Fed Repo Support and the Bessent Doctrine: Liquidity Relief Without Full-Blown Easing

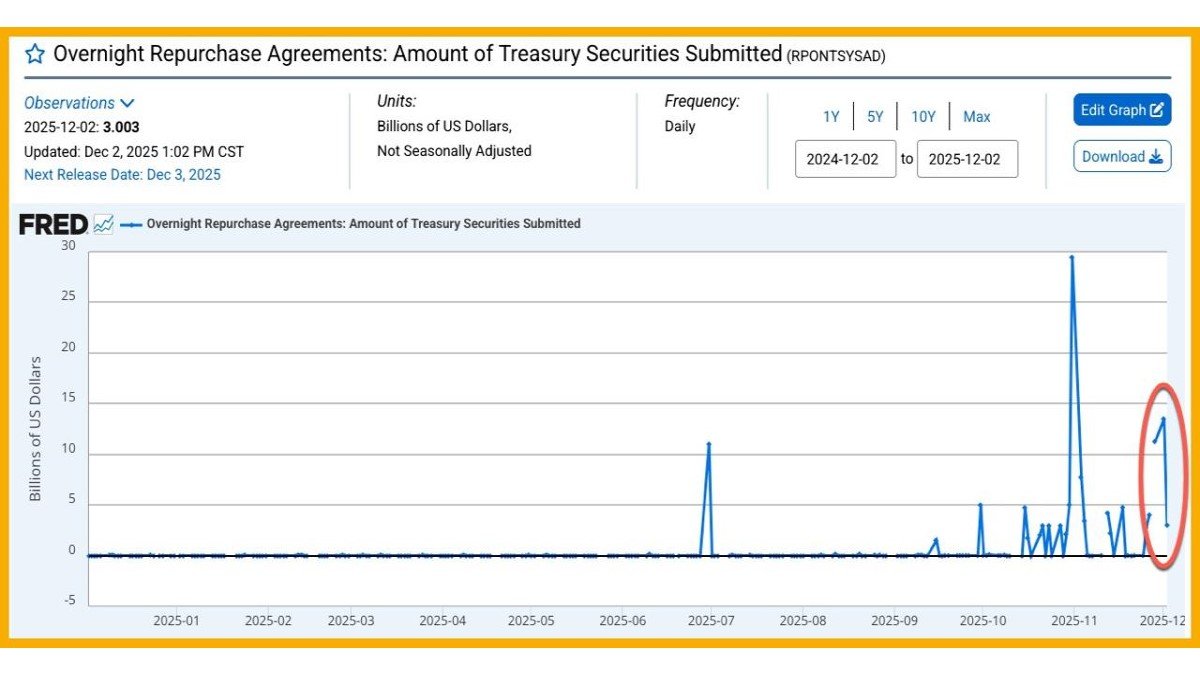

Two signals from US economic policy have arrived almost at the same time, and they are more intertwined than they look at first glance. On one side, Treasury Secretary Scott Bessent has urged the Federal Reserve to return to a more restrained style—less constant commentary, more focus on long-term monetary stability. On the other, the Fed has delivered a $13.5 billion repo operation, one of the largest single-day liquidity injections since the pandemic era, right after officially ending its quantitative tightening programme.

For market participants watching everything from Treasury yields to digital-asset prices, it is tempting to read this as an abrupt pivot: the Fed is “back to easing.” The reality is more nuanced. Ending QT and deploying repos does not instantly recreate the conditions of 2020–2021, but it does mark a shift away from the most restrictive phase of this tightening cycle.

This article breaks the story into three parts. First, we look at what Bessent is actually saying about the Fed’s role and why his words matter. Second, we examine how repo operations work and what a $13.5 billion injection really signals about banking-system liquidity. Finally, we outline the potential implications for broader markets—including crypto—through an educational, brand-safe lens that focuses on frameworks, not fast predictions.

