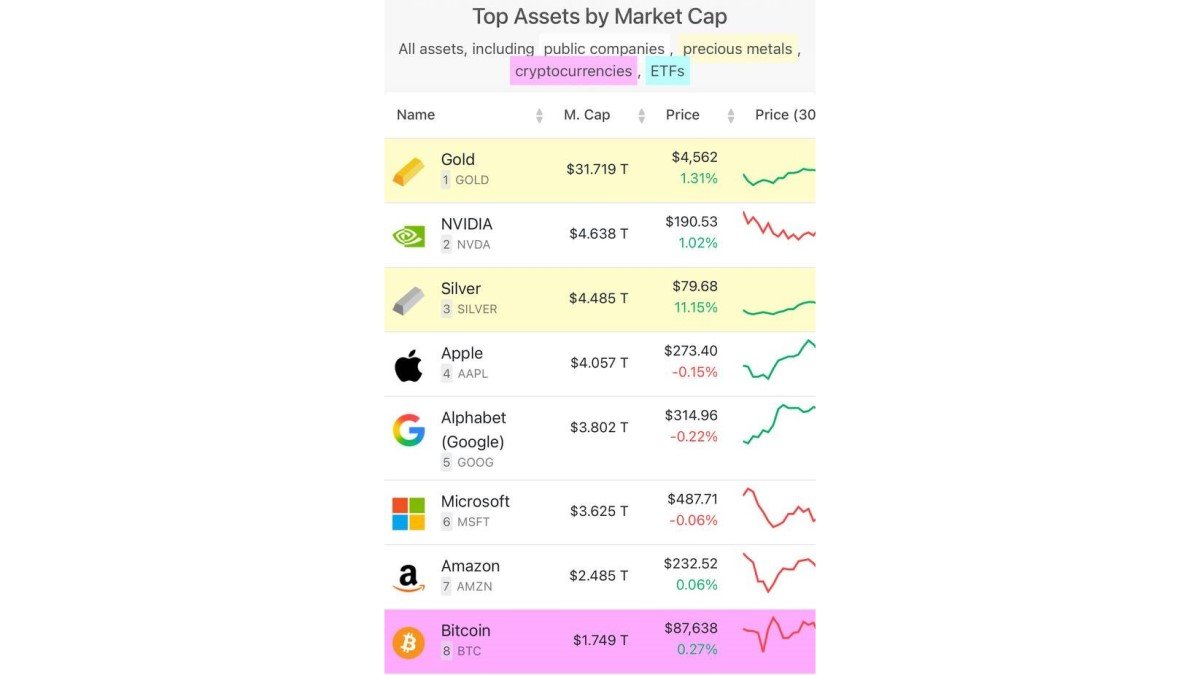

When Silver Overtakes Silicon: What the New Market-Cap Rankings Say About Global Risk

Silver rising into the global Top 3 assets by market capitalization, above Apple, Alphabet and Microsoft, is not just a price story. It is a signal that investors are repricing physical, strategically useful resources relative to technology and financial claims – and that the world is quietly preparing for a decade where security, energy and resilience matter as much as innovation.

Read more →