Gold and Silver Surge on Fed Rate-Cut Hopes: What the New Highs Really Mean

Gold and silver are back in the spotlight. In recent sessions, gold climbed to its highest level in six weeks, briefly trading around $4,264 per ounce, while spot silver pushed to a fresh record near $58.82 per ounce. The catalyst, at least on the surface, looks simple: markets increasingly expect the US Federal Reserve to begin cutting interest rates sooner rather than later.

Underneath that headline, however, sits a more nuanced mix of factors. The US dollar has softened, parts of the American economy are flashing signs of deceleration, and global investors are once again looking toward defensive assets as policy uncertainty lingers. Silver, which straddles the line between safe-haven and industrial metal, is receiving an extra boost from structurally rising demand in sectors like renewable energy and electronics.

At the same time, the picture is not entirely one-way. Bond yields remain elevated by historical standards, which normally creates headwinds for metals that do not pay income. The fact that gold and silver are rallying anyway underscores just how powerful expectations around policy and growth have become.

In this analysis, we break down what is driving the current move, why the upcoming speech from Fed Chair Jerome Powell is so important, and how to interpret these developments in a calm, educational and brand-safe way.

1. Why Gold and Silver React So Strongly to Fed Expectations

At a high level, gold and silver respond to the same macro forces that influence many other assets: interest rates, inflation, currency movements and risk sentiment. But their sensitivity to monetary policy is especially pronounced because of two core characteristics:

- No yield. Gold and silver do not pay coupons or dividends. Their relative attractiveness depends in part on how compelling interest-bearing alternatives, such as bonds or cash, look on a risk-adjusted basis.

- Long-term store-of-value narratives. For centuries, precious metals have played a role as stores of value when confidence in fiat currencies or financial systems is uncertain. That narrative intensifies when investors perceive a potential shift in policy regimes.

When markets expect the Fed to cut interest rates, they are effectively saying that future real yields could fall and that the opportunity cost of holding non-yielding assets may decline. At the same time, if those expectations come alongside worries about growth or financial stability, safe-haven assets can benefit from a demand boost.

In the current environment, both channels are in play:

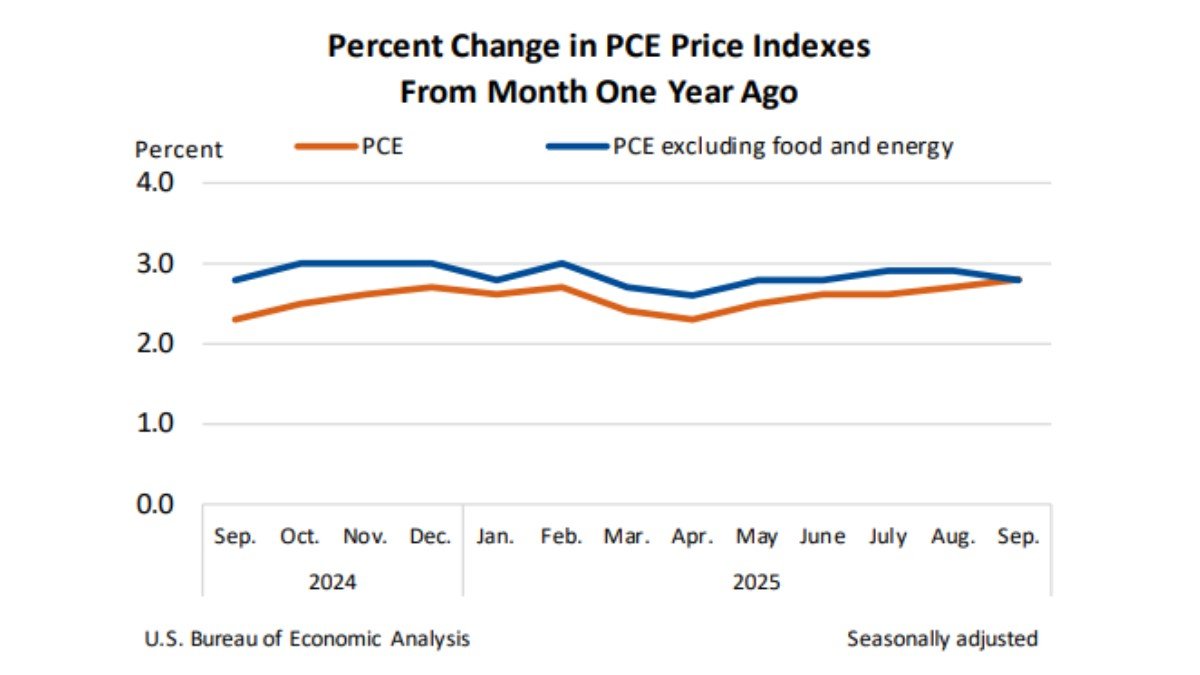

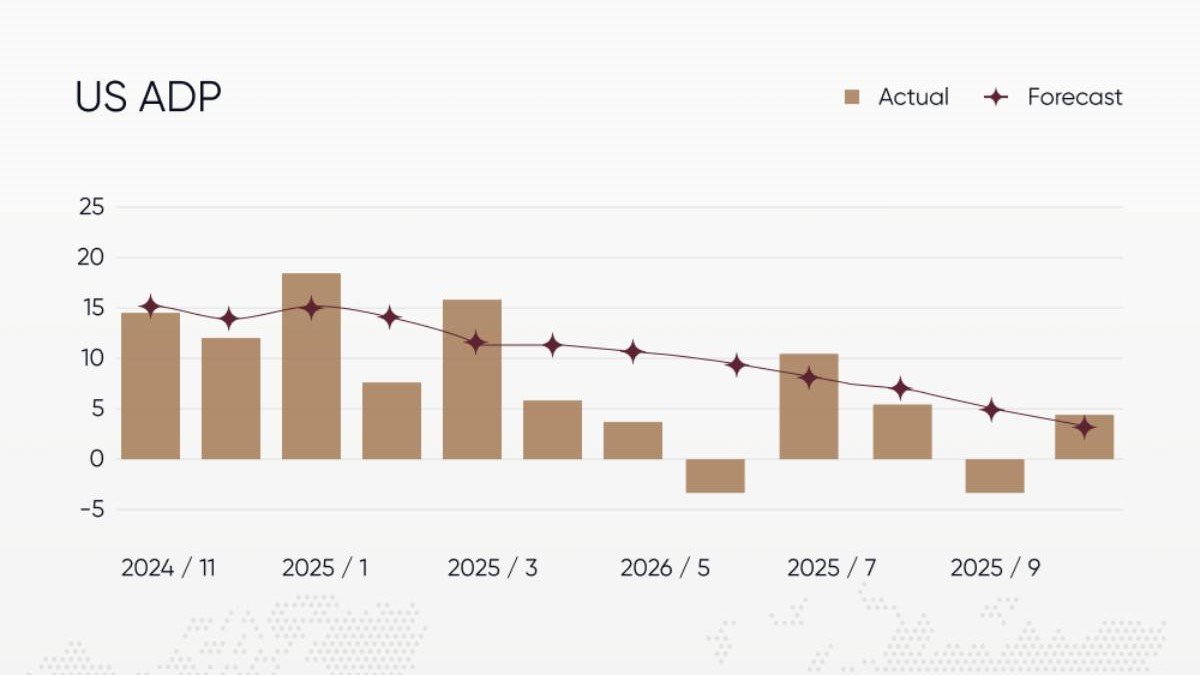

- Futures markets are increasingly pricing in a path of lower policy rates over the next year.

- Some economic indicators suggest the US expansion is losing momentum, which encourages a more defensive stance in portfolios.

- The US dollar index has eased, improving the affordability of gold and silver for buyers outside the United States.

Against that backdrop, it is not surprising to see precious metals making gains. What stands out is the magnitude of the move in silver and the speed with which prices have revisited their prior highs.

2. The Role of a Softer US Dollar and Slower Growth Signals

Gold and silver are typically priced in US dollars on global markets. That makes the exchange rate a key part of the story. When the dollar weakens:

- Buyers using other currencies effectively see a discount on dollar-denominated metals.

- Central banks and institutional investors may find it more attractive to diversify part of their reserves into gold as a complementary store of value.

Recently, the dollar has come under pressure as traders reassess the likelihood and timing of Fed easing. The expectation that policy rates may have peaked reduces the relative yield advantage of dollar assets. Combined with softer data in some segments of the US economy, this has nudged capital toward assets perceived as more defensive.