1. Scott Bessent’s Critique: Less Noise, More Mandate

Bessent’s comments are pointed but not purely rhetorical. As Treasury Secretary and the person reportedly involved in interviewing candidates for the next Fed Chair, he is effectively sketching out a job description in public. His core arguments can be summarised as follows:

• The Fed should “step back” from centre stage. In Bessent’s view, monetary policy works best when the central bank provides a stable backdrop rather than acting as a constant protagonist in daily market narratives.

• Communication has become excessive. He argues that frequent speeches from regional Fed presidents add more noise than insight, especially when officials offer divergent views that are not always anchored in concrete policy changes.

• The focus should return to long-term objectives. Instead of reacting to every data point or market move with public commentary, Bessent wants the Fed to re-emphasise its dual mandate—price stability and maximum employment—over multi-year horizons.

Behind this criticism is a broader concern: when policy communication becomes fragmented and constant, it can unintentionally amplify volatility. Markets start trading every phrase, and households hear a confusing mix of messages about inflation, rates and growth. For an institution that relies heavily on credibility, that kind of noise can dilute the power of its actual decisions.

Bessent’s remarks therefore serve two functions at once. They are a public nudge to current Fed leadership to tone down the chatter, and a signal that any incoming Chair is expected to restore a calmer communication regime—fewer unscripted comments, more clearly framed policy updates.

2. Why Bessent’s View Matters for Markets

Many policymakers have opinions about the Fed; not all of them matter equally. Bessent’s position is different for at least two reasons:

- He is close to the selection process. By shaping the criteria for the next Chair, he indirectly influences the future style of monetary policy—whether it leans technocratic and quiet or highly communicative and reactive.

- He bridges the fiscal and monetary worlds. As Treasury Secretary, Bessent sees both sides of the ledger: the government’s borrowing needs and the central bank’s rate decisions. His call for a more patient, long-term Fed hints at a desire to avoid policy whiplash that might destabilise funding markets.

For investors and analysts, the practical takeaway is not that a specific rate path is locked in, but that the style of policy may be changing. A Fed that speaks less frequently but moves with deliberate steps can create a different trading environment than one in which every week features new, sometimes conflicting speeches.

In that sense, Bessent’s comments and the Fed’s recent liquidity actions are two sides of the same coin: a shift from maximum pressure and constant commentary toward a slightly more supportive, but still cautious, stance.

3. From QT to Targeted Liquidity Support

To understand why the latest repo operation is attracting attention, it helps to recall the backdrop. For a prolonged period, the Fed has been engaged in quantitative tightening (QT)—shrinking its balance sheet by allowing bonds to mature without reinvesting the proceeds. QT withdraws reserves from the banking system and, over time, reduces the liquidity buffer that banks rely on to meet short-term funding needs.

Recently, the Fed announced that QT would come to an end. That does two things immediately:

- It stops the active drain of reserves from the system.

- It signals that the Fed believes it is close to the lower bound of “comfortable” banking-system liquidity.

However, ending QT does not automatically fix all short-term funding pressures. Reserves are unevenly distributed; some banks hold ample cash, while others are closer to their regulatory or internal comfort limits. That is where repo operations enter the picture.

4. How Repo Operations Work (and Why They’re Not the Same as QE)

The term “repo” can sound technical, but the mechanics are straightforward. A repurchase agreement (repo) is effectively a short-term collateralised loan:

- A bank (or other eligible institution) sells high-quality securities—usually government bonds—to the Fed.

- At the same time, it agrees to repurchase those securities at a slightly higher price at a specified future date, often the next day.

- The difference between the sale and repurchase price reflects the effective interest rate on the loan.

From the bank’s perspective, the transaction temporarily turns bonds into cash, boosting short-term liquidity. From the Fed’s perspective, it is a way to ensure that the plumbing of the financial system continues to function smoothly without committing to long-term asset purchases.

Crucially, repos differ from quantitative easing in at least three ways:

• They are temporary. The cash created by a repo returns to the Fed when the agreement is unwound. By contrast, QE involves buying assets and holding them for an extended period, expanding the balance sheet.

• They are demand-driven. Banks choose to access repos based on their needs; the Fed is not forcing reserves into the system but standing ready as a lender of high-quality cash against good collateral.

