Why Bitcoin Is Quietly Becoming the World’s Prime Collateral Asset

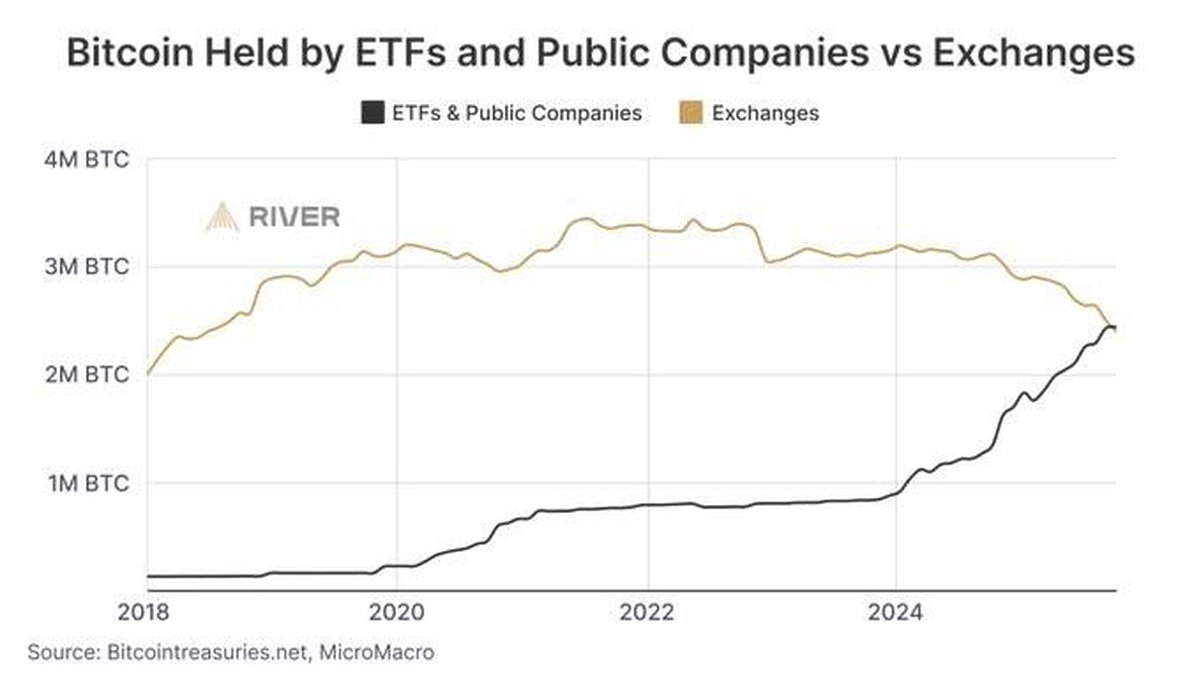

A single chart has been circulating across research desks in 2025: one line shows the amount of Bitcoin held by ETFs and publicly listed companies, the other shows balances sitting on centralized exchanges. For years, exchanges dominated. Now, the lines have crossed. Institutional vehicles and corporate treasuries are locking away more BTC than trading venues hold in hot wallets.

That crossover may look like just another on-chain curiosity, but it signals a deeper transition. When long term institutions hold more BTC than trading platforms, the asset is no longer just a tool for short term speculation. It starts to resemble something closer to what U.S. Treasuries and gold have historically been for finance: base collateral that anchors lending, derivatives, and balance sheets.

This article unpacks why Bitcoin is increasingly discussed as prime collateral for the global financial system, how that thesis compares with gold, bonds, and real estate, and what a Bitcoin collateral standard could look like between 2025 and 2033. It is educational analysis only, not a recommendation to buy, sell, or hold any asset.

From Exchanges to Balance Sheets: A Structural Ownership Shift

On chain and custodial data sets now tell a consistent story. Spot Bitcoin ETFs, closed end funds, and similar vehicles collectively hold well over a million BTC. Public companies, led by large treasury allocators, own another sizeable chunk. Combined, these pools control a material share of the fixed 21 million BTC supply. At the same time, centralized exchange reserves have fallen to multi year lows, both in percentage terms and in absolute coin counts.

