When Billion-Dollar Whales Move: How to Read Institutional Positioning on Bitcoin and Ethereum

Large institutions and so-called megawhales play a very different game from most individual traders. They do not wake up every morning trying to capture a one percent swing. When asset bases reach into the billions, the cost of moving capital, the constraints on risk, and the scrutiny from stakeholders all change the playbook.

The reference flow here is clear: at one point a megawhale desk holding close to 2 billion USD deployed capital aggressively, combining spot positions with leverage to expand exposure. At the same time, several venture and proprietary desks controlling hundreds of millions built directional positions on the expectation that the market would trend higher in the following months. In October 2024, that cohort leaned into a narrative around the U.S. election cycle, and those who aligned with that wave were rewarded.

Today, the story is shifting. Two Asian-based groups reportedly managing more than 1 billion USD and 10 billion USD respectively are increasing their Ethereum exposure while trimming part of their Bitcoin holdings. Their working assumption: a local bottom for Bitcoin roughly around 87,000 USD and a value area for Ethereum near 2,700 USD, with a medium-term view that ETH could lead the next leg higher.

For individual participants, the crucial question is not simply, “Should I do the same?” but rather: How should I interpret these moves in the context of my own risk profile, time horizon, and understanding of the cycle?

1. How Billion-Dollar Whales Actually Behave

It is tempting to imagine institutional flows as an always-on force constantly steering the market. In reality, large players behave in a far more episodic way. When capital bases reach one or ten billion dollars, several patterns tend to appear:

• They focus on inflection points, not every fluctuation. Big capital usually waits for moments when the risk/reward of a structural move improves: macro regime changes, policy decisions, election cycles, or sharp dislocations in pricing.

• They express views across multiple instruments. A megawhale rarely buys only spot. They may combine spot positions, futures, options and basis trades to engineer a specific payoff profile over weeks or months.

• They accept being early within a wide time window. For a desk managing billions, being early by a few weeks is acceptable if the thesis plays out over a quarter. That tolerance can look like "being wrong" to short-term traders watching one-hour candles.

• They care about liquidity as much as price. Entering and exiting positions at scale is often the constraint. A price level that looks attractive on paper may still be impractical if order books cannot absorb the size without heavy slippage.

When a megawhale adds leverage on top of a billion-dollar base, it is rarely for entertainment. It is usually an attempt to magnify a thesis built on macro, on-chain structure, and order-flow analysis that spans months, not days.

2. Looking Back: The 2024 Election Wave

October 2024 is a useful case study. During that period, several large funds and megawhale wallets visibly leaned into a narrative tied to the U.S. political calendar. As polls shifted and markets began to price a particular outcome, risk assets including Bitcoin reacted. Capital flowed into BTC and other major assets on the expectation that the combination of policy direction, potential fiscal expansion, and liquidity conditions would be supportive.

Those who tracked the flows and understood the macro story were able to ride the move rather than fight it. But there is an important nuance: it was not the label of the trade ("election wave") that made it profitable. It was the alignment of several layers:

- Positioning data showing that large players were building exposure.

- Macro indicators hinting at easier financial conditions or stronger risk appetite.

- Market structure that still had room for new leverage without tipping into overcrowded extremes.

In other words, the election was a catalyst, not a guarantee. The real value of that period as a reference is that it illustrates how megawhales often wait for convergence of narrative, liquidity, and positioning rather than acting on isolated headlines.

3. The New Rotation: From Bitcoin to Ethereum

The current setup looks different. Instead of building fresh risk in Bitcoin alone, the reported Asian groups are rotating: reducing part of their BTC holdings and increasing allocations to ETH. They appear to be treating the 87,000 USD area for Bitcoin and the 2,700 USD zone for Ethereum as attractive entry or add levels, at least within their internal models.

This kind of rotation hints at three deeper views:

3.1 Relative value, not just direction

By shifting weight from BTC to ETH rather than simply buying both, these desks are expressing an opinion about which asset is likely to outperform on a relative basis. In this framing, Bitcoin remains a core macro asset – a digital store of value tied to broader confidence in monetary policy – while Ethereum is seen as more sensitive to:

- Network usage and fee generation.

- Staking yields and restaking ecosystems.

- On-chain financing, tokenization, and application growth.

When conditions favor growth in on-chain activity and yield-bearing infrastructure, it is rational for some institutions to tilt toward ETH.

3.2 Confidence in structural demand for Ethereum

Increasing ETH exposure near a perceived local bottom also implies conviction that the network will continue to attract capital, developers, and experimenters. Ethereum has become a base layer for stablecoins, decentralized exchanges, restaking protocols, and real-world asset platforms. A thesis built around 2,700 USD as a value zone is not only about charts; it assumes that this activity is durable.

3.3 Willingness to live with volatility

Finally, any large rotation between BTC and ETH acknowledges the obvious: the path will not be smooth. Even if 87,000 USD and 2,700 USD are attractive in a multi-quarter model, prices can spend time below those levels. Institutions can tolerate this within their risk frameworks; individual investors must decide whether they can do the same without panicking.

