From Silver Shock to Bitcoin Accumulation: What Today’s Cross-Market Signals Are Telling Crypto

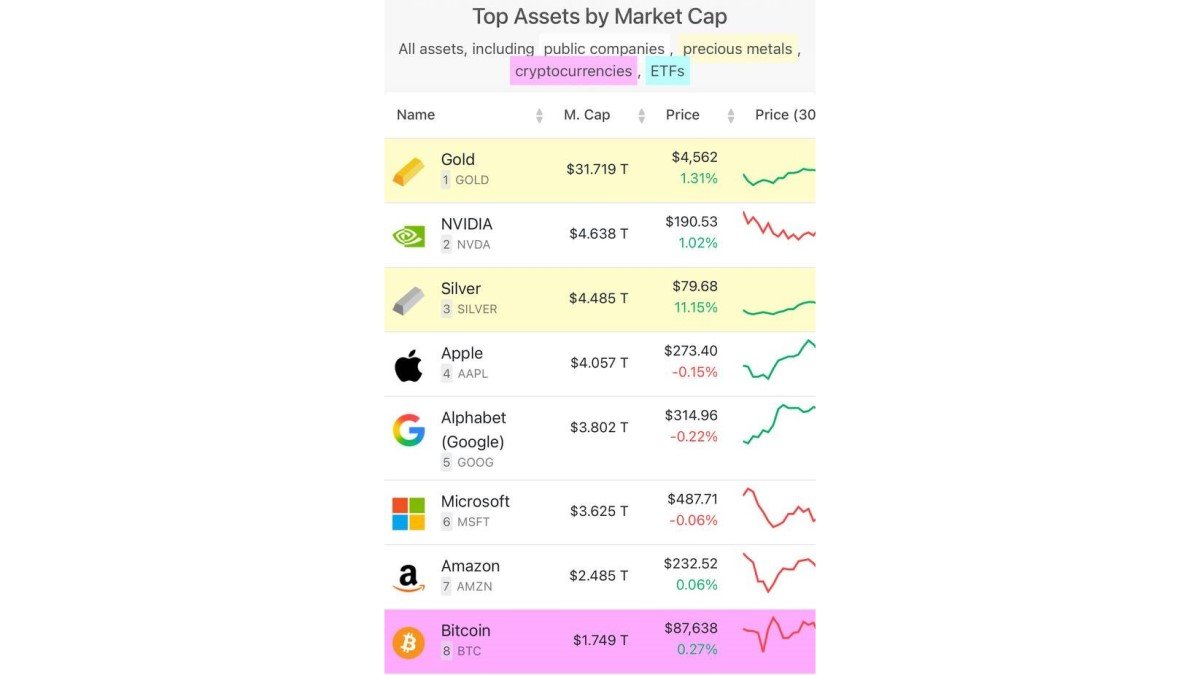

The final days of 2025 are refusing to be quiet. Precious metals, macro politics and digital assets are all sending mixed but highly informative signals about where capital feels safest – and where it still sees upside. Silver has just suffered a double-digit correction on rumors of stress at a major U.S. bank, even as long-term demand remains strong. Bitcoin continues to migrate into institutional treasuries ahead of the next halving. On-chain infrastructure and new token listings keep evolving beneath the surface, from zkPass on Bithumb to new restaking flows into Ethereum.

Instead of treating these headlines as isolated stories, it is more useful to read them together. Taken as a whole, they describe a market that is nervous about parts of the traditional financial system, but not willing to abandon risk entirely. Capital is rotating, not disappearing. The question is where it is choosing to land.

1. Silver’s 10% Drop: Stress Test for the “Metals First” Trade

The most eye-catching move in the past 24 hours came from silver. After months of momentum and a climb to record levels, the metal saw a pullback of more than 10% following rumors that a large U.S. bank could be facing severe difficulties. On the surface, that reaction might sound paradoxical: if investors are worried about banks, shouldn’t they be buying more precious metals, not less?

There are two key dynamics to keep in mind.