In practical terms, that means more Bitcoin is being held in regulated custodial structures and corporate treasuries than on speculative trading platforms. Instead of constantly rotating through order books, these coins sit in long term mandates: fund vehicles aimed at pensions and wealth managers, corporate balance sheets, and even sovereign treasuries. That is exactly the type of holder mix you would expect if Bitcoin is maturing into collateral rather than remaining purely a speculative instrument.

For exchanges, this trend reduces the pool of immediately sellable BTC and can tighten liquidity during stress events. For institutions, however, the same trend is positive: coins held in institutional custody are easier to plug into repo style agreements, structured lending, or derivatives margin frameworks. In other words, the financial system is slowly rewiring itself so that a growing share of Bitcoin lives where collateral is normally managed, not just where day traders place orders.

What Makes an Asset “Prime Collateral”?

To understand why this matters, it helps to ask a simple question: what qualities does an asset need to become prime collateral in modern finance? Historically, U.S. Treasuries have played that role. In earlier eras, physical gold and high grade commercial paper did. Across these examples, six recurring features show up:

• Predictable scarcity and supply rules that are difficult to change for short term political reasons.

• Deep, reliable liquidity so positions can be opened or closed quickly without moving the market too much.

• Clear ownership claims that are easy to verify and transfer across borders.

• Low storage and verification costs relative to the value being secured.

• Integration into institutional “plumbing” such as custodians, clearing houses, and standardized contracts.

• Acceptability across jurisdictions so that the asset is not tied too closely to one government or one banking system.

The argument for Bitcoin is that it increasingly meets, and in some cases exceeds, these requirements. The details matter, so let us look at them one by one.

1. Absolute, Programmable Scarcity

Bitcoin is the first large scale monetary asset with a fixed, programmatic supply cap. There will only ever be 21 million coins. New supply is introduced through block rewards that follow a known schedule, and halvings periodically reduce that issuance until it trends toward zero. Changing that cap would require global consensus across thousands of nodes and economic actors, which makes it extremely resistant to policy drift.

By contrast, gold is scarce but not fixed. Higher prices encourage more mining, new exploration technology, and recycling. Fiat currencies and the government bonds denominated in them can be issued in large quantities, especially during crises. Real estate supply is constrained in prime locations but can expand with new construction, and its value is tied to local regulations, zoning, and political decisions.

This does not automatically make Bitcoin “better”, but it does make its long term supply dynamics unusually transparent. For a bank, clearing house, or asset manager designing collateral frameworks decades into the future, that kind of rigidity is attractive. It reduces the risk that new issuance or policy changes will quietly dilute the asset backing their loans.

2. Strong, Verifiable Ownership

Bitcoin also stands out in how clearly it encodes ownership. Control over coins is governed by cryptographic keys, not by an entry in a centralized database or a paper certificate in a vault. Anyone can audit the full ledger and verify that a given UTXO exists and has not been double spent. Transfers settle directly on the network without needing a correspondent bank, central securities depository, or notary.

For individuals, this means they can, in principle, self custody coins without relying on intermediaries. For institutions, the same cryptographic guarantees apply even when keys are held at a regulated custodian using multi party computation or hardware security modules. In both cases, the economic claim is straightforward: if you control the keys that can sign valid transactions, you control the asset.

That is very different from traditional collateral such as real estate or corporate shares, where ownership is ultimately enforced by courts, registries, and local authorities. Those systems can work well, but they introduce legal friction and jurisdictional risk. Bitcoin reduces that layer: the network validates ownership according to a common rule set, regardless of the country or institution involved. That is a powerful feature for cross border collateral agreements.

3. Global, 24/7 Liquidity

Another reason market participants are increasingly interested in BTC as collateral is its trading profile. Native Bitcoin markets operate 24 hours a day, seven days a week, across dozens of venues worldwide. On top of that, there are liquid futures and options markets, as well as spot ETFs in major jurisdictions. Together, these venues support continuous price discovery and hedging.

Compare that with traditional assets. Government bonds trade during local market hours and can become illiquid in stressed conditions. Real estate is famously slow moving, with each transaction requiring weeks of negotiation and paperwork. Even gold, while globally traded, still relies heavily on a network of dealers, refineries, and vaults that do not match the always on rhythm of digital markets.

For banks, market makers, and asset managers, the ability to mark collateral to market and adjust exposures in real time is crucial. BTC’s liquidity profile is not perfect – some markets are fragmented, and during extreme events spreads can widen – but its combination of global access and around the clock trading makes it unusually flexible compared with other scarce assets.

