A Rare “Everything Green” Session: What Markets May Be Saying After the U.S.–Venezuela Weekend Shock

Some sessions feel like a debate. Others feel like a shrug. This one felt like a collective exhale—an early-2026 Monday where U.S. stocks opened higher, crypto pushed up, precious metals climbed, and even crude oil was green. After a weekend dominated by dramatic headlines around U.S.–Venezuela, the market’s first instinct was not to pick a moral side or forecast a final geopolitical outcome. It was to re-price uncertainty.

That matters because markets don’t trade “right vs. wrong.” They trade the second-order consequences: supply constraints, policy risk, risk premia, and the availability of liquidity. When almost everything rises at once, it can look like a simple “risk-on” stampede. In reality, it often signals something subtler: investors are buying optionality across regimes—growth exposure (equities), monetary hedges (gold), and alternative liquidity rails (crypto)—while the fundamental story is still unresolved.

1) The opening snapshot: a synchronized green screen

Let’s start with the facts on the screen. By late morning in the U.S. session, major indices were positive, crypto was higher, and metals were leading. Oil was also up, which is what makes this session unusual: the common “risk-on” pattern typically pairs rising equities with softer oil (on supply expectations) or softer gold (on reduced fear). Here, the market chose breadth.

Below is the cross-asset snapshot from the dashboard image you provided. Treat it as a moment-in-time reading—useful not because it predicts the next week, but because it reveals the market’s first interpretation of shock: not panic, but repricing.

| Asset | Level | Change | % | Timestamp (EST) |

|---|---|---|---|---|

| DJIA | 49,018.15 | +635.76 | +1.31% | 10:40:14 AM |

| S&P 500 | 6,908.20 | +49.73 | +0.73% | 10:40:14 AM |

| NASDAQ | 23,441.371 | +205.743 | +0.89% | 10:40:14 AM |

| Bitcoin | 93,643.28 | +2,383.91 | +2.61% | 10:40:26 AM |

| Ether | 3,180.70 | +41.98 | +1.34% | 10:40:26 AM |

| Solana | 135.74 | +1.78 | +1.33% | 10:40:25 AM |

| Gold* | 4,453.90 | +124.30 | +2.87% | 10:30:51 AM |

| Silver* | 76.55 | +5.535 | +7.79% | 10:30:51 AM |

| Oil* | 57.96 | +0.64 | +1.12% | 10:31:11 AM |

*Levels shown are from the dashboard snapshot and may reflect specific futures contracts or reference pricing on that feed.

2) Why “everything up” can happen without contradicting itself

It feels counterintuitive: if geopolitical tension rises, shouldn’t equities fall and oil rise? If risk appetite returns, shouldn’t gold cool off? The truth is that markets are not forced to pick just one story at the open. When uncertainty spikes, investors often buy multiple expressions of “I want to be covered if the narrative turns.” That can lift equities and lift hedges—especially when positioning was cautious going in.

Think of this session as a choreography of three motives: relief, hedging, and liquidity. Relief bids show up in equities and high-beta crypto. Hedging shows up in gold (and often silver, which can behave like a leveraged cousin of gold). Liquidity shows up as “broad participation”—where desks would rather own optionality than sit out and miss a potential trend day.

Relief: the absence of immediate escalation can be bullish. Weekend shocks create a gap risk. If Monday opens without fresh deterioration, markets can rally simply because the worst-case path did not immediately materialize. This isn’t optimism; it’s math. Risk premia widen on uncertainty and can compress quickly when the feared tail doesn’t arrive on schedule.

Hedging: gold rising does not always mean panic. Sometimes gold rises because the market is hedging policy consequences (sanctions, fiscal moves, inflation pathways) rather than imminent conflict. Gold can be less about fear and more about “I don’t trust the distribution of outcomes.” That’s a very 2026 kind of trade.

