Silver’s 150% Rally: What SLV’s Outperformance Over Gold Is Really Telling the Market

The chart comparison between iShares Silver Trust (SLV) and SPDR Gold Shares (GLD) for 2025 looks almost unreal. Gold has had an excellent year by any historical standard, with GLD posting around 70% total return. Yet silver has left even that impressive performance in the dust. SLV is up roughly 150%, meaning silver has delivered more than double the return of gold.

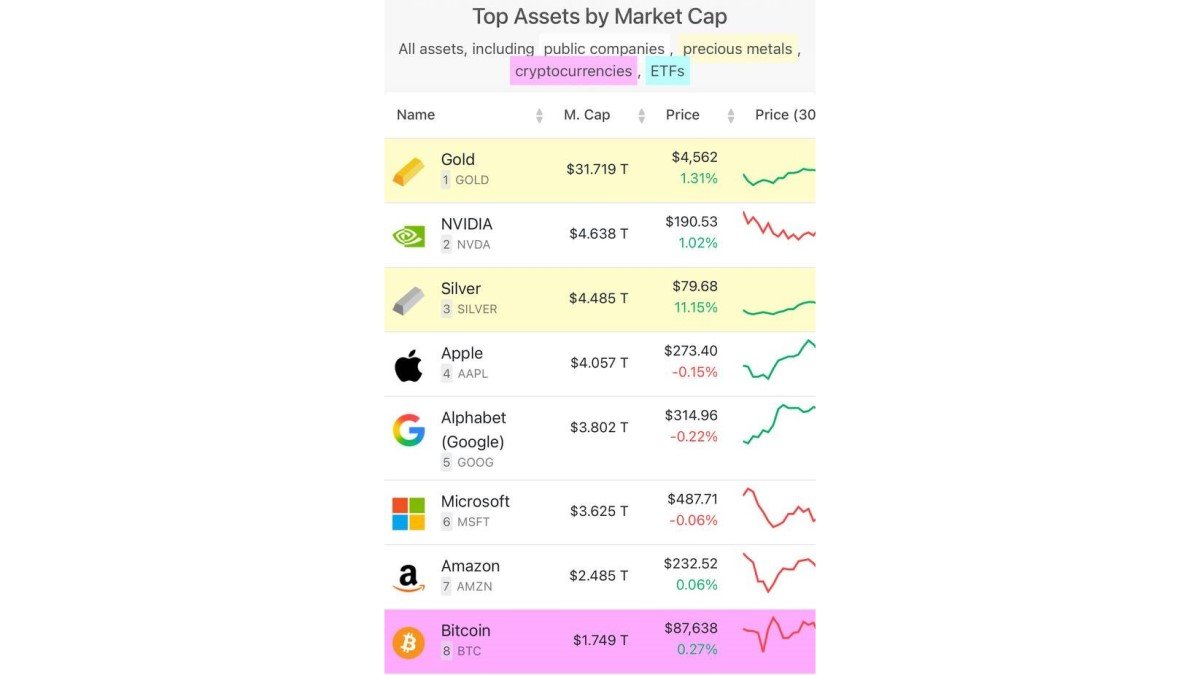

The extremes do not stop at price. In the week leading into the Christmas holidays, SLV recorded about 21 billion USD in trading volume — the highest weekly turnover in roughly fifteen years, and it happened in what is usually a quiet period for markets. At the same time, year-to-date net inflows into SLV stand at only about 3.4 billion USD. That is a healthy number, but small when put alongside the roughly 23 billion USD that has flowed into GLD and the approximately 25 billion USD that has gone into the leading spot Bitcoin ETF, IBIT.

In other words, silver’s price has exploded, but the bulk of new institutional capital is still going elsewhere. Understanding that tension is the key to interpreting what this rally really means. Is silver undergoing a structural re-rating, or are we simply seeing a sharp squeeze in a relatively tight market? And what does the pattern of flows and volumes tell us about how professional investors are thinking about risk going into 2026?

1. Price vs. Flows: A Rally Built on Positioning, Not a Wall of Money

When an asset doubles in a year, the default assumption is that a huge amount of fresh capital must have poured in. The SLV data tells a more nuanced story.

Weekly turnover of 21 billion USD shows that silver has moved to the center of the macro conversation. Trading desks, systematic funds and retail participants are all active. But net inflows of only 3.4 billion USD suggest that much of this volume is repositioning rather than new money. Existing holders are trading more aggressively, hedge funds are rotating in and out, and short-term strategies are recycling liquidity rapidly.

