BNB Pays for AWS While Macro Winds Shift: What the Last 24 Hours Say About Crypto’s Next Phase

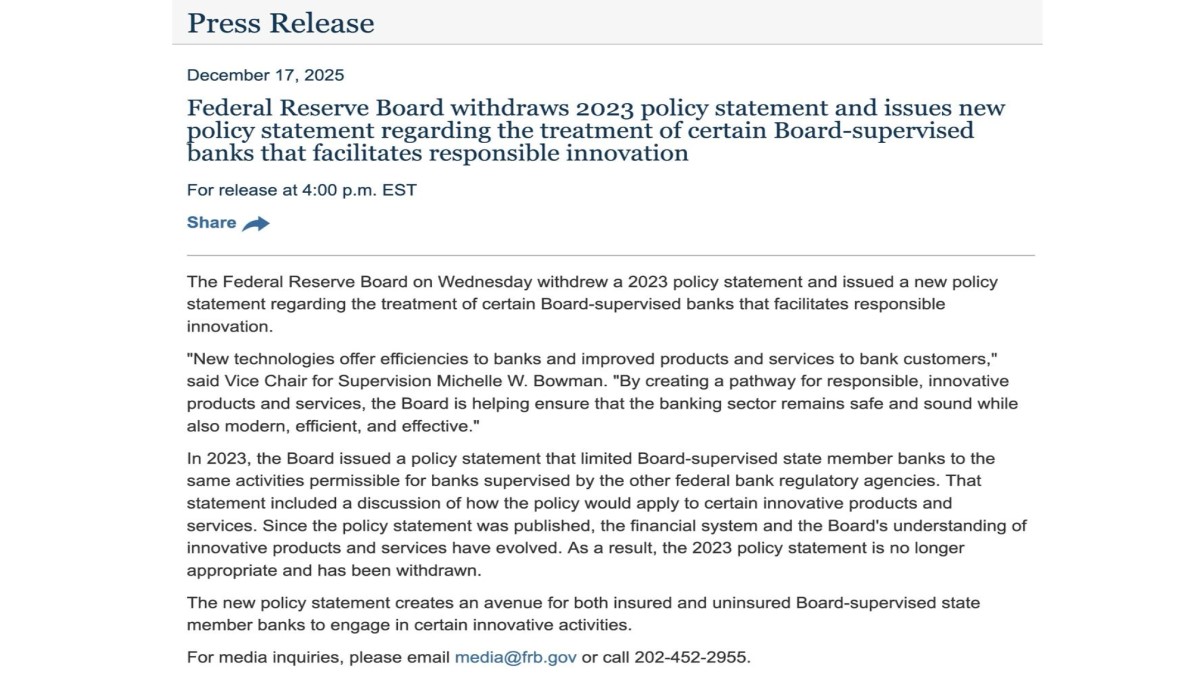

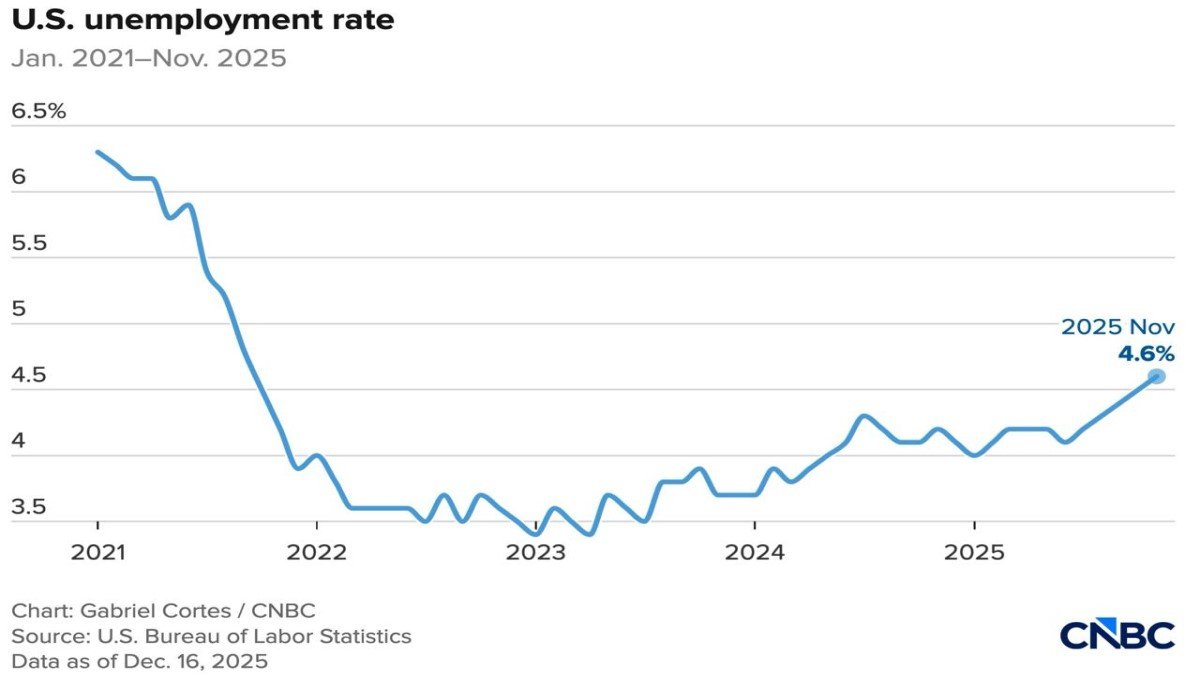

BNB Chain is becoming a payment option for AWS customers via Better Payment Network just as U.S. macro data softens, inflation eases to 2.7%, and policymakers promise lower rates and large tax refunds. At the same time, DeFi builders push new roadmaps, stablecoin and RWA projects seek regulatory clarity, and banks receive a green light from the Fed to re-enter digital-asset activities. This wrap connects the dots between payments, regulation, infrastructure and price action to help long-term investors understand what really changed in the last 24 hours.

Read more →