Liquidity: synchronized rallies often reflect positioning more than fundamentals. Early January is notorious for rebalancing flows. If money managers enter the year under-allocated to risk, a broad rally can be the fastest way to normalize exposure. When that happens, correlations temporarily rise: everything trades as “risk” and “hedge” simultaneously because the true driver is allocation, not conviction.

3) The oil ‘paradox’: up today, unclear tomorrow

Oil being green alongside equities and metals is the part that grabs attention, because the weekend story is fundamentally an oil story. Yet the most honest near-term assessment is also the least satisfying: the impact on oil is not clean in the short run. That ambiguity is not a weakness—it’s the core variable.

In market commentary attributed to a Goldman Sachs view, the near-term oil effect of a change in Venezuela’s political situation was described as unclear: production could rise if a U.S.-backed government is established and sanctions are relaxed, but the market may remain in “wait-and-see” mode rather than pricing a single scenario immediately. That framing matches what the tape is showing: oil is up, but not acting like the market has confidently priced a large supply surge.

Here’s the deeper logic. The oil market is not just a story about reserves; it’s a story about flow and friction. Even if a path to higher Venezuelan production exists, the timeline is not overnight. Heavy oil requires infrastructure, blending, maintenance, and stable operating conditions. If traders can’t confidently map a timeline, they don’t price it aggressively. They hedge it.

Why oil can rise even if “more supply” is a plausible future:

• Risk premium: uncertainty around shipping, insurance, and regional stability can add a short-term premium.

• Implementation lag: rebuilding capacity and restoring exports is operationally slow.

• Policy gating: sanctions relief and contractual clarity are political decisions, not engineering decisions.

• Demand narrative: if equities are green on growth/AI optimism, demand expectations can support oil even with future supply hopes.

4) Gold and silver didn’t just rally—they spoke

Gold up nearly 3% and silver up nearly 8% in the same window is not a “cute” detail. It suggests the market is not treating the weekend event as a single-asset story. Metals typically respond to the perceived stability of the monetary and geopolitical environment. A strong move in silver often implies an additional layer: positioning and momentum. Silver can behave like a high-beta monetary hedge.

One way to interpret the metals move is that the market is pricing policy aftershocks more than battlefield outcomes. If investors believe the next chapter includes sanctions changes, fiscal re-prioritization, or inflation-sensitive energy dynamics, then gold becomes a way to own uncertainty without needing to forecast the exact headline sequence.

Educationally, this is a useful distinction: gold is often a hedge against regime uncertainty, not just fear. When the world transitions between regimes—policy frameworks, trade blocs, energy alliances—gold can be a tool people reach for because it’s broadly legible across systems.

5) Crypto up with everything else: not a prophecy, but a positioning tell

Bitcoin and major alt exposure were higher in the same snapshot, with Bitcoin up about 2.6%. In a broad green session, crypto often behaves as the “sentiment amplifier.” It tends to move when liquidity conditions feel supportive and when traders want convex exposure—assets that can move more than the indices if risk appetite holds.

But it’s important to keep the interpretation disciplined. A green day does not prove a long-term thesis. It proves something narrower: that, at this moment, the market is willing to express risk and hedge simultaneously. Bitcoin can be treated as both a risk-on asset (in short horizons) and a monetary alternative (in longer horizons). That dual identity is exactly why it can rise alongside equities and gold in certain regimes.

If you want a practical lens, consider this: broad rallies tend to be the market’s attempt to regain balance after a shock. Crypto’s role is often to show whether traders are embracing that balance with leverage and speed. It is less a verdict and more a diagnostic.

6) The real question: what would make this rally “stick”?

The most dangerous mistake after a synchronized green tape is to assume the market has “made up its mind.” Sessions like this can be the start of a trend—or the release valve before reality returns. The difference usually comes down to whether uncertainty narrows into a tradable base case.

Instead of predicting outcomes, a more resilient approach is to track which variables would convert ambiguity into clarity. If those variables remain unresolved, markets may stay bid but choppy—especially with macro data arriving and policy messaging evolving.

