Why Downtrends Are the Most Important Phase of Investing

Most people fall in love with markets during the exciting part: price charts go up, headlines sound optimistic, and social media is full of success stories. That is the visible, noisy phase of the cycle. But the work that really shapes long-term outcomes almost never happens at the top. It happens quietly, in the middle of uncomfortable drawdowns, when sentiment is weak and attention has moved somewhere else.

This article explains why the downtrend phase of a market cycle is often the most important period for serious investors, especially in volatile assets like Bitcoin, Ethereum, and broader digital assets. We will look at what actually happens beneath the surface during a downturn, how large and small investors behave differently, and how thoughtful participants use this time to build a resilient position instead of chasing quick gains.

Nothing here is a prediction about where prices will go next, and it is not a recommendation to buy, sell, or hold any specific asset. The goal is to give you a more structured way to think about downtrends so you can design your own plan and stick to it with more discipline.

1. Why Downtrends Feel So Painful – and Why That Matters

Downtrends are uncomfortable by design. Markets move from optimism to pessimism faster than fundamentals change. When prices fall for weeks or months, negative headlines cluster together: macro concerns, regulatory worries, protocol issues, liquidations, and company-specific problems all arrive at the same time. That environment produces three psychological effects:

• Loss amplification: A 40% drawdown on screen feels worse than a 40% gain ever felt good. Behavioural finance calls this loss aversion, and it pushes many participants to exit simply because the emotional pressure is too high.

• Story inversion: The same narrative that supported an asset in the uptrend suddenly becomes a reason to abandon it: 'too volatile', 'has no future','was just a bubble'. The asset did not change overnight, but the tone of discussion did.

• Time distortion: Weeks of sideways or falling prices feel like eternity, while similar periods in an uptrend pass quickly. Investors start to believe the downtrend will last forever, even though history shows that is rarely true.

These reactions are human and understandable. But they also mean that prices in a downtrend often reflect emotion as much as fundamentals. For disciplined investors, recognizing this gap is the first step to using the phase constructively instead of being pushed around by it.

2. What Actually Happens Under the Surface in a Downtrend

While most eyes are on the price chart, the underlying structure of the market is shifting in slower, less visible ways. In a typical downtrend you will often see at least three deeper processes unfold.

2.1. Ownership quietly changes hands

Short-term participants tend to be more sensitive to price and news flow. When volatility rises and losses accumulate, they are the first to reduce or close positions. Their selling does not make the asset worthless; it simply transfers ownership from impatient holders to entities with longer time horizons and stronger conviction.

This transfer is not smooth. It happens through sharp legs down, forced liquidations, and periods of low liquidity where even modest sell orders move the market. But once that re-allocation is far enough along, the asset can be held by a base of owners who are less likely to react to every headline.

2.2. Market structure is rebuilt

Downtrends expose weaknesses in infrastructure and risk management. Exchanges with poor controls, funds with excessive leverage, and protocols with fragile designs often face the toughest stress during these periods. The result is messy in the short term, but over time the system tends to emerge stronger: platforms upgrade their risk frameworks, builders improve code, and investors become more selective about counterparties.

In other words, a downtrend works like a stress test. It removes some unstable parts of the ecosystem and rewards those that remain functional under pressure.

2.3. Expectations are reset

In an uptrend, future assumptions become ambitious: growth projections, price targets, and adoption curves often stretch far beyond what is realistic. A prolonged drawdown forces the market to rethink those assumptions. Revenue, usage, and cash flow matter again. Teams that deliver real progress continue to attract attention, while purely narrative-driven stories fade.

This resetting of expectations is healthy. It is also the environment in which thoughtful investors can distinguish between assets that were simply carried higher by the tide, and those that have underlying fundamentals that could justify long-term participation.

3. Why the Best Entry Points Rarely Feel Comfortable

A common mistake is to imagine that a “good buying opportunity” will arrive with calm markets, positive headlines, and clear confirmation that the worst is over. In practice, history across many asset classes suggests the opposite: the most attractive valuations often appear when news flow still feels negative and confidence is fragile.

That does not mean every deep drawdown is automatically a bargain, or that prices cannot fall further. It simply means that:

- The market tends to price in bad news before it becomes obvious in mainstream coverage.

- By the time the narrative turns positive, a meaningful part of the re-pricing has often already happened.

This “discomfort premium” is one reason downtrends are so important. If you wait until conditions feel emotionally safe, you are usually paying a higher price for that comfort. The trade-off for long-term investors is clear: accept short-term discomfort in exchange for better long-term entry levels, or accept less favorable entries in exchange for a calmer psychological experience.

4. How Long-Horizon Investors Use Downtrends

Professional allocators, family offices, and experienced individuals rarely see downtrends as a signal to abandon their entire framework. Instead, they often use these phases for tasks that are difficult to perform in the middle of an aggressive rally.