4. What Whale Flows Tell You – and What They Do Not

On-chain dashboards and flow trackers have made it easier than ever to monitor where large amounts of BTC and ETH are moving. That access is powerful, but it is also easy to misuse. There are several myths worth clearing up.

4.1 Myth: “Whales are always right.”

Large players are not infallible. They can be early, they can be overconfident, and they can be constrained by mandates that do not apply to smaller participants. A billion-dollar desk might accept a sizeable drawdown in the near term because their horizon is 12–24 months and their funding is locked. That same drawdown might be intolerable for someone managing personal savings with no external capital.

4.2 Myth: “If a whale buys, price must go up immediately.”

Flows can take time to show consequences. A desk can accumulate quietly over weeks while price oscillates in a range. Markets often need a catalyst – a macro surprise, a change in funding, a break of a key level – for those positions to translate into trends.

4.3 Myth: “Copy-trading whales is a strategy.”

Blindly mirroring large moves is dangerous for two reasons:

- You rarely see the full picture. A visible spot inflow may be hedged elsewhere with derivatives or offset by positions in correlated assets.

- You do not share the same constraints and objectives. A treasury manager, a market-neutral fund, and an individual saver can all hold the same coin for completely different reasons.

The real value of whale data is not as a checklist of trades to copy, but as context for where risk is concentrating in the system and which narratives large capital is willing to back with size.

5. A Framework for Using This Information Responsibly

So what should an individual participant actually do with the knowledge that two Asian groups are rotating from BTC into ETH and treating 87,000 and 2,700 as key zones? A constructive approach might look like this.

5.1 Translate flows into questions, not instructions

Instead of reading flows as orders, turn them into prompts for your own analysis:

- “Why would a billion-dollar desk prefer ETH over BTC at this stage of the cycle?”

- “What assumptions about network growth, staking yields, and regulatory risk must be true for that trade to work?”

- “How would my portfolio behave if their thesis is right – and how would it behave if they are early or wrong?”

This shift – from imitation to critical thinking – is where whale data becomes genuinely educational.

5.2 Align with your own time horizon

If the desks in question are looking at a six- to twelve-month window, but your tolerance for drawdown is only a few weeks, trying to replicate their positioning is misaligned from the start. It is more productive to:

- Define your minimum holding horizon for any BTC or ETH allocation.

- Size positions so that a realistic drawdown does not force you to exit at exactly the wrong time.

- Avoid leverage unless you fully understand the liquidation dynamics and can survive adverse moves.

Institutional players can sometimes negotiate bespoke financing or collateral terms. Most individuals cannot. That difference matters more than the choice between 87,000 and 2,700 as levels.

5.3 Think in scenarios, not predictions

Rather than fixating on a single "correct" outcome, map a few plausible paths:

• Scenario A: Bitcoin holds above the referenced zone, Ethereum responds positively, and the rotation thesis plays out. In this case, having some ETH exposure alongside BTC can help capture relative outperformance.

• Scenario B: Both assets dip well below the quoted levels before recovering. Here, survivability – the ability to hold through stress without forced selling – matters more than precise entries.

• Scenario C: Macro conditions deteriorate, liquidity tightens, and both BTC and ETH underperform other assets for a period. In that environment, strict position sizing, diversification, and a clear risk plan are essential.

The whales may be positioned for Scenario A, but your financial situation might require preparing seriously for B and C as well.

