US Labour Market Blinks: What a Weaker Jobs Engine Could Mean for the Next Fed Cut

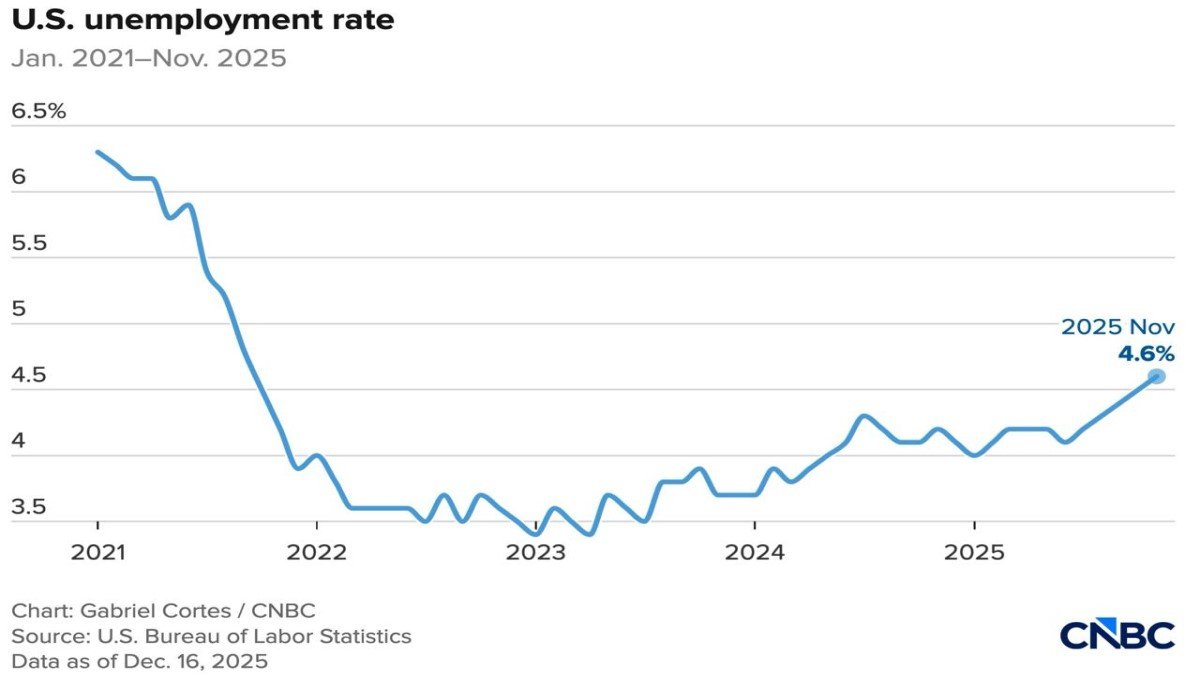

For most of the post-pandemic period, the US labour market has been the hero of the macro story. Even as growth slowed and inflation cooled, job creation remained surprisingly robust, allowing the Federal Reserve (Fed) to tighten policy without triggering a surge in unemployment. This resilience is one of the main reasons the central bank has been able to move cautiously toward rate cuts instead of rushing to support the economy.