• Positioning was crowded. Silver had benefited from a powerful narrative that combined monetary concerns, industrial demand from solar and electronics, and geopolitical risk. When positioning is extended, even a piece of negative news can trigger profit-taking simply because traders want to lock in gains.

• Liquidity matters in moments of stress. When institutions need cash quickly – whether due to margin calls, balance-sheet constraints or risk-management rules – they often sell what has gone up the most and remains easy to trade. The fact that silver sold off after the bank rumor may reflect this “sell winners to raise cash” pattern, not a sudden loss of faith in the metal’s long-term role.

For crypto investors, the key takeaway is not that the metals story is over. Instead, it is a reminder that even assets positioned as long-term hedges can behave like short-term liquidity reservoirs in moments of stress. If silver has truly become a core portfolio holding for institutions, sharp pullbacks along the way are part of that maturation process.

2. Institutions Keep Accumulating Bitcoin Ahead of the Halving

While silver absorbed a sudden shock, Bitcoin quietly strengthened its case as a long-term treasury asset. Two headlines stand out:

- Only 120,000 blocks remain until the next Bitcoin halving. At current block times, that places the event within months. Historically, halvings have not been magic triggers, but they have tended to frame multi-year supply dynamics and influence investor narratives.

- Institutional treasuries added more BTC. Michael Saylor’s group purchased 1,229 BTC for approximately 108 million USD, and Metaplanet added 4,279 BTC (around 375 million USD), taking its total holdings to 35,102 BTC – nearly 3 billion USD at current prices.

There is a simple but powerful message embedded here: while short-term traders debate support and resistance levels, some long-horizon buyers are using every period of uncertainty to add to their reserves. These entities are not trying to time the exact bottom into the halving; they are dollar-cost averaging into an asset they treat as a strategic holding.

That behavior also intersects with the macro picture. Concerns about public-sector balance sheets remain elevated. Elon Musk recently argued that a significant portion of the U.S. federal budget may be lost to inefficiencies and misuse, suggesting that headline deficit numbers may understate the true fiscal challenge. In parallel, political pressure on the Federal Reserve has intensified, with public criticism of the central bank’s leadership and its interest-rate decisions.

In that environment, Bitcoin’s fixed issuance schedule and transparent on-chain ledger continue to appeal to investors who are uneasy about long-term currency dilution. The accumulation by corporate treasuries and listed companies such as Metaplanet is not merely a bet on price; it is a statement about preferred reserve assets in a world of fiscal and monetary uncertainty.

3. Crypto Market Sentiment: Between Reassurance and Skepticism

The broader crypto market is still navigating a fragile mood. Headlines capture both reassurance and lingering caution.

On the reassurance side, Binance founder CZ emphasized that Bitcoin and the wider digital-asset ecosystem are resilient and will "be fine" despite macro noise and regulatory change. Comments like these are partly symbolic, but they matter for sentiment: many retail participants still look to high-profile industry figures as emotional anchors during turbulent periods.

At the same time, traditional investors are watching leadership transitions in legacy finance. Warren Buffett is entering his final day as CEO of Berkshire Hathaway, closing a chapter in value-investing history. That change reinforces the sense that the old playbook – built around a small set of stable blue-chip holdings – is slowly giving way to a more complex environment where technology, data and alternative assets play much larger roles.

Crypto sits directly in the middle of this transition. It is still seen as speculative by many, but it increasingly shares the stage with metals, technology giants and sovereign bonds in asset-allocation debates. Today’s headlines show that when uncertainty hits banks, energy markets or budgets, digital assets quickly re-enter the conversation.

4. Solana, Security Incidents and the Ongoing Maturity of Infrastructure

The last 24 hours also delivered several signals about how core infrastructure in the crypto ecosystem is evolving, especially around Solana and security practices.

4.1 Jito BAM crosses 10% of Solana stake

On-chain data shows that Jito’s Block Engine and MEV (BAM) ecosystem now accounts for more than 10% of staked SOL, with 42.59 million SOL delegated across 146 validators and continuing to grow. This concentration has two implications:

• Performance and yield optimization. Jito’s tooling is designed to capture additional value from block production and transaction ordering, sharing part of that revenue with validators and delegators. As more stake flows into this system, it can improve economic efficiency for participants.

