When Silver Overtakes Silicon: What the New Market-Cap Rankings Say About Global Risk

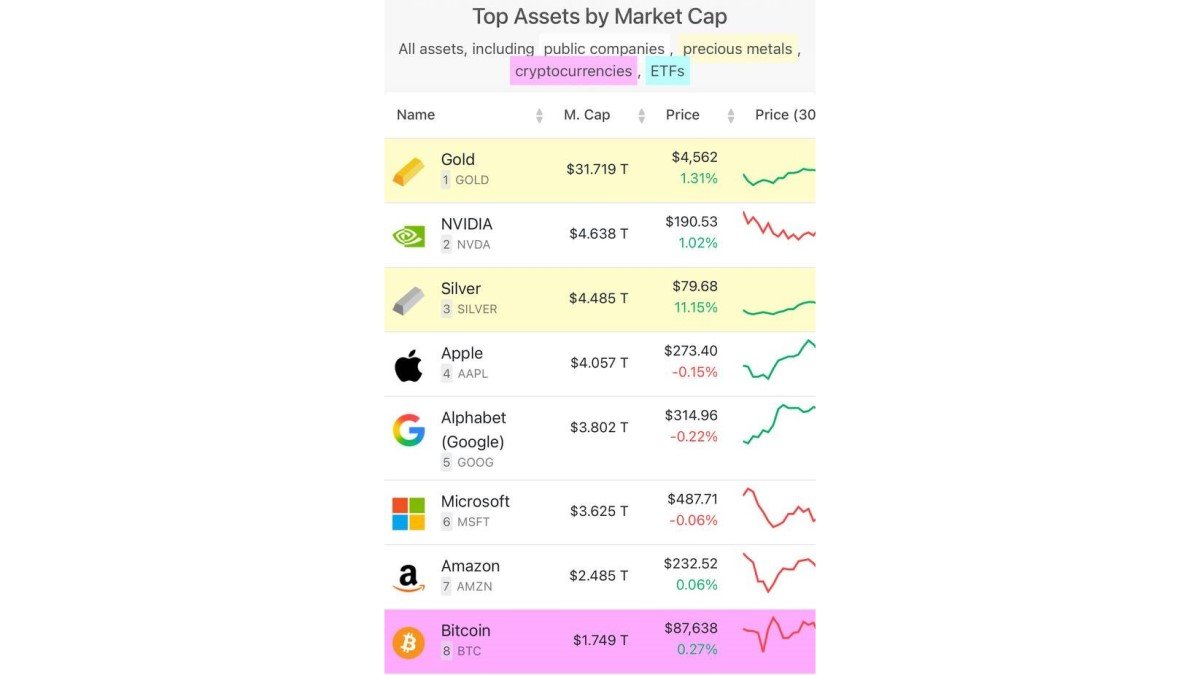

A glance at the latest rankings of the world’s largest assets by market capitalization reveals a configuration that would have looked unusual just a few years ago. Gold still sits comfortably in first place. But just below, silver has climbed into the global Top 3, edging ahead of Apple, Alphabet (Google) and Microsoft – the companies that defined the last decade of digital growth. Bitcoin now appears further down the table, still enormous in absolute terms, but below silver’s rapidly expanding footprint.

This is more than a curiosity for market statisticians. The reshuffle captures a deeper shift in how investors think about resilience, technology and value. In a world that feels less predictable – with supply chains under strain, security policy back at center stage, and energy infrastructure being rebuilt for the age of electrification and artificial intelligence – tangible, strategically useful metals are being repriced relative to purely financial or digital claims.

Silver’s rise above the largest technology companies and its lead over Bitcoin is therefore not only a comment on price. It is a snapshot of how the global system is reordering its priorities.

1. From “secondary metal” to systemic asset

For much of modern market history, silver has lived in the shadow of gold. It has been treated as a smaller, more volatile cousin: part monetary metal, part industrial input, important but rarely central to macro conversations. That framing no longer fits.