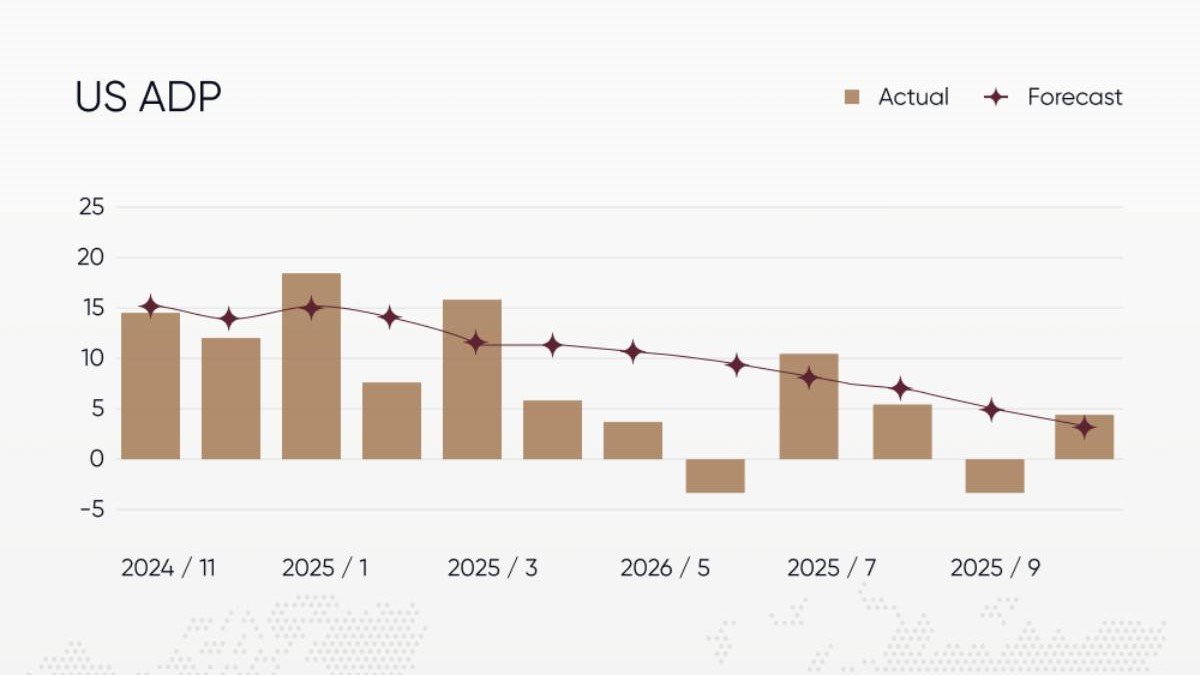

The latest private-sector employment report from ADP challenges that narrative. Instead of modest job gains, the US economy appears to have shed positions in November, and the weakness is concentrated exactly where policymakers least want to see it: among small businesses and cyclical industries that are sensitive to interest rates.

With the official non-farm payrolls report delayed until 16 December, the ADP data suddenly carries more weight than usual. Markets now view it as a key input into the Fed's 9–10 December meeting, where many investors expect another reduction in the federal funds rate. The question is no longer just whether the Fed can cut—it is whether weakening labour conditions mean it must cut to prevent a more pronounced slowdown.

1. What the ADP Report Actually Showed

ADP's November numbers surprised almost everyone. Economists had pencilled in an increase of around 10,000 private-sector jobs, expecting a continuation of the gradual cooling trend. Instead, ADP estimates that the private sector lost roughly 32,000 positions during the month.

The breakdown is even more telling:

- Small businesses (fewer than 50 employees) eliminated about 120,000 jobs. This segment has now been under pressure for several months, but the November figure marks one of the sharpest declines of the cycle.

- Manufacturing, a sector highly sensitive to both interest rates and global demand, shed around 18,000 jobs.

- Construction, which had been supported by strong demand for housing and infrastructure spending, lost approximately 9,000 jobs.

- Information technology roles declined by about 20,000, consistent with reports of renewed cost-cutting in parts of the tech industry.

