BitMine’s $112M Ethereum Purchase and the Truth About Price Targets

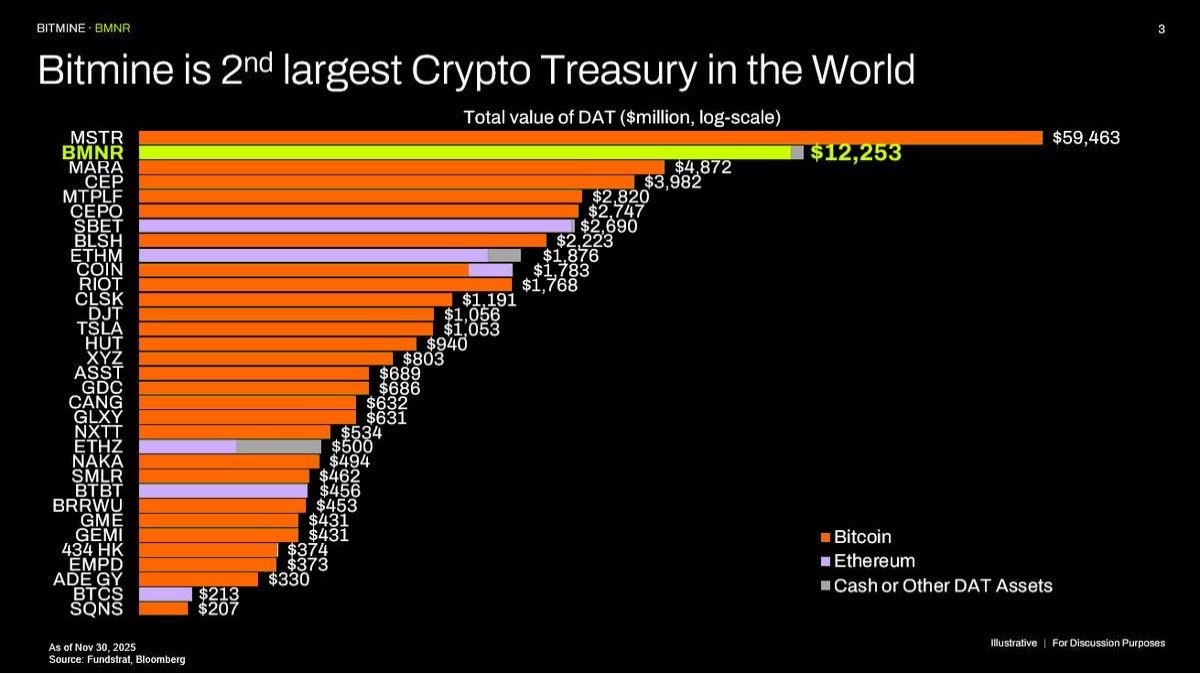

BitMine has just added another 33,504 ETH to its treasury, pushing its holdings to 3.86 million ETH – roughly 3.2% of Ethereum’s circulating supply. Chairman Tom Lee argues that ETH has already found a durable bottom and is entering its own supercycle, with targets of 7,000 USD in early 2026. This article unpacks what such large-scale accumulation really means for the market, why price forecasts should be treated as narratives rather than roadmaps, and why disciplined long-term strategies still matter more than any headline prediction.

Read more →