Fed Officially Halts Quantitative Tightening: What a Liquidity Pause Means for Markets and Crypto

The headline is simple but powerful: the Federal Reserve has confirmed that it is stopping quantitative tightening (QT). After years of gradually shrinking its balance sheet and pulling cash out of the banking system, the central bank is now choosing to leave the size of that balance sheet roughly where it is.

For anyone active in traditional markets or digital assets, this is more than a dry policy detail. QT has been a constant, sometimes invisible, drain on liquidity. When that drain stops, the background conditions for all risk assets change. It does not automatically mean a straight line higher for prices, but it does mean that one of the main forces pushing against valuations has finally eased.

In the crypto community, it is tempting to translate this immediately into a single word: bullish. Before jumping to that conclusion, it is worth slowing down and asking a few deeper questions:

- What exactly is QT, and how does halting it affect liquidity in the real world?

- Why did the Fed decide to stop now, and what risks was it trying to avoid?

- How have markets behaved around previous QT pauses and policy turns?

- What does all of this mean for Bitcoin and other digital assets that are often portrayed as macro-sensitive?

The rest of this article walks through those questions step by step, with an emphasis on education and risk awareness rather than short-term predictions.

1. What Quantitative Tightening Actually Is

To understand why the halt matters, we need to start with the mechanics. Quantitative tightening is the mirror image of quantitative easing (QE). During QE, the Fed buys Treasury and mortgage-backed securities from the market, paying for them by creating bank reserves. The balance sheet grows and new liquidity enters the system. During QT, the process runs in reverse: the Fed allows bonds it already holds to mature without reinvesting the proceeds, or actively sells assets. As those securities roll off, bank reserves decline and the balance sheet shrinks.

Three features of QT are particularly important for investors:

• It operates slowly but relentlessly. Unlike a single rate decision, QT is a mechanical process. Month after month, a set amount of bonds disappears from the Fed’s portfolio, and an equivalent amount of cash disappears from the banking system.

• It reduces the cushion of reserves. Banks hold reserves at the Fed as their safest, most liquid asset. When those reserves shrink, the system as a whole has less flexibility to absorb funding shocks.

• It tightens financial conditions even when policy rates are unchanged. The official policy rate might be steady, but the underlying liquidity that supports credit, repo markets and risk taking is being withdrawn.

Over the past few years, QT has played that quiet role in the background: reducing reserves, nudging yields higher at the margin and making some funding channels more fragile. Now, with the decision to halt QT, the Fed has chosen to stop that process. The balance sheet will no longer shrink; reserves will no longer be forced lower by design.

2. Why the Fed Is Stopping Now: The Reserve Constraint

So why halt QT at this particular point in the cycle?

