PCE at 2.8%, Gold Up, Bitcoin at $89K: Why the Fed’s Focus Is Quietly Shifting to Jobs

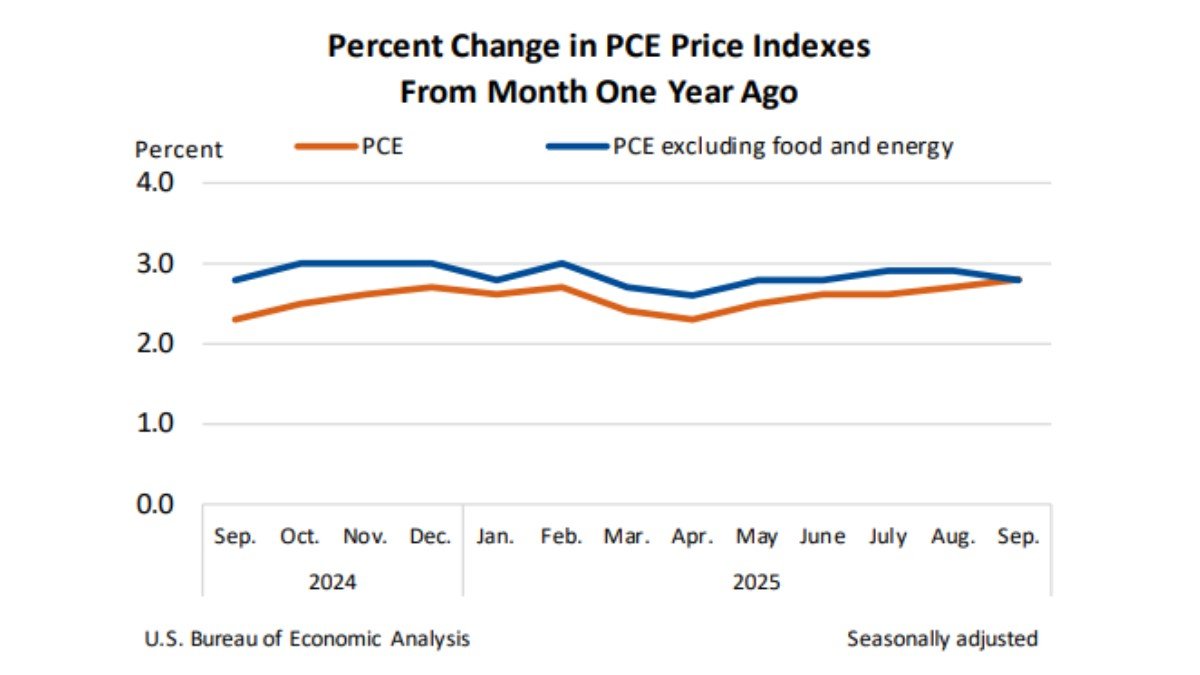

The latest US inflation update landed exactly where many economists expected – and still managed to move markets in very different directions. Headline PCE inflation printed at 2.8% year-on-year in September, with a 0.3% month-on-month increase. Core PCE, which strips out food and energy, also came in at 2.8% year-on-year and 0.2% month-on-month.

On paper, that is a remarkably tidy set of numbers: not “victory” for the Federal Reserve, but close enough to its 2% inflation goal that nobody is talking about emergency tightening. Gold responded by pushing higher, reflecting growing expectations that the next major move in policy rates will be downward. Bitcoin, by contrast, slid toward the $89,000 area, giving back recent gains even as the macro backdrop became slightly more supportive.

To make sense of this divergence, you have to look beyond the headline print. The key story is not just that inflation is still under control, but that the balance of risk inside the Fed’s dual mandate is changing. Prices remain elevated but manageable. The labour market, by contrast, is clearly slowing. That shift matters for every risk asset, from long-dated bonds and gold to Bitcoin and the broader crypto complex.

1. PCE: The Inflation Gauge the Fed Actually Watches

Most headlines still quote CPI, but the Federal Reserve’s preferred inflation metric is the Personal Consumption Expenditures (PCE) price index. PCE is built from national accounts data and uses a flexible, chain-weighted approach that captures how consumers substitute between goods over time. Because of that design, it tends to give a more comprehensive view of household spending than CPI, which is based on a fixed basket of goods and services.

