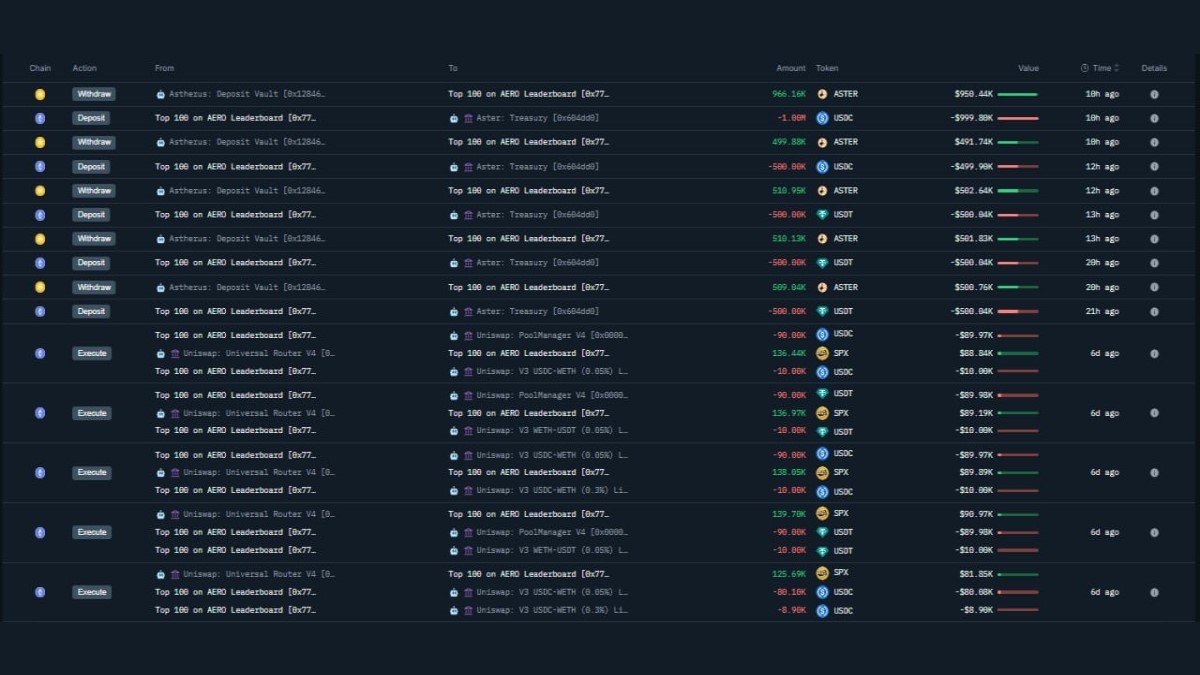

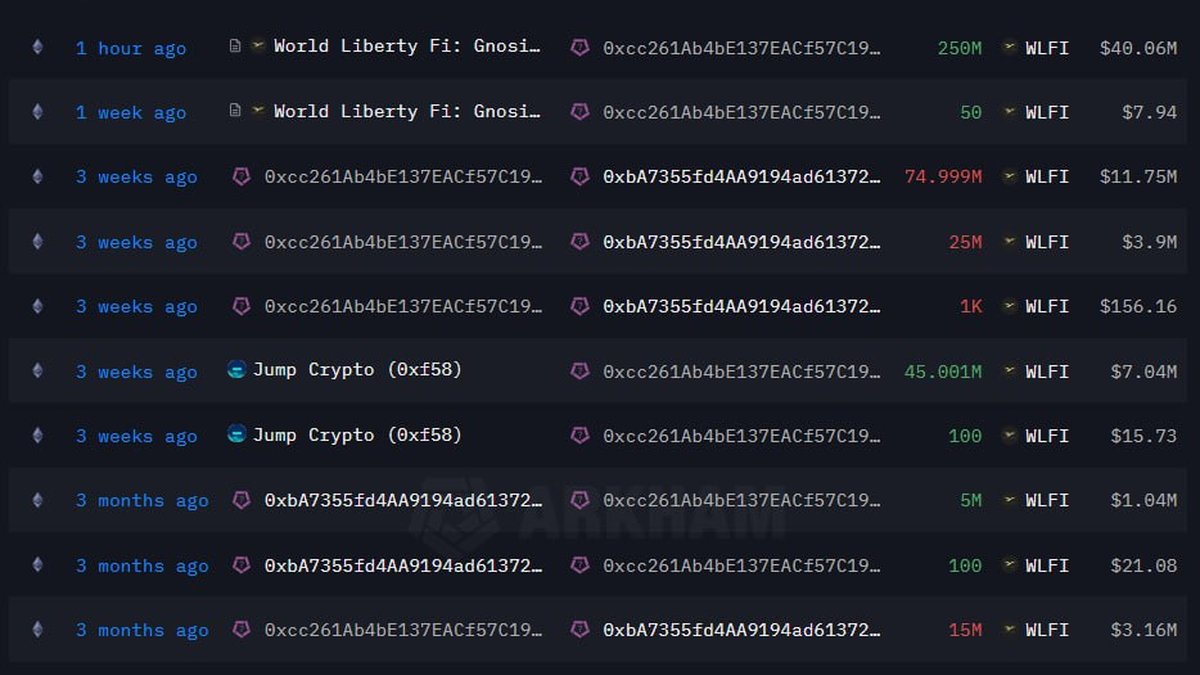

Over roughly a 24-hour window, a single address – 0x7771d1FDA54db864d52b7aa61061D7537025F064 – has swapped about 3 million USDC into roughly 2.996 million ASTER. One of the latest transactions alone saw 1 million USDC exchanged for around 966,160 ASTER, implying an entry price close to $0.966 per token.

This is not the wallet’s first encounter with ASTER. Earlier in November, the same address built a position of about 3.6 million USD, then exited as the price structure started to weaken, crystallising an estimated 150,000 USD loss. In percentage terms that is a modest hit, but it is a clear sign that this participant is willing to reduce risk when the market does not cooperate, instead of holding through every drawdown.

Now the address is back, accumulating ASTER again – and quietly rebuilding exposure to SPX as well. For observers, the tempting question is: “Does this whale know something?” A more useful question is: “What can we actually learn from this behaviour about risk management, conviction and the limits of using whale flows as a shortcut?”

This article unpacks the recent activity, explores why a sophisticated participant might re-enter a token after a loss, and offers brand-safe, educational takeaways for anyone watching whales on-chain.

1. Reconstructing the Whale’s ASTER Timeline

Based on the activity described, we can roughly split this wallet’s ASTER journey into three phases.

Phase 1 – Deep-dip accumulation

- Earlier in November, the address accumulated exposure to ASTER on what looked like a sharp pullback.

- Total notional committed was in the region of 3.6 million USD.

- The context resembled a classic “buy the dip” attempt after a strong prior move, with the wallet stepping in as others were reducing risk.

Phase 2 – Disciplined exit with a controlled loss

- Toward the end of the month, ASTER showed renewed weakness instead of the clean rebound the wallet might have anticipated.

- Rather than adding indefinitely, the address exited the bulk of its position, booking an estimated 150,000 USD loss.

