The Adoption Reality Check: Fewer Owners Than the Hype Implies

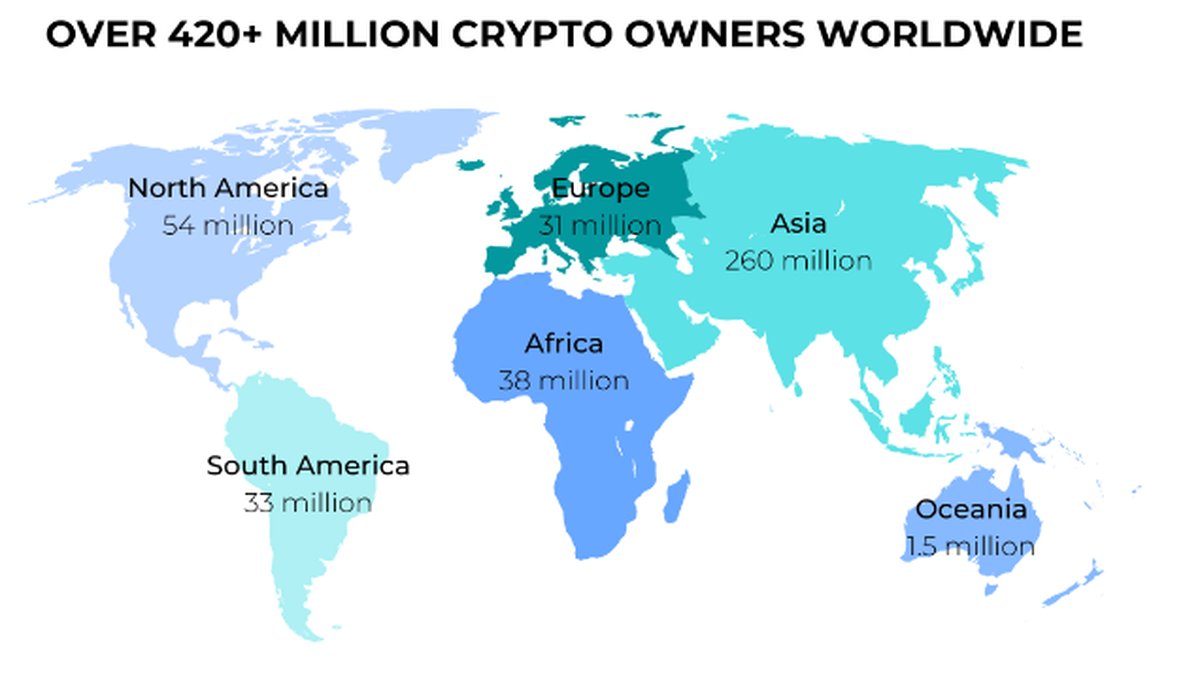

For years, the industry has talked about the “next billion users.” Yet the most widely cited headcount suggests we are barely halfway there. Triple-A’s latest global ownership snapshot for 2024 estimates just over 560 million crypto owners worldwide—roughly 6.8% of the global population. In other words, about 93% of people still do not own any crypto at all. ([Triple-A – Triple-A][1])

Two clarifications matter. First, methodologies differ (wallets vs. verified accounts vs. modeled ownership by country), so any single number has error bars. But the order of magnitude is robust: single-digit global penetration, not the double-digit ubiquity often implied by headlines. Second, adoption is not evenly distributed: Chainalysis’s 2024 Geography of Cryptocurrency report highlights that grassroots uptake remains strong in several lower-middle-income markets even as patterns differ across regions. That’s a reminder that “global average” hides pockets of real product–market fit. ([Chainalysis][2])

Why the 93% Still Wait: It’s Not Just Volatility

It is tempting to blame price cycles for slow adoption. But most non-participants are not merely waiting for a better entry point. They face daily frictions and rational doubts:

• Trust deficits. High-profile failures and security incidents have normalized consumer skepticism. Without strong guardrails—audited reserves, segregated client assets, circuit breakers, and recourse—newcomers rationally prefer familiar finance.

• UX that still feels foreign. Seed phrases, gas fees, bridges, signature pop-ups, and MEV-risked swaps are not the mental model of money for 93% of people. Until UX becomes “tap-and-done,” adoption stalls.

• Compliance friction. On-/off-ramp KYC and tax reporting remain inconsistent. For many, the risk of “doing it wrong” exceeds perceived benefits.

• Unclear everyday jobs-to-be-done. Speculation is not a household budget category. Clear consumer jobs—remitting funds, saving safely, paying merchants, or earning protected yield—must feel obviously better than alternatives.

