How Big Can the Stablecoin Pie Really Get by 2030?

When people debate stablecoins, they often argue about market cap—as if the size of the pie is the number of tokens sitting still. But stablecoins are not a collectible; they are a rail. Rails are measured by throughput, not by how much steel is stacked in a warehouse.

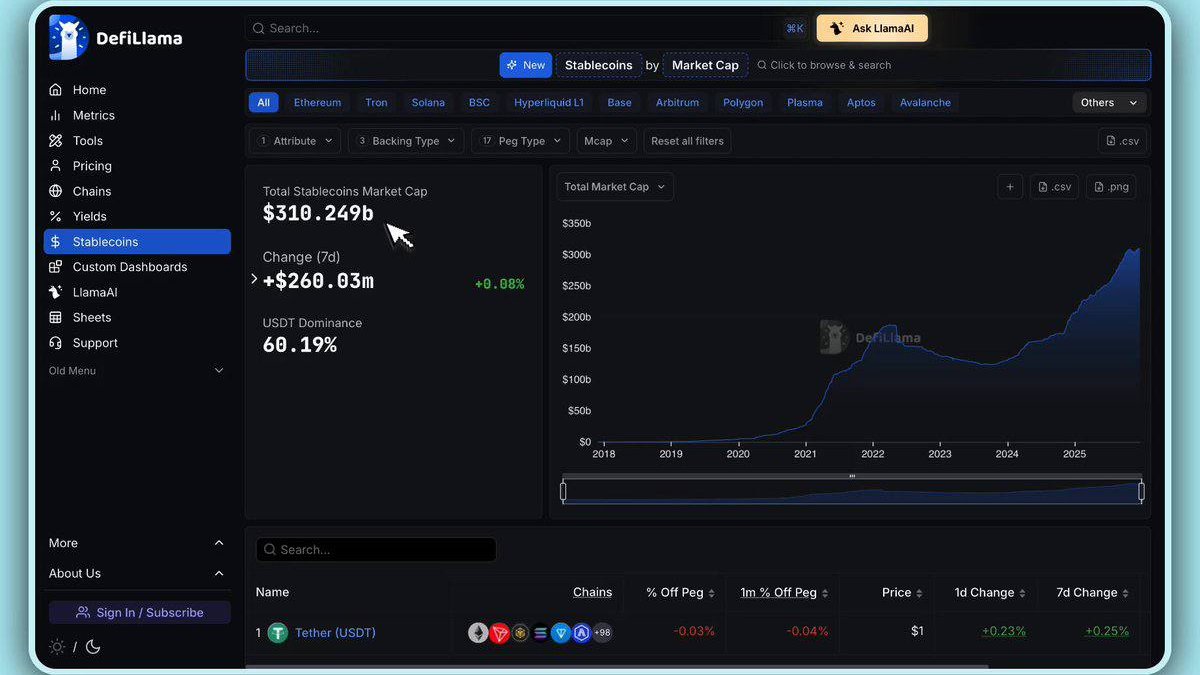

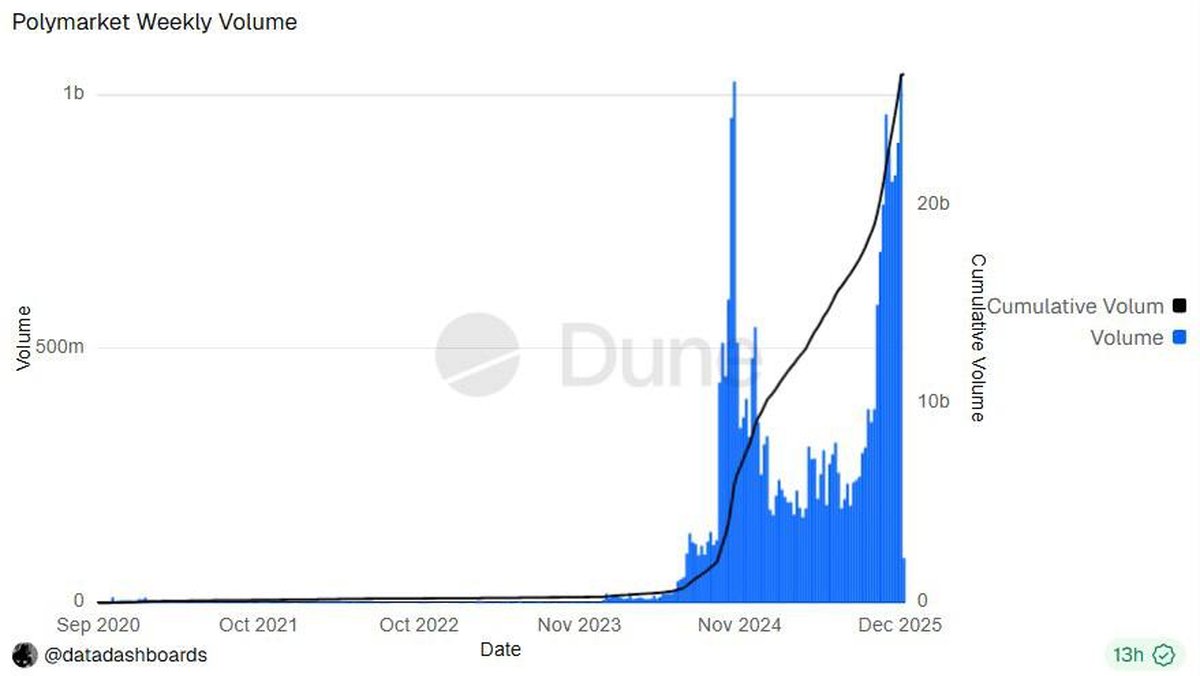

That is why the headline numbers are so eye-catching: stablecoin payment value reportedly hit $2.9 trillion in 2025, and a projection cited by Bloomberg suggests that figure could climb to $56.6 trillion by 2030. If you take those at face value, you’re not looking at “a crypto thing.” You’re looking at a candidate for one of the largest settlement networks on the planet.

First, define what we’re actually sizing

“Payment value” can be a slippery metric. It may include exchange-to-exchange flows, on-chain arbitrage, merchant payments, remittances, and treasury management—often counted gross, not net. That’s not a flaw; it’s how payment networks work. Visa’s volume is huge not because everyone is rich, but because money moves constantly.

So the right mental model is not: stablecoin market cap → stablecoin payments. It’s: stablecoin trust + distribution + compliance + liquidity → stablecoin velocity. A modest supply can generate enormous throughput if users treat it as spendable, redeemable cash.

Practical takeaway: A $56.6T “payments” world does not require $56.6T of stablecoins outstanding. It requires stablecoins to become the default bridge asset in many recurring money-movement loops—especially where traditional rails are slow, expensive, or politically constrained.

The two engines that can turn stablecoins into “internet dollars”

The Bloomberg-style thesis usually rests on two pillars: (1) institutional adoption, and (2) demand for USD exposure in high-inflation or unstable economies. Those sound broad, but each has a very specific mechanism that either works—or doesn’t.

Institutions don’t adopt stablecoins because they “like crypto.” They adopt when stablecoins reduce operational friction: faster settlement, fewer intermediaries, programmable controls, and cleaner audit trails. The moment stablecoins become a back-office tool rather than a front-page headline, growth becomes boring—and durable.

Engine #1 — Institutional demand: the corporate/financial sector uses stablecoins as a programmable cash equivalent.

• Cross-border treasury: moving USD liquidity between subsidiaries without waiting for cut-off times.

• Collateral mobility: posting margin 24/7 across venues without wiring delays.

• Atomic settlement: delivery-versus-payment style flows that reduce counterparty risk.

Engine #2 — “everyday dollarization”: in fragile currency environments, stablecoins behave less like a trade and more like a survival tool.

• Store-of-value: households hedge local inflation by holding stable balances.

• Informal payments: small merchants accept stablecoins because the alternative is unreliable banking access.

• Remittances: families prefer predictable USD-denominated receipts over volatile FX spreads.

