What a Kevin Hassett Fed Might Mean for the Dollar, Rates and Digital Assets

Central banks are usually associated with gradual, carefully worded changes. Every so often, though, personnel questions jolt the conversation. That is happening again in the United States as commentators speculate about who might succeed Jerome Powell when his term as Federal Reserve Chair ends in May 2026. One name appears again and again: Kevin Hassett.

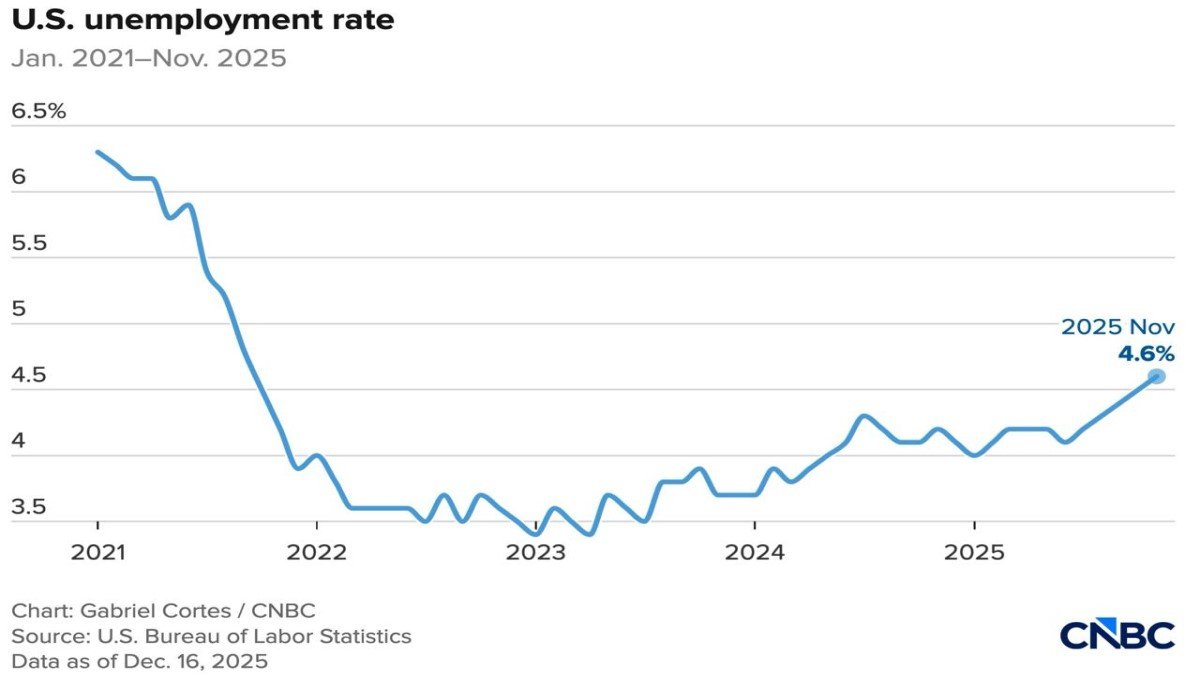

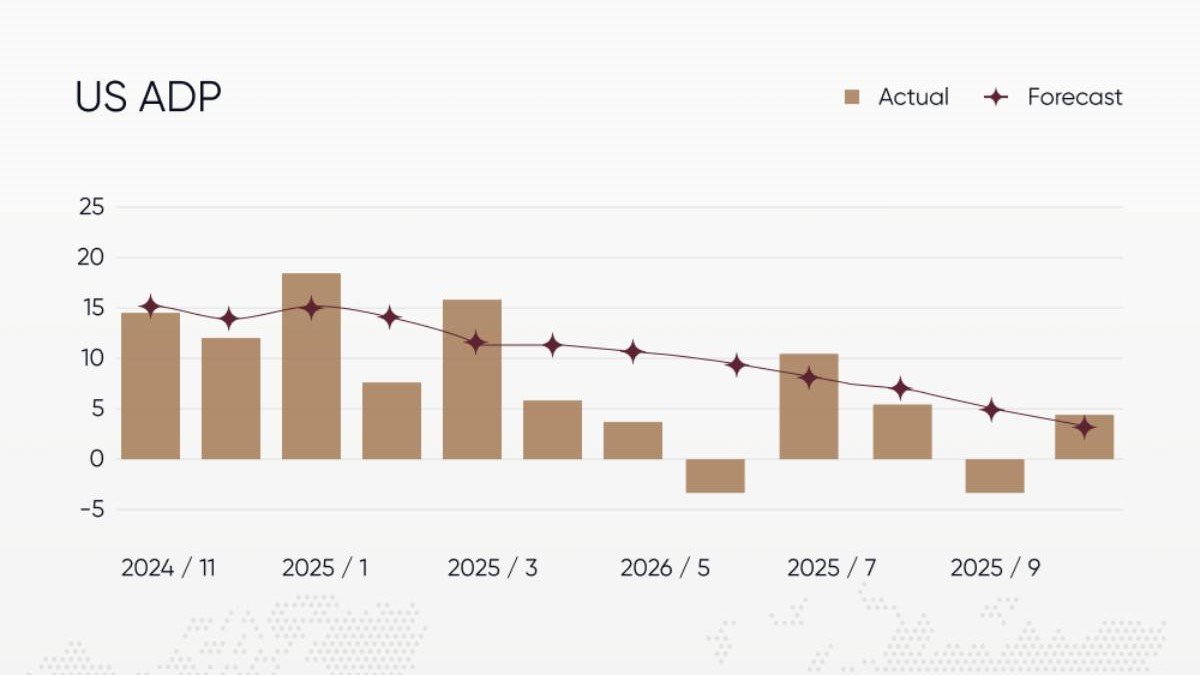

Hassett is not a stranger to Washington. He served as chair of the White House Council of Economic Advisers, has advised multiple administrations and once held a senior economist role at the Fed itself. What makes him stand out now is not just his résumé, but his recent public comments. He has argued that, given today’s labour-market softness and progress on inflation, he would already be cutting interest rates if he were running the central bank.

That stance has triggered a wave of analysis. Supporters say a quicker move toward lower borrowing costs could reduce the risk of an unnecessarily sharp slowdown. Critics worry that such an approach might weaken the US dollar, reignite inflation and subtly encourage excess risk-taking across global markets. For participants in digital-asset markets, where macro conditions are increasingly important, the discussion matters even if the outcome is still several years away.

1. Why the Fed Chair Matters So Much

Before focusing on Hassett, it is worth revisiting why the identity of the Fed chair attracts so much attention. Formally, the Federal Reserve operates under a dual mandate: achieving maximum employment and stable prices. In practice, the chair is the public face of the institution and has significant influence over how that mandate is interpreted.

The Fed sets a target range for its key policy rate and manages a large balance sheet of US Treasury securities and mortgage-backed bonds. Those decisions ripple outward to the entire financial system. Short-term rates influence everything from credit-card interest to corporate borrowing costs. Longer-term yields react to the expected path of policy and to the Fed’s bond holdings. Together, these factors shape the value of the US dollar relative to other currencies and influence global appetite for risk-sensitive assets, including equities and crypto.

In theory, policy is driven entirely by data and a shared framework within the Federal Open Market Committee. In reality, the chair’s preferences and communication style can tilt that framework in more flexible or more conservative directions. That is why markets pay close attention when a potential future leader expresses clear views about how policy should evolve.

2. Kevin Hassett’s Policy Leanings

Hassett has long been associated with a pro-growth approach to macroeconomic management. During his time as a senior adviser, he often emphasised the role of investment, productivity and labour-force participation in sustaining long-term prosperity. In the current context, his most striking comments relate to the level of interest rates.

