Another Deliberate Turn of the Flywheel

Strategy—the enterprise software firm that rebranded from MicroStrategy in 2025—has disclosed the purchase of 487 BTC for roughly $49.9 million, implying an average price near $102,557. The print arrived as Bitcoin repeatedly tested the psychologically heavy $100K handle, amplifying the impression that management continues to accumulate on weakness rather than chase strength. In short: not a heroic bottom call, a methodical entry. ([BTC Times][1])

Two contextual details matter. First, this is not an isolated action. Strategy has turned accumulation into corporate habit, consistently adding to holdings through cycles and now controlling a stack cited at ~641,692 BTC in early November. Second, the firm has broadened its financing toolkit beyond simple common stock issuance to include preferred stock programs—a hallmark of an issuer designing staying power rather than trading the tape. ([BTC Times][1])

From MicroStrategy to Strategy: Why the Name—and the Structure—Matters

For readers who tuned out during the rebrand: MicroStrategy formally became Strategy in 2025, a pivot that codified what markets already understood—that the firm’s identity and valuation are tethered to its programmatic Bitcoin treasury. The rebrand was covered widely across mainstream finance outlets, signaling the market’s acceptance (even if reluctant in some corners) that a public company can function as a hybrid: operating software business + BTC reserve vehicle. ([Investopedia][2])

Why does the name matter for today’s trade? Because branding follows economics. A company willing to endure accounting volatility, headlines, and governance debates to accumulate BTC needs a capital structure that can hold up when the path is messy. Strategy’s toolkit—spanning at-the-market equity and multiple preferred share tickers (e.g., STRF, STRC, STRK, STRD per disclosures)—points to a treasury built for duration, not drama. ([BTC Times][1])