• Decentralization questions. Having a double-digit share of stake routed through one ecosystem raises important discussions about diversity of clients, operators and strategies. For Solana to remain robust, stakeholders will need to monitor whether such concentrations are balanced by healthy competition and transparent governance.

4.2 Lessons from social-engineering attacks

Security researchers, including ZachXBT, have highlighted allegations that a Canadian individual known as “Haby” used social-engineering techniques to impersonate customer support from Coinbase, convincing victims to share sensitive information and gaining unauthorized access to their funds. Although this case primarily affects centralized-exchange users, not base-layer protocols, it underscores a persistent theme: human interfaces remain a major point of vulnerability.

For everyday users, the takeaway is straightforward but important: treat unsolicited contact carefully, verify support channels through official websites or apps, and consider hardware-based authentication wherever possible. For platforms, it is another reminder that security is not just about code audits but also about training, communication and user-experience design.

5. Network Resilience: Flow’s Recovery and Ethereum’s Restaking Wave

5.1 Flow rescinds rollback plan and restores full functionality

Flow Foundation has fully restored network functionality after a security incident that led to approximately 3.9 million USD in losses. Importantly, the team decided not to proceed with a chain rollback that had been discussed earlier, a proposal that had raised concerns among partners such as deBridge about precedent and systemic risk.

By choosing to move forward without rewriting chain history, Flow signals a commitment to predictable rules and open coordination over quick but disruptive fixes. For institutions evaluating smart-contract platforms, this type of governance decision is as important as throughput or fees.

5.2 Restaking momentum on Ethereum

On Ethereum, restaking continues to attract large holders looking to earn additional yield from their existing positions. ETHZilla deposited 10,600 ETH into Puffer Finance to participate in restaking strategies, while Bitmine Immersion (BMNR) announced that it plans to launch its MAVAN staking solution in Q1 2026.

These developments matter for several reasons:

- Risk layering. Restaking effectively re-uses collateral for multiple roles (securing Ethereum and additional services). This can increase capital efficiency but also requires careful assessment of smart-contract and slashing risks.

- Institutional participation. The presence of named entities and structured products indicates that restaking is moving beyond experimental territory and into more formal investment strategies.

For Ethereum’s broader narrative, growing restaking infrastructure reinforces its role as a base layer for modular security services, not just a platform for decentralized applications.

6. Tokens, Listings and the Geography of Demand

Beyond base-layer infrastructure, several token-specific developments highlight how regional exchanges and specialized projects continue to shape market structure.

6.1 zkPass ($ZKP) gains KRW pair on Bithumb

Zero-knowledge identity protocol zkPass has been listed with a KRW trading pair on Bithumb, one of South Korea’s largest exchanges. This is more than just an additional venue: listing directly against the Korean won opens the door for local retail and institutional participants to access the token without routing through USD or stablecoin pairs.

Given South Korea’s historically active trading community and its interest in privacy-preserving technologies, the listing could become an important liquidity driver for $ZKP. It also reinforces a broader theme: Asia, and particularly Korea, remains a critical region for discovering and pricing mid-cap crypto assets.

6.2 Yield Basis ($YB) debuts on Upbit

Yield Basis, a project focused on structured yield products and basis-trading strategies, has been listed on Upbit with YB/BTC and YB/USDT pairs. For a token in this category, being listed on a top-tier exchange is not just about visibility. It is a test of whether investors believe its revenue model and risk management can sustain long-term demand for the token.

The listing also fits into a larger pattern in which yield-oriented protocols seek to move closer to spot markets, rather than staying confined to niche DeFi venues. If successful, such integrations could blur the line between traditional structured-product desks and on-chain equivalents.

