Visa Crypto Cards in 2025: The Year Crypto Quietly Became Spendable

A 525% jump in Visa-linked crypto card spending is less about hype—and more about infrastructure finally behaving like a payment product.

Read more →

A 525% jump in Visa-linked crypto card spending is less about hype—and more about infrastructure finally behaving like a payment product.

Read more →

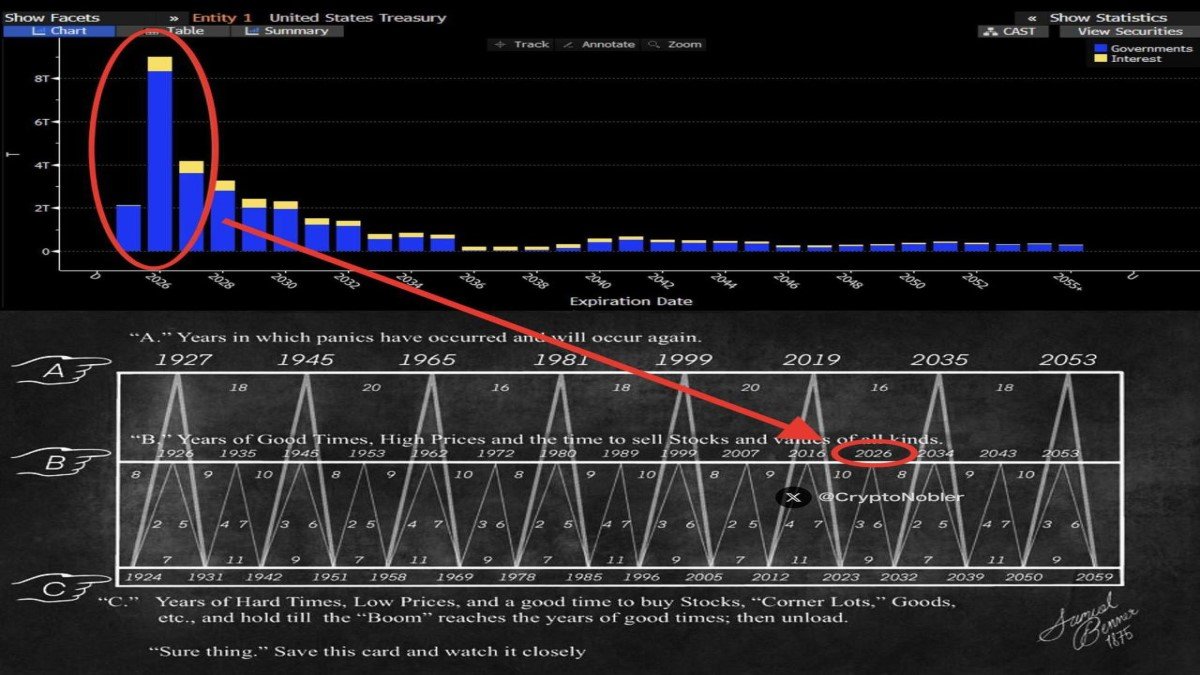

A possible Supreme Court reversal of emergency-law tariffs isn’t just a political headline—it’s a liquidity event with real implications for Treasury cash flows, risk appetite, and crypto’s narrative as both “risk asset” and “sovereign collateral.”

