The Message Behind the Chart

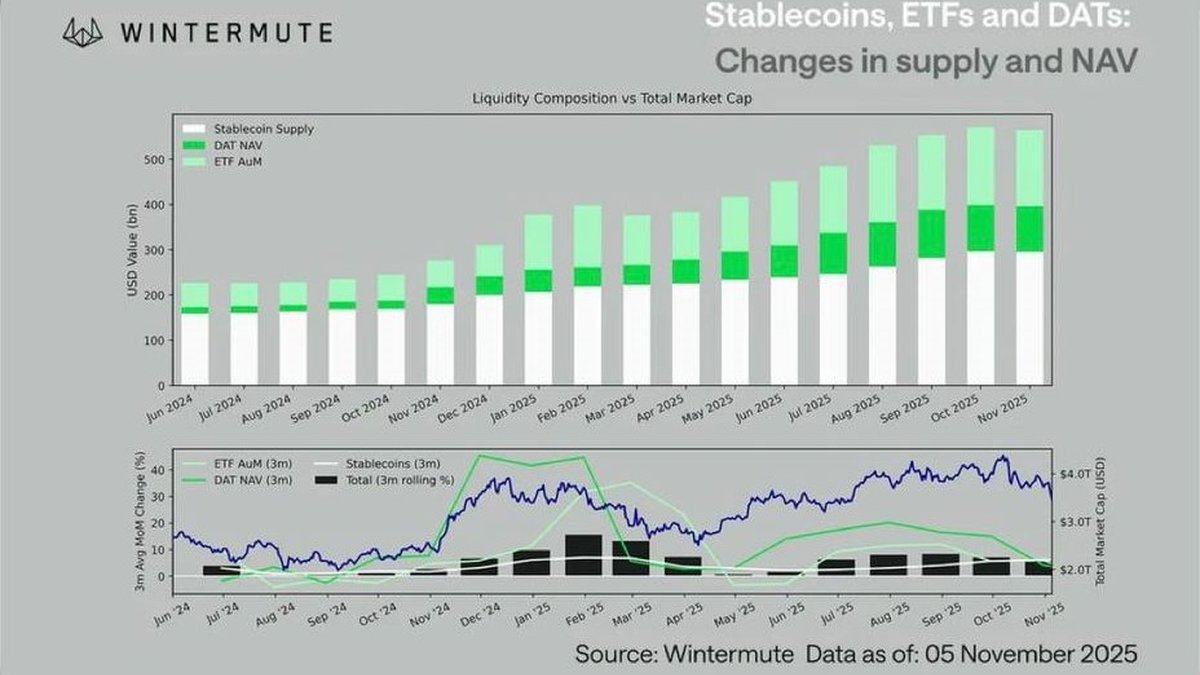

Wintermute’s post is not a mere complaint about the tape; it is a diagnosis of market plumbing. Their chart (attached) shows an impressive climb in the combined stock of stablecoins, ETFs, and DATs since early 2024, but the slope has flattened in recent months. Translation: the mechanisms that bring outside dollars into crypto—new stablecoin issuance, spot ETF creations, and allocations into digital asset trusts—are no longer accelerating. Prices can still move, sometimes violently, yet those moves rely on investors swapping exposure within the ecosystem rather than on fresh demand adding to the pool.

That subtle shift matters. The last two crypto expansions were powered by structural inflows (yield farming plus stablecoin expansion in 2020–21; ETF distribution and institutional mandates in 2024–25). When the inflow engine slows, the market transitions from an upslope regime to a redistribution regime. In the upslope, you could make money simply by holding quality beta and surviving volatility. In redistribution, you earn by anticipating who will be sold to fund the next story.

A Simple Framework: Three Buckets of Liquidity

Think of crypto liquidity in three buckets:

- Base Liquidity — the circulating stock of stablecoins and bank-channel fiat sitting at exchanges or in vaults. This is the dry powder for spot purchases and redemptions.

- Structural Channels — ETF creations/redemptions, centralized exchange fiat rails, and trust vehicles that convert non-crypto capital into crypto exposure. These determine the direction of the tide.

- Reflexive Leverage — perps funding, options gamma, and credit lines that amplify moves by synthetically increasing exposure.

When the second bucket slows, the third becomes dominant relative to the first. That is why you see day-long surges that reverse on thin headlines: leverage waves can push prices far, but if base liquidity is not growing, each squeeze meets a hard cap where there is nobody new left to buy the top.

Rotation Markets: Five Traits You Should Expect

1. Narrower breadth. Leadership concentrates in a small handful of narratives—AI-adjacent L1s, a payments theme, or a single memecoin complex—while the median asset lags or bleeds.