The new ranking – with silver sitting just behind gold and one of the largest technology companies – tells us that investors now see it as part of the core architecture of the global economy. The key difference is that today’s demand for silver is not only about storing value; it is about enabling critical infrastructure.

Silver’s conductivity, reflectivity and anti-bacterial properties make it essential for a surprising range of applications:

- High-performance electronics, sensors and connectors in data centers and communication networks.

- Solar panels and other components of renewable-energy systems.

- Power electronics in electric vehicles and charging networks.

- Advanced defense and aerospace systems, where reliability and signal integrity are non-negotiable.

In other words, silver is not just ornamentation or a store of value in coin form; it is part of the physical base layer for AI infrastructure, modern defense capabilities, satellite networks and energy transition projects. When investors pay up for silver, they are effectively pricing the scarcity of that base layer.

2. Why silver is being repriced now

Several forces have converged to push silver into this new position.

2.1 A world rediscovering resource risk

The last decade was dominated by narratives of software, cloud platforms and digital platforms. But the events of the early 2020s – from supply chain disruptions to energy crunches and renewed geopolitical competition – have reminded policymakers and investors that physical inputs matter. Strategic reserves, access to minerals and control over refining capacity have returned to the front page.

Silver sits at the intersection of this discussion. It is geographically concentrated in a handful of producing countries; new large deposits are rare; and developing mines is a multi-year process with environmental and social constraints. That combination – rising structural demand and limited near-term supply flexibility – is exactly what long-horizon capital is willing to pay for when uncertainty is high.

2.2 The hardware side of the AI boom

Public narratives around artificial intelligence often focus on software models and cloud compute, but the AI boom is also a hardware story: data centers, high-bandwidth connections, cooling, specialized chips and power infrastructure. All of these rely on dense networks of high-quality electrical connections, many of which depend on silver’s superior conductivity.

As countries and companies race to secure AI advantages – including in security and defense domains – they are implicitly committing to large, long-term purchases of the materials that make these systems possible. The market-cap table is starting to reflect that commitment.

2.3 Inflation hedging with real-world utility

Silver also benefits from a hybrid identity. Like gold, it has a long history as a monetary metal and is used by some investors as a hedge against currency debasement and prolonged inflation. Unlike gold, a substantial portion of its demand comes from industry. That gives it a dual support: if investment flows slow, industrial demand can still underpin the market; if industrial demand softens temporarily, monetary demand may fill the gap.

In an environment where public debt is high and real yields are uncertain, that combination of store-of-value appeal plus concrete industrial usage looks attractive relative to purely financial assets whose cash flows are further out in time.

3. Why are technology giants now below silver?

The fact that silver’s market value now exceeds that of Apple, Alphabet and Microsoft does not mean these companies are suddenly fragile. They remain highly profitable businesses with immense cash flows and dominant positions in software, cloud services and digital advertising.

However, the comparison does highlight several structural differences between technology equities and strategic commodities.

• Duration and discount rates. The value of a large technology company depends heavily on earnings far into the future. When interest rates rise or uncertainty about regulation increases, those long-dated cash flows are discounted more aggressively, weighing on valuations.

• Policy and competitive risk. Tech leaders face scrutiny over data usage, competition policy, and their role in the information ecosystem. Shifts in regulation, taxation or antitrust enforcement can alter forward expectations quickly.

• Intangible versus tangible value. Much of a technology company’s worth lies in intellectual property, network effects and brand. Silver’s value, by contrast, resides in atoms that participate directly in power grids, devices and industrial processes. In periods of heightened concern about physical security and energy stability, investors may be inclined to pay more for assets whose usefulness is immediately visible.

The new ranking therefore does not imply that technology is less important than before. It suggests that in a world facing tighter resource constraints and geopolitical rivalries, the market is willing to assign a higher relative premium to the finite materials that enable technology to operate.