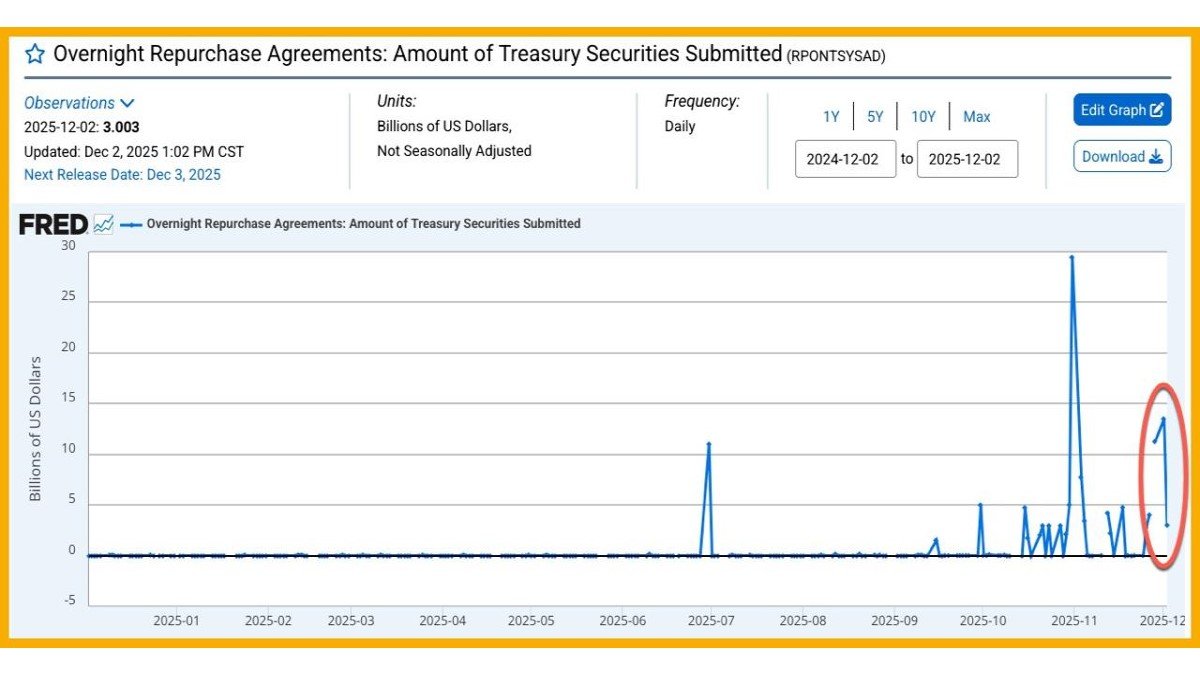

The core issue is the level of reserves in the banking system. Central banks learned an important lesson from the 2019 repo turmoil in the United States: there is a threshold below which reserves stop being “abundant” and start being “scarce”. When reserves are abundant, banks are relaxed about lending them in overnight funding markets. When reserves become scarce, each institution worries about its own needs and becomes less willing to part with cash, even at higher rates. Funding markets then become volatile, and the central bank may be forced to intervene with emergency operations.

During the recent QT cycle, reserves have been trending down toward that minimum comfortable level. At the same time, other liquidity buffers—such as the Fed’s overnight reverse repo facility—have been drawn down as money market funds rotated cash back into higher-yielding assets. Put simply, both major cushions were being used at the same time.

Against that backdrop, policymakers faced a choice:

- Continue QT and risk repeating a 2019-style funding squeeze, with unpredictable knock-on effects for banks, credit and markets.

- Halt QT before reserves fall too low, accepting a larger balance sheet but preserving stability in core funding markets.

The decision to stop QT signals that the Fed values funding stability more than squeezing out the last bits of balance-sheet shrinkage. In the language of central banking, they are choosing an 'ample reserves' framework over a narrower, more fragile one.

3. What It Means When the 'Money Vacuum' Turns Off

The easiest way to visualise QT is to imagine a vacuum cleaner continuously pulling liquidity out of the system. The halt to QT is essentially the moment when that vacuum is switched off. Several direct consequences follow:

- Bank reserves stabilise. Instead of trending lower month after month, the aggregate cash that banks hold at the Fed will flatten out.

- The pressure on banks to defend their balance sheets eases. With a more comfortable reserve cushion, banks can be less defensive in repo markets and more willing to extend credit.

- The drain on market liquidity slows. While other factors—such as Treasury issuance—still matter, one major source of tightening is no longer pushing in the same direction.

This does not mean that the Fed has started quantitative easing again. No new bonds are being purchased; no new reserves are being created. The best description is a pause. The system is no longer being squeezed, but it is not yet being actively refilled with fresh liquidity.

From a sentiment standpoint, however, the change can feel much larger. As long as QT was running, investors knew that another month of balance-sheet shrinkage was always coming. That knowledge encouraged defensive positioning and a cautious tone. Once the program stops, conversations naturally shift from “How much more tightening is left?” to “When will conditions start to become easier?” Even before any new stimulus arrives, expectations begin to move.

4. Lessons From History: Policy Turns and Market Bottoms

Market historians often point out that some of the most durable equity and credit bottoms have formed near the moment when central banks stop tightening. The logic is intuitive:

- By the time policymakers are comfortable halting tightening, a lot of bad news is already reflected in asset prices.

- Financial conditions are usually restrictive, and risk sentiment is depressed.

- Even small hints of stability or future easing can therefore have an outsized impact.