Signals of slower growth do not automatically imply recession, but they do change the balance of risks. Companies can face margin pressures, households can become more cautious, and investors can become more selective in their risk-taking. Historically, such phases have often coincided with increased interest in gold as a store of value and in silver as both a precious and industrial metal.

3. Silver's Dual Identity: Safe Haven and Industrial Workhorse

Silver's behaviour in this rally is especially interesting. While gold has advanced to a six-week high, silver has set new all-time highs around $58.82 per ounce. That disproportionate strength reflects silver's dual identity:

- Like gold, silver can benefit from safe-haven flows when financial conditions feel uncertain.

- Unlike gold, silver has a larger share of demand coming from industrial applications.

In practice, this industrial demand includes:

- Solar panels, where silver is used in photovoltaic cells.

- Electronics and semiconductors, where its conductivity and reliability are prized.

- Automotive and renewable technologies, which increasingly integrate sensors and advanced electrical components.

As the world invests more in energy transition infrastructure and advanced computing, demand for certain metals, including silver, can rise structurally. When that trend meets a macro environment favouring safe havens, silver can experience a kind of double lift: macro-driven flows on top of longer-term industrial demand.

This does not mean the price moves in a straight line. Silver remains a volatile asset, and sharp rallies can be followed by equally sharp pullbacks. From an educational standpoint, the recent surge is a textbook example of how fundamentals and sentiment can align in the short term.

4. What About Rising Bond Yields?

One apparent contradiction in the current setup is that government bond yields have ticked higher at the same time as precious metals have rallied. Traditionally, higher yields are a headwind for gold and silver: they increase the opportunity cost of holding assets that do not pay interest.

There are a few reasons why metals can still move up in such an environment:

- Markets focus on the path of policy, not just today's yield. If investors believe yields are near a peak and will fall once the Fed starts cutting, they may look through shorter-term moves in the bond market.

- Real yields matter more than nominal yields. If inflation-adjusted yields are stable or falling, the environment can still be supportive for metals even if nominal yields rise slightly.

- Risk sentiment can overwhelm yield effects. In periods of stress or uncertainty, safe-haven demand can dominate the more mechanical impact of yield changes.

In short, the relationship between yields and metals is strong but not mechanical. The current rally suggests that, for now, expectations of easing and concerns about growth are carrying more weight than incremental changes in bond markets.

5. All Eyes on Powell: Why One Speech Matters So Much

With gold and silver at elevated levels, the market's next focal point is the upcoming speech from Fed Chair Jerome Powell. While a single appearance cannot rewrite the entire macro script, it can clarify how the central bank views the trade-off between inflation and growth.

Broadly, there are three scenarios that investors often contemplate ahead of such remarks:

• Unexpectedly hawkish tone. If Powell emphasises the risk of inflation persistence and downplays the need for near-term cuts, markets could reassess their expectations. That might support the dollar and bond yields, potentially cooling the rally in metals.

• Balanced or 'data-dependent' tone. If he acknowledges progress on inflation but stresses uncertainty, markets may interpret that as a sign that cuts are still on the table but not imminent. In that case, gold and silver could consolidate rather than extend aggressively in either direction.

• More dovish guidance. If Powell clearly signals openness to earlier or faster cuts, markets could deepen their rate-cut expectations. That would likely support safe-haven assets further, although some of that optimism may already be reflected in current prices.

It is impossible to know in advance which nuance will dominate. For educational purposes, the key point is that precious metals are pricing not just today's environment but an entire forward path. When that path shifts, prices can adjust quickly.

6. Safe-Haven Demand: Beyond Simple Fear

When headlines say that money is 'flowing into safe havens', it can sound like a simple fear reaction. In reality, the motives behind those flows are more varied:

- Portfolio diversification. Some asset managers allocate a small share of capital to gold as a hedge against inflation surprises or geopolitical shocks.

- Currency diversification. Central banks and long-term investors sometimes view gold as a way to diversify away from concentrated holdings in a single currency.

- Risk management. During periods of macro uncertainty, adding exposure to assets with different drivers than equities and corporate bonds can help smooth returns.

Silver participates in this dynamic but with an added layer of complexity due to its industrial uses. In a slowing economy, some industrial demand might soften; however, structural trends like electrification can cushion that effect. The current environment appears to reflect a blend of cyclical caution and long-term thematic optimism.