By contrast, GLD and IBIT have attracted far larger net inflows. That signals that the truly long-horizon, benchmark-driven pools of capital — pension funds, sovereign portfolios, conservative asset allocators — still see gold and Bitcoin as their primary strategic hedges. Silver is acting more like an amplifier on top of those core positions: a way to express directional macro views with higher sensitivity.

This distinction matters. A rally built on massive net inflows can be self-reinforcing for longer, because long-term buyers are less sensitive to short-term swings. A rally built on repositioning and short-term flows can be spectacular, but it is also more vulnerable to sharp reversals if sentiment changes.

2. Why Silver Is Outrunning Gold in 2025

Silver’s outperformance is not random. It reflects a combination of structural and cyclical forces that all came into alignment this year.

2.1 A decade of underperformance set the stage

For much of the past decade, silver lagged gold. The gold/silver ratio — the number of ounces of silver needed to buy one ounce of gold — spent long periods at historically elevated levels. Put simply, silver was cheap relative to gold for a long time. When investors eventually concluded that gold had broken into a new valuation regime, it was natural to look at silver as the “high beta” catch-up trade.

That re-rating dynamic matters because it attracts a specific kind of buyer: macro funds that look for distorted relationships between related assets. Once they believe the ratio is unsustainable, they can express that view by buying silver and, in some cases, hedging with gold.

2.2 Industrial demand in a constrained supply environment

Unlike gold, which is held mostly for reserves and jewelry, silver is deeply embedded in industrial supply chains. It is used in electronics, solar panels, high-end glass, medical applications and a wide range of components for power and communications infrastructure.

Three medium-term trends have quietly tightened that market:

- The expansion of solar power installations, which consume significant quantities of high-purity silver in photovoltaic cells.

- Ongoing growth in data centers, electric vehicles and advanced electronics, each of which requires silver for reliable conductivity.

- Years of relatively low investment in new primary silver mines, combined with falling grades at many existing deposits.

On their own, these forces would not produce a 150% price move in a single year. But they create a backdrop in which any incremental increase in investment demand can have an outsized impact, because the underlying physical market is already tight.

2.3 A macro regime that rewards tangible assets

2025 has been defined by a blend of stubborn core inflation, heavy public borrowing and heightened geopolitical uncertainty. In that environment, investors have gravitated toward assets that are difficult to dilute and that play a role in strategic supply chains. Gold benefits from this, but silver adds another layer: it is not only a financial reserve metal, it is also a critical input for the hardware that supports artificial intelligence, communications and modern energy systems.

This dual identity — part monetary metal, part industrial workhorse — allows silver to capture both defensive and growth-oriented capital. When investors worry about currency debasement, they can look to precious metals. When they want exposure to the physical backbone of the AI and electrification theme, silver appears again on the list.

3. Reading the SLV Numbers: Volume Explodes, But Flows Stay Measured

The contrast between huge weekly volume and relatively moderate net inflows hides several important signals about how investors are using SLV.

3.1 High turnover points to tactical usage

Twenty-one billion dollars of volume in a holiday week is extraordinary. It suggests that SLV has become the preferred vehicle for short-term positioning in silver. Rather than dealing with futures rolls or physical bar logistics, many participants simply use the ETF to move in and out quickly.

High turnover does not necessarily mean instability, but it can mean that a large percentage of the shareholder base is sensitive to news flow and price levels. That is very different from a central bank accumulating gold over years, or a retirement plan gradually dollar-cost averaging into a diversified ETF.

3.2 Relatively modest inflows suggest silver is not yet a core allocation

Net inflows of 3.4 billion USD are positive and show that silver is attracting incremental interest. Yet when investors have sent roughly seven times more capital into GLD and about eight times more into IBIT, it becomes clear that silver remains a satellite position for most large portfolios.

That has two implications:

- There may still be room for additional re-rating if long-horizon allocators decide that silver deserves a more permanent slot in their policy portfolios.

- The current rally is still driven more by marginal buyers than by a structural wall of capital. If macro conditions change or if sentiment turns, these marginal buyers can retreat quickly.

4. Is This a Structural Re-pricing or a Late-Cycle Spike?

Whenever an asset posts triple-digit gains, the natural question is whether we are witnessing a durable shift or the late stages of a momentum phase. With silver, the answer may be “some of both.”