6.3 WLFI and the state-backed stablecoin experiment

World Liberty Financial has proposed the use of public funds to accelerate adoption of its USD1 stablecoin, positioning it as a digital cash instrument with official support. While details on governance, reserve management and regulatory oversight still need close scrutiny, the direction is clear: experiments at the intersection of state treasuries and programmable money are moving from theory to pilot programs.

For crypto markets, this raises both opportunities and questions. Official backing can dramatically increase usage, but it also introduces new expectations around transparency, risk sharing and policy influence. How USD1 evolves will be a case study in state-aligned digital currency design outside of traditional central-bank projects.

7. Leadership, Technology and the Politics Around AI

Beyond purely financial news, several political and technological headlines are shaping the narrative backdrop for digital assets.

• Elon Musk and Israeli leadership held discussions on AI development in Israel. This underscores how advanced compute, data centers and sovereign AI capabilities are becoming strategic priorities for governments.

• Musk also argued that a very large share of the U.S. federal budget may be lost to inefficiencies and misuse each year. If such concerns gain broader traction, they could further fuel public interest in transparent, programmable forms of value transfer.

• Political pressure on the Federal Reserve continues. Former President Trump has sharply criticized Fed Chair Jerome Powell, signaling that monetary policy could remain a central topic in upcoming political cycles.

For crypto, these developments matter less for their short-term price impact and more for what they reveal about the direction of policy and technology. As AI infrastructure, energy grids and payments systems converge, digital assets and blockchains are likely to be part of the toolkit governments and corporations consider – whether for reserves, settlement or programmable incentive structures.

8. How to Read This Cross-Asset Moment

Put together, the last 24 hours tell a story of markets that are neither euphoric nor in full retreat. Instead, capital is actively reshuffling:

• Metals such as silver remain in focus but are now volatile enough to serve as liquidity sources when stress appears elsewhere.

• Bitcoin continues to migrate into institutional treasuries ahead of the halving, reinforcing its role as a strategic reserve asset for some investors.

• Layer-1 ecosystems like Solana and Flow are moving through growing pains around concentration and security, while Ethereum deepens its restaking stack.

• New tokens like zkPass’s ZKP and Yield Basis’s YB are testing appetite for privacy and yield innovation, particularly in active regional hubs like South Korea.

• Experiments such as WLFI’s USD1 suggest that the boundary between public finance and on-chain infrastructure will continue to blur.

In this context, a binary label like “risk-on” or “risk-off” is too simple. A more accurate description might be: “risk is being repriced and redistributed.” Investors are not stepping away from markets; they are choosing more carefully which assets they trust – and for what scenarios.

9. Practical Takeaways for Market Participants

For traders and long-term allocators alike, several practical lessons stand out from this mix of headlines:

• Watch how different hedges behave under stress. Silver’s pullback shows that even popular defensive assets can be sold to meet liquidity needs. Observing cross-asset moves during shocks is as important as tracking day-to-day trends.

• Track real accumulation, not just price. Institutional Bitcoin purchases and long-term staking commitments on Ethereum tell a deeper story than intraday volatility.

• Pay attention to regional demand channels. Korean listings for ZKP and YB, or future KRW pairs, can significantly shape liquidity and narrative for specific tokens.

• Evaluate infrastructure through both technical and governance lenses. Flow’s decision not to roll back the chain, and Solana’s stake concentration dynamics, are examples where governance choices are as informative as throughput benchmarks.

The end of a calendar year often invites simple narratives about "closing the book" on one cycle and opening another. Today’s news instead suggests a more gradual transition: legacy giants handing over leadership roles, metals and digital assets competing for the role of macro hedge, and programmable finance beginning to intersect with public budgets and industrial policy.

How investors navigate that landscape – balancing caution with selective risk-taking – will likely matter more for 2026 returns than any single headline. The silver correction, the Bitcoin accumulation and the steady march of on-chain innovation are all chapters of the same evolving story.

Disclaimer: This article is for educational and analytical purposes only and does not constitute financial, investment or legal advice. Digital assets and commodities can be highly volatile and may not be suitable for every investor. Always conduct your own research and consider consulting a qualified professional before making financial decisions.