2. Shorter trends. Without constant outside bids, trends exhaust once early entrants take profits to chase the next rotation.

3. Higher dispersion and cross-asset negative correlation. Funds finance one speculative position by trimming another. This produces seesaws where winners and losers flip weekly.

4. Liquidity gaps at extremes. Breakouts feel explosive because order books are thinner, but exits are unforgiving when the music stops.

5. News overweights microstructure. Headlines serve mainly as catalysts to rearrange existing capital, not magnets to pull fresh capital in—unless they directly unlock new rails (e.g., a broker enabling retail coin trading or a bank turning on custody).

Why the Stock Market Is Soaking Up Flows

Investors are rational about certainty. ETFs for broad equities offer deep liquidity, familiar tax treatment, and central-bank-adjacent tailwinds. By comparison, on-chain yields compress when risk appetites cool, and basis trades become competitive, leaving fewer easy carry opportunities. The marginal dollar therefore prefers equity index exposure until crypto either offers clear exogenous yield (new staking primitives, safer real-world assets, regulated credit) or presents a macro narrative that crowds in capital (e.g., monetary easing cycles).

None of this means crypto is doomed; it means the hurdle for the next expansion is higher. The catalyst must add new dollar pathways, not just shuffle the existing ones.

What Would Count as Fresh Money?

- Stablecoin net mints that persist across multiple chains, ideally diversified by issuer and banking partner.

- Consistent net creations in spot ETFs beyond the first-hour pop, with a slow-and-steady bid that survives risk-off days.

- Real corporate balance-sheet adoption where treasuries convert cash into BTC/ETH or programmatic stablecoin usage for payables.

- New retail rails from mainstream brokers turning on crypto trading or savings products linked to tokenized T-bills.

Until these appear in tandem, treat every broad-based rally as guilty until proven sticky.

Reading the Tape When the Pool Is Closed

A professional desk should not just repeat that liquidity is low; it should show you a way to measure it. Here is a practical dashboard that converts the Wintermute thesis into testable signals.

1) Stablecoin Net Supply Delta (7–14 day)

Track net issuance on major dollar stablecoins. The signal you want is a monotonic rise that lasts for weeks. Sharp mints around a single exchange listing or farm are noise; sustained, cross-chain growth is the tide.

2) ETF Creations Minus Redemptions

Ignore premarket chatter and look for the three-day sum of creations minus redemptions. A steadily positive line says new cash is entering via brokerage accounts that behave differently than crypto natives.

3) Exchange Fiat Balances vs. Coin Reserves

Growing fiat/USDC balances alongside falling coin reserves indicate future buying capacity; the opposite suggests distribution pressure.

4) Perps Basis and Funding

When funding jumps while the above metrics are flat, you are watching a leverage-only rally. Enjoy it, but tighten stops and plan exits because the squeeze will hunt late longs.

5) Breadth and Advance/Decline

Count how many top-200 assets are above their 20-day moving average. Sustained bull phases require breadth to rise and stay high; otherwise you are surfing sector rotations.

6) Slippage at Size

Measure executable depth for $1–5 million clips across majors. Deteriorating depth with the same headline volumes means HFTs are recycling orders while real liquidity hides.

7) Volatility Term Structure

A steep front-end IV spike with flat back months during rallies screams “event trade.” A parallel shift higher, especially when coupled with positive ETF flows, smells more like the start of a regime change.

Case Study: How a Rotation Rally Forms and Fails

Consider a week where an L2 announces an AI toolkit, a payments token signs a card-partner pilot, and a celebrity coin gets a media bump. Perps funding goes positive, the winners print double digits, and CT declares a new season. Under the hood, stablecoin supply is unchanged; ETF creations are flat. The bid that pushed the leaders came from selling slower coins and reducing BTC/ETH to chase higher beta. Two days later, funding remains elevated but open interest falls—late longs are washed out, and the winners give back half the move. Without new dollars, the rally exhausts at the point where early buyers want to recycle into the next story.

Avoid moral judgments here. Rotation is not stupidity—it is the only rational strategy in a closed pool. Your edge is recognizing the pool is closed before consensus does.

From Diagnosis to Action: Playbooks

For Traders

• Trade the spread, not the story. Start with cross-sectional momentum and mean reversion pairs. If AI L1s are the bid, buy the higher-quality one against a laggard in the same cluster rather than running naked beta.

• Use hard stops tied to liquidity metrics. For example: exit if ETF net creations turn negative for three consecutive days while funding remains positive.