We saw versions of this dynamic in several past episodes. In 2012, aggressive easing by major central banks helped mark the end of the Eurozone crisis. In late 2018 and early 2019, the Fed signalled a pause in rate hikes and later stopped QT after repo markets flashed stress, coinciding with a durable bottom in US equities. During the 2020 pandemic shock, an even more forceful set of measures stabilised markets that were under severe strain.

The important caveat is that correlation is not destiny. Policy turns do not always line up neatly with market lows, and even when they do, short-term volatility can remain high. Ice-cold macro conditions can warm slowly. Still, from an educational perspective, it is useful to recognise that the end of a tightening phase often marks a shift in the balance of risks: instead of constantly worrying about further drains on liquidity, investors begin to weigh the timing and scale of eventual support.

5. Channels Through Which a QT Halt Affects Risk Assets

How does all this translate into actual asset prices?

There are several channels, each with its own timeline:

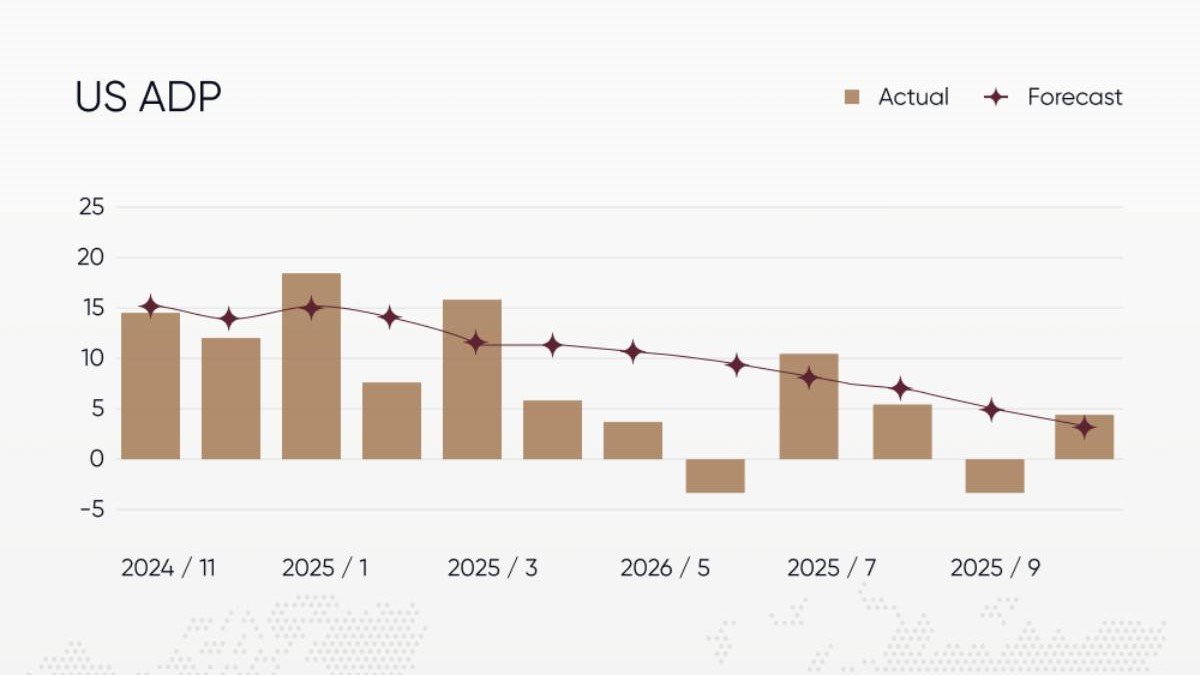

• Funding costs and availability. When reserves stop shrinking, pressure on short-term funding markets eases. Banks and dealers may feel more comfortable extending credit and holding inventory, which can improve liquidity in bonds and other instruments.

• Risk appetite. Market participants pay close attention to the direction of policy, not just its level. A shift from “tightening” to “on hold” often encourages investors to re-evaluate depressed assets and add measured exposure.

• Discount rates and valuations. Expectations of future rate cuts tend to follow the end of a tightening phase. Even before cuts arrive, forward curves adjust, impacting the discount rates used to value long-duration assets such as growth stocks and, increasingly, digital assets.