Read more →

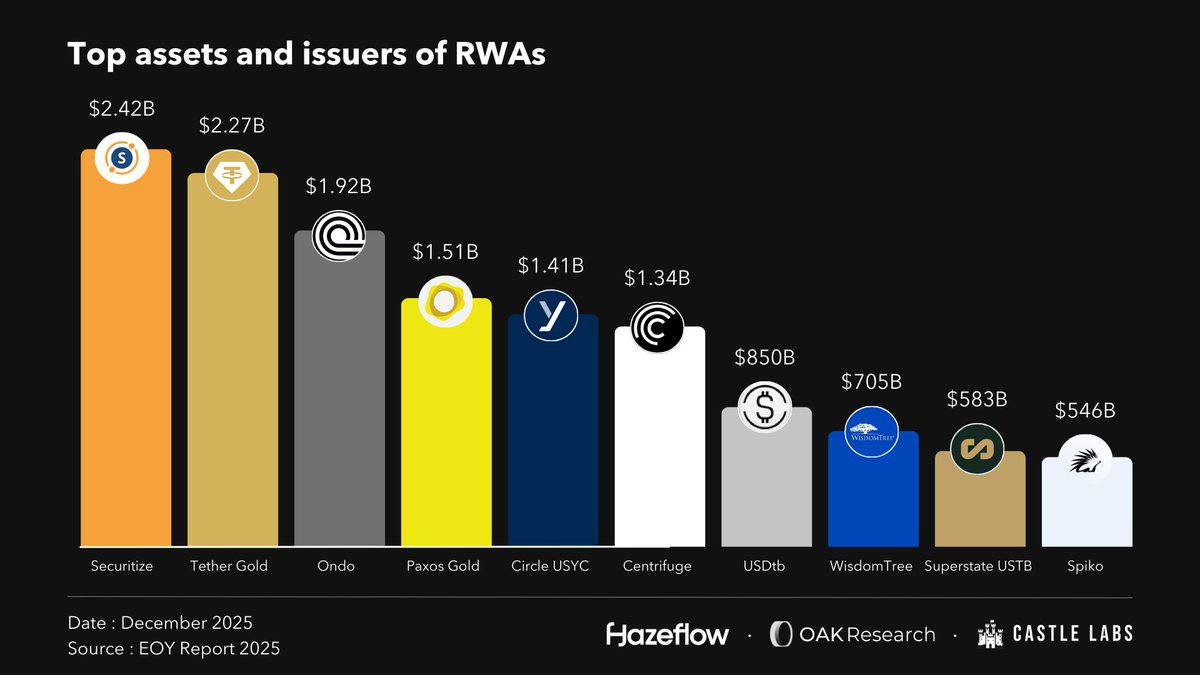

In 2026, “institutional crypto” looks less like chasing speculative altcoins and more like rebuilding the plumbing: stablecoins, tokenized Treasury bills, private credit, and compliant distribution rails. The surprise is not the growth—it's the shape of it.

