November Jobs Report: A Cooling US Labor Market And The Next Phase For Crypto

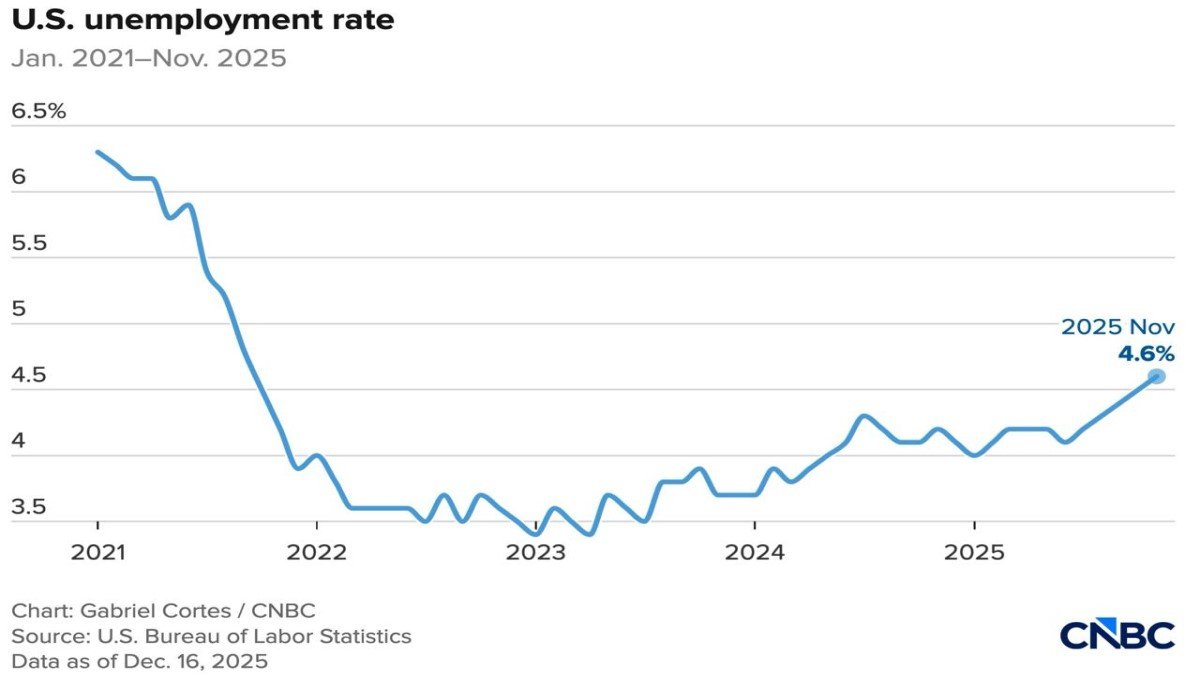

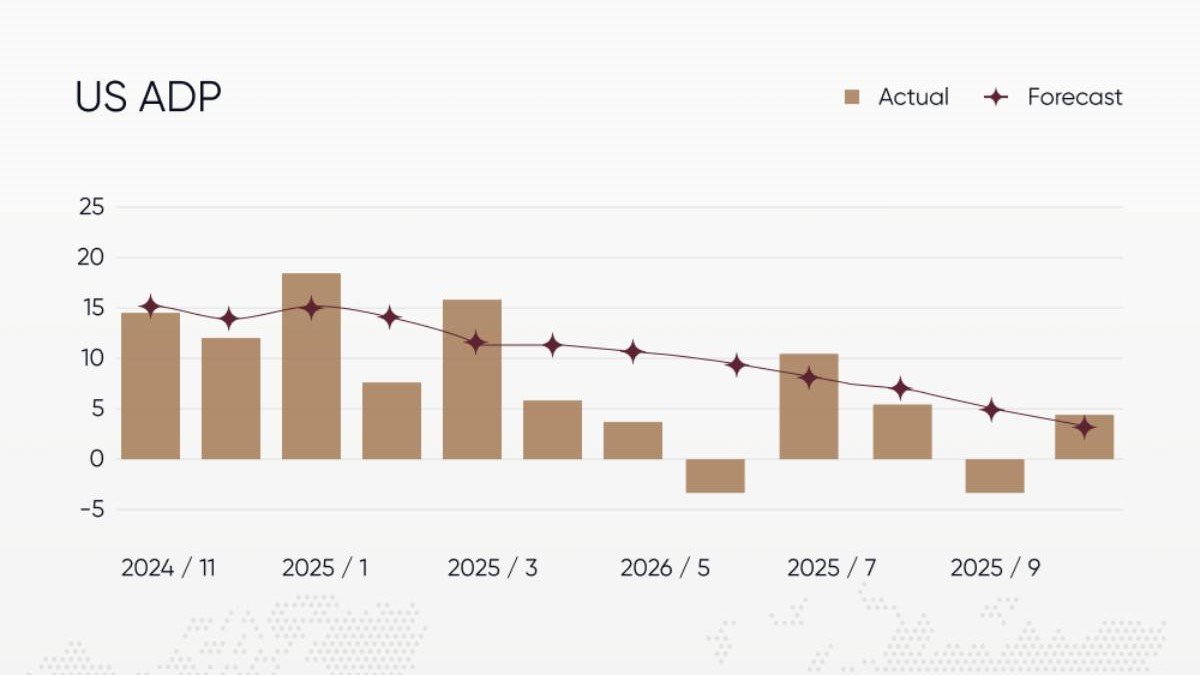

The latest labor market figures from the United States arrived without dramatic surprises, but they carry important signals for interest rates, traditional assets and digital currencies. In November the unemployment rate climbed to 4.6 percent, compared with 4.4 percent in October and a consensus forecast of 4.5 percent. Nonfarm payrolls rose by 64 thousand jobs, modestly above expectations of 50 thousand but far below the 119 thousand increase recorded the previous month. Meanwhile average hourly earnings grew 3.5 percent year over year, a step down from 3.8 percent previously and slightly below the market view of 3.6 percent.

At first glance these numbers look mixed. The economy is still adding jobs, yet unemployment is drifting higher and pay increases are losing momentum. When we place the report in its multi year context, a clearer picture emerges. The United States appears to be transitioning from a very tight post pandemic labor market toward a cooler, late cycle environment. For policy makers, investors and participants in the digital asset ecosystem, this shift matters more than the small gap between actual data and forecasts.

1. From Overheating To A Controlled Slowdown

To understand why a 4.6 percent unemployment rate is seen as a sign of cooling rather than crisis, it helps to recall where the economy has come from. In 2021 and early 2022, the jobless rate fell to the low 3 percent range while monthly job creation regularly exceeded 300 thousand. Massive fiscal stimulus, reopening demand and easy monetary policy combined to create one of the tightest labor markets in modern US history.

That phase is now firmly behind us. Since mid 2023 the unemployment rate has been edging up, and hiring has settled into a lower, more sustainable range. November’s 64 thousand net new jobs follow a distorted October figure that showed a loss of roughly 105 thousand positions, largely due to reductions in government payrolls and technical disruptions in data collection. On a three or six month basis, the pace of job creation is clearly weaker than during the peak boom years but still positive.