Why USDT and USDC dominate—and why that matters more than people admit

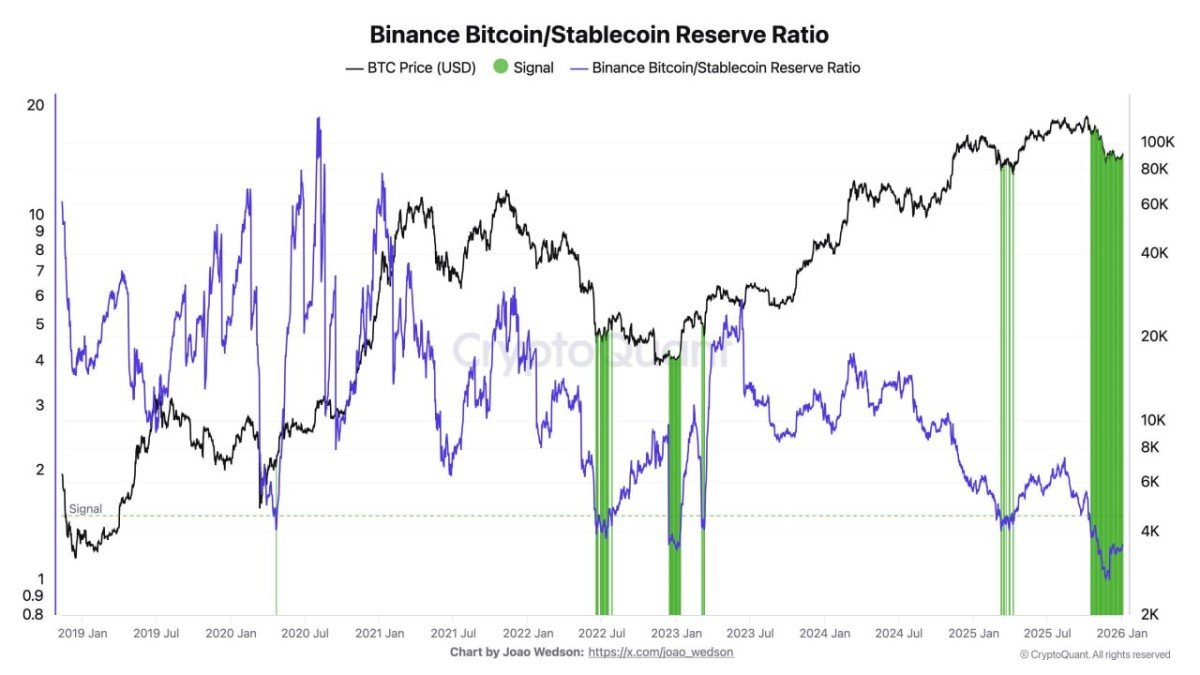

You noted a critical data point: USDT dominates payments and savings behavior, while USDC is preferred in DeFi. Together they allegedly represent 95%+ of volume (and that concentration reportedly increased, up 72% year-over-year). This is not just “market share.” It’s a structural statement about how money networks evolve.

Payment networks tend to centralize around the most trusted “hub” assets. Users don’t want twenty cash equivalents; they want one or two that are always accepted, always redeemable, and always liquid. That is why the stablecoin endgame looks less like altcoin fragmentation—and more like global banking, where a few dominant pipes do most of the work.

But concentration creates a trade-off: the easier it is for users to coordinate on stablecoins, the more systemic the consequences of an issuer or rail failure. In other words, the same network effects that power growth also amplify tail risks. The market is voting for convenience and liquidity; regulators will vote for resilience and transparency.

What must be true for a $56.6T stablecoin world to be plausible

If stablecoin throughput is to multiply by an order of magnitude, the ecosystem needs more than hype. It needs boring infrastructure upgrades and governance clarity. Here are the conditions that matter most—and they’re not evenly distributed across issuers or chains.

1) Credible reserve + redemption plumbing: In a payments context, redemption is the product. Users may tolerate volatility in crypto assets; they do not tolerate a dollar that sometimes isn’t a dollar.

2) Distribution that feels “invisible”: The best payment tech disappears. Stablecoins win when users don’t think about bridges, gas, or custody—they just tap, send, and reconcile.

3) Compliance that scales without killing UX: Institutions will not push meaningful flow through systems that can’t answer basic questions about AML controls, sanctions risk, and auditability. The future is not “no rules.” It’s rules embedded into software—quietly.

4) A credible multi-issuer landscape: Even if USDT/USDC remain dominant, the system benefits from additional regulated options (including potentially public-sector or bank-linked designs). Competition is not only about fees; it is about resilience.

The underappreciated point: stablecoin growth is a macro story in disguise

People talk about stablecoins like they’re a niche corner of crypto. In practice, stablecoins are a bet on the global appetite for USD liquidity—and on the idea that digital networks can route dollars more efficiently than legacy correspondent banking.

If global uncertainty rises, stablecoin demand can increase even when risk assets wobble, because the core product is stability and access. That makes stablecoins unusual: they can benefit from both “growth narratives” (institutions modernizing rails) and “defensive narratives” (individuals seeking dollar refuge). Few financial products sit comfortably in both boxes.

Conclusion

The size of the stablecoin pie is not constrained by how many tokens exist, but by how much economic activity chooses stablecoins as the default medium of exchange, settlement, and savings. The leap from $2.9T in 2025 to a projected $56.6T by 2030 is ambitious—but directionally coherent if stablecoins keep absorbing real-world payment loops and institutional plumbing.

The most important question is not “which stablecoin pumps.” It’s “which stablecoin stays boring under stress.” In money, boring is the ultimate feature.

Frequently Asked Questions

Is stablecoin payment value the same as stablecoin market cap?

No. Market cap is how many tokens exist; payment value is how often they move. High velocity can produce huge annual throughput even with a smaller outstanding supply.

Why do USDT and USDC dominate volume?

Because money networks reward liquidity, acceptance, and trust. Most users prefer a small number of universally accepted “digital dollars” rather than dozens of partially liquid options.

What could stop stablecoins from reaching the projected 2030 scale?

The biggest blockers are not technical: they’re redemption trust, regulatory fragmentation, compliance failures, and distribution that remains too complex for mainstream use.

Are stablecoins mainly for crypto trading?

Not anymore. Trading is still a major driver of volume, but the long-term growth story is payments, treasury operations, remittances, and programmable settlement—especially where traditional rails underperform.

Does stablecoin adoption automatically benefit all crypto assets?

Not automatically. Stablecoins can grow as a payments layer even when speculative assets struggle. Their value proposition is access and stability, not necessarily risk-on exposure.

Disclaimer: This article is for educational and informational purposes only and does not constitute financial, investment, or legal advice. Digital assets involve risk, including the potential loss of principal. Always do your own research and consider your risk tolerance.