• Currency dynamics. If investors expect that the era of balance-sheet shrinkage is over and a more accommodative stance may follow, the relative strength of the domestic currency can soften over time. That can be supportive for assets priced in that currency, though the relationship is complex.

Each channel works with different lags. Pricing in futures markets can adjust within minutes; shifts in credit creation or corporate investment take months. For long-horizon investors, the key point is that the direction of travel in policy has changed—from active tightening toward eventual easing.

6. What It Might Mean for Bitcoin and Digital Assets

Digital asset markets are smaller than global bond or equity markets, but they are unusually sensitive to global liquidity conditions and investor psychology. When cash is scarce and funding markets are tense, many participants cut risk across the board, including crypto. When conditions stabilise and investors begin to look ahead to more supportive policy, digital assets often participate strongly in the recovery.

There are several reasons for this sensitivity:

• Perception of Bitcoin as a macro asset. Over the past decade, Bitcoin has evolved from a niche experiment into a widely watched macro instrument. Many institutional investors now view it alongside gold, growth equities and other assets that respond to liquidity and real yield conditions.

• Access channels through ETFs and listed companies. With the emergence of widely traded products, inflows or outflows driven by macro views can reach the Bitcoin market more directly.

• High volatility and convexity. When investors expect better conditions, they often look for assets that can respond strongly to improving sentiment. Crypto frequently sits high on that list.

How might the halt to QT feed into this dynamic?

1. Reduced downside pressure. As long as liquidity was being drained month after month, many market participants were wary of taking on additional exposure to volatile assets. With the drain now paused, one source of downside risk is softer.

2. Room for new narratives. Crypto markets thrive on narratives that connect macro conditions with digital scarcity, innovation or on-chain growth. A world moving away from strict tightening and toward eventual easing provides fertile ground for such stories.

3. Potential shift from defence to accumulation. Some long-term allocators who sat on the sidelines during the QT phase may now be more comfortable implementing gradual accumulation plans, especially if they believe that the difficult part of the liquidity cycle has passed.

Of course, there are important caveats. Digital assets remain volatile and can move sharply in both directions based on regulatory updates, technology developments, or shifts in global risk sentiment. A halt in QT is a supportive backdrop, not a guarantee of sustained appreciation.

7. Why 'Bullish News' Still Requires Discipline

Given all of this, it is understandable that many commentators summarise the halt to QT with a simple reaction: 'Good news—time to be optimistic.' In spirit, there is truth to that. History suggests that the end of a tightening phase often corresponds with more constructive conditions for risk assets over the medium term.

At the same time, a brand-safe and responsible approach emphasises a few balancing points:

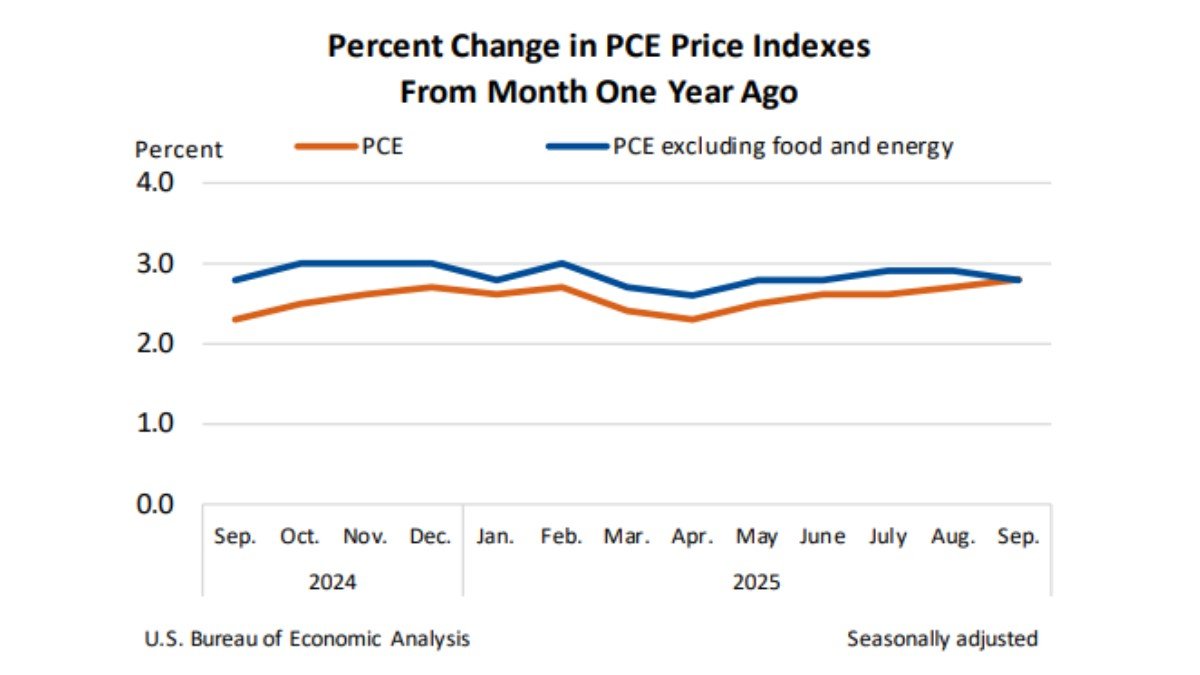

• Policy can change again. If inflation were to re-accelerate or new shocks emerged, the Fed could adjust its stance, including resuming balance-sheet shrinkage or keeping rates higher for longer than markets expect.

• Other forces matter. Geopolitics, corporate earnings, regulatory decisions and technology progress all interact with monetary policy. Liquidity is a powerful driver, but it is not the only one.

• Positioning starts from somewhere. If many investors already anticipated the QT halt, part of the effect may be reflected in prices. The reaction then depends on the gap between expectations and reality.

• Risk management still comes first. Even in supportive macro environments, concentrated positions without diversification or planning can lead to stressful outcomes.

In other words, the halt to QT is genuinely meaningful, but it should be treated as a shift in background conditions rather than a short-term signal to chase volatility. For investors in Bitcoin and other digital assets, it may justify a fresh look at long-term theses and allocation sizes, but it does not replace careful research and a clear understanding of personal risk tolerance.

8. Practical Takeaways for Readers

To summarise the educational lessons from this policy move:

1. Understand the plumbing, not just the headlines. QT is about the size of the Fed’s balance sheet and the level of bank reserves. When you hear that it has stopped, think about reserves stabilising and funding markets gaining more breathing room.

2. Policy direction matters as much as policy level. Even if rates remain high, the shift from active tightening to a pause can alter risk appetite and valuations.

3. Liquidity conditions are especially relevant for volatile assets. Crypto tends to respond more strongly than many traditional assets when liquidity moves from restrictive toward neutral or easy.

4. Historical patterns are guides, not promises. Past episodes where markets bottomed around policy turns are informative, but each cycle has its own mix of macro forces.

5. Use macro news to refine your plan, not replace it. A solid investment plan already accounts for the possibility of changing monetary environments. News like a QT halt is a reason to revisit assumptions, not to abandon discipline.

9. Conclusion: The Toughest Liquidity Phase May Be Behind Us

The Fed’s decision to halt quantitative tightening marks an important turning point in this cycle. The balance sheet will no longer shrink, bank reserves will stop grinding lower, and the constant background drain on liquidity will ease. That shift reduces one of the main macro headwinds that risk assets—including Bitcoin and other digital currencies—have been facing.

It is fair to say that this is genuinely positive news for markets. The most restrictive phase for liquidity appears to be over, and history suggests that such moments often line up with the early stages of longer-term bottoms. But moving from 'headwind' to 'less headwind' is not the same as a guaranteed tailwind. Policy, macro conditions and market psychology will continue to evolve.

For investors and observers, the most constructive response is to deepen understanding: learn how QT works, pay attention to reserves and funding markets, and recognise the role of liquidity in shaping both traditional and digital asset cycles. With that foundation, news about central bank decisions becomes less of a mystery and more of a useful piece in a well-thought-out framework.

Disclaimer: This article is for informational and educational purposes only. It does not constitute financial, investment, legal or tax advice, and it should not be treated as a recommendation to buy, sell or hold any asset. Digital asset and traditional financial markets are volatile and can involve significant risk, including the possibility of total loss. Always conduct your own research and consider consulting a qualified professional before making financial decisions.