Within PCE, policymakers pay particular attention to core PCE – inflation excluding food and energy. It is not that food and energy do not matter; they matter a lot to household budgets. But those prices can be dominated by short-term supply shocks, so core measures are often used to infer the underlying trend in inflation.

The Fed’s formal target is 2% inflation over time, expressed in terms of PCE. Since the 2021–2023 inflation surge, when supply disruptions and aggressive fiscal and monetary stimulus pushed price growth well above that level, the central bank has tightened policy sharply. That tightening has brought inflation down from peaks above 5% on the PCE measure to the high-2% range today.

Against this backdrop, a 2.8% core PCE reading that is slightly below the consensus forecast reinforces a simple message: inflation is no longer the out-of-control problem it was two years ago. Price pressures are still there, but they are drifting rather than surging.

2. Reading the September Print: Stable, Not Spectacular

The September report is notable for its lack of surprises. Headline PCE rose 0.3% on the month and 2.8% versus a year earlier. Core PCE increased 0.2% month-on-month and 2.8% year-on-year, coming in marginally softer than the 2.9% many economists had pencilled in.

A few implications follow from that pattern:

• Momentum is steady. Monthly gains of 0.2–0.3% annualise to roughly 2.4–3.6% inflation. That is still above the Fed’s goal, but it is a far cry from the rapid price increases seen during the mid-2020s inflation shock.

• Core inflation is cooling at the margin. The fact that core PCE undershot expectations, however slightly, adds weight to the idea that underlying pressures are easing rather than re-accelerating.

• There is no clear reason to tighten more. If anything, the data strengthen the case for holding rates steady and waiting for earlier hikes and balance-sheet reduction to work through the economy.

This is exactly the sort of environment in which markets begin to talk less about whether the Fed will hike again and more about when and how fast it might cut. That change in narrative is part of why gold rallied on the release: lower expected real interest rates tend to support precious metals by reducing their opportunity cost relative to interest-bearing assets.

3. Why Gold Rallied While Bitcoin Slipped to $89K

At first glance, it might seem odd that Bitcoin retreated toward $89,000 on a day when the macro narrative arguably became more friendly to risk assets. After all, lower long-run rates and a more patient Fed are usually described as “good for crypto.” Why did gold catch a bid while BTC sold off?

There are at least three overlapping explanations:

1. Positioning and profit-taking. Gold had not run as hard as many other risk assets into the data, leaving more room for a relief rally. Bitcoin, by contrast, was already trading near elevated levels. For traders who rode the previous leg higher, a “comfortable” PCE print was a convenient moment to lock in profits or rebalance.

2. Different roles in portfolios. Gold remains the classic hedge against monetary easing and currency debasement. When investors think “Fed closer to cuts,” gold is a familiar and liquid expression of that view. Bitcoin is increasingly seen as a macro asset too, but it still carries a higher beta to overall risk sentiment and to positioning in derivatives markets.

3. Short-term liquidity dynamics. In the near term, flows in futures, options and leveraged products can dominate how BTC trades around macro events. Liquidations, hedging and basis trades can produce intraday moves that have more to do with microstructure than with a slow-moving indicator like PCE.

In other words, the PCE print and the Bitcoin price move are not in contradiction. The data arguably improve the medium-term environment for digital assets, but the path from macro signal to price runs through a complex network of positioning, leverage and sentiment.

4. The Fed’s Dual Mandate: Inflation Is No Longer the Only Star

To understand why this particular PCE report feels like a turning point, it is helpful to revisit the Federal Reserve’s dual mandate: maximum employment and stable prices. When inflation is far above target, it tends to dominate the conversation. When inflation is near target, the employment side of the mandate becomes more prominent.

With PCE at 2.8%, the Fed can no longer justify extremely restrictive policy solely on the basis of runaway inflation. That does not mean cuts are automatic, but it does mean that other data – especially labour-market indicators such as payroll growth, unemployment claims and wage trends – will carry more weight.