4. Bitcoin’s place in the hierarchy

Another notable detail in the ranking is that Bitcoin, despite a market capitalization approaching two trillion dollars, still sits below silver. That relationship is instructive.

Bitcoin has often been framed as “digital gold” – a scarce, non-sovereign asset designed primarily as a hedge against currency debasement and as a long-term store of value. In environments where financial repression or monetary expansion dominate the narrative, that digital hedge can attract substantial institutional interest.

Silver, however, offers something Bitcoin does not: direct industrial utility. In a benign macro scenario where inflation is contained and growth is healthy, this may not matter much. In a world where investors are also thinking through scenarios involving energy disruptions, cyber risks, infrastructure stress or regional conflict, the ability of an asset to support essential hardware becomes more important.

This helps explain why, in the current configuration, national treasuries, large funds and industrial players appear comfortable assigning a higher aggregate valuation to silver than to Bitcoin. The two assets can still coexist in portfolios – one as a digital monetary alternative, the other as a strategic industrial metal – but they sit on different layers of the resilience hierarchy.

5. A ranking that looks like a survival checklist

Viewed through this lens, the market-cap table begins to resemble something more than a league table of prices. It starts to look like a priority list for resilience in the current decade.

• Gold reflects the oldest layer of financial security – a globally recognized store of value outside the control of any single government.

• Silver now captures both monetary hedging and the materials needed for energy transition, AI infrastructure and advanced industrial systems.

• Technology giants provide the software, platforms and cloud capabilities that run the digital economy, but depend in turn on stable access to power, materials and secure supply chains.

• Bitcoin adds an entirely digital layer of optionality, offering a censorship-resistant asset that operates outside traditional banking rails.

That ordering does not represent a verdict on which asset is “best.” Rather, it echoes a logical sequence: in periods where global conditions feel fragile, capital first secures foundational resources – metals, energy, baseline monetary hedges – and only then adds exposure to higher-beta assets tied to innovation, growth and digital narratives.

6. What this means for market participants

For investors and analysts, silver’s move into the Top 3 is a reminder to look beyond traditional style boxes. The asset no longer fits neatly into the simple label of “precious metal.” It has become a hybrid instrument at the crossroads of industrial policy, energy transition and macro hedging.

Several practical takeaways emerge:

• Macro analysis needs a materials layer. When evaluating the outlook for AI, electric vehicles, grid upgrades or defense technology, it is no longer sufficient to study only software companies and chip designers. Access to key inputs such as silver, copper and rare earth elements is a core part of the story.

• Risk models should include resource shocks. For decades, many financial models treated commodity shocks as temporary disturbances. In a world of structural energy transition and supply constraints, price moves in key metals can reshape profitability across entire sectors.

• Digital and physical hedges can complement each other. Bitcoin, gold and silver each respond differently to various macro scenarios. Understanding how they behave in combination – rather than assuming they are interchangeable – is essential for thoughtful portfolio construction.

7. Looking ahead: will silver keep its lead?

Whether silver will remain above the largest technology firms and Bitcoin is an open question. Market-cap tables are snapshots, not destiny. A period of strong equity performance, new AI revenue streams or a change in monetary policy could easily push technology valuations higher again. Conversely, further supply constraints or new industrial uses could reinforce silver’s position.

What is less likely to reverse quickly is the underlying shift in mindset. The last few years have shown that physical constraints, logistics and security considerations can reshape economic outcomes just as profoundly as software innovation. The market is simply catching up to that reality.

In that sense, silver’s rise into the global Top 3 is a symbol of a broader transition: from an era that assumed almost frictionless globalization and abundant resources to one that acknowledges scarcity, strategic rivalry and the need for robust physical foundations. The chart on the screen is telling a quiet story about how the world now ranks its priorities.

Disclaimer: This article is for educational and analytical purposes only and does not constitute financial, investment or legal advice. All assets discussed carry risk and may not be suitable for every investor. Always conduct thorough research and consider consulting a qualified professional before making financial decisions.