Nordea’s Turn: From ‘No’ in 2018 to ‘Now’ in 2025

In 2018, Nordea drew global attention by prohibiting its employees from trading cryptocurrencies—an emblematic stance during an era of nascent policy and volatile markets. That policy was widely reported and framed as a compliance safeguard in the absence of clear rules.

Fast-forward to late 2025: multiple European outlets report that Nordea is enabling customer access to a Bitcoin exchange-traded product (ETP), effectively reversing the optics of its earlier posture. While a bank employee ban and customer product access are different decisions, the symbolism is unmistakable: crypto has graduated from a compliance outlier to a product that can live inside a bank’s risk and suitability rails. In public coverage, the move was described as allowing access to an external spot Bitcoin ETP—potentially via existing European issuers—on a timeline reported as early as December. ([Markets][1])

ETF vs. ETP: Words Matter in Europe

Before we go further, a crucial correction: what Nordea is opening up to clients is an ETP, not a UCITS ETF. European regulators and exchanges have long allowed physically backed crypto ETPs (including ETNs and ETCs) to trade on mainstream venues. But UCITS rules make a plain-vanilla, spot crypto ETF highly atypical—hence the European market evolved around ETP wrappers. Financial press has repeatedly explained the distinction: ETPs, not ETFs, are the prevailing structure for crypto exposures in Europe. ([Cơ quan Ngân hàng Châu Âu][2])

Why it matters: an ETP can differ on legal form, collateralization, issuer risk, and listing venue. For investors, that affects due diligence—who the issuer is, where the collateral sits, how redemptions work, and how fees are taken. But for bank distribution, ETPs solve the most important problem: they’re already engineered to sit on European securities rails—with ISINs, exchange tickers, and a disclosure regime that banks understand.

Why Now? MiCA, Maturity—and Metrics That Banks Care About

Nordea is not flipping a switch in a vacuum. Europe’s MiCA framework (Markets in Crypto-Assets Regulation) has been phasing in since 2024, with the regulation applying in full from December 30, 2024 (and stablecoin titles from June 30, 2024). That doesn’t ‘approve’ any single product; it standardizes how crypto-asset service providers, custody, and stablecoin issuers should operate—giving bank compliance teams something they’ve wanted for years: a reference rulebook.

Bank product governance always turns on a few boring but decisive questions: Can we KYC and suitability-check the buyer? Are we happy with the issuer’s risk and custody chain? Do we know how to reconcile taxes, reporting, and client servicing? In a MiCA world, these answers are clearer. Meanwhile, the client appetite didn’t vanish; bitcoin has moved from a niche idea to a global alternative asset with broad brand awareness, and banks are increasingly motivated to serve that demand on-platform rather than watch assets leave to fintechs and exchanges.

Scale Matters: Why a Nordic Giant Changes the Narrative

Nordea claims roughly ten million retail customers and is commonly described as the largest financial-services group in the Nordics. Distribution at that scale is the story: even single-digit adoption rates translate into meaningful AUM for a Bitcoin ETP and adjacent services (advisory, discretionary portfolios, or digital-asset education).

Another narrative shift: Nordea’s 2018 decision was often cited as a bellwether for bank caution. Its 2025 move now becomes a bellwether for bank normalization—a template other incumbents will study. It signals to boards and risk committees that crypto exposure can be handled within standard wealth-management workflows, especially when the instrument is exchange-listed, duly collateralized, and issuer-disclosed.

What We Know—and What We Don’t

Coverage to date highlights that Nordea will provide access to an external, exchange-listed spot Bitcoin ETP; some reporting mentions CoinShares as a plausible partner, reflecting the firm’s long history with crypto ETPs across European venues. The precise SKUs, fee schedule, and countries of availability haven’t been exhaustively detailed in English-language press at time of writing. We therefore treat partner specifics as likely but not officially confirmed details until Nordea’s own product pages or press center posts definitive documentation. ([investor.coinshares.com][3])

Fact-check corner: We’ve seen social posts describing a ‘Nordea Bitcoin ETF.’ That’s shorthand; in the EU context the correct term is ETP. We’ve also seen references to a partner name ‘CorSec’—we found no credible, primary source linking Nordea to any such entity in this rollout. If a third-party issuer or custodian is involved, expect it to be one of the established European ETP providers or regulated custodians already operating under MiCA-aligned or national frameworks. ([Cơ quan Ngân hàng Châu Âu][2])