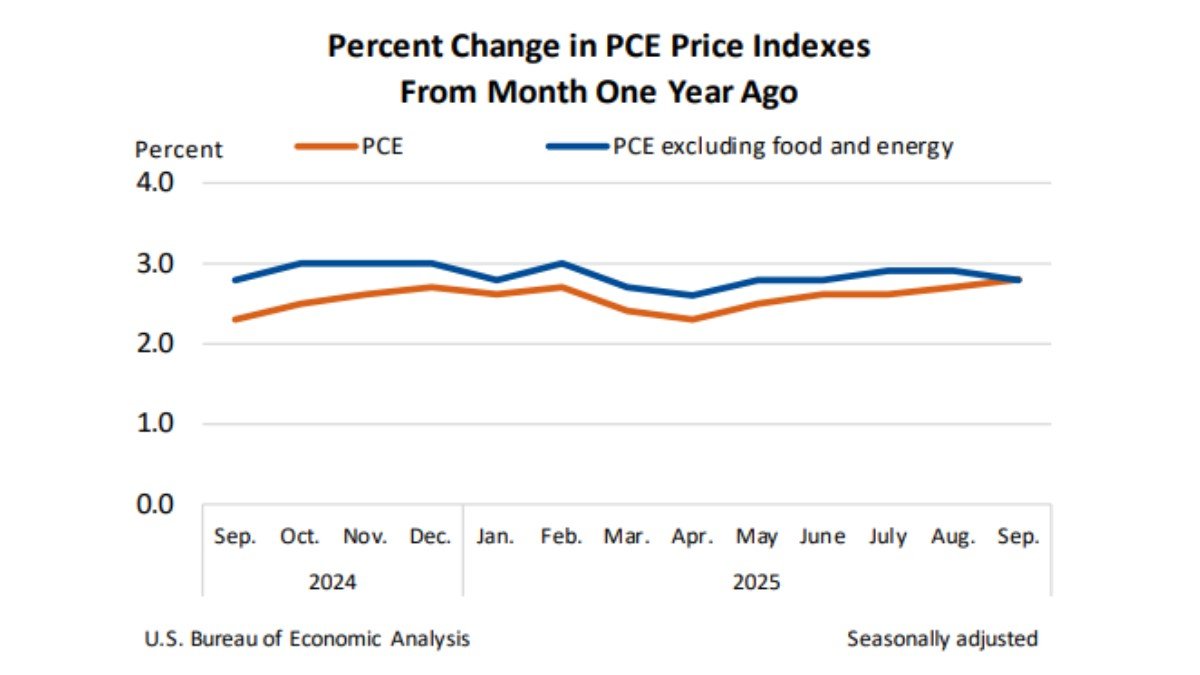

On the wage side, ADP reported that annual pay growth eased slightly from 4.5% to 4.4%. On the surface that might look like a tiny move, but it continues a gradual downtrend from the very elevated levels seen in 2022–2023. Slower wage growth is precisely what the Fed has been hoping to see as evidence that inflationary pressure is fading.

In aggregate, ADP concluded that the 'labour market's momentum is weakening, especially among smaller firms'—a phrasing that will not go unnoticed in the Eccles Building.

2. Why Small Businesses Matter So Much

Small businesses rarely dominate headlines, but they play an outsized role in the US economy. Firms with fewer than 50 employees account for a large share of job creation and are often the first to respond to changes in credit conditions. When borrowing costs are high and demand is uncertain, these companies tend to slow hiring or trim staff quickly because they have limited financial buffers.

That is why many economists view small-business employment as a 'canary in the coal mine' for the broader labour market. When small firms start cutting jobs aggressively, it can foreshadow similar behaviour by larger corporates a few quarters down the line. The November ADP report fits this pattern:

- Access to credit has tightened over the past two years as interest rates rose and banks became more cautious.

- Consumer demand is softening in some discretionary categories, squeezing margins for local retailers and service providers.

- Input costs—from wages to insurance and rent—remain elevated even as selling prices stabilise or fall.

In that context, it is not surprising that smaller enterprises are trimming payrolls. What concerns policymakers is whether this is a short-lived adjustment or the start of a broader trend that could undermine household income and demand.

3. Reading the Signals for the Federal Reserve

The Fed has a dual mandate: achieve maximum employment and stable prices. For much of 2022 and 2023, inflation was the main concern, and labour strength gave the central bank room to focus on price stability. Today, the balance is shifting.

Inflation has moved decisively lower from its peaks, even if it remains slightly above the Fed's 2% target on some measures. Meanwhile, growth indicators—from manufacturing surveys to consumer sentiment—have cooled. Until recently, the labour market was the last hold-out, but the ADP data suggest that this support may be weakening.

