Prediction Markets: Opportunities and Risks When Forecasts Become Financial Assets

Prediction markets have moved from the fringe of crypto culture into the centre of macro discussion. In only a few years, platforms such as Polymarket and Kalshi have seen weekly activity climb from almost zero to hundreds of millions of dollars, with cumulative volume in the tens of billions. At the same time, these venues are partnering with major media brands and winning important regulatory approvals. Their price feeds now appear next to bond yields, equity indices and currency rates.

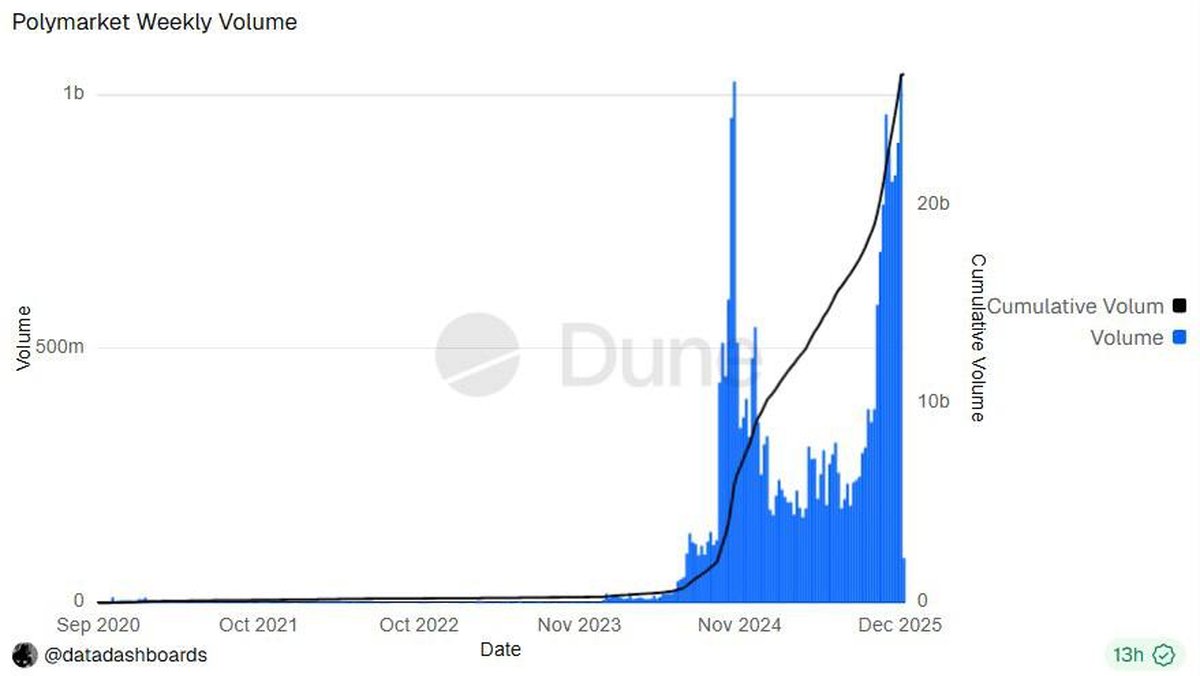

The chart above, showing Polymarket's weekly volume, captures this break-out moment. For three years the bars are barely visible. Then, around late 2023 and early 2024, the blue spikes start to resemble a wall, and the cumulative volume line bends sharply upward. The message is straightforward: event contracts have become big business.

Yet the same growth that excites technologists and investors also worries supervisors. Reports of inflated volumes, information asymmetry and unresolved legal questions have led regulators, academics and even credit analysts to treat these platforms not only as innovation, but also as potential sources of systemic risk.

This article takes an educational and analytical look at prediction markets as an emerging asset class: how they work, what makes them attractive, and why the very features that make them powerful can, if unchecked, create structural vulnerabilities for users and for the wider financial system.