• Respect exit capacity. Size positions by what you can unwind in 30 minutes without moving the book, not by how good the chart looks.

• Security vulnerability event calendars. Rotations often pivot on listings, unlocks, or governance votes. Build a weekly map and assume the pre-event ramp is financed by selling yesterday’s winners.

• Prefer options for asymmetry. In a short-trend market, defined-risk exposure via call spreads or calendars survives whip-saws better than levered spot.

For Builders and Protocol Treasuries

• Design for stickiness, not bursts. Incentive programs that pay for consecutive-use days and real retention have a chance to hold capital in a rotation market; raw APR wars merely shuffle it around.

• Build fences around liquidity. Circuit breakers, RFQ modes for large orders, and partial fills protect users when depth vanishes.

• Favor partnerships that open new rails. A wallet integration at a mainstream broker or a fiat on-ramp in a new geography beats a washed-out co-marketing campaign.

• Manage treasuries like corporates. Ladder stablecoin reserves, hedge major liabilities, and avoid committing to buybacks or burns unless you have visibility on inflows beyond the hype cycle.

For Long-Only Allocators

- Scale entries on flow confirmation, not on price alone. Add on days when ETF creations stay net positive and stablecoin supply grows; avoid chasing green candles with negative flows.

- Re-underwrite liquidity risk. For mid-cap names, assume half the reported depth vanishes in stress. Adjust position sizing accordingly.

- Harvest dispersion. Allocate to managers with explicit rotation frameworks and risk budgets rather than pure beta chasers.

What Could Invalidate Wintermute’s Warning?

We should always ask: what would prove this view wrong? Three clear developments would flip the script:

- A durable stablecoin reacceleration. Multiple issuers, multiple banks, multi-chain—sustained over a month.

- Retail brokerage activation. If a top U.S. broker launches crypto trading and custody, ETF flows will be complemented by direct spot demand.

- Policy catalysts that reduce compliance friction. A predictable framework for staking, tokenized cash instruments, or stablecoin legislation can unlock sidelined institutional mandates.

Absent these, the base case remains rotation-dominant.

Scenario Analysis: Three Paths From Here

1) Rotation Grind (Highest probability)

Breadth remains weak, leaders rotate every two to three weeks, and spot majors range while perps oscillate between positive and negative funding. Returns are concentrated in a handful of themes at any time. Strategy: play relative value, reduce holding periods, keep cash optionality.

2) External Re-acceleration

Stablecoins re-mint, ETF creations run steadily green, and one retail brokerage opens spot trading. Breadth improves and dollar inflows absorb rotation without forcing sharp givebacks. Strategy: increase beta, extend holding periods, favor quality majors and the few mid-caps with real users.

3) Liquidity Shock

Macro stress or a high-profile security vulnerability triggers net redemptions in ETFs and stablecoin outflows. Because the pool is already shallow, selling cascades faster than models expect. Strategy: cut risk, hedge with majors, and avoid perps leverage that can gap against you overnight.

Method Matters: Why Our Desk Exists

A professional analysis outlet must do more than relay social posts. Our job is to translate a narrative about flows into a diagnostic kit you can use tomorrow morning. That is the difference between news and insight. We laid out the instruments (net stablecoin mints, ETF creations, breadth, depth, funding, term structure) and the logic to combine them. The goal is not a single forecast; it is a running test you can update every day.

A Note on Data Quality

Flow analytics are only as good as the sources. Stablecoin supply needs chain-by-chain de-duplication; ETF creations and redemptions should be read from primary issuers rather than headline aggregates; depth and slippage are best measured by your own execution, not by exchange-marketed figures. Build redundancy into your pipelines and expect revisions.

Practical Weekly Routine

- Every Monday: record seven-day change in top stablecoins and three-day sum of ETF creations minus redemptions.

- Daily: compute an advance/decline count for the top 200 assets and track median 20D momentum.

- Before New Positions: check perps funding and OI, and simulate exit slippage for your intended size.

- Fridays: review IV term structure; if front-end spikes without flow confirmation, lighten risk into weekend headlines.

Bottom Line

Wintermute’s warning is not bearish rhetoric—it is a map. In a rotation-only phase, the market rewards discipline over devotion. Chasing every breakout is a quick path to giving back gains, while ignoring microstructure is a tax disguised as optimism. The cure is simple but not easy: trade with a flow checklist, demand confirmation from external capital, and be willing to hold more cash than your ego prefers. The next true uptrend will advertise itself with boring, persistent inflows. Until then, treat every spike as rented and every exit as precious.