Inside the Fed’s December Split: What a 9–3 Vote Really Says About the Path of Interest Rates

On the surface, the Federal Reserve’s December meeting looked straightforward. The committee delivered a widely anticipated 25 basis point cut, bringing the target range for the federal funds rate down to 3.5%–3.75%. Markets yawned: Chair Jerome Powell’s press conference stuck closely to the script, and the broad message appeared consistent with earlier guidance.

The minutes tell a different story. Behind the neat policy statement was a deeply divided committee. The final tally was 9 votes in favor of cutting and 3 against, and even some of the officials who backed the cut admitted that keeping rates unchanged had been a very real option. In effect, the Fed did not glide into this decision; it edged into it, one cautious step at a time.

Understanding that internal tension matters because it shapes how we should interpret the Fed’s outlook for 2026 and 2027. The so-called dot plot now points to only one additional cut in 2026 and one more in 2027, leaving rates hovering around 3% in the medium term. The minutes also highlight concerns about the inflation impact of new trade tariffs, including those introduced by President Donald Trump, even though most participants still see those effects as temporary.

In other words, the Fed is not declaring victory. It is cautiously testing the waters of easier policy while keeping its options open. Below, we break down what the December minutes reveal about the committee’s internal debate, what the slow path of projected cuts really implies, and how investors might read these signals without overreacting to every headline.

1. A 9–3 Vote That Was Closer Than It Looks

The headline number from the minutes is clear: nine members supported a quarter-point cut, three preferred to hold. But the text makes it equally clear that this was not a simple hawks-versus-doves battle where each side entered the room with a fixed position.

Several officials in the majority camp acknowledged that the decision was, in their own words, a close call. They were prepared to justify leaving rates unchanged if incoming data on inflation or employment had surprised to the upside. The final choice to cut reflected an assessment that the balance of risks had inched just far enough toward supporting the labor market without abandoning the inflation objective.

That nuance is important. It means December should not be read as the start of an automatic easing cycle in which cuts arrive at regular intervals. Instead, the committee is signaling that each step from here will be data dependent and potentially contentious. The same arguments that almost kept rates on hold in December could easily dominate a future meeting if inflation readings firm up or if financial conditions loosen too quickly.

2. Two Camps, One Mandate: Labor Versus Inflation

The core dispute inside the Fed, as captured in the minutes, revolves around how to balance the institution’s dual mandate in the current environment.