Read more →

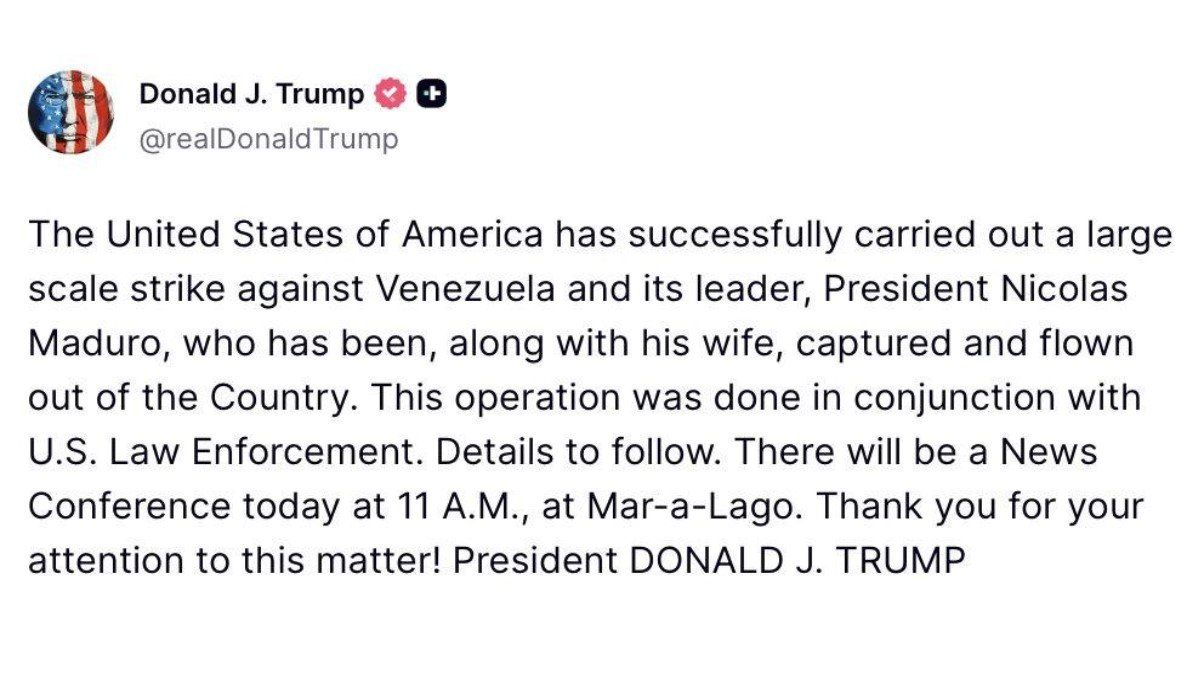

Venezuela’s main stock index (IBC) surged 16.45% in a single session after reports that U.S. authorities detained President Nicolás Maduro. The move looks like a “regime-change rally,” but the deeper story is about heavy crude, sanctions optionality, China’s balance-sheet risk, and why oil can dip even as local equities spike.

Read more →

The tape looks risk-on: equities, crypto, and precious metals bid. Underneath, the market is quietly voting for better collateral and better rails—tokenized gold, stablecoin plumbing, and regulatory pathways.

Read more →

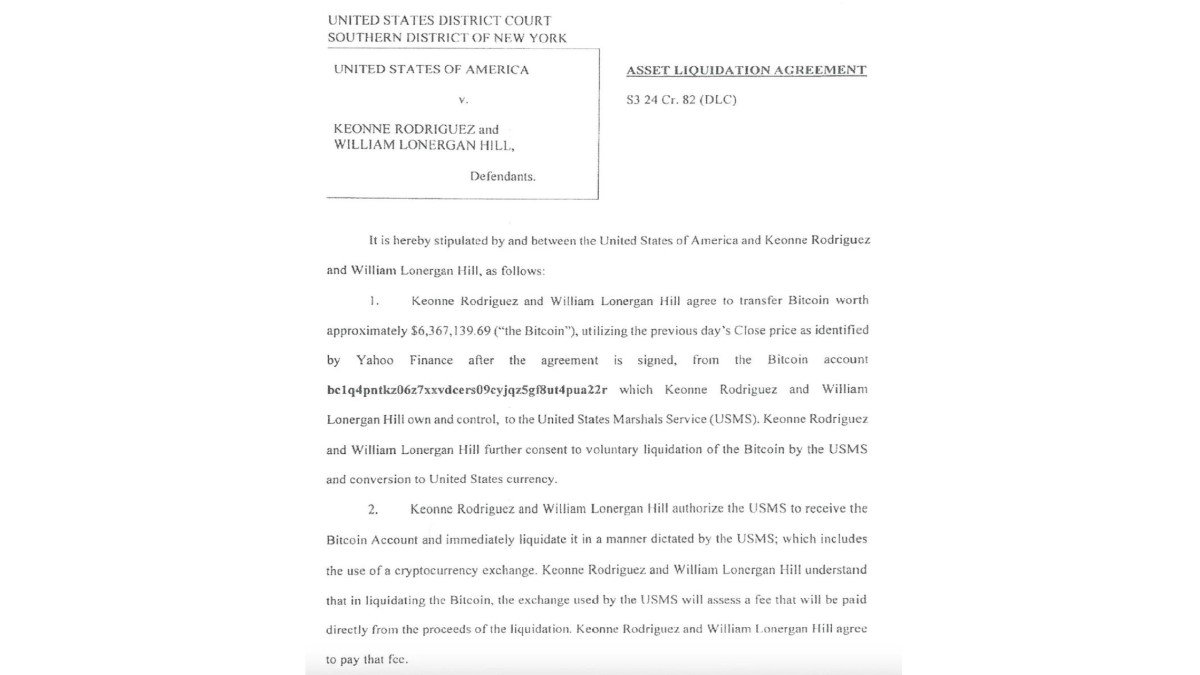

A report claims the U.S. Marshals sold seized Bitcoin despite an executive order promoting a Strategic Bitcoin Reserve. The real story is institutional plumbing: who controls the state’s balance sheet, and how quickly policy can (or can’t) rewrite default routines.