• They target plumbing, not asset prices directly. QE is explicitly about easing financial conditions across the curve. Repo operations are more about ensuring that short-term funding markets remain orderly.

When observers say, “This is not money printing,” they are pointing to this temporary nature. The operation does not permanently inject new purchasing power into the economy, but it does reveal something important about how tight conditions have become.

5. Reading the $13.5 Billion Repo Injection

Against that backdrop, the Fed’s decision to execute a $13.5 billion repo operation—the second-largest one-day support since COVID—carries several messages.

• Short-term funding was under pressure. Banks do not tap large repos without cause. Elevated demand suggests that institutions felt the need to reinforce their cash positions, especially around regulatory reporting dates or periods of market stress.

• Reserves are closer to the “scarce” zone. Even after the end of QT, the overall level of reserves appears tight enough that some banks are uncomfortable relying solely on interbank lending.

• The Fed is willing to act pre-emptively. By stepping in with a sizeable operation, the central bank is signalling that it wants to avoid a repeat of past funding squeezes, such as the 2019 repo turmoil.

At the same time, the Fed is not signalling an open-ended return to large-scale asset purchases. The emphasis remains on temporary liquidity backstops rather than a structural shift to permanent easing. This is why the operation can coexist with a policy stance that is still cautious on inflation and keeps policy rates at elevated levels.

6. What This Means for the Banking System

From a financial-stability perspective, the repo move is both a reassurance and a reminder.

It is reassuring because it shows that the Fed is closely monitoring funding markets and is prepared to deploy its toolkit before stress becomes visible to the broader public. By providing collateralised cash quickly, it helps banks avoid fire-sales of assets or abrupt cutbacks in lending.

It is a reminder because it underscores that liquidity remains tight. If the system were swimming in excess reserves, demand for a large repo operation would likely be negligible. The fact that banks lined up for $13.5 billion in overnight funding suggests that the balance between safety, regulation and profitability remains delicate.

For observers, the key educational point is that banking-system health is not a binary “safe/unsafe” question. It is a continuum. Repo usage near zero can signal abundant liquidity; surging usage can signal stress. A medium-to-high level, combined with proactive Fed involvement, is often a sign that conditions are tight but managed.

7. Implications for Risk Assets, Including Crypto

Although repo operations take place in the background, their effects ripple outward. When banks feel more comfortable about their short-term funding, they are less likely to cut back abruptly on lending, reduce market-making activity or shed assets at unfavourable prices. That, in turn, can:

- Reduce the probability of sudden spikes in yields driven by forced selling.

- Support valuations for a wide range of assets, from equities to corporate bonds.

- Create a slightly more stable environment for digital assets, which are sensitive to global liquidity conditions.

However, it is important to keep scale in perspective. A $13.5 billion repo is sizeable in the context of overnight funding markets, but modest compared with the trillions added during full-scale QE programmes. It can ease acute stress, but it does not, by itself, set off a long wave of abundant liquidity.

For crypto markets, this kind of operation usually matters indirectly. Digital assets are influenced by:

- The overall cost of capital (interest rates and credit spreads).

- Investor risk appetite, which tends to improve when macro uncertainty and funding stress are lower.

- Flows from institutional and retail participants, which respond to a mixture of policy signals, regulatory clarity and technological developments.

In that sense, the combination of ending QT and supporting banks via repo nudges conditions in a more constructive direction, but it does not eliminate volatility. It simply reduces one specific tail risk: that short-term funding stress cascades into a broader liquidity event.

8. The Intermediate Regime: No Longer Tightening, Not Yet Easing

Putting Bessent’s comments and the Fed’s actions together, a pattern emerges. The central bank appears to be moving into an intermediate regime characterised by:

- No further balance-sheet tightening. QT has ended; the active drain of reserves is over.

- Targeted liquidity support. Repos and similar tools are used to keep funding markets orderly without committing to a full QE programme.

- Heightened communication discipline. At least in principle, the next phase is meant to feature fewer ad-hoc comments and more deliberate, scheduled policy guidance.