How Bank Distribution Changes the Demand Curve

Crypto adoption tends to happen in waves: retail exchanges, then fintech brokers, then wealth-platform wrappers. The last step—banks—doesn’t necessarily maximize performance, but it maximizes comfort and compliance. Here’s why Nordea’s access switch matters:

- Suitability & advice: Advisors can include a small ETP sleeve in diversified portfolios with documented rationale and risk bands. That shrinks the behavioral gap between ‘crypto curious’ and ‘crypto allocated.’

- Operational trust: Clients already understand bank statements, tax reports, and dispute mechanisms. An ETP sitting next to equity and bond funds is a low-friction story.

- Liquidity optics: Exchange-listed ETPs plug into the same dealing desks and settlement rails banks already use. No wallet setup, no off-platform transfers—important for cautious adopters.

None of this eliminates bitcoin’s volatility or issuer risks. But it removes procedural barriers that kept many mainstream clients on the sidelines while fintechs captured the early flows.

Pricing, Fees, and the ‘Why Banks?’ Question

Investors will ask whether a bank-sourced ETP is more expensive than buying spot on a crypto exchange. The answer is often ‘yes’ on a narrow fee basis. But total cost of ownership includes security, reconciliation, tax reporting, and the value of advice. If you pay 95–150 bps on an ETP but avoid the operational frictions and self-custody risk you can’t quantify, many clients will accept it as the price of sleeping at night. Europe’s crypto ETP market has grown precisely because it lives where the rest of the investor’s life already is—on a brokerage or bank platform. ([Cơ quan Ngân hàng Châu Âu][4])

Regulation: The Quiet Enabler

MiCA doesn’t turn banks into crypto evangelists. It turns crypto from an interpretive problem into a process. Titles III and IV (on asset-referenced and e-money tokens) have applied since June 30, 2024; full application since December 30, 2024 gives compliance leaders a line in the sand. Banks can finally pilot, audit, and scale with less ambiguity. That is the precondition for moves like Nordea’s.