From the Fed's perspective, several features of the report stand out:

- Negative job growth in the private sector, even if modest, is a different regime from the steady gains seen over the past two years.

- Sectoral breadth—with manufacturing, construction and information technology all seeing declines—points to economy-wide pressure rather than an isolated shock.

- Softening wage growth supports the view that inflation risks are receding and that the labour market is no longer overheated.

Combined, these elements strengthen the argument for another rate cut at the December meeting. Futures markets reacted quickly, with Treasury yields dipping as traders increased the implied probability of a third reduction this year. For policymakers, the challenge is to calibrate the pace: cut too slowly and they risk a sharper downturn; cut too quickly and they could re-ignite inflation or encourage excessive risk-taking.

4. How Markets Are Responding So Far

Financial markets tend to process labour data through two lenses: growth and policy. Weaker job numbers typically mean slower growth, which is negative for corporate earnings but positive for bonds because it invites rate cuts. The ADP release triggered both reactions:

• Bond yields eased, especially at the short end of the curve, as investors priced in a higher chance of near-term policy easing.

• Equities showed a mixed response. Rate-sensitive sectors such as technology and real estate often benefit from lower yields, but cyclical names tied directly to economic activity can struggle if investors fear a broader slowdown.

• Digital assets such as Bitcoin reacted in their usual, more volatile way. Some traders framed the data as supportive because lower rates and easier financial conditions have historically coincided with stronger performance for alternative assets. Others emphasised the growth risk: if economic activity slows sharply, risk appetite can contract even in a lower-rate environment.

In short, markets viewed the report as another step toward a Fed pivot but not yet as evidence of a serious downturn. That distinction matters for how investors, businesses and households plan the next year.

5. Labour Market Crossroads: Soft Landing or Early Downturn?

One reason the current environment feels so uncertain is that the data can support two competing narratives.

5.1 Soft-Landing Scenario

In the optimistic view, the November ADP report is evidence that the Fed's tightening has achieved its goal: inflation pressures have eased, wage growth is moderating and the labour market is transitioning from 'very hot' to 'merely warm.' Under this scenario:

- Job growth may slow or even oscillate around zero for a few months, but unemployment remains relatively low.

- Lower rates, if delivered gradually, help refinance corporate and household debt without sparking a surge in speculative behaviour.

- Growth settles into a modest but sustainable range—neither booming nor collapsing.

For long-term investors, a soft landing can be a favourable backdrop: volatility is lower than in crisis periods, and lower yields can support valuations across a range of asset classes.

5.2 Early-Downturn Scenario

The more cautious narrative emphasises the breadth of job losses in small businesses and cyclical industries. In this view:

- Small-firm layoffs are an early signal that demand is weakening more sharply than top-line GDP figures suggest.

- Corporate profit margins are under pressure from higher financing costs and still-elevated input prices, prompting broader cost-cutting.

- If the Fed waits too long to ease, tighter financial conditions could interact with labour softening to produce a more pronounced slowdown.

Under this scenario, additional rate cuts would eventually arrive, but they would be responding to a more serious deterioration in activity rather than gently guiding the economy toward a soft landing.

At this stage, the data does not conclusively support either story. That is why upcoming releases—including the delayed official employment report and updated inflation figures—will be watched so closely.

6. Why the ADP Report Matters Even With Limitations

It is important to note that ADP's series is not a perfect predictor of the official non-farm payrolls report. Historically, the two datasets can diverge meaningfully in any given month because they are constructed differently and rely on distinct samples. Analysts therefore treat ADP as an informative, but not definitive, signal.

However, in the current context the report carries extra weight for two reasons:

- Timing. With the official payroll data delayed until after the Fed meeting, ADP provides one of the only timely glimpses into recent hiring trends.