2.1 The group focused on the labor market

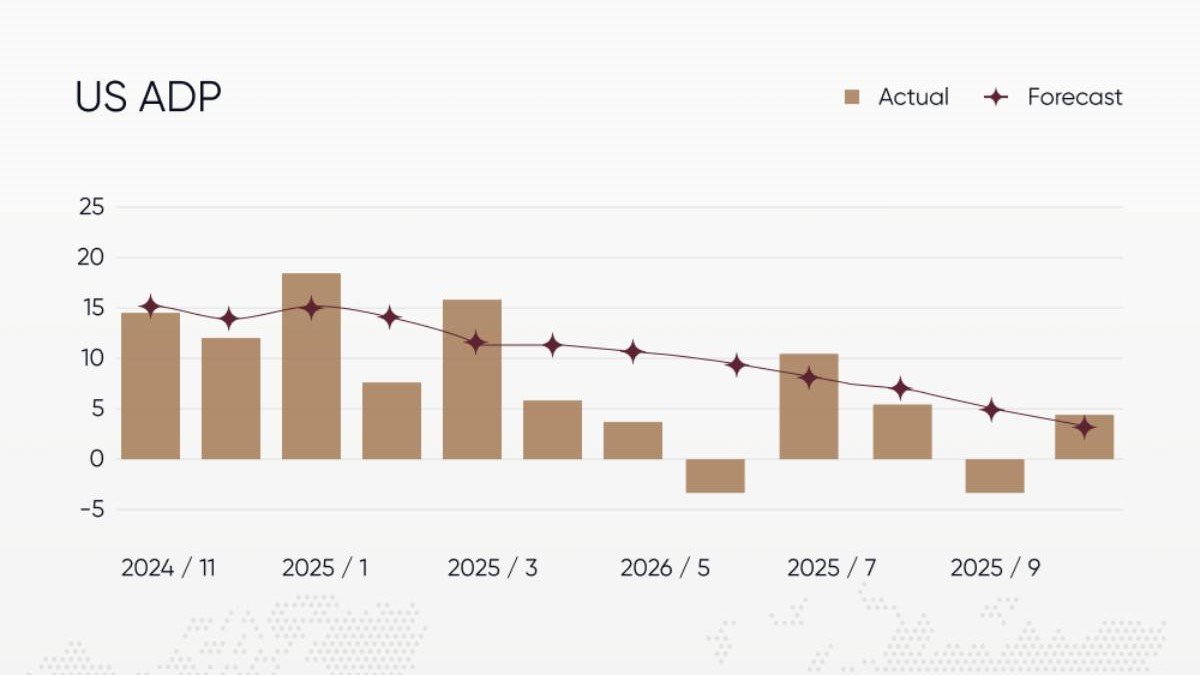

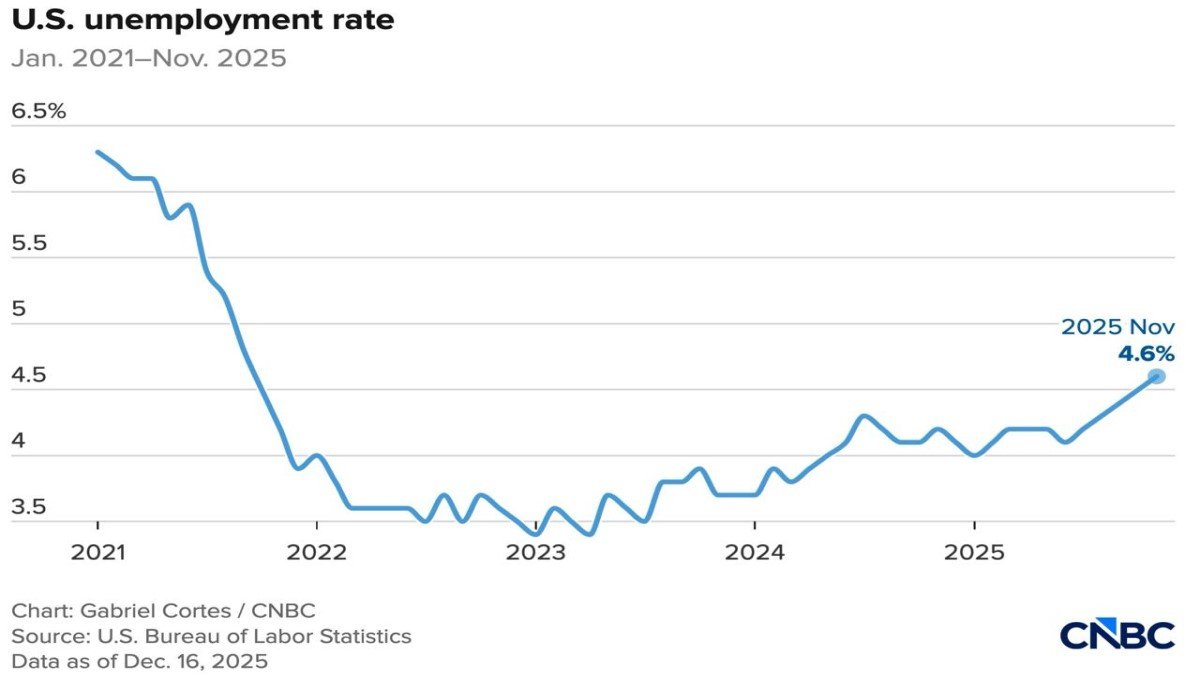

One camp emphasized evidence that the job market is cooling. Job growth has slowed compared with the post-pandemic surge, and the unemployment rate has edged higher from its lows earlier in the cycle. While conditions remain far from recessionary, the trend points to a gradual softening in hiring and wage growth.