4.1 The case for a structural shift

Several arguments support the view that silver's role in portfolios is changing in a lasting way:

• Strategic relevance. As governments and corporations invest heavily in electrification, grid upgrades and advanced sensing, demand for silver in high-value components looks resilient even under conservative growth assumptions.

• Limited short-term supply response. Bringing new mines online is a multi-year process. Many existing operations are by-products of other metals, which means their silver output does not respond instantly to higher prices.

• Renewed interest in diversified stores of value. Some allocators want to avoid concentrating all their defensive exposure in a single metal or a single digital asset. Silver offers a way to diversify that “hard asset” sleeve.

4.2 The case for caution

At the same time, the magnitude and speed of the move invite prudence:

- Valuations have already adjusted sharply. A 150% rally prices in a significant amount of future optimism. Even if the long-term story is correct, paths matter; assets that revalue too quickly can spend long periods consolidating.

- Flow concentration remains elsewhere. With GLD and IBIT still receiving the bulk of fresh capital, silver can remain more sensitive to short-term traders than to long-term allocators.

- Industrial demand is cyclical. While structural trends are supportive, a global slowdown could temporarily dent consumption in sectors such as electronics and construction.

The net picture is one of genuine fundamentals meeting powerful positioning. Silver’s underlying importance to modern industry and reserve management is real, but the recent vertical price action is also heavily driven by how investors choose to express their macro views.

5. How Investors Are Using Silver Alongside Gold and Bitcoin

With gold and Bitcoin each receiving tens of billions of dollars in net inflows, silver increasingly plays a complementary role rather than a standalone hedge.

• As a higher-sensitivity expression of the same theme. For investors who are already long gold or Bitcoin as protection against monetary and geopolitical risk, silver offers a way to increase exposure to that scenario without simply adding more of the same assets.

• As part of a relative-value basket. Some macro funds may treat silver as a way to balance positions across metals, pairing it with gold, copper or even energy exposures in multi-asset trades.

• As a bridge between defensive and growth themes. Because of its industrial usage in solar panels, data centers and electronics, silver can fit into portfolios that seek both resilience and exposure to long-term technology trends.

This more nuanced role may explain why net flows are smaller even as price performance is dramatic. Silver is becoming a targeted tool within an allocation framework, not necessarily the anchor of that framework.

6. What to Watch in 2026

Whether 2025 marks the beginning of a multi-year silver renaissance or the high point of a powerful cycle will depend on a few observable factors.

• Flow persistence. Do net inflows into SLV and other silver vehicles continue at a steady pace, or do they fade as the year-end rally cools?

• Physical market tightness. Premiums in key wholesale markets, delivery times and mining company guidance will show whether the physical side of the market remains constrained.

• Policy and infrastructure spending. Decisions on grid upgrades, renewable energy projects and data center expansion will influence long-run industrial demand.

• Behavior of gold and Bitcoin. If gold and Bitcoin continue to attract the vast majority of strategic inflows, silver may remain a satellite allocation. If large institutions start explicitly adding silver targets to their policy documents, that would signal a deeper shift.

7. Conclusion: A Small Market Sending a Big Signal

Silver’s 150% rally in 2025 is more than just an eye-catching chart. It is a message about how investors view tangible assets in an era of elevated debt levels, renewed industrial policy and rapid technological change. The metal that long lived in the shadow of gold is now delivering roughly twice the return, even as most new capital still flows into gold funds and digital asset products.

For cautious allocators, the lesson is not necessarily to chase the move, but to recognize what it reflects: rising demand for assets that combine physical scarcity with strategic usefulness. For more active traders, SLV’s surge highlights how quickly sentiment can shift when a previously overlooked corner of the market becomes the focus of macro narratives.

As always, the key is to separate story from structure. The story around silver is compelling: a critical input to modern technology, a precious metal with a long monetary history, and a relatively small market that can move sharply when attention arrives. The structure is more measured: flows are still modest compared with gold and Bitcoin, and industrial demand, while robust, is not immune to the business cycle.

Over the coming years, the interplay between these forces will determine whether 2025 is remembered as the start of a new era for silver or as a dramatic chapter in the ongoing evolution of the precious metals complex.

Disclaimer: This article is for educational and analytical purposes only and does not constitute financial, investment, or legal advice. Commodities and digital assets can be volatile and may not be suitable for every investor. Always conduct your own research and consider consulting a qualified professional before making financial decisions.