What 487 BTC at ~$102.6K Actually Says

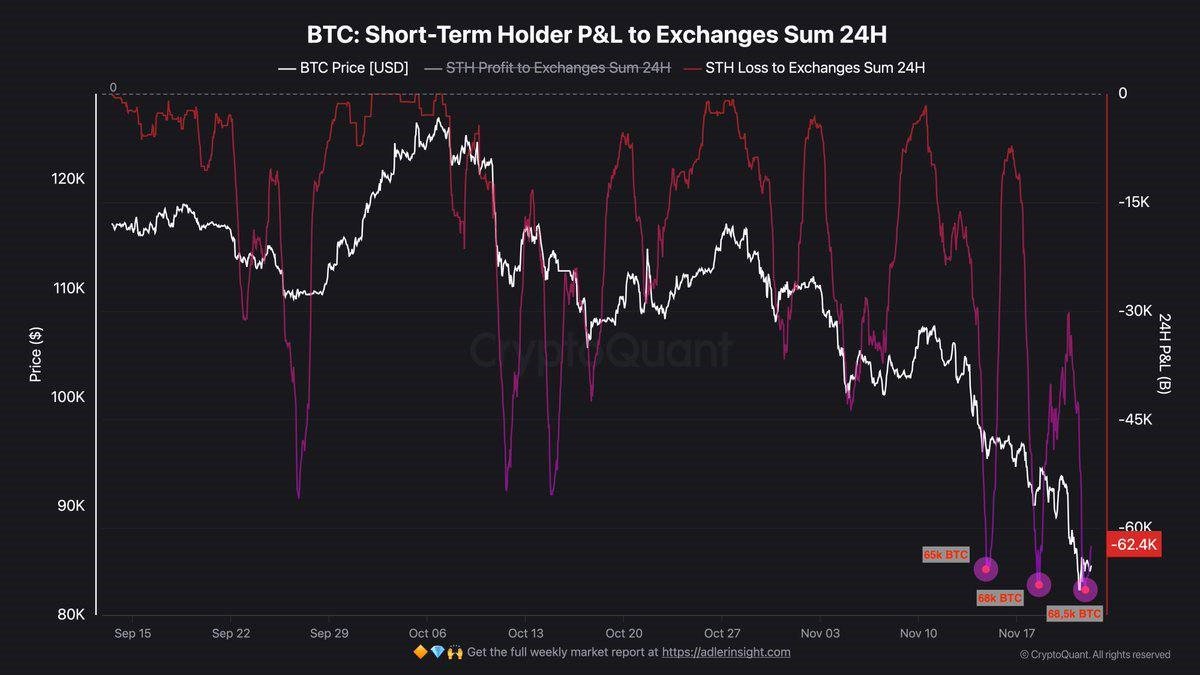

In absolute terms, 487 BTC won’t change supply dynamics alone. In signaling terms, it is significant. The purchase came as the market’s sentiment wobbled around successive breaks of $100K, a level prone to stop cascades and funding resets. When a known whale telegraphs demand near a panic pocket, it does three things: (1) channels liquidity to weak hands cashing out; (2) sets an anchor for peers considering balance-sheet exposure; and (3) narrows the left tail—investors infer that structurally motivated bids exist under stress. That inference is crucial in a regime where ETF flows and macro headlines can whipsaw intraday trend.

Cadence Over Clairvoyance: The Process Advantage

The more interesting angle is procedural. Strategy’s public disclosures and consistent cadence suggest a rules-based treasury: accumulate on weakness, finance in tranches, avoid being hostage to a single market window. That approach confers a process premium. Whereas discretionary buyers can get timing-shamed into waiting for lower prices (and then never buy), a cadence buyer sidesteps the psychology trap—and compounds across cycles. The firm’s messaging and the steady drumbeat of buys since 2020 have effectively turned its treasury into a long-volatility bet on adoption, with the company’s operating cash flows and financing tools paying the carry. ([Barron's][3])