Officials in this group argued that holding policy too tight for too long risks an unnecessary loss of employment and income, particularly for more vulnerable segments of the labor force. With inflation already down significantly from its peak, they saw room to provide modest support to the real economy without abandoning the longer-term goal of price stability.

2.2 The group focused on lingering price pressures

The smaller but vocal opposing camp viewed the situation through a different lens. For these officials, the fact that inflation remains slightly above the Fed’s 2% target was enough reason to keep policy unchanged. They pointed out that services inflation, in particular, has proven sticky, and that premature easing in past cycles has sometimes reignited price pressures.

This group also worried that financial markets might interpret a cut as a green light for renewed risk-taking, potentially easing financial conditions more than the committee intends. If credit spreads compress and asset prices rise sharply, the effective stance of policy could become more accommodative than the nominal fed funds rate suggests.

In short, the debate was less about whether inflation will ultimately return to target and more about how quickly the Fed can safely reduce restraint without undermining that process.

3. The Dot Plot: Slow and Steady, Not a Full Pivot

The December projections show Fed officials expecting policy to drift lower only gradually. The median path now anticipates:

- A modest easing in 2025 (already underway with the December move).

- One additional cut in 2026 and one in 2027, leaving the policy rate near 3% by the end of the forecast horizon.

This slow trajectory carries several messages:

• No rush to return to the pre-pandemic world. A terminal rate around 3% is meaningfully higher than the near-zero policy settings that prevailed through much of the 2010s. The Fed is implicitly acknowledging that the neutral rate — the level consistent with stable inflation and full employment — may now be higher.

• Inflation scars still matter. Even if inflation is close to target, the experience of the last several years has made policymakers wary of declaring victory too soon. Keeping rates somewhat elevated provides insurance against renewed price pressures, especially if growth or fiscal spending remains strong.

• The committee wants flexibility. A gradual baseline path leaves room to adjust in either direction. If growth disappoints, more cuts can be added. If inflation proves stubborn, projected cuts can be delayed or canceled.

For markets, the key takeaway is that December’s decision does not mark a sharp pivot toward highly accommodative policy. Instead, it is the beginning of a cautious transition toward what the Fed hopes will be a more sustainable, moderately restrictive stance.

4. Tariffs, Trade and Inflation: Temporary Shock or Lasting Pressure?

Another notable element in the minutes is the discussion of new trade tariffs introduced by President Donald Trump. Officials generally agreed that these measures are exerting upward pressure on prices, particularly for imported goods. Tariffs effectively act as a tax on cross-border trade, raising costs for importers and, ultimately, for consumers and businesses.

However, most participants judged that this impact is likely to be temporary. Their reasoning is that one-off price increases driven by tariff adjustments do not necessarily lead to a self-reinforcing cycle of inflation, especially if underlying demand conditions are softening. In that sense, tariffs are seen more as a relative price shock than as a driver of ongoing inflation.

Still, the minutes make it clear that the Fed is watching these developments carefully. If tariffs were to broaden or become part of a wider shift toward trade restrictions, the combined effect on supply chains, business costs and expectations could be more persistent. For now, though, the committee is not treating them as a reason to reverse course on gradual easing.

5. Why the Minutes Felt "Unspectacular" to Markets — and Why They Still Matter

Market reaction to the release of the minutes was muted. One reason is that the document largely echoed themes already articulated by Chair Powell at the press conference: cautious optimism on inflation, humility about the outlook and a strong emphasis on data dependence. There were no dramatic surprises or new policy tools unveiled.

Yet the minutes serve a deeper purpose. They reveal the texture of the debate: who is worried about what, and how close the committee might be to changing course if the data shift. Several insights stand out:

- The December cut cannot be taken for granted as the start of an uninterrupted series of reductions. Future moves may be spaced out and could even pause if inflation data firm up.

- Dissenting voices, while in the minority, are well represented and articulate. That increases the odds that communication around future meetings could be less predictable than in recent years.

- There is broad agreement that economic uncertainty remains elevated. Both upside and downside risks to the outlook are acknowledged, which is another way of saying that policy mistakes in either direction are possible.