Fact-Checking the Narrative: What’s Solid, What’s Anecdotal

Solid: The “~560 million owners ≈ 6.8%” figure is sourced to Triple-A’s 2024 compilation. That is the cleanest single reference we have for a recent year. ([Triple-A – Triple-A][1])

Solid: Adoption is lumpy by country; recent Chainalysis data shows meaningful activity in markets outside the G7, consistent with a thesis that crypto solves pressing cash-flow problems where banking frictions are worst. ([Chainalysis][2])

Less solid / anecdotal: Claims circulating on social feeds that “5% of all holders blew up on a specific liquidation day” are not verifiable against transparent, representative datasets. Innerdevcrypto appears to be a social media handle rather than a primary data provider with published methodology. Futures liquidations are routinely measured (by venues and analytics firms) but translate poorly to “share of all global owners,” especially when most owners are spot-only and unlevered. Treat such statements as sentiment, not statistics.

Beyond ‘Number Go Up’: Where the 93% Actually Needs Crypto

Remittances are the clearest mass-market use case. They are huge, frequent, and too expensive. The World Bank’s Remittance Prices Worldwide program still shows global average costs well above the UN’s SDG target of 3%, with corridors frequently charging multiples of that. A 2024 RPW brief highlighted that the cost to send $200 remained stubbornly high across many corridors—underscoring persistent pain that cheaper, always-on rails can address.

Scale matters: international remittances have reached hundreds of billions of dollars annually and, according to the IOM’s 2024 World Migration Report, have even surpassed foreign direct investment to developing nations in recent years—a striking backdrop for digital money initiatives. If moving value is a bigger, more regular activity than allocating capital, then safe, compliant, low-cost digital cash rails are a mainstream public good, not a crypto niche. ([The Guardian][3])

The Ownership Illusion: Why ‘560M’ Isn’t the Same as Active Daily Users

Even within the 6.8–6.9% who own crypto, activity levels vary dramatically:

- Parked assets vs. live usage. Many “owners” maintain small balances on exchanges or wallets, but rarely transact. That’s not adoption; it’s curiosity on pause.

- Address count ≠ individuals. A single human may control multiple addresses; a single custodial account may represent thousands. This is why ownership tallies and on-chain usage metrics tell different stories.

- Speculative skew. If the majority of hours-spent are in leverage, liquidation charts will dominate the conversation—even if the majority of people are not using leverage at all.

Good analytics separate reach (how many people hold something) from reliance (how many people depend on it for an everyday job). Today, crypto has reach; what it needs is reliance.

Who the 93% Are—and Why They Stay Out

- “Can’t” users. Households living month-to-month cannot absorb volatility or complex onboarding. Any solution must offer capital protection, predictable costs, and human support.

- “Won’t” users. Affluent, banked consumers don’t see incremental value yet. For them, crypto must save time (instant settlement), save fees (especially across borders), or unlock yield (tokenized T-bills with transparent custody) within fully regulated wrappers.

- “Don’t know how” users. Even willing adopters fail at the first hurdle: self-custody anxiety, tax confusion, and fear of irreversible mistakes.

Designing for the Next Billion: A Practical Blueprint

1) Make trust visible

- Always-on attestations (audited reserves for stablecoins, segregated client assets for custodians) with machine-readable proofs that wallets and watchdogs can verify in real time.

- Consumer recourse—dispute flows, loss-sharing pools, and tiered limits for new users—so first-timers can try without existential risk.

2) Hide the crypto, sell the outcome

- Let users send dollars that arrive as local currency in minutes, invisibly riding stablecoins and on-chain liquidity under the hood.

- Offer wallet recovery (passkeys, social recovery, or hardware-bound MPC) so a lost phone doesn’t mean lost savings.

3) Fix on-/off-ramps—then partner with national instant payment rails

- Integrations with systems like Pix, UPI, and FedNow can turn crypto from “another app” into a cheaper route inside the apps people already use.

- Settlement finality should be measured in seconds with fee ceilings users can predict (no surprise gas spikes).

4) Regulate like money, not like memes

- Stablecoins used for payments should meet cash-equivalent reserve rules, daily disclosure, and strict redemption SLAs. In return, they should get clear legal status and access to narrow banking or custodial trust structures.

- Tokenized cash & bonds need simple tax treatment so spending them doesn’t trigger capital gains complexity.

5) Build products for real household jobs

- Remittance+: combine low-cost cross-border transfers with auto-conversion and optional on-receipt savings into a regulated, short-duration yield fund.