- In percentage terms, that is roughly a mid-single-digit drawdown on the ASTER allocation – painful, but far from catastrophic for a strategy of this size.

Phase 3 – The comeback: fresh capital, new average price

- Within the last 24 hours, the wallet has returned with 3 million USDC in new swaps, acquiring close to 3 million ASTER at levels around $0.966.

- The latest leg alone saw 1 million USDC converted into about 966,160 ASTER.

- In parallel, the same address appears to be building up exposure to SPX, suggesting a broader thesis-driven strategy rather than a single isolated trade.

Put simply, this is not a “never sell” story. It is a case of a large, nimble participant that:

- Built a sizeable position,

- Accepted a controlled loss when the initial attempt did not play out as planned,

- Then re-entered when conditions and pricing looked more attractive.

2. What the Comeback Tells Us – And What It Does Not

It is easy to oversimplify whale behaviour. A lot of social-media commentary frames every large buy as proof that “smart money is buying” and every sale as a definitive top signal. Reality is usually more nuanced.

The fact that this wallet is returning to ASTER with meaningful size tells us a few specific things.

What it does tell us

• Ongoing conviction in the asset. The participant clearly has not written ASTER off. A purely opportunistic trader with no underlying view might simply move on after a losing trade. Coming back with new capital suggests that, in their assessment, the long-term story remains attractive.

• Flexible time horizon. The wallet appears comfortable treating the earlier position as one attempt in an ongoing strategy, not as the single, all-or-nothing shot. That is very different from the “I must be right immediately or I am out forever” mindset.

• Emphasis on risk control. Cutting a 150,000 USD loss on a 3.6 million USD position hints that risk is being managed in percentage terms. The owner seems to care about keeping drawdowns within a defined band rather than trying to prove a point.