Read more →

The U.S.–Venezuela story is no longer a single-commodity headline. It’s a value-chain story (heavy crude and refinery design), a corporate earnings story (refiners and oilfield services), and a geopolitics story (spheres of influence, U.S.–China friction, and precedent anxiety spilling into Taiwan and even Greenland narratives). The market’s broad rally may look counterintuitive—but it’s a clue about what investors think the next regime could be.

Read more →

Grayscale’s first staking distribution for an ETH spot ETF is less about a small quarterly payout—and more about redefining what investors expect from crypto exposure: not only price, but compliant on-chain cashflow.

Read more →

Tom Lee’s bullish $250K scenario is less a crystal-ball prediction than a claim that Bitcoin is changing regimes. Here’s what a true “cycle break” would look like—and what could still derail it.

Read more →

When Fed’s Neel Kashkari says rates are “near neutral,” he’s not just forecasting fewer cuts—he’s describing a regime shift where policy becomes finely balanced and labor dynamics matter more than headline growth. If AI is slowing hiring while inflation remains sticky (especially under tariff pressure), the economy can drift into a deceptively calm state: fewer layoffs, fewer openings, and slower re-entry for job seekers. Markets don’t price morality or politics; they price consequences—and 2026’s consequences may hinge on productivity, not panic.

Read more →

Japan’s finance minister publicly framing 2026 as a “digital year” for assets is not a marketing slogan—it’s a market-structure signal. The country’s emphasis on exchanges as the gateway to blockchain adoption reveals a pragmatic thesis: crypto will scale fastest when it becomes an invisible layer inside familiar, supervised venues rather than a parallel financial universe.

Read more →

Bank of America allowing advisors to proactively recommend spot Bitcoin ETFs is less about a single bank ‘turning bullish’ and more about Bitcoin being granted a new distribution channel: standardized portfolio construction for high-net-worth clients. The move reframes demand from episodic, client-request driven purchases into policy-guided allocations—small in percentage terms, but powerful in how it stabilizes participation and reshapes market behavior.

Read more →

In the last 24 hours, markets didn’t just move—they revealed what they now reward: cash-flow narratives, distribution rails, and credible risk controls. The details matter, but the pattern matters more.

Read more →

PwC’s decision to go deeper into crypto—especially stablecoins and tokenization—after a clearer U.S. regulatory posture is not just another ‘institutional adoption’ headline. It’s a market-structure shift: when the Big Four commit, crypto stops being a product category and starts becoming a compliance-native financial system. In the next phase, audits, controls, reporting, and accounting standards won’t be side quests—they’ll be the distribution channel.

Read more →

Jupiter’s JUPUSD—built with Ethena—signals a strategic shift in stablecoin design: prioritize reserve clarity and institutional-grade custody, then deliver utility via integrated lending rather than direct token yield. With reserves initially held ~90% in USDtb and ~10% in USDC for liquidity, and custody routed through Anchorage Digital’s Porto, JUPUSD reads less like a “DeFi experiment” and more like a settlement primitive engineered for composable credit.

Read more →

The first Monday session of 2026 opened with an uncommon sight: stocks, crypto, gold, silver, and even oil all rising together after a volatile U.S.–Venezuela weekend headline. When nearly every asset is green, it’s tempting to call it “risk-on.” But the deeper signal is often more nuanced: a market choosing to postpone certainty—pricing optionality, not a clean narrative. This piece breaks down why a synchronized rally can happen, what it suggests about positioning and liquidity, and which indicators matter most if the oil story is still genuinely “wait-and-see.”

Read more →

Markets don’t trade slogans like “energy war.” They trade choke points: refinery inputs, shipping routes, policy constraints, and financing costs. If Venezuela’s energy system becomes a lever in US–China competition, the first-order move might be oil—but the second-order story is inflation expectations, Treasury term premiums, and liquidity conditions that can spill into equities and crypto.