- Safe-save buckets: tokenized cash instruments with insured custody and daily liquidity—think “Treasury-like” exposure without opaque wrappers.

- Credit you can explain: collateralized micro-credit lines with clear APRs and transparent liquidation rules; no hidden funding rates, no jargon.

Separating Signal from Noise in ‘Ownership’ Discussions

When you hear “560 million owners,” ask: How many transact weekly? How many receive income in stablecoins? How many pay a bill or remit money on-chain? For market structure, also track who is using crypto. Chainalysis’s ranking shows countries with capital controls, currency instability, or remittance needs often rank highly—because crypto solves urgent cash problems there. This isn’t a paradox; it’s the product telling you where it already fits. ([Chainalysis][2])

Metrics That Actually Matter (and Are Harder to Game)

- Stablecoin settlement share in remittance corridors (on-chain settlement volume as a % of corridor flows; average end-to-end fee vs. RPW corridor benchmarks).

- Active users with recourse (KYC’d wallets with dispute support) vs. purely self-custodied addresses.

- Time-to-fiat (minutes to cash out locally at fair rates).

- Cost ceilings (guaranteed max fee per transaction) rather than “typical gas.”

- Loss rates (illegal deception or self-custody loss per 1,000 users) trending down quarter by quarter.

Addressing Common Objections

“Volatility makes crypto unusable.” Payments can be denominated in fiat units end-to-end using stablecoins, with crypto price risk hedged by professional liquidity providers. Consumers never touch volatility if the UX is designed correctly.

“Illegal deception schemes will always dominate.” Illegal deception schemes thrive where there is no recourse. Mandate risk-tiered limits for new accounts, default to allow-lists, add shared risk pools funded by protocol fees, and surface machine-readable attestations to block rogue endpoints at the wallet layer.

“Regulators will never allow it.” They’ve already allowed parts of it. The pathway is not to avoid regulation but to right-size it: treat stablecoin payment tokens like narrow-scope money with cash-equivalent reserves and enforceable redemption.

What Builders Should Ship Next

- Human-grade custody. Passkeys by default; social recovery for the rest; zero seed phrases shown to novices.

- Guaranteed quotes. Slippage-capped, MEV-protected swaps with execution guarantees, not “best effort.”

- Money-like receipts. Itemized, readable transaction proofs that a non-crypto auditor understands at a glance.

- Tax-ready exports. One-click annual reports in regulator-blessed formats.

- Compliance-by-construction. Sanctions screening, travel rule messaging, and proof-of-funds flows embedded in the core wallet, not bolted on.

What Allocators Should Actually Underwrite

Stop chasing narratives; underwrite plumbing. Favour networks and tokens where unit economics improve as fees compress (high throughput, low variance), and where the marginal user is a remitter or merchant, not a perpetuals degen. Look for stablecoin issuers with real-time reserve proofs and bank-grade custody. Back L2s and appchains that absorb compliance logic (allow-listed settlement, identity attestations) without surrendering global composability.

A Word on Sentiment Indices and Hype

Fear & Greed indices are useful snapshots but lag the real work: building products that help people move and store value safely. If you are a retail investor, don’t anchor decisions on social euphoria spikes (which analytics firms like Santiment often flag as contrarian signals). Reversion in sentiment happens faster than onboarding, and onboarding is what compounds.

Scenarios for 2026–2030

1) Utility-led Expansion (Probability 45%)

Stablecoins with bank-like protections become mainstream in 20+ countries. Remittance providers and neobanks migrate settlement to on-chain rails; average costs per RPW corridor fall by 30–50%. Total owners cross 1 billion, but more importantly, weekly active transactors exceed 300 million.

2) Status-Quo Drift (Probability 35%)

Speculation dominates. Ownership inches up to ~800 million, but usage remains thin. Regulatory patchwork persists; UX stagnates. Crypto remains a high-beta satellite asset class, not a payments rail.

3) Fragmented Retrenchment (Probability 20%)

A major compliance or custody shock triggers outflows; ring-fenced, permissioned networks outcompete open rails for mainstream flows. Open networks refocus on niche, high-value settlement.

Bottom Line

The truth about crypto adoption is humbling: most people still aren’t here. That’s not a failure—it’s an opportunity to build for real-world jobs with grown-up safeguards. If crypto wants the other 93%, it must look, feel, and behave like money that cares: reliable, reversible when appropriate, and boringly dependable at scale. The market will reward the teams who ship that future—and the capital allocators who back them before the metrics spike.