What it does not tell us

- No guarantee of future profit. A whale re-entry is not a promise that the asset will recover. Even experienced players can be early, incorrect, or both.

- No visibility into hedging. The address-level view does not reveal whether this position is hedged elsewhere via derivatives, correlations, or off-chain agreements.

- No insight into funding structure. We cannot see whether this is proprietary capital, pooled investor capital, or part of a wider corporate balance-sheet strategy.

For observers, the safest way to treat this information is as context, not as a direct instruction. It is an interesting signal about one wallet’s conviction and process, but it should not override independent research, time-horizon planning or risk management.

3. Why Re-Entering After a Loss Can Be Rational

On the surface, buying a token again after taking a loss on it sounds emotionally difficult. Many newer market participants avoid assets that previously caused them losses, even when conditions later improve. Yet for disciplined investors, revisiting a name can be perfectly rational.

Several reasons stand out:

• Improved pricing, unchanged thesis. If the underlying story for ASTER has not deteriorated, but the price has reset lower, the expected risk-reward profile may actually look better today than during the first attempt.

• New information. Development updates, ecosystem growth, community activity or integrations can all shift the probabilities. A wallet may decide that the updated picture justifies renewed exposure.

• Cleaner technical structure. After a volatile month, ASTER may now be trading in a range or forming a base that makes position management easier: clearer invalidation levels, better liquidity pockets and more predictable behaviour.

From a process standpoint, this behaviour aligns with a simple principle:

Separate being wrong on timing from being wrong on thesis.

The first is inevitable in fast markets; the second is more serious. By exiting when the timing was off and re-entering when pricing and structure improved, the whale appears to be treating ASTER as a long-running idea that can be implemented through several attempts rather than one massive position.

4. The ASTER + SPX Angle: A Portfolio, Not a Single Position

Another important detail is that this wallet is not only active in ASTER. It is also accumulating SPX. Without speculating on the detailed fundamentals of either project, this dual focus suggests a portfolio approach:

- Concentrated, but not singular. Instead of putting every dollar into one token, the participant is building a basket of exposures that likely share some narrative or technological theme.

- Cross-token thesis. ASTER and SPX might both belong to a particular sector – for example, infrastructure, scaling, or a specific on-chain niche. The wallet could be expressing a view on that entire segment rather than on one ticker.

- Optionality across narratives. If one token underperforms while another outperforms, the overall strategy can still work, even if individual entries are not perfect.

For observers, this is a reminder that many sophisticated players think in terms of portfolios and probability distributions, not single, make-or-break positions. Large buys in specific tokens are often just one leg of a broader strategy.

5. How Large On-Chain Buys Affect Market Structure

Even if we avoid treating whales as infallible, their activity does shape the environment in which everyone else trades. A 3 million USD re-entry is large enough to matter, especially if ASTER’s daily trading volume is moderate.

Some potential impacts include:

- Liquidity absorption. Swapping millions of USDC into ASTER removes supply from the open market and can tighten order books, at least temporarily.

- Short-term price impact. Depending on how orders are routed and executed, aggressive buying can move the price intraday, potentially attracting additional flows and arbitrage.

- Psychological effect. Public discussion that a previously active wallet has returned can shift sentiment, especially among holders who already believed in the asset but were hesitant to add exposure.

All of these, however, are local effects. Over a multi-month horizon, fundamentals, broader crypto sentiment and macro conditions tend to dominate. A single wallet, no matter how large, can influence the path but rarely re-writes the entire story on its own.

6. Lessons in Risk Management From the Whale’s Behaviour

Perhaps the most valuable aspect of this case study is not the re-entry itself, but the sequence of decisions that led to it. There are at least four risk-management lessons that generalise well beyond ASTER.

1) Treat losses as a cost of participation

Even well-researched positions will sometimes move against you. The key is to size and manage them so that a setback is survivable. A 150,000 USD realised loss on a 3.6 million USD allocation is noticeable but controlled; it leaves plenty of room to re-engage later.

2) Separate conviction from stubbornness

Exiting a position does not have to mean abandoning an idea forever. You can decide that the current combination of price, liquidity and sentiment is sub-optimal, step aside, and revisit later when conditions improve.

3) Use the chart as feedback, not prophecy

The whale did not try to push against the market all the way down. When ASTER failed to behave as expected, they allowed the price action to inform their risk decisions without treating any single pattern as destiny.