Unemployment at 4.6 percent is higher than the trough, yet it remains below the average of the past two decades. In other words, the labor market is softening, not collapsing. For the Federal Reserve, that distinction is crucial. A gentle rise in joblessness gives room for inflation to slow without forcing emergency action to support growth.

2. Sector Dynamics: Where Jobs Are Gained And Lost

The headline numbers also hide important differences across industries. The November report shows that job gains were concentrated in health care related services and parts of construction. These segments tend to be less sensitive to short term shifts in interest rates and more tied to demographics, public investment and long term demand.

By contrast, sectors such as transportation, warehousing and some areas of leisure and hospitality saw weaker hiring or net job losses. Many of these industries enjoyed a strong rebound in the first years after the pandemic, supported by elevated goods consumption and pent up travel demand. As those temporary forces fade, employers are adjusting staffing back toward more normal levels.

For investors this sector breakdown is a reminder that a single unemployment figure does not tell the whole story. Some parts of the economy remain resilient, while others are undergoing a gradual recalibration after unusual pandemic era swings. Equity portfolios that lean heavily on cyclical, rate sensitive companies will experience the slowdown very differently from portfolios focused on defensive or health care names.

3. Wage Growth: Slower Pressure, Lower Inflation Risk

Perhaps the most market relevant element of the report is the trend in wages. Average hourly earnings increased just 0.1 percent over the month and 3.5 percent compared with a year earlier. That is still healthy by historical standards, but clearly below the peak rates seen in 2022, when wages were climbing by more than 5 percent annually.

