From 310 Billion to 750 Billion? Why Stablecoins May Be Heading for a 2026 Breakout

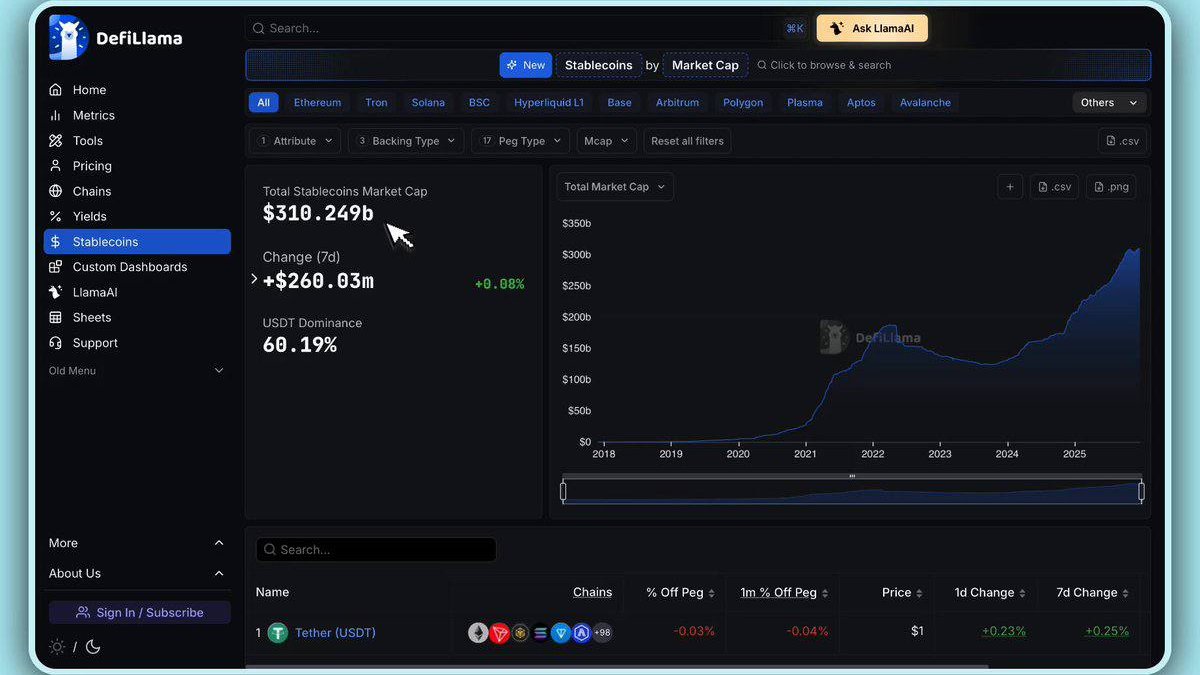

Market narratives tend to focus on whichever asset is swinging the most on a given day. Yet in the background, a quieter story has been unfolding. While digital-asset prices have gone through a choppy correction, the combined market capitalization of U.S. dollar stablecoins has climbed to around 310 billion USD and continues to make new highs. That divergence – shrinking risk appetite on one side, steady growth in tokenized cash on the other – is the key to understanding why many observers now see 2026 as a potential breakout year for stablecoins.

The basic thesis is straightforward. If adoption continues at the current pace and new legal frameworks lower the barriers for banks, fintechs and asset managers to issue and use stablecoins, a 500 billion USD market cap by 2026 looks like a conservative base case. Add deeper participation from global financial institutions and real-world asset platforms, and a 750 billion USD scenario no longer feels unrealistic. In that world, stablecoins would be less of a niche instrument used primarily on exchanges and more of a global settlement layer connecting banks, payment processors, capital markets and decentralized applications.

This article explores what is driving the current growth, how regulation is reshaping the landscape, and which forces could push stablecoin capitalization from today’s 310 billion USD to the next set of milestones.

1. What a 310 Billion USD Stablecoin Market Really Represents

Before jumping to 2026 scenarios, it is worth unpacking what today’s 310 billion USD actually signals. On the surface, the number is just a sum of circulating supply across major dollar-linked tokens. Underneath, it reflects several overlapping use cases:

• Trading and liquidity on exchanges. Stablecoins remain the dominant base pair for many digital-asset markets, offering traders and market makers a way to move between positions without touching traditional bank rails.

• Collateral in decentralized finance. Lending protocols, derivatives platforms and automated market makers rely heavily on stablecoins as the low-volatility leg in their designs.

• Global payments and remittances. For individuals and businesses in regions with volatile local currencies or slow banking systems, dollar-linked tokens have become a practical tool for cross-border settlements and payroll.