How the Financing Shows Up in the Tape

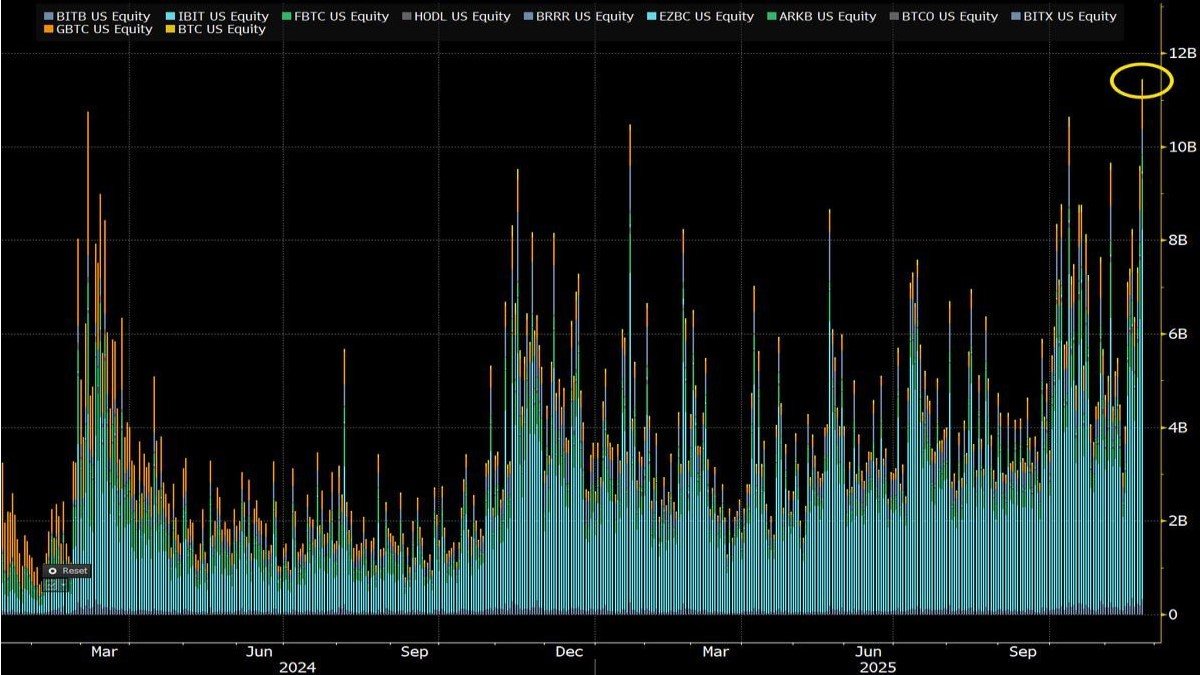

Strategy’s capital stack now includes multiple preferred share programs and recurring equity pathways. Preferreds—cumulative, cash-pay instruments—sit senior to common and can be priced attractively for income-focused funds seeking crypto-adjacent exposure with a yield cushion. When proceeds are rotated into BTC, a bridge forms between traditional capital and digital scarcity. It’s a calculated trade: pay a visible coupon to own a more volatile, non-yielding asset whose expected drift (over multi-year windows) is presumed to exceed the cost of funds. The Barron’s coverage of Strategy’s financing spree earlier in the year underscored just how aggressive the firm can be when windows are open. ([Barron's][3])

There are risks to this approach (we’ll detail them shortly), but the signal today is straightforward: as long as Strategy can raise multi-hundred-million-dollar clips via equity or preferreds, the corporate bid remains a feature, not a bug, of Bitcoin’s microstructure.

Positioning Within the Macro Tape

Zoom out. The latest buy landed amid a noisy macro: wavering risk appetite, shifting expectations for rate policy, and episodic ETF outflows that keep day-to-day price action jumpy. While ETFs have indisputably broadened access and deepened liquidity, they have also synchronized some flows to the same daily windows, amplifying herding around headlines. Corporate treasuries, by contrast, can act outside those windows. A corporate buyer adding on a Monday morning rather than at 3:55 p.m. when ETF baskets shuffle can absorb supply without signaling into the same liquidity troughs.

That desynchronization matters when narrative turns sour. In an ETF-dominant tape, one bad macro headline can cluster redemptions and widen intraday ranges; a corporate cadence buyer can stagger fills and reduce slippage. Strategy has played this role before—buying into weakness while the market debates whether a down day is the start of a trend or just a positioning flush.

Supply, Scarcity, and the Corporate Accumulation Archetype

Back to the stack. Strategy remains the most visible corporate holder of BTC. Its balance sheet has become a benchmark for the institutionalization of Bitcoin ownership on public-company ledgers. The mix of disclosed holdings, recurring adds, and financing innovation has inspired imitators—from miners rethinking treasury to non-crypto corporates dipping toes. Anecdotally and in press coverage, Strategy’s footprint is framed as north of 600K+ coins in late 2025, a figure that dwarfs many sovereign treasuries in other asset classes. ([BTC Times][1])

Why that matters: circulating supply available to trade at any moment is smaller than the total minted—long-term cold storage, sovereign/sovereign-adjacent, ETF warehousing, corporate treasuries, and HODL-cohorts all exert varying degrees of illiquidity. Each time another “stickier” owner adds, the float thins a little. In bull regimes, that thinning powers upside convexity; in chop, it dampens realized volatility on the downside. A corporate buyer with a repeatable process increases the probability that dips meet bids before they metastasize into deleveraging cascades.

Did Strategy Buy the Bottom?

No one knows, and it isn’t the point. The disclosed average of roughly $102.6K is around a contested zone where forced sellers and hedgers converged. If price revisits five-figure territory, the entry will look early; if BTC reclaims the prior high, it will look prescient. The bigger takeaway is that Strategy refuses to let volatility break the cadence. Cadence builds time in the market, and time in the market—when aligned with a positive long-run drift—outweighs the occasional bad print.

Risks: Cash Cost, Accounting Noise, and Policy Shocks

There is nothing free about hybrid capital. Preferred coupons and equity raises have reputational and financial costs. In risk-off windows, the marginal dollar of capital can arrive with a yield teenagers or a deep discount to market, turning treasury management into optics management. Accounting doesn’t help: fair-value treatment makes gains and losses visible in real time, which is fair but visually noisy. Boards must stomach quarters where large non-cash swings overshadow software KPIs. Then there’s policy: custody rules, tax guidance, ETF mechanics, and even macroprudential chatter can inject headline risk that no treasury model anticipates perfectly. The strategy works until liquidity windows shut; running a dividend-like cash burn to fund BTC accumulation requires buffers and discipline.