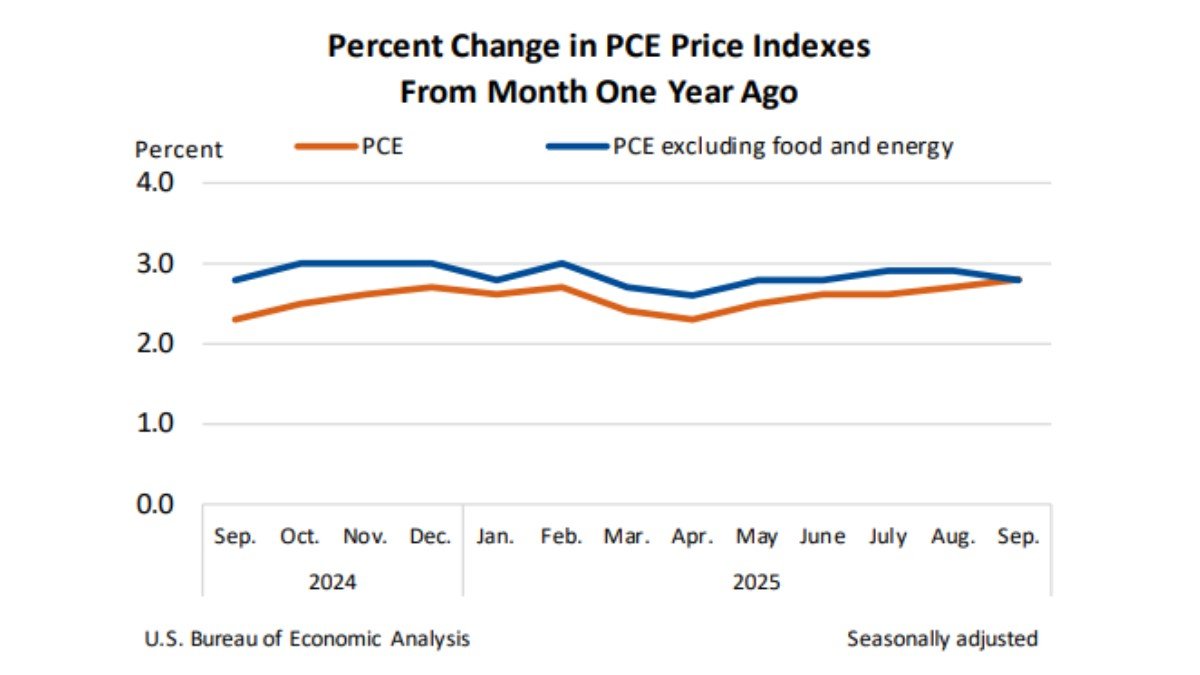

For the Federal Reserve, decelerating wage growth is a welcome sign. Services inflation, especially in categories like hospitality, health care and education, is heavily influenced by labor costs. When wage growth slows in a broad based way, it becomes easier for overall inflation to converge toward the Fed’s 2 percent target without requiring extremely restrictive monetary policy.

From the perspective of households, the story is more complex. Prices for many essentials remain high compared with pre pandemic levels, even if the pace of increase has slowed. When wage gains cool, purchasing power can feel squeezed. This tension helps explain why consumer sentiment surveys sometimes remain subdued even when the technical definition of a recession has not been met.

4. What The Numbers Mean For Fed Policy

How is the Federal Reserve likely to interpret this mix of slightly higher unemployment, modest job creation and slower wage growth? The answer is that the data fit reasonably well with the central bank’s current narrative. Officials have been signalling that they want to see continued progress on inflation and a gradual cooling of labor conditions, but they are not seeking a sharp contraction in employment.

November’s report moves the economy a little further along that desired path. The labor market is no longer overheating; demand for workers is still present but has clearly softened, and pay pressures are easing. At the same time there is no spike in job losses that would justify urgent rate cuts. For that reason, most analysts expect the Fed to keep its policy rate unchanged at the next meeting and to wait for several more data points before considering an easing cycle.

In short, the report reduces the odds of additional rate hikes but does not yet support an aggressive pivot toward cuts. Markets that were hoping for an imminent shift in January are therefore likely to be disappointed, while those concerned about a rapid tightening of financial conditions can take some comfort from the absence of strong inflationary signals.

5. Implications For Bonds, Equities And The Dollar

For the US Treasury market, the combination of softer wages and higher unemployment reinforces the idea that longer term yields do not need to climb much further. Investors who buy government bonds care primarily about future policy rates and long run inflation. A labor market that is cooling without breaking suggests that the Fed will eventually be able to reduce rates as inflation falls, though not immediately. That prospect tends to cap yields and may encourage some investors to extend duration gradually.

Equity markets face a more nuanced balance. Lower wage pressure can help protect corporate profit margins, especially in labor intensive industries. On the other hand, slower job growth and subdued income gains can limit revenue growth, particularly for companies dependent on discretionary consumer spending. As a result, leadership within stock indices may continue to rotate toward firms with strong balance sheets, pricing power and exposure to secular themes such as artificial intelligence, electrification and digital infrastructure.

The US dollar sits at the intersection of these forces. High relative interest rates and a resilient labor market have supported the dollar in recent years. As markets look ahead to eventual rate cuts, that support may gradually weaken, particularly if other central banks move in a similar direction. However, as long as the US economy remains comparatively strong, demand for dollar assets is unlikely to vanish. For global investors in both traditional and digital assets, the dollar path remains a central variable.