For fixed-income and equity investors, the implication is that volatility around key data releases — especially inflation and labor market reports — is likely to stay elevated. The Fed has left itself room to react, and that means markets will keep trying to front-run how each data point might shift the internal balance between the two camps.

6. What This Means for Households, Businesses and Global Markets

While the minutes are written for a technical audience, the policy choices behind them have tangible consequences for everyday economic life.

6.1 For households

Lower policy rates gradually filter through to borrowing costs for mortgages, auto loans and credit cards. The December move, combined with earlier declines in long-term yields, is already helping to bring the average 30-year mortgage rate closer to the low 6% range. That supports housing activity at the margin, although other constraints such as down payments and limited supply remain.

On the savings side, deposit rates may drift lower over time, but the Fed’s projected path suggests that the era of near-zero returns on cash is unlikely to return quickly. Households may continue to earn reasonable yields on high-quality savings products even as policy eases slowly.

6.2 For businesses

Firms sensitive to financing costs, such as those in capital-intensive industries, will welcome any relief in borrowing rates. However, the cautious pace of projected cuts means that companies should not expect a rapid return to the extremely low cost of capital that defined the decade after the global financial crisis.

The emphasis on data dependence also means that management teams will need to remain flexible in their planning. Investments that only make sense under very low rates may warrant re-evaluation, while projects with robust cash flows and moderate leverage remain attractive in a world where policy stabilizes near 3%.

6.3 For global and digital asset markets

Internationally, a Fed that is easing slowly, rather than aggressively, tends to support the U.S. dollar relative to a scenario of rapid cuts. That can influence capital flows into emerging markets and shape risk appetite across asset classes, including digital assets.

For cryptocurrencies in particular, the December minutes reinforce a familiar pattern: macro conditions matter, but they are only one piece of a broader narrative. A gradual easing path reduces the likelihood of extreme liquidity swings, encouraging investors to focus more on fundamentals such as network adoption, token design and real-world use cases.

7. The Road Ahead: What to Watch After the December Split

The December minutes close the book on one chapter of the Fed’s tightening-then-pausing story, but they also open the next. Several markers will be crucial in determining whether the committee’s internal split narrows or widens in 2026:

• Labor market data. If job growth weakens more sharply than currently expected, the camp focused on employment could gain influence, pushing for a faster pace of cuts.

• Core inflation and services prices. Persistent strength here would reinforce the concerns of the more cautious group and might delay future easing.

• Financial conditions indices. A significant easing driven by asset price rallies could make the Fed reluctant to deliver additional cuts, even if the dot plot suggests they are coming.

• Further developments in trade policy. An expansion of tariffs or new trade frictions could complicate the inflation outlook and force the committee to revisit its assumption that these effects are temporary.

Ultimately, the most important message from the December minutes is that the Fed is not on autopilot. The 9–3 vote, the careful language around inflation risks and the slow projected pace of future cuts all point to a central bank that is still deeply engaged in balancing its dual mandate, rather than acting as a one-way source of support for markets.

8. Conclusion: A Cautious Cut in a Fragile Equilibrium

The December rate cut may go down in history as a small move, but the debate behind it captures a larger story. After several years of elevated inflation and rapid policy tightening, the Fed is trying to navigate a return toward normality without undermining the progress it has made. Some officials are more worried about growth and employment, others about price stability and financial excesses. Both sets of concerns are legitimate, and the minutes show a committee trying to weigh them in real time.

For observers and investors, the lesson is straightforward: do not mistake a single cut for a wholesale shift in regime. The Fed’s baseline path of only a few additional cuts over the next two years, combined with continued sensitivity to incoming data, suggests that policy will remain moderately restrictive even as headline rates move lower.

In that sense, the December minutes are neither thrilling nor dramatic. They are, instead, a reminder that monetary policy in the post-pandemic world is likely to be characterized by nuance, incrementalism and frequent reassessment. The days of one-directional guidance may be behind us; the age of constant recalibration has begun.

Disclaimer: This article is for educational and analytical purposes only and does not constitute financial, investment or legal advice. Economic conditions and policy decisions can change rapidly. Readers should conduct their own research and consider consulting qualified professionals before making financial or investment decisions.