Ondo Finance Takes Tokenization Debate to Washington as Crypto Markets Reset

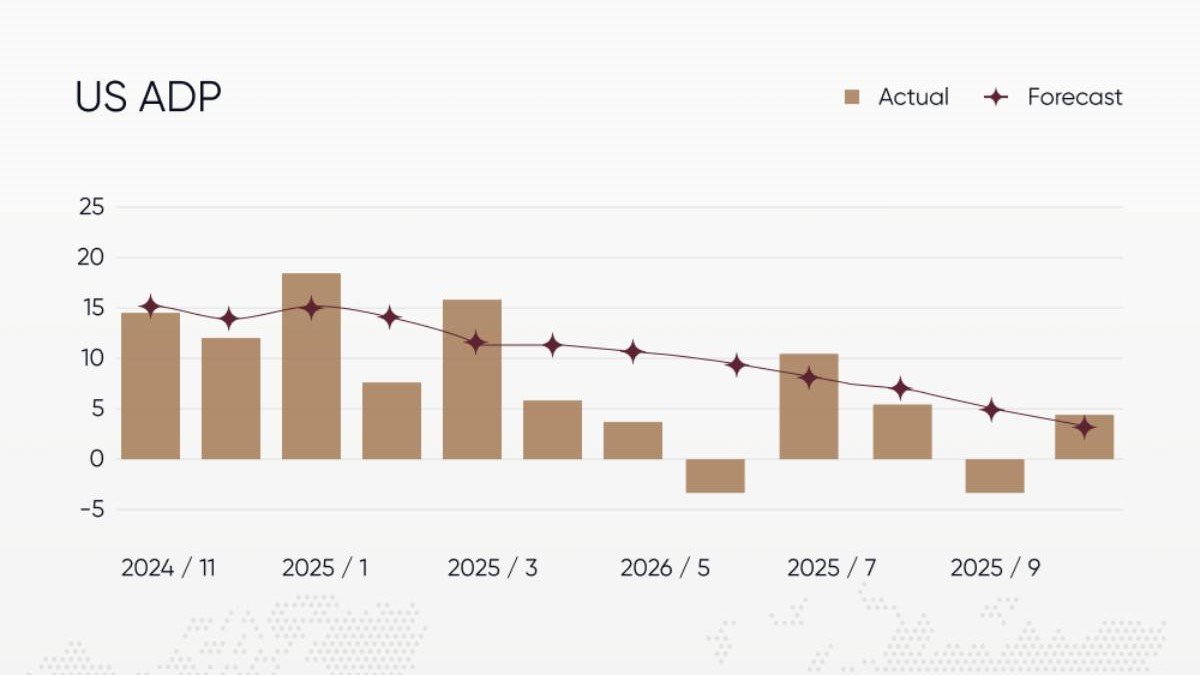

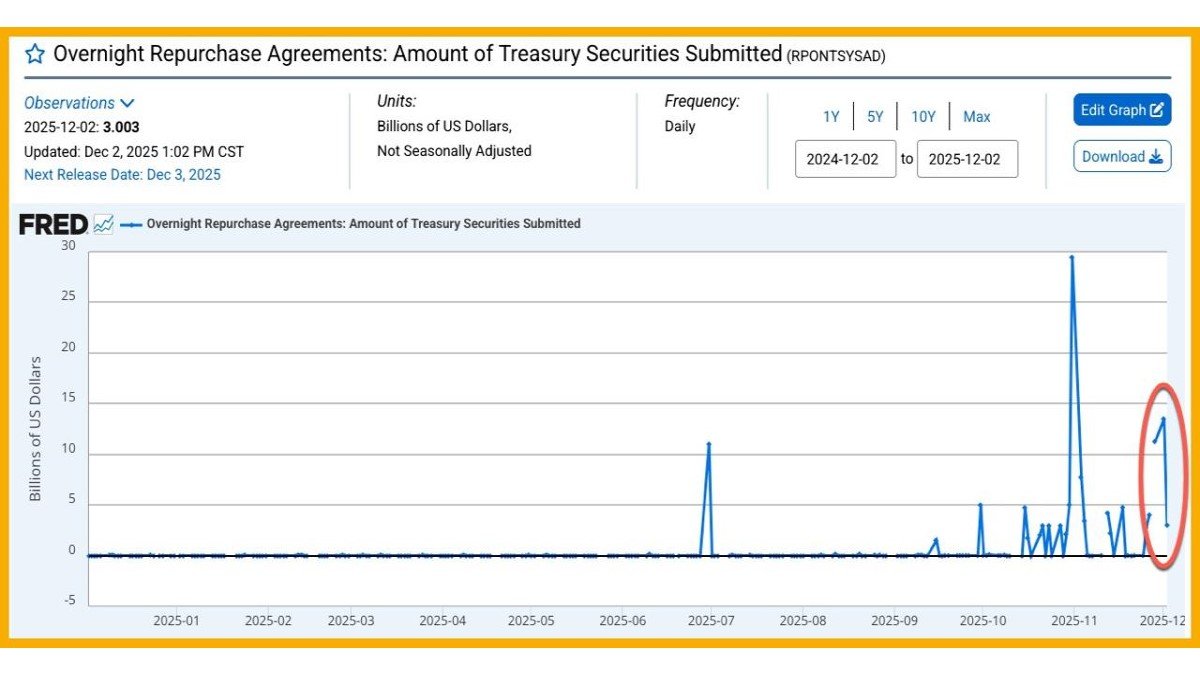

Ondo Finance has submitted a detailed tokenization roadmap to the U.S. Securities and Exchange Commission, calling for flexible ownership models and deeper on-chain integration of traditional securities. The move comes as Bitcoin briefly loses the 89,000 USD level, leverage is flushed out of the market and regulators worldwide refine their approach to both spot crypto and tokenized real-world assets.

Read more →