1. From opinions to positions: how prediction markets financialise disagreement

A prediction market turns a question about the future into a standardized contract. Instead of asking, 'Do you think core inflation in the US will fall below 2.5% next year?', the venue lists a contract that pays 1 unit if the event happens and 0 if it does not. Participants trade this contract at a price between 0 and 1 (or between 0 and 100), which can be read as an implied probability.

This structure has three important consequences:

• Opinions become tradable. A view about an election result, a central bank decision or a sports final can be expressed as a position with transparent pricing and instant mark-to-market.

• Disagreement creates liquidity. Markets only exist where people differ. Prediction venues make that disagreement explicit and match those who think the probability is too high with those who think it is too low.

• Information is compressed into prices. In theory, if informed and well-capitalised participants are active, prediction prices should incorporate a wide range of dispersed knowledge more quickly than polls or opinion surveys.

Crypto-native venues add a further twist. They use stablecoins and public blockchains for settlement, allowing positions to be opened and closed 24/7 with transparent on-chain records. Some contracts are fully decentralised; others combine off-chain order books with on-chain settlement to balance speed and transparency.

2. The growth story: from niche experiment to mainstream data source

For most of the last decade, prediction markets were a niche concept relegated to academic papers and small on-chain experiments. That picture has changed dramatically since 2023–2025.

On the crypto side, Polymarket has become the flagship on-chain platform. Public dashboards built on Dune and other data services show weekly notional volume at times exceeding one billion dollars, with cumulative activity passing the twenty-billion mark. While not all of this represents unique economic exposure, the growth trajectory is undeniable: markets that once cleared a few thousand dollars per week are now handling institutional-scale flows.

In parallel, Kalshi has emerged as a regulated event-contract venue operating under the supervision of the US Commodity Futures Trading Commission (CFTC). A key legal milestone was a federal court decision allowing certain election-related contracts to be listed as regulated derivatives. That ruling framed at least part of the sector as a legitimate piece of market infrastructure rather than a grey-area entertainment product.

The most visible signal of mainstream acceptance, however, has been the wave of media partnerships. Kalshi has signed multi-year deals with CNN and CNBC, whose broadcasts will carry real-time prediction data alongside traditional market indicators. Yahoo Finance and other portals have integrated feeds from Polymarket and similar platforms. The message to viewers is subtle but powerful: these numbers sit next to government-bond yields and stock indices because they might contain information worth tracking.

3. The opportunity set: why institutions care about prediction markets

Why are established financial players and media organisations paying attention? The answer lies in what prediction markets can offer if they are designed and supervised well.

3.1. Better expectations, not just entertainment

Traditional polls, analyst surveys and research notes all attempt to capture expectations, but each has weaknesses. Polling can lag reality. Surveys can suffer from groupthink or low participation. Research pieces are valuable but not always updated continuously.

Prediction markets approach the same problem from a different angle. They force participants to back their views with capital. A forecast that is wrong has a measurable cost. Over time, this mechanism can reward informed views and penalise noise, leading to prices that incorporate a wide range of information sources – from macro data and political analysis to local insights that never make the headlines.

3.2. Hedging non-tradable risks

Many real-world uncertainties are difficult to hedge with conventional instruments. A media company trying to plan advertising revenue for an election year, a manufacturer exposed to specific trade policies, or a climate-focused NGO tracking carbon regulations may all face event risks that are not neatly captured by equity or bond prices.

Event contracts offer a way to transfer some of that risk. A firm that is harmed if a particular regulation is delayed can take the opposite side of a contract that pays out if the delay occurs. Losses in the real world are partly offset by gains in the prediction position. In this sense, prediction markets mirror the economic function of derivatives: reassigning risk to those more willing or able to hold it.

3.3. New data products and engagement models

For media and analytics companies, prediction prices are a rich new data stream. They can be charted, sliced by event category, compared against polls and combined with other indicators to produce dashboards that capture collective expectations in near real time. This is particularly attractive around elections, central bank decisions and major sporting events, where audience interest is already high.