- Direction. While the magnitude of job losses could be revised or differ in other surveys, the shift from modest gains to outright declines is a clear directional signal that conditions have changed.

For policymakers and investors alike, the key is not to treat any single report as the final word but to integrate it into a broader mosaic that includes unemployment claims, business surveys, wage trackers and inflation expectations.

7. Implications for Crypto and Other Alternative Assets

What does a weakening US labour market mean for digital assets such as Bitcoin and Ethereum, or for the broader world of tokenised finance?

From an educational perspective, it helps to separate two channels:

• Interest-rate channel. Lower policy rates and a less aggressive Fed can support valuations of long-duration assets—those whose expected cash flows (or, in Bitcoin’s case, adoption and scarcity narratives) stretch far into the future. Historically, periods of easier monetary policy have often coincided with stronger performance for growth equities and digital assets, although the relationship is far from perfect.

• Risk-appetite channel. If labour weakness signals a broader slowdown, households and institutions may become more cautious, reducing appetite for volatile assets. In extreme downturns, this effect can dominate, leading to lower prices even as rates fall.

In practical terms, a gradual cooling of the labour market that nudges the Fed toward measured rate cuts—without tipping the economy into recession—tends to be the most constructive backdrop for assets like Bitcoin. It encourages diversification away from cash and low-yielding bonds while avoiding the disorderly conditions that can trigger forced selling.

However, it is essential to treat these relationships as tendencies rather than rules. Macro conditions are just one of many drivers of digital-asset prices, alongside regulatory developments, technological upgrades, institutional adoption and shifting investor narratives.

8. How Readers Can Interpret Labour and Fed Data Responsibly

For individuals who follow macro news primarily to understand their environment rather than to make frequent trades, a few guidelines can help keep things in perspective:

1. Focus on trends, not single numbers. A weak ADP print is noteworthy, but its real significance will depend on whether subsequent months confirm a downtrend or show a rebound.

2. Watch how different indicators align. If employment, industrial production, consumer spending and confidence all soften together, the probability of a broader slowdown increases. If some metrics remain strong, the picture is more nuanced.

3. Separate the rate story from the growth story. Lower interest rates are not automatically positive or negative. They can signal relief from tight conditions, but they can also reflect concerns about future growth.

4. Match information to your time horizon. Day-to-day market moves in response to labour headlines may matter to short-term traders but are less relevant for long-term savers whose plans span many years.

Ultimately, the most constructive way to use macro data is as context for thoughtful planning rather than as a prompt for hasty decisions.

9. Conclusion: A Market Waiting for Confirmation

The November ADP employment report marks a clear shift in the macro narrative. After months of describing the labour market as a pillar of strength, analysts now have to grapple with data showing outright job losses in the private sector, concentrated among small businesses and key cyclical industries. Wage growth is cooling, and the overall momentum of hiring is weaker than at any point in the past two years.

For the Federal Reserve, this development strengthens the case for another rate cut at next week’s meeting, especially given that the official payroll data will not arrive in time. Yet the central bank must also guard against moving so aggressively that it appears to be panicking, which could undermine confidence.

For markets—from equities and bonds to digital assets—the message is mixed. Softer labour conditions increase the likelihood of easier monetary policy, a factor that has historically supported asset prices. At the same time, they highlight the real-economy risks that come with a prolonged period of high rates and tighter financial conditions.

Whether this moment ultimately marks the start of a gentle soft landing or the early stages of a deeper downturn will depend on how subsequent data evolve and how carefully policymakers manage the transition. For now, the best description of the environment is one of heightened sensitivity: each new piece of information—not just from labour markets but also from inflation, growth and financial conditions—has the potential to shift expectations quickly.

Disclaimer: This article is for informational and educational purposes only. It does not constitute financial, investment, legal or tax advice, and it should not be treated as a recommendation to buy, sell or hold any asset. Economic conditions and digital-asset markets can change rapidly and involve risk, including the potential loss of capital. Readers should conduct their own research and consider consulting qualified professionals before making financial decisions.