Read more →

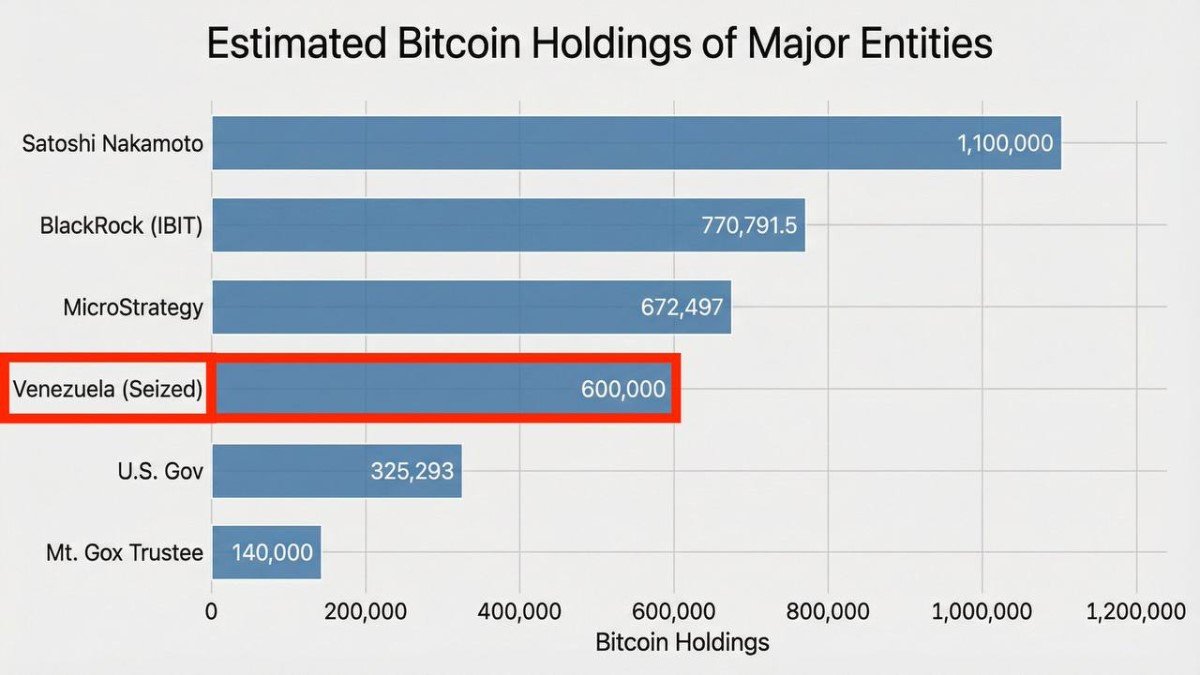

A report claims Venezuela may control 600,000–660,000 BTC—potentially worth $60B+—accumulated through resource-for-value channels since 2018. The bigger market question isn’t whether the number is exact, but what happens if a major state-sized BTC stash transitions from ‘private and mobile’ to ‘seized and frozen.’ That shift changes supply, narrative, and policy incentives—without a single coin needing to move on-chain.

Read more →

Next week is a classic market setup: a headline-driven shock gets digested on Monday, then a sequence of labor-market datapoints forces investors to price reality rather than narrative. The biggest risk isn’t being wrong—it’s reacting to noise as if it were signal.

Read more →

Today’s 24-hour tape looks like a collection of unrelated headlines—wallets adding prediction markets, buyback debates, token unlocks, and geopolitical oil shocks. But the connective tissue is clear: crypto is moving from ‘places you go’ (exchanges) to ‘rails you use’ (embedded financial primitives), and that transition is changing what adoption actually means.

Read more →

Ethereum’s latest scaling story isn’t about chasing the next narrative. It’s about separating responsibilities—data availability, execution, and verification—so the network can grow without turning decentralization into a luxury product.