4. Storage and Operational Costs: Beating Gold at Its Own Game

Holding large quantities of physical gold is expensive. Bars must be stored in secure vaults with multiple layers of physical security. They need to be transported, insured, audited, and sometimes re assayed to verify purity. All of that adds up to non trivial carrying costs that ultimately feed into the yield that lenders demand.

Bitcoin flips this equation. The asset exists as information. Whether an institution custodies one BTC or one hundred thousand, the incremental cost mostly comes from the security processes and governance around keys, not from physical dimensions. Rebalancing positions does not require moving heavy metal across borders; it is a matter of updating entries on a public ledger. In practice, large custodians have built enterprise grade hardware and insurance arrangements around this, so that institutions can treat BTC custody as another line item in their operations budget.

From a collateral perspective, this is attractive. If an asset can be stored, insured, and audited at scale without trucks, armored doors, or shipping containers, it becomes easier to reuse it across lending relationships. That does not remove all risks – operational errors and cyber threats still exist – but it does make the cost structure fundamentally different from metals or real estate.

5. The Institutional Plumbing Is Now in Place

Perhaps the biggest change since 2020 is not ideological, but infrastructural. The pieces needed for institutions to treat Bitcoin as standard collateral now exist and are being stress tested in real markets.

Custody. Regulated custodians offer segregated accounts, multi signature setups, SOC audited controls, and insurance coverage. For many investors, this is a prerequisite before they can even consider holding BTC on behalf of clients. It also gives lenders and clearing houses a credible way to perfect security interests over coins pledged as collateral.

Spot ETFs and other wrappers. In major markets, spot Bitcoin ETFs have turned BTC into a familiar, regulated security with a clear net asset value and standard settlement cycles. For institutions bound by strict mandates, buying shares in such a fund is operationally easier than wiring coins to an exchange wallet. These funds, in turn, hold real BTC with custodians, concentrating collateral in structures that are straightforward to plug into traditional financing agreements.

Institutional lending. Specialist lenders, prime brokers, and some banks now accept Bitcoin as collateral for loans denominated in dollars, euros, or other fiat currencies. Haircuts and risk controls are conservative, but the trend is clear: BTC is no longer just something banks quote a price for, it is something they increasingly accept as security for their own exposures.

When custody, investable wrappers, and lending come together, an asset moves from being speculative to being part of the collateral stack. That is the stage Bitcoin is entering now.

6. A World Looking Beyond Government Debt

For the past century, the ultimate collateral asset has been U.S. government debt. Treasury securities are considered low risk, easily priced, and deeply liquid. They sit at the core of money markets, derivatives margining, and bank liquidity buffers. Yet the context around them is changing.

Since 2000, U.S. federal debt has climbed from roughly 5 to over 13 trillion dollars by 2010 and into the mid 30 trillion range by 2024. By late 2025, total debt outstanding surpassed 38 trillion dollars, and major rating agencies have gradually lowered their long term assessments of U.S. credit quality. The bonds remain widely used and markets continue to function, but the direction of travel is clear: more supply, higher interest costs, and recurring debates over fiscal sustainability.

Other major economies face similar challenges, with aging populations, higher social spending, and rising interest expenses. In that environment, it is natural for some institutions to explore collateral options that are not direct obligations of any single government. Gold has historically filled part of that role. Bitcoin, with its non sovereign design and global ownership base, is increasingly discussed as another candidate in that diversification process.

7. Neutral, Borderless Collateral

One of Bitcoin’s most distinctive qualities is its neutrality. The protocol is open source, the supply schedule is transparent, and the network is maintained by participants spread across many jurisdictions. No central bank can unilaterally change its monetary policy, and no finance ministry can decide to issue a new batch of coins to fund a deficit.

From a collateral standpoint, this neutrality has two implications. First, counterparties in different countries can agree to use BTC as security without either side having to depend on the legal system or fiscal policy of the other. Second, the asset’s supply and rules are not subject to election cycles or domestic political pressure. That makes it easier to model long term scenarios where Bitcoin plays a small but important role in international balance sheets.

Of course, neutrality at the protocol level does not eliminate all concentration risks. If a handful of custodians, ETFs, or governments end up holding a large share of the circulating supply, their governance and regulatory environment will matter. A world where most BTC sits inside a small number of institutions would be very different from the early vision of purely peer to peer money. Any serious collateral thesis therefore needs to track not just how much Bitcoin is held as collateral, but who is holding it and under what rules.