6. Why Crypto Investors Should Care About A Jobs Report

At first glance a labor market update might seem far removed from Bitcoin, Ethereum and other digital assets. Yet macro indicators like employment, inflation and interest rates are key drivers of liquidity and risk appetite, two variables that shape crypto cycles just as much as they influence equities and bonds.

When the labor market is extremely tight and inflation is high, central banks tend to keep policy restrictive. Elevated rates raise the opportunity cost of holding volatile assets that do not generate cash flow. They also make it more expensive for traders and institutions to use leverage. This environment can compress valuations across the risk spectrum, from growth stocks to digital assets.

Conversely, when data show a controlled cooling in employment and wages, central banks gain more flexibility to ease policy over time. Even if actual rate cuts are months away, markets begin to price a friendlier liquidity backdrop. For Bitcoin, which is often treated as a long duration asset, expectations about future liquidity can matter as much as the present level of economic activity.

The November report nudges the narrative in that direction. It reinforces the view that the peak of the tightening cycle is behind us and that the next significant move in policy rates is likely downward, albeit not immediately. For long term holders of digital assets, that trend tends to be supportive, even if short term price action is dominated by positioning, sentiment and idiosyncratic events.

7. A Late Cycle Setting For Digital Assets

Putting these elements together, the macro environment facing crypto investors can be described as late cycle but still open ended. Growth is slowing, inflation is moderating and policy rates are high yet likely close to their peak. Central banks are not racing to cut, but neither are they trying to engineer further sharp slowdowns.

In such an environment several patterns are common:

- Institutional investors become more selective, favouring larger and more liquid assets over highly speculative tokens.

- Volatility clusters around data releases and policy meetings, as each new signal about growth or inflation prompts repricing of the future rate path.

- Long term narratives gain importance, from the tokenization of real world assets to the role of stablecoins and the gradual integration of blockchain based settlement into mainstream finance.

For Bitcoin and major digital assets, this setting can feel frustrating in the short run. Prices may lack clear direction, swinging between optimism and caution as each macro headline hits. Yet from a structural perspective, a controlled cooling of the economy combined with slow but steady integration of on chain infrastructure creates fertile ground for the next sustained cycle once policy eventually turns.

8. How To Read The Data Without Overreacting

A common mistake among market participants is to treat every single data release as a turning point. In reality, most reports simply add one more dot to the picture. The November labor numbers are best viewed as another confirmation that the United States is gliding down from an overheated post pandemic boom toward a more balanced, if slower growing, state.

For portfolio construction, the key questions are not whether the unemployment rate is 4.5 or 4.6 percent in a given month. More important is whether the trend points toward a soft landing, a mild recession or a renewed inflation flare up. Each scenario implies a different path for interest rates and risk premiums, and therefore different outcomes for both traditional and digital assets.

Investors can use the current data to stress test their assumptions. Are they relying on very rapid rate cuts that may not materialise if the labor market remains only moderately weak? Have they considered how assets with longer duration, such as growth stocks and Bitcoin, might perform under a scenario of rates staying elevated a bit longer but eventually moving lower? Are they prepared for the possibility that the path to lower inflation is uneven, with occasional setbacks that trigger periods of market volatility?

9. Takeaways For Long Term Participants

Several educational lessons stand out from this jobs report and its interaction with markets:

• The November data confirm a cooling but not collapsing labor market. Job creation continues, unemployment is rising gradually and wage pressures are easing.

• The Federal Reserve is unlikely to react with immediate policy changes. The report supports a pause, not an urgent cut, reinforcing the message that rates may stay high for a little longer even as the next move is expected to be downward.

• For bonds and equities, the environment favours careful rebalancing rather than drastic shifts. Longer maturity bonds become more interesting as inflation risks fade, while equity investors need to distinguish between sectors that can grow in a slower economy and those that depend on rapid demand expansion.

• For digital assets, macro indicators like this jobs report are a reminder that liquidity and risk appetite are macro driven variables. Price cycles in Bitcoin and other assets are tightly connected to the path of policy rates and the availability of capital.

• Separating short term price noise from long term structural progress is essential. While monthly data can move markets for a few days, the deeper story for crypto remains the gradual build out of infrastructure, regulation and institutional participation.

In that sense, the rise of the US unemployment rate to 4.6 percent is not merely a domestic statistic. It is one piece of a larger puzzle that determines how quickly central banks can step back from restrictive policy, how global investors allocate capital and how the next phase of digital asset adoption unfolds.

Disclaimer: This article is for educational and informational purposes only and does not constitute investment, legal or tax advice. Digital assets are volatile and carry risk. Always conduct your own research and consult a qualified professional before making financial decisions.