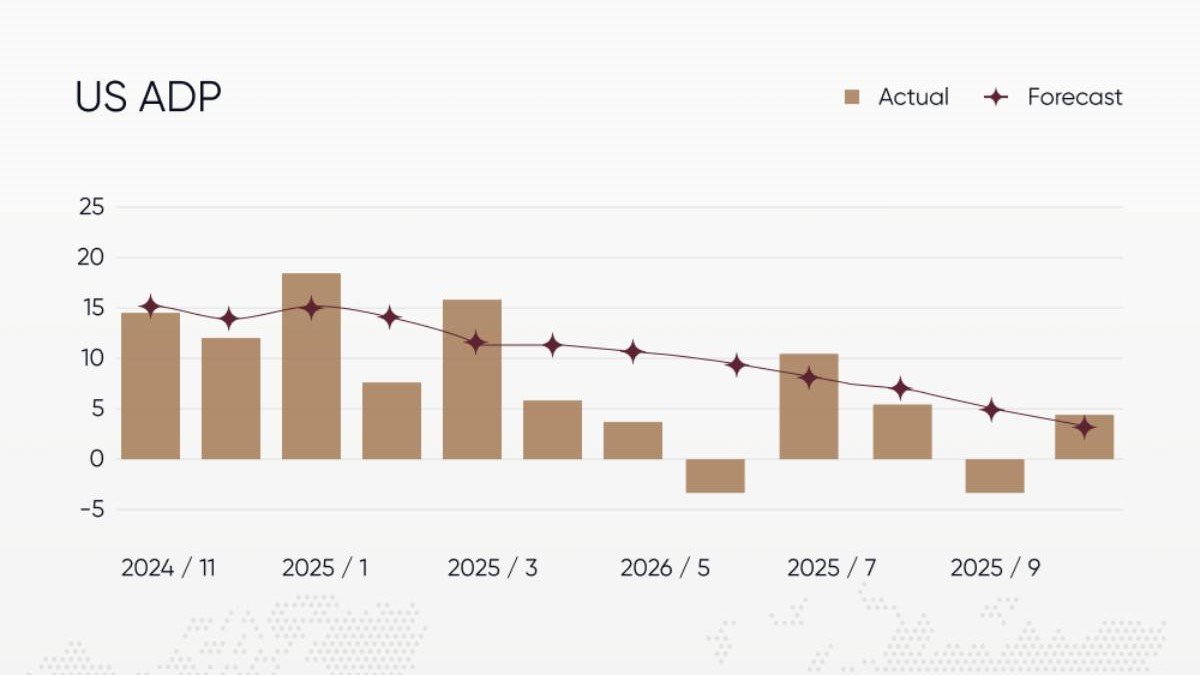

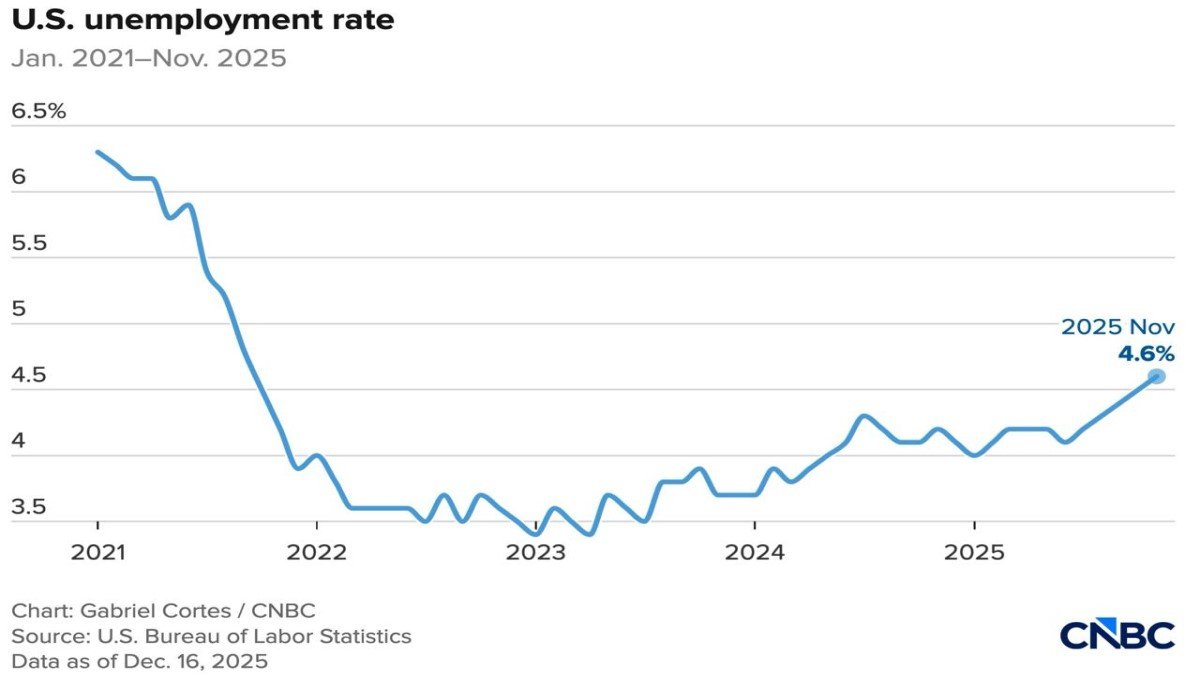

Recent reports from private payroll trackers and official statistics have pointed to a cooling labour market: slower job creation, some uptick in unemployment from cycle lows and early signs that wage growth is moderating. None of this screams “crisis,” but it is consistent with an economy that is gradually decelerating under the weight of higher borrowing costs.

Combine near-target inflation with softening employment and the risk balance inside the Fed’s framework tilts. Instead of asking, “Are we doing enough to fight inflation?” policymakers increasingly have to ask, “Are we risking unnecessary damage to the job market?” That is a very different conversation for markets.

5. From QT and Tight Liquidity to a Gentler Backdrop

Monetary policy is not only about the policy rate; it is also about the size and composition of the Fed’s balance sheet. Over the past two years, the central bank has been running quantitative tightening (QT), allowing bonds to mature without reinvestment and thereby slowly draining reserves from the banking system. Combined with heavy Treasury issuance, that process has contributed to a persistently tight liquidity backdrop.

As the cushion of excess bank reserves has thinned, the risk of renewed funding stress has crept higher. In the previous cycles, something similar happened in 2019, when shrinking reserves contributed to a spike in repo rates and forced the Fed to intervene to stabilise funding markets.

With PCE inflation now in the high-2% range rather than at 5–6%, the Fed has more flexibility to slow or stop QT if liquidity strains intensify. Markets have already begun to price in that possibility, particularly after recent signs that key liquidity buffers in the system – such as the Fed’s reverse repo facility – have been largely drawn down.

For risk assets, the combination of:

- Stable-to-cooling inflation,

- A softer labour market, and

- A potential end to balance-sheet tightening