Why Markets Care About This 487 BTC

Because playbooks scale by repetition. When a large, visible corporate buyer adds into fear, it strengthens three hypotheses at once:

- Structural bid hypothesis: Not all demand is momentum-chasing; some is mandate-driven.

- Bridge hypothesis: Hybrid capital (preferreds/equity) can recycle TradFi flows into BTC exposure without ETF wrappers.

- Volatility absorption hypothesis: Cadence-based treasuries smooth order books during stress, narrowing the left tail.

Each hypothesis gains Bayesian weight with every well-telegraphed purchase.

Scenario Lens: What Comes Next

1) Chop-with-an-upward-drift

ETF flows oscillate, macro remains ambiguous, and realized volatility grinds sideways. In this base case, programmatic corporate buying helps maintain higher lows. Strategy’s ability to raise successive tranches (preferreds or ATM equity) at non-punitive terms becomes the gating factor.

2) Velocity-on-positive-policy

Regulatory clarity advances or macro eases (rate cuts or benign inflation data), and ETF inflows resume. Cadence buyers get tailwind; previously ‘stuck’ supply on exchanges rotates into stronger hands; price pushes through prior highs with less resistance because the float is thinner.

3) Liquidity accident

A shock in funding markets or an exogenous policy headline triggers redemptions and cross-asset de-risking. Cadence buyers step in but cannot offset forced deleveraging; prices overshoot lower. This is the stress test for preferred coupons and cash buffers. If buffers exist, Strategy can add; if not, it must pause and protect the hull.

How to Read Strategy’s Next Filings

Three lines in the next quarterly update (and any interim purchase notices) will carry outsized informational value:

- Instrument mix: How much came from preferreds versus equity? A rising preferred mix implies an appetite from yield funds; a heavier equity tilt may reflect a richer equity multiple—or simply cheaper capital at that moment. ([BTC Times][1])

- Cash runway: Disclosed cash and equivalents relative to quarterly OpEx and any recurring obligations. If runway expands while BTC holdings increase, the firm’s risk budget is growing, not shrinking.

- Average purchase windows: Timestamp clusters around distressed tape increase the evidence of a rules-based approach.

Market Microstructure: Why Cadence Buys Matter More Today

Spot ETFs unlocked a new investor class, but they also created narrow bands of coordinated activity (creations/redemptions near market close, passive tracking behaviors). That clustering can create micro-vacuums—thin books that exacerbate moves. Corporate cadence buyers distribute their orders across time zones, dark pools, and OTC rails, quietly backfilling these vacuums. When they disclose after the fact, the market retrofits the narrative: dips met bids because process > panic.

The Narrative Dividend

In crypto, narrative is cash flow. Strategy’s consistency pays a narrative dividend that extends beyond its balance sheet. Each disciplined add validates the “Bitcoin as corporate treasury reserve” meme for CFOs watching from the sidelines. Media coverage of those adds—whether in crypto-native press or mainstream outlets—further normalizes the practice. A flywheel emerges: more disclosures → more social proof → more boardroom consideration → more potential buyers on future dips.

Counterarguments You Should Take Seriously

“It’s leveraged beta dressed as strategy.” Fair. If BTC’s structural drift stalls for a multi-year window, the cash cost of preferreds and the dilution from equity raises compound into a drag. The offset is liquidity optionality—issuers can slow purchases, raise smaller tranches, or monetize portions of the stack in emergencies. But yes, this is a thesis with path-dependence.

“What if rules change?” Also fair. Custody, tax, or capital treatment could shift—positively or negatively. The antidote is diversification across instruments (not just one preferred line), conservative cash buffers, and transparent communication with investors so the first adverse surprise isn’t the first time the board hears about the risk.

Bottom Line

Strategy’s 487 BTC purchase at roughly $102.6K won’t rewrite supply math on its own; it refines the market’s beliefs about who buys the lows and why. The company’s cadence, capital-stack engineering, and willingness to underwrite volatility signal that corporate treasuries remain a durable pillar of demand—even during macro white noise. As long as access to capital persists and discipline holds, each new add tilts the distribution of outcomes a little more toward the right tail.