8. How Institutions Already Use Bitcoin as Collateral

The idea of Bitcoin backed borrowing is no longer theoretical. Several public companies have used BTC on their balance sheets to secure long term loans. In these structures, coins are pledged to a lender or trustee, haircuts are applied to account for price volatility, and covenants define what happens if market conditions deteriorate.

This is quite different from short term, high leverage trading by individuals. In a corporate or institutional loan, the amount borrowed relative to the BTC collateral is usually modest, interest rates are negotiated, and both sides plan for multi year horizons. The borrower is often trying to avoid selling coins in order to maintain long term exposure, while still accessing fiat liquidity for operations or acquisitions.

For lenders, accepting BTC as collateral can be attractive when combined with conservative loan to value ratios and robust risk management. If the asset appreciates, the loan is over collateralized. If it falls sharply, the parties may agree on additional margin, restructuring, or partial repayment. None of this eliminates risk, but it shows how Bitcoin can already function inside familiar credit structures rather than sitting entirely outside the banking system.

9. 2025–2033: A Possible Roadmap for a Bitcoin Collateral Era

So what might the next decade look like if current trends continue? Any forecast is speculative, but we can outline a plausible roadmap rather than a precise prediction.

2025–2027: Standardization and risk frameworks. In this phase, regulators and industry groups focus on clarifying how BTC exposures should be treated in capital requirements, liquidity ratios, and stress tests. More custodians obtain licenses, spot ETFs expand outside early adopter markets, and banks experiment with small scale BTC backed lending or repo lines. The emphasis is on building robust risk frameworks rather than maximizing volume.

2027–2030: Integration into collateral chains. If volatility continues to moderate and infrastructure proves reliable, a subset of large financial institutions may begin to treat Bitcoin as eligible collateral for a wider range of activities: derivatives margin, structured products, and secured lending. Haircuts will likely remain high compared with Treasuries, but the asset may start to appear alongside gold and high grade bonds in collateral menus.

2030–2033: Selective sovereign adoption. Some mid sized economies could add modest BTC positions to their reserve mix, not to replace core holdings like dollars or euro assets, but to diversify. At the same time, international institutions might explore using tokenized Bitcoin or BTC referenced instruments in cross border settlement pilots. In this scenario, Bitcoin becomes one of several pillars in a more multi polar collateral landscape.

There are also paths where this thesis does not play out: regulatory pushback, a major technical failure, a prolonged period of underperformance, or excessive concentration in a few custodians could all slow or reverse progress. That uncertainty is exactly why responsible analysis treats the “Bitcoin as global collateral” idea as a scenario to study, not an outcome to assume.

10. What This Means for Individual Readers

For everyday participants, the discussion about Bitcoin as prime collateral can feel distant. Yet it has concrete implications even for people who never interact with derivatives or repo markets.

First, large institutional ownership tends to align Bitcoin more closely with the broader financial system. That can bring benefits, such as more professional risk management, better disclosures, and regulated investment products. It can also introduce new channels of contagion: if BTC is widely used as collateral, sharp price moves could feed back into leverage and risk taking elsewhere.

Second, the growth of ETFs and custodial products changes what it means to “own” Bitcoin. Holding an ETF share is not the same as controlling keys on chain. One approach emphasizes convenience and regulatory protections; the other emphasizes direct control and independence from intermediaries. Both can coexist, but they confer different rights and responsibilities.

Third, the collateral narrative highlights that Bitcoin’s long term story is no longer only about price. It is about how deeply the asset becomes embedded in payment rails, investment mandates, and sovereign balance sheets. Even if prices move in cycles, the structural question is whether more of the financial system chooses to build on top of BTC as a neutral, scarce base layer.

None of this guarantees outcomes. Bitcoin remains a volatile asset, subject to technological, regulatory, and market risks. But the chart showing ETFs and public companies overtaking exchanges is a useful signal. It suggests that, quietly and gradually, Bitcoin is evolving from a purely speculative instrument into something the financial system can lean on: a digital, globally accessible, rule based form of collateral that has no direct analogue in previous monetary history.

This article is for educational purposes only and does not constitute investment, legal, or tax advice. Always consider your own situation, regulations in your country, and professional guidance before making financial decisions.