Read more →

If a market-structure bill is the rulebook for crypto’s ‘financial highway,’ DeFi is the intersection where the traffic lights don’t have a legal owner. That’s why negotiations keep stalling—and why 2026 could still be the year the U.S. draws an enforceable perimeter.

Read more →

When Venezuela hits the headlines, oil dominates the conversation. But the country’s gold reserves function like financial collateral—liquid, portable, and politically sensitive in ways oil can’t match. Here’s a framework for reading the story beneath the noise.

Read more →

A Venezuela geopolitical shock, a $91K Bitcoin tape, and a sudden connectivity play reveal a deeper story: crypto is increasingly shaped by infrastructure and statecraft—not just charts.

Read more →

After President Trump said the U.S. would temporarily ‘run’ Venezuela and that Nicolás Maduro and Cilia Flores were captured, the conversation immediately jumped to oil: billions in promised investment and the world’s largest proven reserves. The deeper story is more constrained. Venezuela’s oil wealth is real, but much of it is extra-heavy Orinoco crude that demands time, specialized expertise, stable governance, and massive capital—exactly the ingredients that are least available right after a shock.

Read more →

Reports that President Trump said the U.S. struck Venezuela and captured Nicolás Maduro and Cilia Flores kicked off 2026 with a geopolitical shock—and a parallel information shock. The real lesson is not prediction, but channel-mapping: energy, policy, funding, and the narratives that move faster than verification.

Read more →

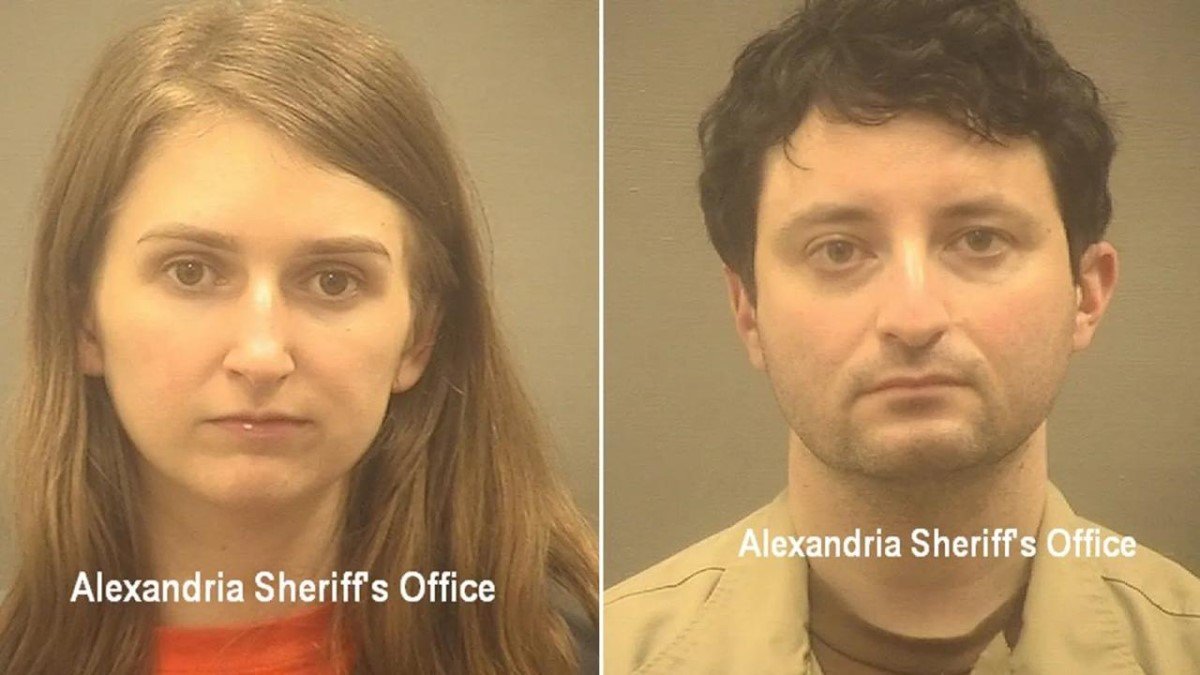

Ilya Lichtenstein, tied to the 2016 Bitfinex theft of ~120,000 BTC, was released early under the First Step Act framework. The headline feels jarring, but the mechanism is procedural—not a special deal. More importantly, the case highlights a bigger shift: in crypto enforcement, deterrence is moving away from long prison terms and toward asset recovery, compliance choke points, and post-sentence constraints that quietly follow offenders for years.