From a crypto perspective, prediction markets also act as a gateway use case. Users who come for an election contract or a macro event may end up discovering stablecoins, on-chain wallets and other decentralised applications. For networks that host these venues, prediction markets can therefore function as part of a broader on-chain economy rather than an isolated product.

4. Structural risks: when volumes grow faster than safeguards

The opportunity narrative is compelling, but the risks are equally real. The same features that make prediction markets exciting – ease of access, binary outcomes, narrative-driven events – can also amplify undesirable behaviour if guardrails are weak.

4.1. Wash trading and volume inflation

One of the most eye-catching data points comes from recent academic work by Columbia Business School, which examined on-chain data from Polymarket. The study estimated that roughly a quarter of the platform's historical volume may be attributable to wash trading – instances where the same participant trades against themselves or coordinates with others to generate artificial activity. In some periods, suspicious activity proportionally accounted for the majority of volume in specific markets.

For casual observers, this matters because the exponential-looking volume charts can give the impression of organic, broad-based participation. If a significant share is instead mechanical self-trading, both the perceived depth of the market and the reliability of its prices are overstated. For institutions considering using these prices as inputs into risk models or research, understanding the quality of liquidity becomes as important as the headline numbers.

4.2. Information asymmetry and insider behaviour

Another structural concern is that many prediction questions are closely tied to information that is accessible earlier to a narrow group of insiders. Employees working on a product launch, campaign staff close to internal polling, or specialists who track obscure legislative procedures may all have an advantage over the broader public.

While modern financial markets constantly grapple with asymmetry of information, prediction venues face a unique challenge: their entire product is built around specific binary events where inside knowledge can be decisive. Without clear rules on what constitutes unacceptable conduct, strong surveillance and credible enforcement, there is a risk that some markets devolve into contests between well-informed insiders and uninformed retail participants.

4.3. Credit, leverage and behavioural risk

Because event contracts often settle to either 0 or 1, they have an embedded leverage-like profile. A position that moves from 0.20 to 0.80 delivers a 300% return before maturity, and a position that goes to zero is a complete loss. When venues allow users to borrow funds or use derivatives on top of these contracts, the effective leverage can become very high.

Credit analysts have started to flag this dynamic as a potential source of strain. If large groups of users take on significant exposures tied to political or macro events, a sequence of adverse outcomes could translate into unexpected losses that affect household finances or small institutions. Because prediction markets are often marketed through social media and integrated with entertainment content, there is a risk that individuals treat them more like games than serious financial instruments, underestimating the downside.

4.4. Legal uncertainty and regulatory fragmentation

Although the CFTC has granted designations and approvals to some platforms, many US states and international regulators are still deciding how to classify event contracts. In some jurisdictions, supervisors argue that these markets resemble unlicensed gaming; in others, they are viewed as derivatives subject to securities or commodities law. This patchwork leads to a confusing situation where a venue can be both federally supervised and simultaneously challenged at the state level.

Legal ambiguity has real economic consequences. Platforms may restrict access or delist certain types of events to avoid conflict with local rules. Financial institutions that might otherwise experiment with small allocations stay on the sidelines because compliance departments cannot map the risk clearly. The result is an industry that grows quickly in volume, but on a foundation that still lacks full regulatory clarity.

5. What a healthier prediction-market ecosystem could look like

Given this mix of promise and risk, what would a more mature and resilient prediction-market landscape require? Several elements stand out.

5.1. Transparent quality metrics, not just notional volume

Headline volume is easy to promote, but less helpful as a measure of economic substance. Platforms and data providers could do more to publish metrics that distinguish between unique counterparties and suspected self-trading, show net open interest rather than gross turnover, and highlight how many participants hold positions until settlement instead of rapidly recycling them.

