Tariffs, Emergency Powers, and a Supreme Court Countdown: Why the Next Ruling Matters Beyond Trade

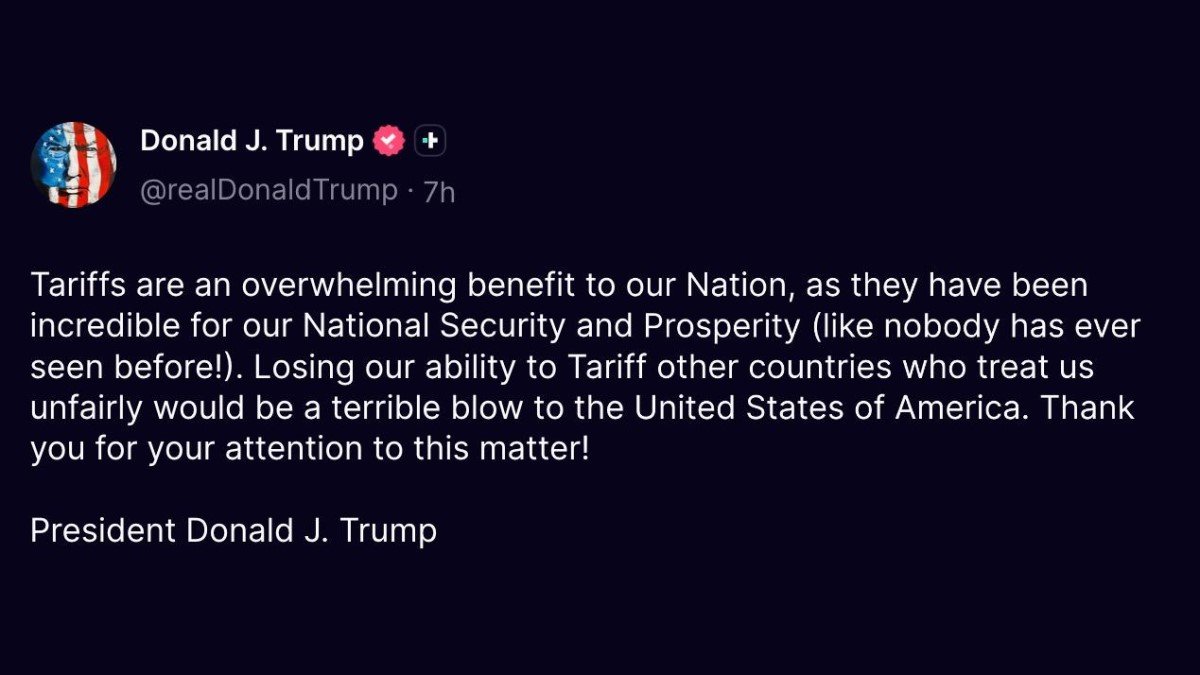

President Trump argues tariffs strengthen U.S. national security and prosperity—and warns that losing tariff authority would be a major blow. With the Supreme Court reviewing whether emergency powers can support sweeping tariffs, the real question is larger than trade: who gets to turn economic pressure into policy at speed, and what guardrails should exist when the tool is this powerful?

Read more →