Read more →

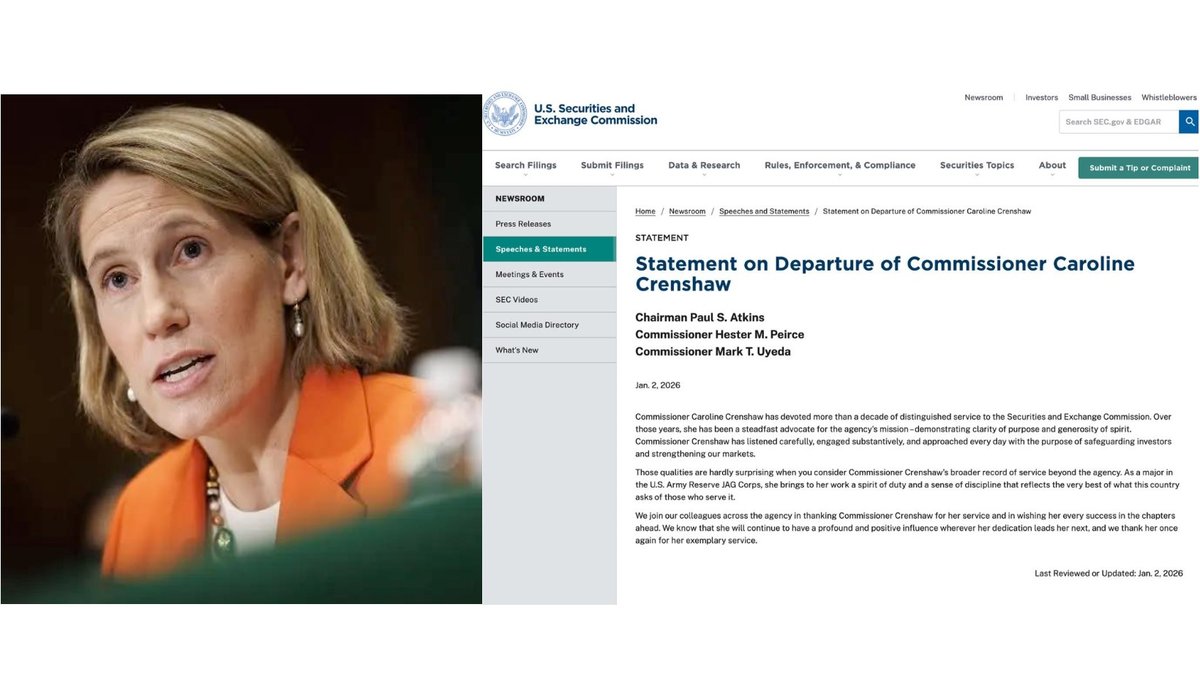

Caroline Crenshaw’s departure closes a chapter of SEC skepticism toward crypto—but the more important story is how vacancies and institutional constraints shape what can realistically change next.

Read more →

U.S. stocks started 2026 with a modestly higher Dow and S&P 500, a flat Nasdaq, Bitcoin hovering near $90K, gold and silver holding elevated levels, and oil staying under $60. The headline looks calm. The subtext is not: the session revealed a market negotiating constraints—policy uncertainty, leadership transitions, and what to do when liquidity is the story and fundamentals arrive as footnotes.

Read more →

BNB Chain’s Lorentz & Maxwell upgrades reportedly cut transaction fees by ~98% alongside a ~6.25M BNB burn—an attention-grabbing combination that reframes what “growth” means in 2026: cheaper rails, more explicit token economics, and a parallel tightening of compliance and institutional plumbing (stablecoin oversight, custody, and governance).

Read more →