4.1. Rebuilding conviction from the ground up

A downtrend is a forcing function to revisit basic questions: Why does this asset exist? What problem does it solve? Who are the users? What is the realistic addressable market? How strong is the balance sheet, the protocol design, or the network effects? In crypto specifically, this can mean studying network usage, fee sustainability, and the quality of the developer ecosystem, rather than relying on momentum alone.

Investors who cannot answer these questions clearly often decide to scale down or exit. Those who can, and still believe the thesis holds over five or ten years, may decide that the drawdown merely provides better risk-reward for gradual accumulation.

4.2. Systematic accumulation instead of guessing the bottom

Trying to identify the exact bottom of a cycle is extremely difficult, even for professionals. Instead of relying on perfect timing, many long-term investors use systematic accumulation approaches: allocating fixed amounts on a regular schedule, or defining a range of prices where they are comfortable adding over time.

This does not eliminate risk, and it does not guarantee profits. What it does is move the focus from prediction (“the low is exactly here”) to process (“if the thesis is intact, I will build a position gradually while prices are depressed”). Downtrends are the natural environment for this kind of disciplined strategy.

4.3. Cleaning up leverage and complexity

When prices are strong, it is easy to accept more leverage, more complex products, and more concentrated bets. A downtrend exposes how fragile that can be. Margin calls, forced sales, and large drawdowns are all reminders that surviving multiple cycles is more important than maximizing any single one.

Thoughtful investors often use a downturn to simplify: reduce leverage, consolidate positions, and move assets to counterparties and custody solutions that they understand and trust. That way, when conditions improve, they are not repairing damage – they are starting from a stronger base.

5. Downtrends as a Test of Mindset and Risk Management

Price action during a downtrend is only half the story. The other half lives inside the investor: their expectations, time horizon, and tolerance for volatility. That is why this phase is often described as a psychological stress test.

5.1. The difference between price risk and thesis risk

Not every drawdown means the original investment thesis is broken. Sometimes the market is simply repricing assets after a period of excessive optimism. In other cases, the thesis really has changed: technology becomes less competitive, regulation moves in an unexpected direction, or business models prove weaker than expected.

A practical framework in a downtrend is to separate:

- Price risk: the chance that the market temporarily values an asset much lower than you think its long-term fundamentals justify.

- Thesis risk: the chance that your core assumptions about the asset are no longer valid.

If price risk is high but thesis risk is low, some long-term investors see a reason to continue accumulating carefully. If thesis risk is high, a drawdown may be a signal to reassess, regardless of how far price has already fallen.

5.2. Time horizon as a competitive advantage

Short-term traders are forced to respond to every move; their performance is measured in days or weeks. Long-horizon investors can sometimes turn time into an advantage. They do not need to predict the exact path of prices, only whether the asset is likely to be meaningfully more valuable years down the line.

This means that an uncomfortable downtrend may be acceptable if:

- The position size fits within a broader risk budget.

- The investor has diversified across different assets and sectors.

- There is a clear plan for how to react if the thesis changes.

Without a defined horizon and risk budget, however, the same drawdown can become overwhelming – leading to forced decisions at exactly the wrong time.

6. Practical Ways to Use a Downtrend Constructively

None of the points above imply that everyone should buy during every downturn. Risk tolerance, financial goals, and time horizons vary widely. But for those who choose to stay engaged with the market, there are several practical habits that can make a downtrend more productive and less chaotic.

6.1. Build or update an investment journal

Documenting your decisions is boring when prices are moving sideways, but it becomes invaluable when volatility returns. A simple journal can record:

- Why you hold each asset.

- What would make you reduce, exit, or add to the position.

- How large the allocation should be relative to your total portfolio.

In the middle of a sharp move, it is easy to forget your original plan and react only to prices on screen. A written record helps you check whether a decision is driven by updated information or by short-term emotion.

6.2. Separate research time from decision time

Downtrends are often rich in information: research from analysts, on-chain metrics, and macro data all compete for attention. One useful approach is to separate research windows (where you deliberately explore new information) from decision windows (where you size positions or rebalance).

This helps reduce impulsive actions, such as responding to a single headline with a large portfolio move. It also makes room for deeper learning: understanding how ETFs, derivatives, regulation, and macro conditions shape the market, instead of reacting only to price.

6.3. Focus on risk first, potential return second

In an early uptrend, many conversations revolve around how high an asset might go. In a downtrend, the core question becomes: How much can I afford to lose if I am wrong? That shift is healthy. It encourages diversification, reasonable position sizing, and an honest look at worst-case scenarios.

Focusing on risk does not remove uncertainty, but it can prevent a single idea from dominating your financial life. Remaining able to participate in future cycles is more important than maximizing any one opportunity.

7. The Role of Education During Downtrends

There is one advantage of a quieter market that is often overlooked: time to learn. When volumes fall and headlines cool, builders keep building. Protocol upgrades, regulatory consultations, institutional pilots, and infrastructure improvements frequently continue in the background while prices drift.