• Treasury and working-capital management. A growing number of companies, from web-native startups to more traditional firms, hold part of their operational balances in stablecoins to move funds quickly across venues and jurisdictions.

Crucially, these activities have persisted – and in many areas grown – despite price drawdowns in other digital assets. That suggests stablecoins are not just a levered way to express a view on crypto prices. Instead, they are becoming an independent category of financial infrastructure: digitized dollars that can be transmitted and programmed at internet speed.

2. Why 2026 Is Shaping Up as an Inflection Point

The expectation of a capitalisation boom in 2026 is not based solely on extrapolating past growth. It is also rooted in regulatory and structural shifts that are converging over the next 18–24 months.

2.1 Regulatory clarity in major jurisdictions

Several large economies are in the process of taking stablecoins out of the grey zone and placing them under dedicated legal frameworks. While the exact details differ from one jurisdiction to another, the broad direction is consistent:

- Stablecoins treated like narrow-purpose payment instruments. New rules tend to require high-quality reserves (cash, short-term government securities), frequent attestations and robust risk controls.

- Clear differentiation between payment tokens and investment products. Lawmakers are carving out regulatory categories that separate low-volatility payment tokens from more speculative instruments.

- Tax relief for low-value payments. Some proposals aim to exempt small purchases made with stablecoins from capital-gains reporting, removing a major friction point for day-to-day usage.

Legal clarity matters because large financial institutions are generally unwilling to build on top of instruments that might later be reclassified or restricted. As the rules solidify, it becomes easier for banks, brokers and payment firms to treat compliant stablecoins as a normal part of their toolkit, not an experimental niche.

2.2 The rise of tokenized cash and securities

In parallel, we are seeing a rapid expansion of tokenized money-market funds, Treasury-backed tokens and tokenized exchange-traded products. These instruments are not stablecoins in the narrow sense, but they inhabit the same design space: digital representations of conservative assets that can move through public or semi-public ledgers.

Once institutions become comfortable issuing and holding tokenized funds, the step toward using regulated payment stablecoins for settlement becomes much smaller. The same custody, compliance and connectivity infrastructure can often support both. That shared infrastructure is part of what underpins the 500–750 billion USD scenarios: the more liquidity lives on-chain in any form, the more convenient it becomes to keep transactional balances there as well.

2.3 Improvements in scalability and user experience

Finally, the technology stack is maturing. Layer-2 networks, high-throughput chains and cross-chain messaging protocols have been lowering fees and shortening settlement times. Wallet providers are investing in better interfaces, account-recovery options and safer default settings. For everyday users, that translates into a simpler experience: sending a stablecoin transaction can start to feel less like operating a trading terminal and more like using a familiar payments app.

When regulation, infrastructure and user experience move in the same direction, adoption inflection points tend to follow. That is the backdrop against which a 2026 growth spurt becomes plausible.

3. The Base Case: How the Market Reaches 500 Billion USD

What would need to happen for stablecoin capitalization to grow from 310 billion USD today to roughly 500 billion USD by 2026? One helpful way to think about it is to break the market into slices and consider modest expansions in each segment rather than assuming a single dramatic shift.

3.1 Organic growth in existing crypto use cases

Even if stablecoins remained confined to trading, decentralized finance and digital-asset treasuries, growth would likely continue. New projects launch, additional exchanges come online, and existing users tend to hold larger balances as they participate in more protocols. A moderate estimate could see this 'core crypto' segment add 100–120 billion USD in demand over the next couple of years, especially if broader market sentiment improves.

3.2 Expansion in cross-border payments and remittances

International transfers remain costly and slow in many corridors. Stablecoins offer a compelling alternative: near-instant settlement, transparent on-chain records and the ability to plug directly into local exchanges or fintech apps. As more licensed remittance providers, payroll platforms and neo-banks integrate stablecoins behind the scenes, this segment could easily account for another 40–60 billion USD in circulating supply, especially in regions where dollar demand is structurally strong.

3.3 On-chain cash management for businesses

Corporate treasurers are starting to view stablecoins not as speculative instruments but as digital operating cash. For companies that work with global suppliers, decentralized applications or multiple exchanges, it can be more efficient to hold a portion of working capital in tokenized dollars. If even a small fraction of mid-sized and larger businesses allocate 1–2% of their liquid assets to stablecoins, that could add another 40–50 billion USD to total capitalization without requiring any dramatic behavioural change.

When we add these conservative components together – deeper penetration in the crypto ecosystem, steady adoption in cross-border payments and modest use in corporate cash management – the path from 310 billion USD to around 500 billion USD becomes less of a stretch and more of a linear extension of current trends.

4. The Upside Scenario: What Would It Take to Reach 750 Billion USD?

The more ambitious scenario – a 750 billion USD stablecoin market by 2026 – requires additional drivers. These are not guaranteed, but they are within the realm of possibility if a few stars align.