4) Think in campaigns, not one-off attempts

The combination of the first and second ASTER campaigns – initial accumulation, controlled exit, thoughtful re-entry – looks more like an ongoing research and positioning process than a series of isolated trades. That mindset is often missing in retail narratives that focus only on individual wins or losses.

7. Why Blindly Copying Whale Wallets Is Dangerous

With so many dashboards tracking “smart money” flows, it is tempting to use whale activity as a shortcut. But there are several reasons why blindly shadowing this or any other wallet is risky.

• Different constraints. A large participant may have access to credit lines, hedging tools, or institutional risk frameworks that look nothing like an individual’s circumstances.

• Time-horizon mismatch. A whale may be comfortable with multi-year holding periods and significant volatility along the way. A household portfolio that needs liquidity in the near term is in a very different position.

• Incomplete information. On-chain data only shows visible transfers. It does not reveal off-chain arrangements, derivatives, or the full context of a trading book.

• Survivorship bias. Many widely discussed wallets became famous because a subset of their high-risk positions performed well. Others with similar approaches may have underperformed without drawing attention.

A healthier way to use wallet data is as inspiration and research input, not as a ready-made plan. Helpful questions include:

- What thesis might this address be expressing about ASTER, SPX or their sector?

- How does that thesis align – or conflict – with my own research and risk tolerance?

- What position size and time frame would make sense for me, regardless of what any single whale is doing?

8. A Brand-Safe Framework for Reading Whale Flows

To keep analysis grounded and responsible, it helps to apply a simple checklist whenever you see a large on-chain move.

- Context: Is this the first time the wallet has touched the asset, or part of a longer pattern?

- Size: How large is the position relative to typical volumes and liquidity?

- Structure: Is the wallet concentrated in one token, or diversified across several themes or ecosystems?

- Behaviour: Does the address cut losses, add selectively, or simply hold regardless of conditions?

- Narrative: What could be the underlying view, and how does it fit into broader sector and macro trends?

In the ASTER case, the answers look roughly like this:

- Context: The wallet is a repeat participant in ASTER, with a documented earlier campaign.

- Size: A 3 million USD allocation is large enough to matter without completely dominating the token’s market.

- Structure: The address is active in more than one token, notably ASTER and SPX.

- Behaviour: It has demonstrated a willingness to take controlled losses and re-enter later, rather than simply holding through every phase.

- Narrative: While the exact thesis is unknown, the dual focus hints at some shared ecosystem or sector view.

This framework will not tell you what happens next, but it does help move the conversation away from simplistic “whale is bullish, so price must rise” thinking, and toward more nuanced, risk-aware analysis.

9. Key Takeaways: What Readers Can Learn From the ASTER Whale

Summing up the main educational points:

• A whale returning to ASTER with a 3 million USD allocation is a sign of continued interest, not a guarantee of future performance.

• The wallet’s history – entering, cutting an estimated 150,000 USD loss, then re-entering at new levels – showcases disciplined risk management and a campaign-based mindset.

• Parallel accumulation of SPX suggests a portfolio strategy anchored in themes or ecosystems, rather than isolated exposure to a single token.

• Large buys can influence short-term market structure, but long-term outcomes still depend on fundamentals, liquidity, regulation and overall crypto conditions.

• On-chain data is most powerful when used as context alongside independent research, not as a shortcut that replaces it.

For individual readers, the most constructive move is not to mirror this wallet’s transactions, but to mirror its process lessons: respect risk, stay flexible, and be willing to revisit good ideas at better prices instead of anchoring emotionally to a single entry.

10. Conclusion

The comeback of the ASTER whale at 0x7771d1FDA54db864d52b7aa61061D7537025F064 is a useful reminder of what sophisticated on-chain behaviour often looks like in practice. It is rarely about never selling or always being early. It is about:

- Forming a thesis about an asset or sector,

- Expressing that thesis with size that fits a risk budget,

- Accepting that some attempts will be mistimed,

- And being ready to step back in when conditions improve.

Whether this specific ASTER campaign ultimately becomes a profitable one is something only future price action can reveal. What we can say today is that the wallet’s behaviour offers a practical case study in disciplined capital deployment – and a timely reminder to treat whale flows as one source of information among many, not as a substitute for personal judgement and responsible risk management.

Disclaimer: This article is for informational and educational purposes only. It does not constitute financial, investment, legal or tax advice, and it should not be treated as a recommendation to buy, sell or hold any digital asset. Digital asset markets are volatile and can involve significant risk, including the potential loss of principal. Always conduct your own research and, where appropriate, consult a qualified professional before making any financial decisions.