For market participants, this carries mixed implications:

- downside pressure from deliberate balance-sheet shrinkage has faded;

- funding strains can still surface, but the Fed has shown it is ready to respond quickly;

- policy rates may remain elevated for some time, as inflation objectives still matter.

This is a regime in which directional calls become harder. When the Fed is aggressively raising rates or buying assets, the macro backdrop provides a strong tailwind or headwind. When policy is in a holding pattern with targeted adjustments, micro factors—earnings, sector rotation, protocol upgrades—can play a larger relative role.

9. Scenario Framework: Three Paths From Here

Instead of predicting a single outcome, it can be helpful to think in scenarios.

1) Soft-Landing Extension

In this optimistic scenario:

- Inflation continues to trend lower without a sharp rise in unemployment.

- Funding pressures ease after the recent repo support, and demand for such operations normalises.

- The Fed keeps rates steady before gradually cutting them as conditions allow.

Risk assets, including crypto, can perform reasonably well in this world, though returns would still vary widely by sector and asset quality.

2) Stop-Start Volatility

In a more mixed scenario:

- Inflation proves sticky, forcing the Fed to keep policy tighter for longer.

- Funding markets experience periodic stress, requiring additional repo operations.

- Economic data sends conflicting signals, keeping investors in a state of uncertainty.

Here, volatility remains elevated. Periodic rallies alternate with drawdowns as markets react to each new data release and policy comment.

3) Renewed Stress Episode

In a downside scenario:

- A shock—whether from geopolitics, credit markets or unexpected data—triggers renewed funding strains.

- Repo usage spikes beyond the current $13.5 billion level.

- The Fed is forced to consider more expansive measures, potentially revisiting QE-style tools.

In this environment, long-duration assets and higher-risk segments of the market could face renewed pressure, at least until a new policy equilibrium is found.

None of these scenarios is guaranteed. The educational value lies in having a mental map: understanding how different data points and policy actions might shift probabilities between them.

10. How Readers Can Use This Information Responsibly

For readers who are not macro specialists, it is easy to feel overwhelmed by acronyms and balance-sheet details. A few practical guidelines can help keep things grounded:

• Focus on direction, not perfection. Ending QT and deploying repos point to a moderation of tightness, not an all-clear signal.

• Separate tools from outcomes. Repos support liquidity, but they do not automatically drive asset prices higher. Their main role is to keep the plumbing functioning smoothly.

• Align information with time horizon. Short-term funding operations matter a great deal for traders operating on days and weeks, but they are only one piece of the puzzle for long-term savers.

• Maintain diversification and risk controls. Macro backdrops can change quickly. A balanced approach—spreading exposure across assets and maintaining clear risk limits—tends to be more resilient than heavy concentration based on a single macro thesis.

Above all, it is useful to treat macro signals as context rather than instruction. Understanding what the Fed and Treasury are doing can help frame expectations, but individual financial decisions still depend on personal circumstances, goals and risk tolerance.

11. Conclusion: A Quieter Fed With a Busy Toolkit

Scott Bessent’s call for a calmer, more long-term oriented Federal Reserve coincides with a moment when the central bank is quietly adjusting its toolkit. By ending quantitative tightening and deploying a $13.5 billion repo operation, the Fed is signalling that it wants to avoid unnecessary stress in the banking system while keeping its broader policy stance cautious.

This is not a return to the hyper-accommodative era of pandemic-era stimulus, but it is a visible step away from the most restrictive phase of the cycle. Liquidity is no longer being drained systematically; instead, it is being managed with targeted support.

For markets—from government bonds to digital assets—the message is subtle but important. Policy is no longer pressing relentlessly on the brakes, yet it is not stepping fully on the accelerator either. In this middle ground, careful analysis, disciplined risk management and ongoing education become more important than ever.

Disclaimer: This article is for informational and educational purposes only. It does not constitute financial, investment, legal or tax advice, and it should not be treated as a recommendation to buy, sell or hold any asset, including digital assets or traditional securities. Economic conditions and policy decisions can change rapidly, and markets are volatile. Readers should conduct their own research and consider consulting qualified professionals before making decisions related to monetary policy, investing or portfolio construction.