One important educational takeaway is that safe-haven flows do not necessarily reflect panic. They can also represent gradual, strategic adjustments as investors recalibrate expectations about growth, inflation and policy.

7. How Precious Metals Fit into a Diversified Portfolio

From a portfolio-construction perspective, the key question is rarely 'Is gold going up or down next week?' Instead, it is: What role can precious metals play alongside other assets?

Several roles are commonly discussed in educational materials:

- Inflation hedge (imperfect but historically relevant). Over very long horizons, gold has often preserved purchasing power better than many fiat currencies. However, in the short term, its relationship with inflation can be noisy.

- Crisis hedge. In some periods of financial stress, gold has held value or even risen while risk assets declined, providing diversification benefits.

- Volatility moderator. A modest allocation to precious metals, used thoughtfully, can sometimes reduce overall portfolio volatility, though outcomes depend on the specifics of the period.

Silver can contribute to diversification too, but with higher volatility and more cyclical behaviour. Investors who consider it often do so as a smaller satellite position rather than a core holding, reflecting its sensitivity to industrial trends and changing market sentiment.

In all cases, responsible education emphasises that position sizing, time horizon and overall risk tolerance matter at least as much as the latest price move. A rally driven by expectations of Fed cuts is one data point among many, not a signal by itself to make dramatic allocation changes.

8. Reading the Rally Without Treating It as a Certainty

To keep this discussion grounded and brand-safe, it is worth highlighting several caveats about the current move:

1. Expectations can reverse. If incoming data or central bank communications shift the perceived timing of rate cuts, the same forces that lifted gold and silver could ease or reverse.

2. Positioning matters. When many traders crowd into similar trades around the same macro narrative, markets can become vulnerable to sharp, sentiment-driven pullbacks.

3. Short-term price targets are speculative. While new highs attract attention, they do not, by themselves, determine what happens next.

4. Global factors can intervene. Developments in other major economies, currency markets or geopolitical events can all influence precious metals alongside US policy.

In other words, the current rally is best understood as a snapshot of how markets are digesting a specific blend of macro signals: softer dollar, slower growth indications, and looming policy communication. It is not a guarantee of continued upside, nor is it a definitive warning sign on its own.

9. Practical, Brand-Safe Takeaways for Observers

For readers using this episode as a learning opportunity rather than a trading roadmap, several practical lessons emerge:

• Follow the narrative arc, not just the price. Gold and silver are reacting to a story about interest rates, growth and currency values. Understanding that story is more useful than memorising price levels.

• Different metals, different drivers. Gold leans more toward monetary and safe-haven themes, while silver mixes those with industrial demand. Their paths can diverge, especially over medium horizons.

• Policy communication is itself a risk factor. Events like Powell's speech can change expectations quickly. Markets do not only respond to what the Fed does; they also respond to what the Fed says it might do.

• Diversification is a process, not a reaction. Building a resilient portfolio typically involves gradual, deliberate decisions, not reacting to each new high or low in a single asset.

Viewed through this lens, the recent surge in gold and silver becomes less of a mystery and more of a case study in how macro forces, expectations and structural demand interact.

10. Conclusion: Metals at the Intersection of Policy and Perception

The latest moves in gold and silver are a vivid reminder that markets are forward-looking. With gold near six-week highs around $4,264 and silver at record levels close to $58.82, investors are not just reacting to today's conditions; they are pricing a future in which policy rates are lower, the dollar is less dominant at the margin and growth is more uncertain.

At the same time, the environment remains complex. Bond yields are still elevated, data remains mixed and upcoming guidance from the Federal Reserve could either reinforce or challenge current expectations. For those watching from the sidelines or thinking about long-term portfolio construction, the most valuable takeaway is not a specific price target, but a deeper understanding of how precious metals fit into the broader macro landscape.

Gold and silver will almost certainly remain volatile as new information arrives. But by focusing on fundamentals, maintaining a diversified perspective and treating high-profile rallies as sources of insight rather than instructions, market participants can engage with these moves in a measured, informed and responsible way.

Disclaimer: This article is for informational and educational purposes only. It does not constitute financial, investment, legal or tax advice, and it should not be treated as a recommendation to buy, sell or hold any asset. Precious metals and other financial instruments involve risk, including the potential for loss of capital. Readers should conduct their own research and consider consulting qualified professionals before making financial decisions.