4.1 Large-scale participation from banks and payment networks

The most obvious accelerant would be direct participation from global banks and card networks. If major institutions begin issuing their own fully reserved stablecoins or white-labelling existing ones, they could shift meaningful volumes of card settlement, merchant payouts and cross-border transfers onto tokenized rails.

Consider that global card purchase volume runs into the tens of trillions of dollars annually. Only a small fraction of that would need to be settled or prefunded in stablecoins for circulating supply to jump by hundreds of billions. This does not require every coffee purchase to move on-chain in real time. Instead, banks and processors could use stablecoins as a high-speed settlement asset in the background while consumers continue to tap plastic or use familiar mobile apps.

4.2 Deeper integration with tokenized securities and real-world assets

Another powerful driver would be stablecoins becoming the default collateral and settlement asset for tokenized securities. As more platforms enable on-chain trading of tokenized funds, bonds, equities or revenue-sharing instruments, they require a stable unit of account that regulators and institutional investors are comfortable treating as cash.

If stablecoins become that unit, and if tokenization platforms begin to manage tens or hundreds of billions in assets, then a significant portion of their liquidity, margin and settlement balances will likely be held in stablecoins. This could add well over 100 billion USD in additional demand, pushing total capitalization toward the upper end of the projected range.

4.3 Government and quasi-public use cases

A final potential catalyst would be limited public-sector experimentation with stablecoins for specific programs – for example, targeted transfers, development aid disbursement or wholesale settlement between partner banks. Even modest pilot programs can validate the technology and encourage private-sector copycats. While it is unlikely that governments will move their entire payment systems to third-party stablecoins in the near term, selective use in well-controlled environments could still contribute measurable volumes and, more importantly, signal acceptance.

Combine these factors – institutional adoption, tokenized capital markets, and cautious public-sector experiments – and the 750 billion USD mark starts to look less like science fiction and more like an ambitious yet achievable outcome.

5. Key Risks and Constraints on the Path Ahead

No growth story is one-sided. For stablecoins, several risks could slow or even reverse the trend if not managed carefully.

5.1 Policy reversals or fragmented regulation

If major jurisdictions were to tighten rules unexpectedly, restrict certain reserve assets or impose heavy reporting requirements on everyday users, adoption could stall. Likewise, if regulations diverge sharply across countries, global firms might find it difficult to offer uniform services, limiting network effects.

5.2 Loss of confidence in individual issuers

Stablecoins rely on trust that reserves are genuinely safe, liquid and properly segregated. Any serious mismatch between reported and actual reserves, or protracted delays in redeeming tokens at par, could trigger loss-of-confidence episodes. Importantly, such events do not necessarily threaten the entire category, but they can shift market share rapidly between issuers and make regulators more cautious.

5.3 Competition from central bank digital currencies and bank-native solutions

Central bank digital currencies (CBDCs) and new digital settlement systems operated by bank consortia could compete with or complement stablecoins. If these official systems are fast, open to a wide range of participants and easy to integrate with, they may absorb some of the demand that would otherwise flow into private tokens. On the other hand, if they are restricted to a narrow set of institutions, stablecoins may remain the most flexible option for the broader market.

These risks do not negate the growth thesis, but they are important reminders that stablecoin adoption is not guaranteed. It depends on careful regulation, prudent reserve management and continued technical resilience.

6. What a 500–750 Billion USD Stablecoin World Means for Crypto

If we do reach the projected ranges by 2026, the implications for the broader digital-asset ecosystem would be profound.