is very different from the environment of 2022–2023. It is, in many ways, the first step toward a neutral or even supportive liquidity regime, even if formal rate cuts are still months away.

6. What This Macro Mix Means for Crypto

For Bitcoin and the broader crypto market, the PCE print and the evolving Fed narrative carry implications on several time horizons.

6.1 Short term: Volatility and Repositioning

In the short run, macro data often act as catalysts for positioning resets. A softer-than-feared inflation backdrop can trigger profit-taking in crowded trades, especially if leverage has built up in derivatives. The move toward $89,000 should be read partly through that lens: after a strong prior advance, some participants may simply be rotating into assets (like gold or long-duration bonds) that they perceive as more direct plays on a lower-rate narrative.

6.2 Medium term: Correlation with Liquidity

Over horizons of months rather than days, crypto returns have historically been sensitive to global liquidity conditions. When central banks are shrinking balance sheets and real yields are rising, digital assets tend to struggle. When liquidity is expanding – or at least not contracting – they tend to do better, even if the business cycle is mixed.

A PCE path that drifts gradually toward 2% opens the door to precisely this sort of environment: one in which the Fed can pause QT, avoid further hikes and eventually consider gradual cuts without appearing to abandon its inflation mandate.

6.3 Long term: Narrative Reinforcement

At the longest horizon, the macro narrative around Bitcoin still revolves around three themes: digital scarcity, hedging against long-run monetary uncertainty and participation in a growing digital-asset ecosystem. A world where inflation is not out of control but where public debt is high and policy has to balance many competing goals still leaves room for all three narratives to coexist. A stable-but-elevated PCE path simply reinforces the idea that monetary policy will continue to adapt – sometimes in ways that are difficult to predict – over the coming decade.