Key indicators that can change the narrative quickly:

• Sanctions and export policy: any credible signal on Venezuelan oil policy and enforcement changes the supply timeline.

• Operational updates: evidence of infrastructure repair timelines matters more than reserve estimates.

• Heavy crude spreads and refinery signals: watch what refiners pay for heavy feedstock—this is where the “heavy oil” story becomes real.

• Risk premium gauges: shipping costs, insurance chatter, and volatility markets can reveal whether stress is rising under the surface.

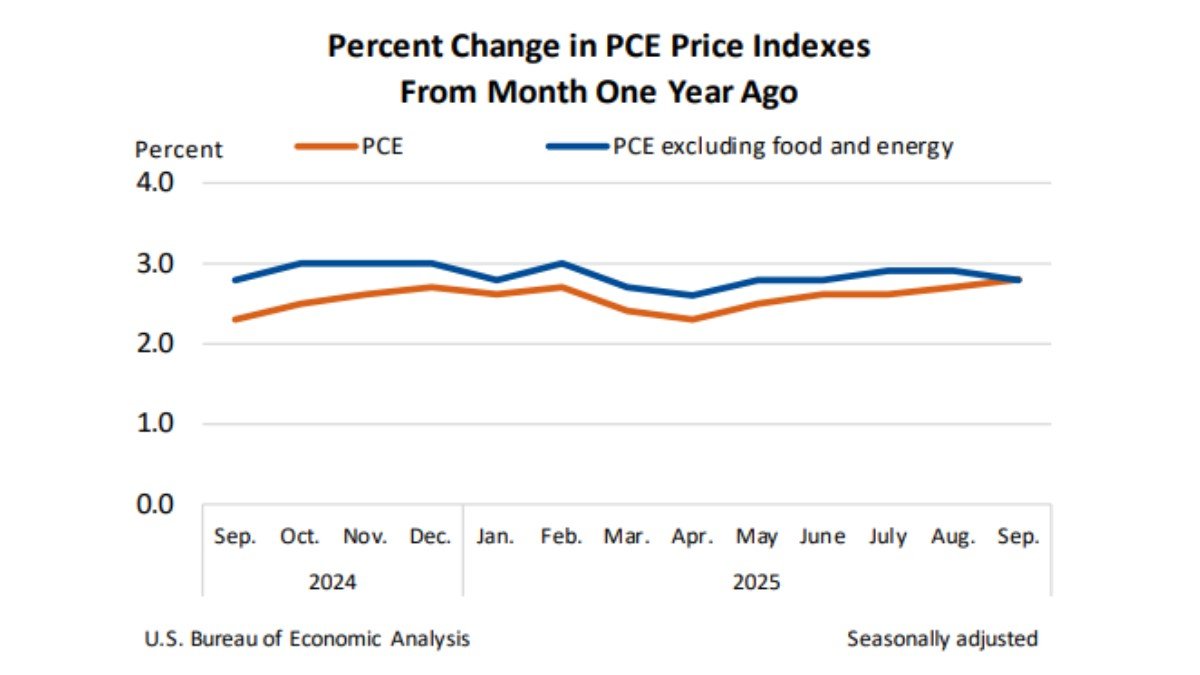

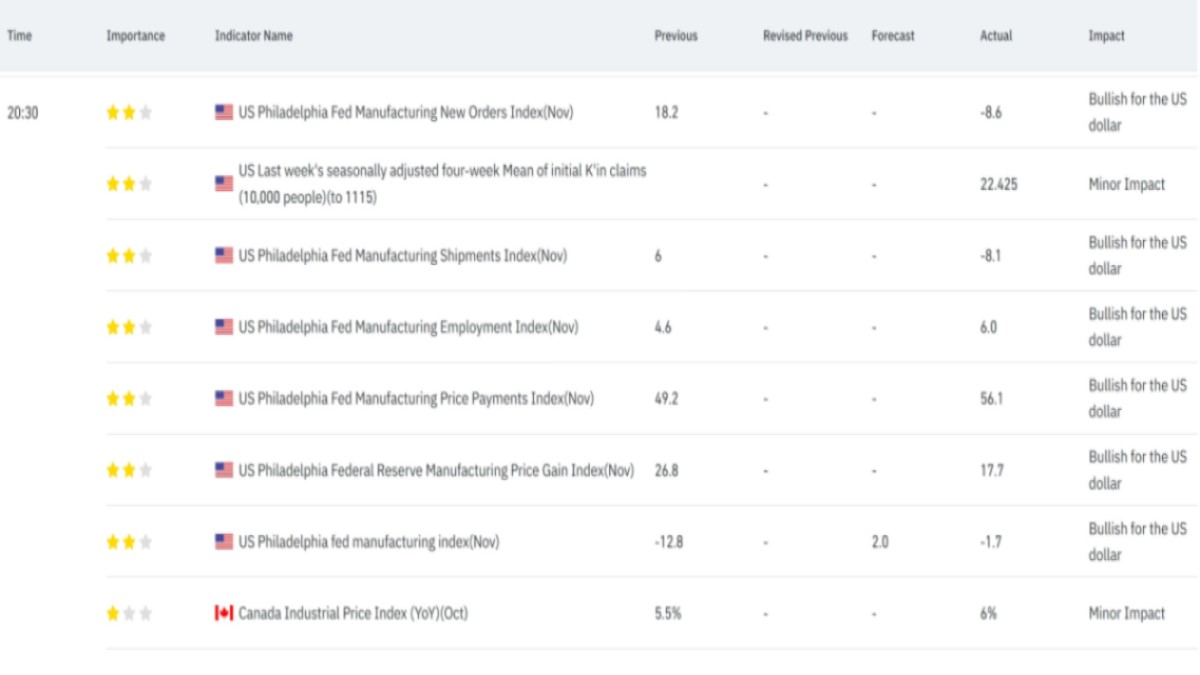

• Macro data flow: labor and inflation prints can determine whether the Fed has flexibility if energy dynamics complicate the picture.

Conclusion

This first Monday session of 2026 delivered a rare optical illusion: a market where almost everything is green at once. But the deeper meaning is not “risk-on is back.” It’s that markets are still refusing to price a single Venezuela endgame. Instead, they are buying time—owning exposure across multiple outcomes while waiting for the policy and operational details that turn a story into a timeline.

If there’s one takeaway worth keeping, it’s this: when equities, crypto, gold, silver, and oil rise together, the market is not necessarily confident. It may be adaptable. And in early 2026, adaptability—more than certainty—might be the most accurate description of how capital is behaving.

Frequently Asked Questions

Why is it unusual for stocks, gold, crypto, and oil to rise together?