For individual investors, this is an opportunity to deepen understanding of:

- How different blockchains and protocols actually work.

- How market structure has evolved with ETFs, custodians, and on-chain finance.

- How macro variables like interest rates, liquidity, and inflation tend to interact with digital assets over multiple years.

Using the downtrend as a classroom instead of a scoreboard can shift the experience from “waiting for price to come back” to “building skills and frameworks” that will remain useful in future cycles, regardless of what any single asset does.

8. Downtrend vs. Uptrend: Where Wealth Is Built vs. Where It Is Displayed

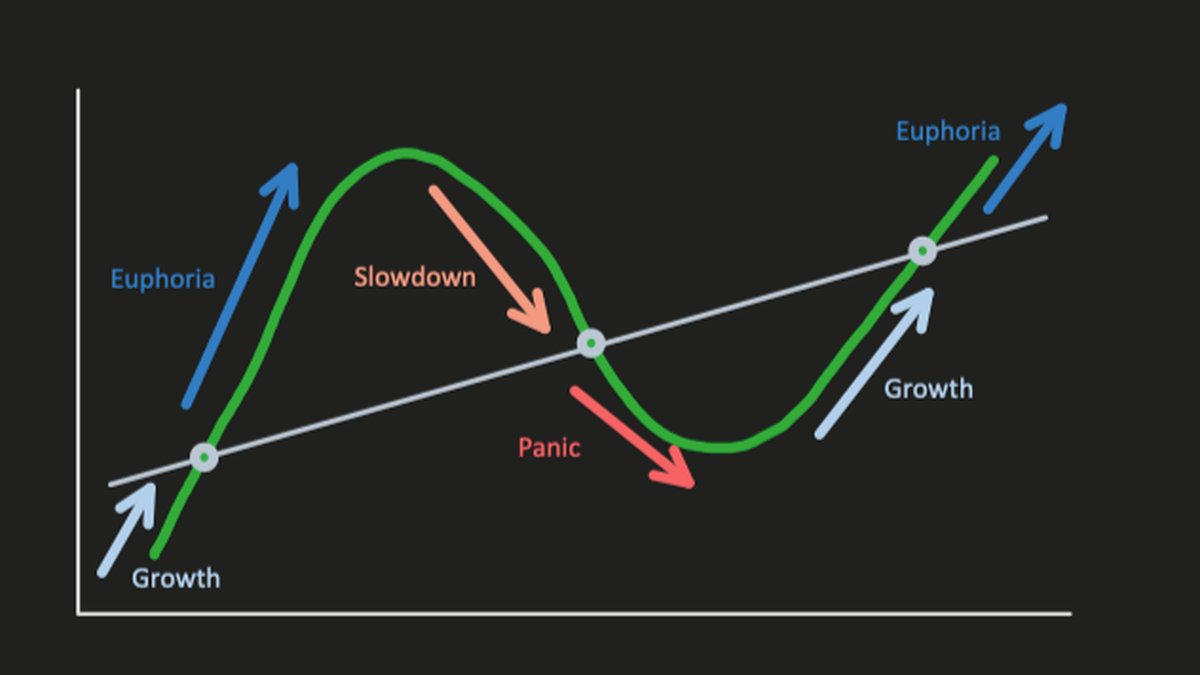

A simple way to summarize the role of downtrends is this:

- Downtrends are where positions are built.

- Uptrends are where those earlier decisions become visible.

By the time an asset is featured in headlines every day and new participants are arriving in large numbers, the most advantageous entry points are usually in the past. That does not mean there is never opportunity in a mature uptrend, but it means the balance of risk and reward has shifted.

The investors who tend to emerge from a full cycle in stronger shape are rarely those who found the perfect top to sell or the exact bottom to buy. They are the ones who:

- Treated downtrends as a core part of the process, not as a personal failure.

- Stayed within a risk framework that allowed them to hold through volatility without being forced to liquidate.

- Used quieter periods to learn more about what they owned and why.

Bottom Line

Downtrends are uncomfortable, noisy, and sometimes discouraging. They come with negative headlines, sharp price moves, and long stretches where it feels easier to look away from the screen. But for investors who think in years rather than days, this phase can be the most important part of the entire journey. It is when ownership changes hands, market structure is strengthened, expectations are reset, and patient participants quietly build positions for the next phase of the cycle.

This article is not suggesting that anyone should automatically buy every dip, or that any specific asset will recover. The real message is more modest: if you decide that an asset still fits your long-term thesis and risk tolerance, the work of building that position almost always happens during periods when it feels hardest to stay engaged.

Disclaimer: This article is for informational and educational purposes only and does not constitute financial, investment, or trading advice. Digital assets are volatile and can involve a high degree of risk, including the potential loss of principal. Always do your own research and consider speaking with a qualified financial professional before making investment decisions.