7. The Labour Market Becomes the Swing Factor

The most important takeaway from the September PCE print is not the exact decimal point on inflation, but what it implies about the Fed’s next decision variable. With prices behaving relatively well, the labour market becomes the swing factor that will determine the timing and pace of policy easing.

A few scenarios illustrate why this matters:

• Soft landing. Inflation continues to inch lower, job growth slows but remains positive and unemployment rises only modestly. In this world, the Fed can cut rates slowly, perhaps beginning in 2026, and risk assets may enjoy a relatively benign environment with lower volatility and gradual gains.

• Harder landing. Labour-market data deteriorate more quickly: rising jobless claims, weaker payrolls, more visible layoffs. The Fed may be forced to cut rates sooner and more aggressively to support employment, but risk assets could experience a choppy period as earnings expectations adjust and recession fears flare up.

• Inflation re-acceleration. A less likely but still possible path: supply shocks or renewed demand push PCE back up. In that case the Fed’s job becomes harder again, and the market has to price the risk of higher-for-longer rates.

In all three scenarios, labour data now matter as much as – or more than – inflation. For macro-sensitive assets such as Bitcoin, that means the market’s daily conversation will shift from “What did CPI/PCE do?” to “What did payrolls and wages do?”

8. Educational Takeaways: How to Read PCE in a Crypto-Aware Way

For readers who follow crypto but are still getting comfortable with macro data, the September PCE report is a useful case study. A few practical principles stand out:

1. Look at the trend, not just the print. A single 2.8% reading means little on its own. What matters is that PCE has moved from well above 3–4% back into the high-2% range over time, signalling that the inflation shock has largely been contained.

2. Core often carries more information than headline. Food and energy noise can obscure the signal. Core PCE at 2.8% with 0.2% month-on-month growth is a clear sign that underlying price pressures are easing at the margin.

3. Map data to the Fed’s reaction function. The Fed cares about inflation and employment together, not separately. When one side of the mandate is close to target (prices), the other side (jobs) gains influence.

4. Connect macro to liquidity, then to assets. Inflation affects interest-rate expectations; those expectations affect liquidity and funding conditions; liquidity affects valuations across equities, bonds, real estate and digital assets. The path from PCE to Bitcoin is indirect but very real.

5. Do not treat any macro release as a trading signal on its own. PCE, payrolls, GDP and other indicators are best used to build a coherent framework rather than to justify overnight reactions.

Viewed through this lens, the September PCE report is less about a single inflation number and more about a phase change in the macro story: from a world dominated by inflation risk to one where employment and growth dynamics share the stage.

9. Conclusion: A Quiet but Important Inflection Point

The September PCE data will not go down as a dramatic moment in macro history. There was no upside surprise, no sudden collapse in prices, no immediate policy announcement. Yet beneath the calm surface, something important is happening. Inflation, as measured by the Fed’s preferred gauge, is now hovering near – though still slightly above – the central bank’s target. That gives policymakers more room to worry about the labour market and less reason to tighten further.

Gold has started to reflect this change, rising on the expectation that the era of relentless rate hikes is behind us and that the next major shift will be toward easier policy. Bitcoin, in the short term, has reacted more like a high-beta risk asset, selling off toward $89,000 as traders rebalance and reassess positioning. Over a longer horizon, however, a world of stable inflation, cautious rate cuts and gradually improving liquidity is far from the worst environment for digital assets.

For now, the message from PCE is one of stability with a tilt toward easing. The bigger swings ahead are likely to come from labour-market data and from how quickly the Fed feels comfortable pivoting from fighting inflation to supporting employment. For investors trying to understand where Bitcoin, gold and other assets fit in a changing macro regime, that shift in emphasis may be the most important signal of all.

Disclaimer: This article is for informational and educational purposes only. It does not constitute financial, investment, legal or tax advice, and it should not be treated as a recommendation to buy, sell or hold any digital asset or traditional financial instrument. Markets are volatile and involve risk, including the possible loss of capital. Readers should conduct their own research and, where appropriate, consult qualified professionals before making any financial decisions.