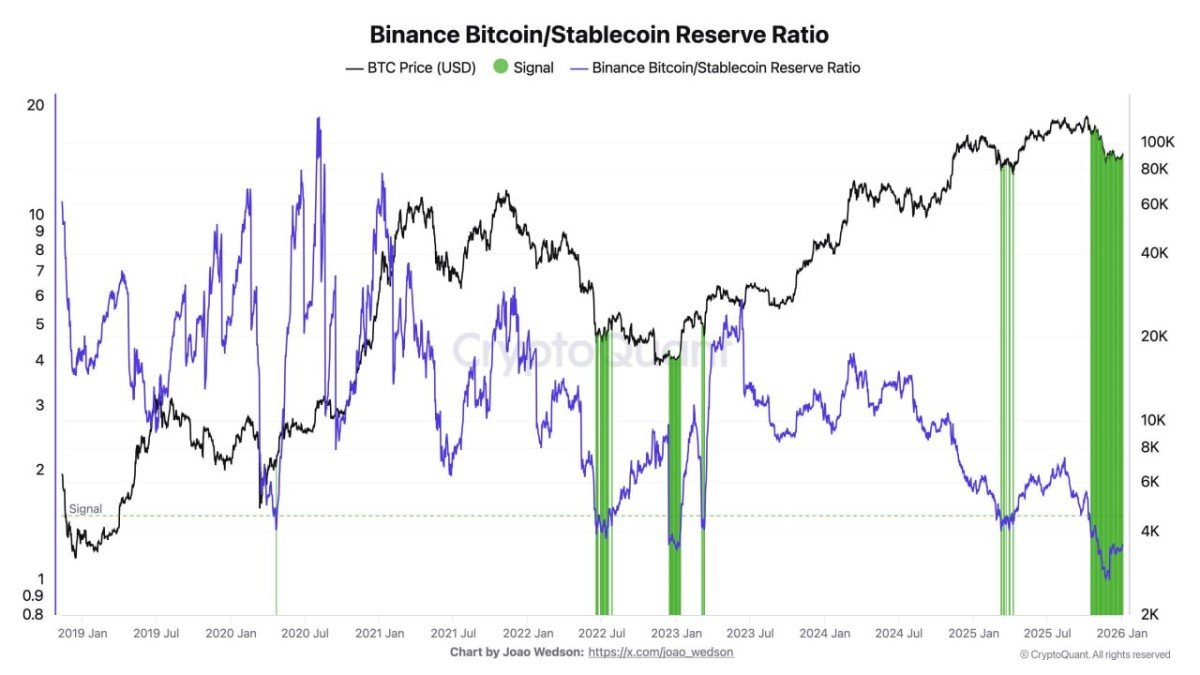

• Liquidity and price discovery. Larger and more geographically diverse stablecoin balances would deepen liquidity across exchanges and protocols, potentially reducing volatility and slippage for many pairs.

• On-chain yield curves. As more tokenized cash and short-term instruments emerge, markets could build richer on-chain yield curves, making it easier to price risk and construct conservative portfolios without leaving the blockchain environment.

• Greater separation between payment rails and speculative assets. When stablecoins represent a growing share of capitalization, the ecosystem looks less like a single speculative market and more like a layered financial system: payment tokens at the base, with higher-risk assets built on top.

• New business models. Startups and established firms could design services around instant, global settlement without needing to become full banks – from marketplace payouts and subscription platforms to decentralized finance protocols serving real-world businesses.

Perhaps the most important shift is psychological. A trillion-dollar-plus stablecoin ecosystem in the years ahead would send a clear signal that programmable digital cash is not an experiment but a core component of the financial infrastructure of the internet.

7. How Individuals and Institutions Can Approach Stablecoins Thoughtfully

While market-cap milestones make for striking headlines, the practical question for most readers is simpler: how should I think about stablecoins in my own context – as a user, an investor or a builder?

Some guiding principles:

• View stablecoins primarily as a payments and settlement tool. They can be useful for moving value quickly, accessing dollar exposure and interacting with on-chain applications, but they are not risk-free savings products.

• Study the reserves and governance of each issuer. Transparency reports, audit arrangements, regulatory licences and redemption policies all matter. Differences between issuers can be as significant as differences between banks.

• Diversify across providers where feasible. Just as depositors may hold accounts at multiple banks, users who rely heavily on stablecoins can consider spreading exposure across more than one token, especially if they are used for business purposes.

• Monitor regulatory developments. Changes in tax treatment, reporting rules or licensing requirements can quickly alter the cost–benefit calculation for certain use cases.

For institutions, the decision set is broader: whether to issue their own tokens, integrate third-party options, or rely on tokenized deposits and funds instead. In all cases, the strategic question is the same: where does programmable, instant settlement create real value for customers or internal operations?

8. Looking Ahead

Stablecoins began as a pragmatic response to a simple problem: how to move dollar value around crypto exchanges without waiting for bank transfers. In just a few years, they have evolved into a bridge between digital assets and the traditional financial system, with hundreds of billions of dollars in circulation and growing relevance to remittances, trading, decentralized finance and corporate treasuries.

From today’s vantage point, a market capitalization of 500 billion USD by 2026 looks like a natural continuation of existing trends. A push toward 750 billion USD would require bolder steps from banks, payment giants and tokenization platforms, but it is well within the range of plausible outcomes if regulatory frameworks continue to mature and institutions decide that programmable money is a competitive advantage rather than a curiosity.

Regardless of which exact milestone is reached, the direction of travel is clear: digitized dollars are becoming a permanent fixture of the global financial landscape. For participants in both traditional markets and the crypto economy, the challenge – and the opportunity – lies in understanding how to use this new form of cash carefully, responsibly and creatively.

Disclaimer: This article is for educational and informational purposes only and does not constitute investment, legal or tax advice. Stablecoins and other digital assets involve risk, including the potential loss of principal. Always conduct your own research and consult a qualified professional before making financial decisions.