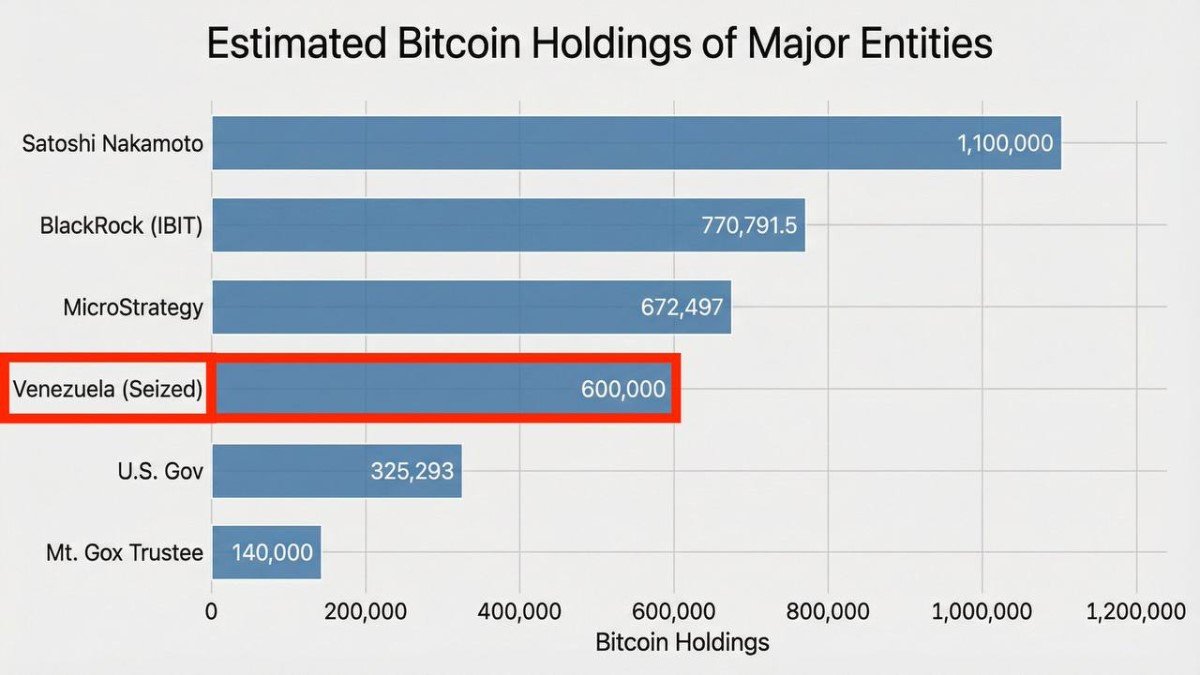

6. Why Institutions Still Rotate Around Bitcoin and Ethereum

Even as capital shifts between them, Bitcoin and Ethereum occupy complementary roles in institutional thinking.

- Bitcoin is still treated as the primary macro asset of the ecosystem: a scarce, transparent digital asset that reacts to interest rates, liquidity conditions, and broader confidence in financial policy. Its supply schedule and neutrality remain central to its appeal.

- Ethereum is increasingly viewed as a programmable yield and infrastructure layer: fees, staking rewards, and application activity combine to create a different type of risk profile, closer in some ways to a technology platform.

When institutions sell part of their BTC to buy more ETH, they are not necessarily abandoning Bitcoin. Often they are rotating within a basket to reflect where they see better risk-adjusted upside over the next phase of the cycle. For example:

- If they expect more on-chain issuance of real-world assets, stablecoins, and structured products, they may tilt toward ETH.

- If they anticipate renewed macro stress, they may tighten exposure to higher-beta assets and lean back toward BTC as a defensive anchor.

Understanding that dynamic helps put today’s flows into perspective. They are part of an ongoing conversation about how to balance macro exposure and network growth, not a binary verdict on which chain “wins.”

7. So, What Should You Do With This Information?

The original question is simple and honest: when you know that billion-dollar players are reallocating between BTC and ETH, what do you do with that knowledge?

There is no single correct answer, but there are several responsible steps:

• Review your own thesis. If you hold Bitcoin, why do you hold it? As a long-term store of value, as a trading asset, or as a hedge against specific scenarios? If you hold Ethereum, is it because of staking yields, application exposure, or simple diversification? Make sure your reasons are explicit, not just inherited from social media.

• Check your allocation balance. Does your BTC/ETH ratio still reflect your beliefs about their roles, or did it drift simply because one outperformed the other for a while? Whale rotations can be a useful reminder to rebalance intentionally rather than accidentally.

• Reassess your risk limits. If price revisits or falls below the areas large players consider attractive, will that tempt you to go beyond your comfort zone? Setting maximum allocation percentages and clear rules in advance can prevent emotional decisions.

• Focus on process, not personalities. It is easy to become fixated on who is behind a "megawhale" wallet. More important is the framework: which signals they are likely watching (liquidity, macro, positioning) and how you can incorporate similar thinking at your own scale.

Ultimately, the fact that experienced institutions are again locking in exposure is a sign that the crypto cycle is very much alive. It does not guarantee an immediate rally, but it suggests that serious capital still views Bitcoin and Ethereum as core parts of the global risk landscape.

8. Conclusion: Read the Whales, But Write Your Own Plan

When assets under management reach the billion-dollar mark, every decision is filtered through governance committees, risk officers, and long-term performance targets. Those players tend to appear in force only at moments that they perceive as strategically important. The recent pattern – megawhales mobilizing leverage around key macro events, then rotating from Bitcoin into Ethereum near specific zones – is another chapter in that story.

For individual investors, the healthiest way to respond is not to imitate, but to observe, interpret, and adapt:

- Observe where large capital is moving and which narratives it is willing to support with size.

- Interpret those flows in the context of macro conditions, on-chain structure, and your own time horizon.

- Adapt your plan where it truly improves your risk/reward, without abandoning discipline in pursuit of someone else’s conviction.

Whale wallets can highlight where the market’s most informed participants are placing their bets. They cannot live your life, pay your bills, or bear your drawdowns. That part is entirely yours.

Disclaimer: This article is for educational and analytical purposes only and does not constitute financial, investment, or legal advice. Digital assets are highly volatile and may not be suitable for all investors. Always conduct your own research and consider consulting a qualified professional before making any financial decisions.