If venues voluntarily disclosed these quality indicators – and if regulators encouraged consistent reporting standards – it would be easier for both individual users and institutions to assess which markets genuinely aggregate information and which ones mostly recycle speculative flow.

5.2. Stronger surveillance and conflict-of-interest rules

To maintain integrity, platforms need policies around insider participation, staff trading and conflicts of interest. For example, an employee with access to unpublished resolution criteria or private data should not be able to take positions on related events. Oracles that define the outcome of a contract must be independent, auditable and subject to review when unexpected disputes arise.

On-chain transparency helps, but it is not a complete solution. Surveillance tools must combine blockchain data with off-chain identifiers to detect coordinated manipulation, especially in small and thinly traded markets where a single actor can move prices significantly.

5.3. Responsible product design and risk limits

From a consumer-protection standpoint, product design matters as much as legal classification. Clear risk warnings, position limits, cooling-off mechanisms and optional loss caps can reduce the likelihood of users taking on exposures beyond their financial capacity. Platforms might also differentiate between professional and retail participants, offering deeper leverage and complex structures only to those who meet suitability criteria.

When prediction markets are framed as tools for hedging or information aggregation, rather than as entertainment products promising high returns, behaviour tends to be more measured. Education – explaining how probabilities work, how to interpret implied odds, and how to size positions prudently – is a central part of that shift.

5.4. Clearer regulatory boundaries

Finally, regulators face the task of drawing lines that protect users without freezing innovation. One possible framework is to distinguish between information markets, which involve broad economic or policy outcomes with identifiable hedging use cases, and purely entertainment-driven events where the primary motive is excitement rather than risk management.

Under such a framework, contracts connected to inflation prints, policy rates or climate targets might be supervised primarily as financial derivatives, while other categories are limited or handled under separate rules. Whatever the eventual model, predictability and consistency are essential; platforms and users need to know where they stand.

6. How investors and observers can interpret prediction-market data today

For now, how should market participants treat volumes and prices from platforms like Polymarket and Kalshi?

• As a complementary indicator, not a single source of truth. Prices on prediction markets are useful inputs into a mosaic of information that also includes bond markets, options curves, surveys and expert analysis. They are most helpful when they confirm or challenge those other signals, not when they are followed blindly.

• With awareness of potential distortions. Reports of wash trading and coordinated flows mean that prices can be skewed, especially in smaller contracts. Looking at order-book depth, open interest and historical accuracy for similar events can help gauge reliability.

• With attention to incentives. Media segments that highlight prediction prices often do so because they drive engagement. Viewers should remember that a colourful chart displayed during a broadcast is still just a reflection of the aggregate views – and sometimes the biases – of the participants who chose to trade that day.

For long-term crypto observers, prediction markets are also a signal of how far the ecosystem has progressed. They showcase stablecoins as collateral, on-chain settlement rails, and novel ways of bridging real-world information with digital assets. At the same time, they highlight how critical governance, transparency and regulatory coherence will be as crypto-based infrastructure becomes intertwined with the broader financial system.

7. Conclusion: financialising uncertainty, responsibly

Prediction markets sit at an intriguing intersection. On one side, they promise more efficient information aggregation, new hedging instruments and a fresh data layer for analysts and media organisations. On the other, they raise complex questions about integrity, credit risk and the social impact of turning every headline into a tradable outcome.

The surge in weekly volume on platforms like Polymarket, the regulatory breakthroughs achieved by Kalshi, and the growing role of these venues in mainstream financial coverage all suggest that event contracts are unlikely to disappear. Instead, the key debate will be about how they evolve: whether they become a robust component of the global derivatives ecosystem or remain a high-risk niche overshadowed by concerns over manipulation and conduct.

For now, the most prudent stance is to treat prediction markets as a rich but imperfect source of information, to pay close attention to the quality of liquidity behind the headline numbers, and to remember that while uncertainty can be priced, it can never be eliminated. Forecasts may have become financial assets, but the responsibility for using them wisely still rests with the humans behind the screens.