What This Means for Issuers and Competitors

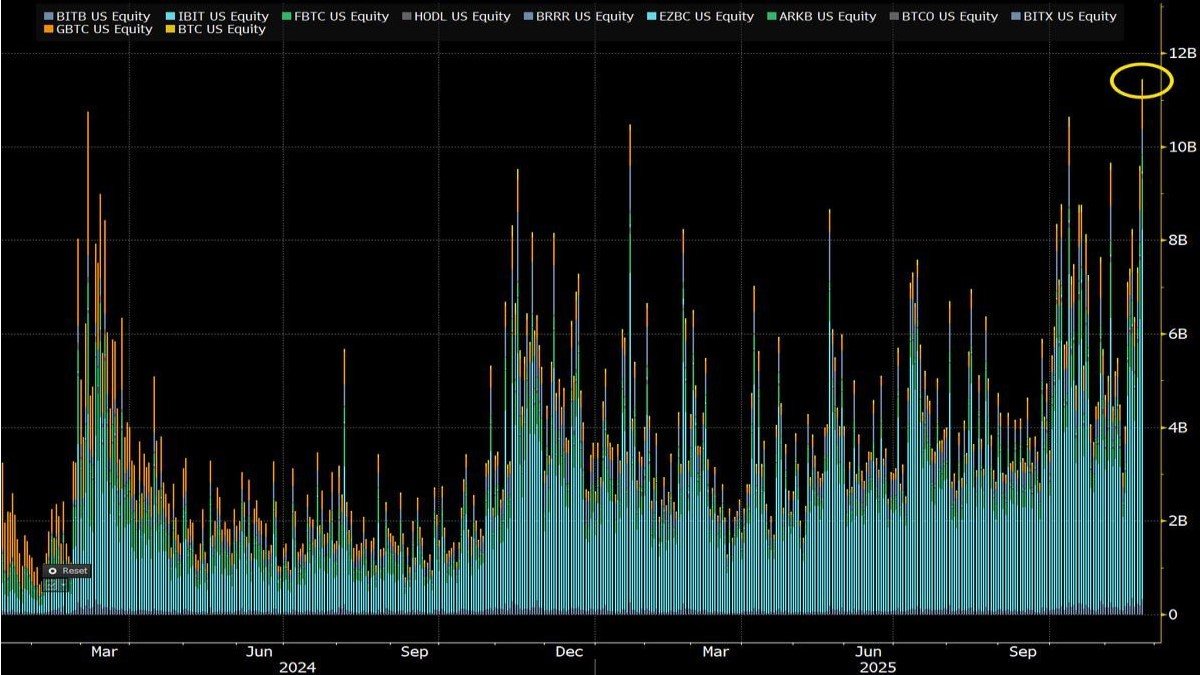

For ETP providers, a Nordea on-ramp is distribution gold. Bank shelf placement can deliver steady primary-market creations, improving secondary-market liquidity and spreads over time. Expect peers—other Nordic banks and pan-EU institutions—to evaluate similar access toggles, especially where MiCA licensing and local permissions are already in place. The result won’t be a speculative mania; it will look like every other asset-class ‘mainstreaming’: modest allocations, portfolio-committee memos, and lots of FAQs.

Risks and Misunderstandings to Watch

- Label risk (ETF vs ETP): Mislabeling can breed false comfort. ETPs usually carry issuer credit risk and a specific collateral framework. Read the prospectus; don’t assume a UCITS ETF. ([Cơ quan Ngân hàng Châu Âu][2])

- Custody opacity: Who holds the underlying bitcoin, where, and under what insurance? In ETPs, this is spelled out—investors should verify the custodian and cold-storage policies.

- Tax treatment: Domestic rules vary: capital gains vs. other income, loss offsets, wealth taxes—banks help, but you must still understand jurisdictional specifics.

- Product availability: Nordic cross-border distribution is complex. A product offered in one domicile may be gated in another pending local approvals.

Macro Context: Why a Bank Move Now Could Matter for Flows

European adoption has always been structurally different from the U.S.: fewer true spot ETFs, more ETPs, more issuer differentiation. With MiCA in place and a decade of ETP operational learnings, the constraint has been channels. When a top-tier bank begins letting mainstream customers buy a spot Bitcoin ETP alongside their equity funds, it compresses the last mile of adoption—the leap from curiosity to a 1–2% sleeve. The impact is unlikely to be instant fireworks; it’s the slow build that matters.

Five Practical Questions Every Prospective Buyer Should Ask

- What exactly is the wrapper? ETN, ETC, or another ETP form? Is it physically backed? What is the daily NAV computation and how are creations/redemptions handled?

- Who’s the custodian? Which firm holds the private keys? What are the insurance and segregation terms?

- What are the all-in costs? Expense ratio, bank platform fees, FX conversion (if the ETP is not in your base currency), and trading spreads.

- What’s my risk band? Discuss with your advisor: are you targeting 1–2% of liquid risk assets, or tactically trading a larger sleeve?

- What happens in stress? How did the ETP trade during prior drawdowns? Did NAV discounts widen materially? What are the issuer’s emergency procedures?

Why Nordea’s Pivot Is a Signal for Incumbents

Bank boards tend to move in packs. One large incumbent validating a product creates cover for others. Nordea’s size in the Nordics makes the move hard to ignore; the ‘Domino Theory’ of bank distribution often starts this way. Furthermore, the decision aligns with a broader pattern: traditional finance didn’t miss crypto because it failed to notice; it waited for rules, ramps, and reputational safety. Those ingredients are now present.

Bottom Line

Nordea’s enablement of client access to a spot Bitcoin ETP is precisely the kind of pragmatic, low-drama milestone that moves crypto from the edges to the center of wealth platforms. It’s not a moonshot promise; it’s an operational yes. In a region governed by MiCA and habituated to ETPs, bank distribution is the catalyst that normalizes allocation. For investors, the right question isn’t ‘Is this bullish?’ but ‘Does this finally fit into my existing portfolio process?’ For banks, the calculus is even simpler: if clients want bitcoin exposure, better to serve it—safely—than to watch it walk out the door.