Because those assets often respond to different regimes: equities to growth, gold to hedging/uncertainty, and oil to supply-demand dynamics. They can rise together when positioning shifts broadly, when uncertainty is being repriced, or when investors buy optionality across scenarios rather than commit to a single narrative.

If Venezuelan production might rise later, why didn’t oil fall immediately?

Markets price timelines, not headlines. Even if higher production is plausible, the path depends on policy decisions and operational constraints. In the short run, uncertainty can add risk premium, and traders may stay cautious rather than pre-price a best-case supply outcome.

Does a strong gold and silver move mean markets expect a crisis?

Not necessarily. Metals can rally as a hedge against regime uncertainty—policy changes, inflation pathways, or geopolitical risk premia—without implying an immediate crisis. Silver can also amplify moves due to momentum and positioning.

What does Bitcoin rising in this context actually indicate?

In the short term, it often indicates improved risk appetite and liquidity willingness. Over longer horizons, Bitcoin can also be framed as a monetary alternative. A single session mainly tells you that traders are willing to hold exposure, not that a long-term outcome is settled.

Disclaimer: This article is for educational purposes only and does not constitute financial, investment, legal, or tax advice. Markets involve risk, and geopolitical developments can evolve quickly. Consider your own circumstances and consult qualified professionals before making decisions.