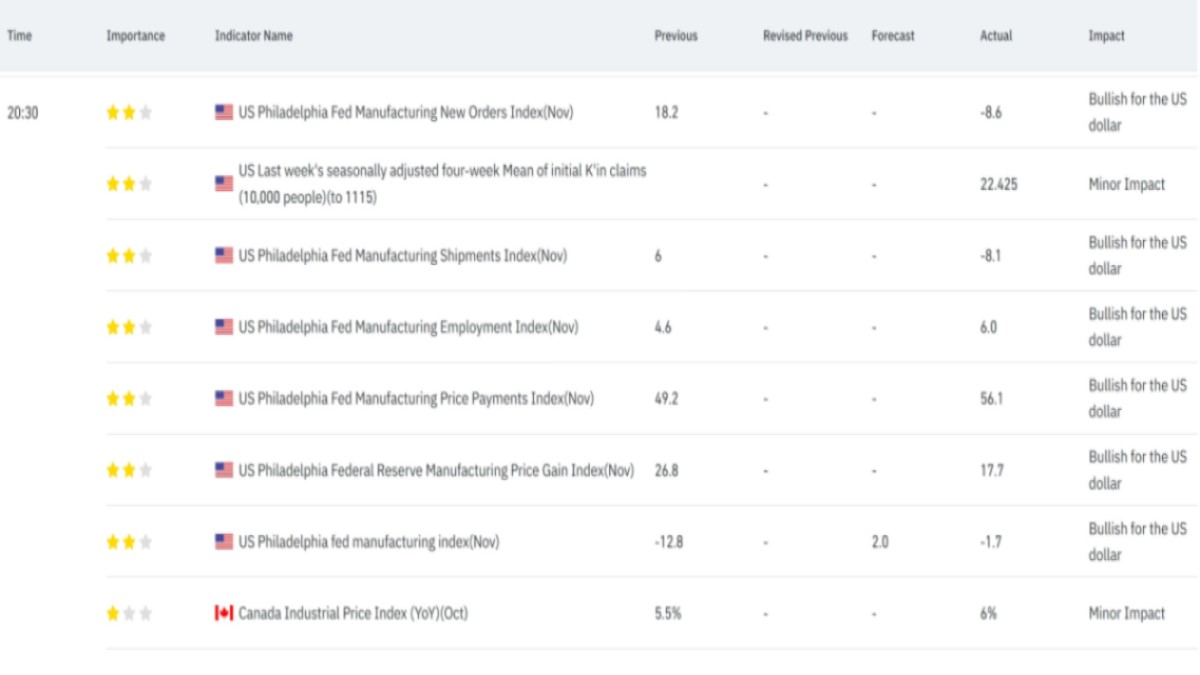

Where Powell has spoken about the need for “careful” adjustment, emphasising that the final leg of disinflation can be slow and uneven, Hassett has argued that the data already justify lower rates. He points to cooling labour-market indicators, moderating wage growth and a gradual decline in core inflation measures as evidence that restrictive policy is no longer necessary. In his view, keeping rates high for too long risks damaging the real economy without doing much more to slow price growth.

That perspective places him toward the more accommodative end of the spectrum within the broader policy debate. It does not mean he is indifferent to inflation; he has been openly critical of the Fed’s response in the immediate aftermath of the pandemic, arguing that officials waited too long to remove emergency stimulus. But when he looks at the current balance of risks, he sees prolonged tightness as a bigger problem than too much support.

3. Why Analysts Worry About the Dollar

The prospect of a Fed chair who is openly enthusiastic about rate cuts naturally raises questions about the US dollar. The connection is straightforward: all else equal, lower interest rates reduce the yield that global investors earn on dollar-denominated assets. If the Fed eases policy more quickly than other major central banks, interest-rate differentials narrow and some capital may shift toward markets that offer higher returns.

For decades the US has benefited from what is often called the dollar’s “reserve currency” status. International trade, commodity pricing and cross-border investment are heavily denominated in dollars. That role is unlikely to disappear suddenly, but the value of the currency can still fluctuate significantly based on expectations about policy and growth. A chair perceived as eager to reduce rates could, at the margin, encourage a weaker dollar if other regions remain relatively firm.

Why does that worry some analysts? There are three main concerns:

• Imported inflation. A softer dollar makes foreign goods and services more expensive in dollar terms, which can add modest upward pressure to consumer prices in the US.

• Perceived discipline. If markets conclude that the central bank is prioritising growth over price stability, long-term inflation expectations could drift higher, leading investors to demand more compensation for holding US debt.

• Shifts in asset allocation. A weaker currency can reduce the appeal of dollar-denominated assets for some global investors, especially if they expect returns elsewhere to be more attractive on a currency-adjusted basis.

None of these outcomes is automatic. Much would depend on how quickly the economy grows, how other central banks respond and whether inflation behaves in line with the Fed’s forecasts. But the combination of a chair who favours faster easing and a political environment that emphasises growth can understandably prompt questions about long-term discipline.

4. The Inflation Question: Has the Fed Done Enough?

A central tension in the Hassett discussion concerns inflation. After the pandemic, price growth in the US reached levels not seen in decades. The Fed responded with one of the fastest tightening cycles in its history, raising policy rates from near zero to restrictive territory in a short period of time. Over the last year, inflation has fallen meaningfully, but in some measures it remains slightly above the 2% target.

Hassett has been critical of the early phase of this story, arguing that the central bank underestimated the persistence of price pressures and moved too slowly to normalise policy. That criticism aligns him with commentators who considered the initial “transitory” narrative overly optimistic. Where he diverges from some of those critics is in his assessment of the present. In his reading, the heavy lifting has been done; labour-market cooling and softer demand now argue for a less restrictive stance.

For observers, the key issue is not whether he is correct today, but how he might respond if inflation were to flare up again. Would he tolerate a temporary overshoot in the name of supporting growth, or would he react swiftly? His recent comments suggest he views the current environment as one where the risk of renewed inflation is manageable, but any central-bank leader must be willing to tighten again if price stability clearly deteriorates.

5. Implications for Bonds, Equities and Digital Assets

A more accommodative Fed chair could reshape the landscape for multiple asset classes.

In bond markets, expectations of earlier or deeper rate cuts typically push down yields at the short and intermediate parts of the curve. If investors also start to worry that inflation expectations will drift higher, long-term yields could move in the opposite direction, steepening the curve. Such a configuration — lower short-term rates but relatively firm long-term yields — can be supportive for certain types of borrowing while keeping a floor under the compensation demanded for long-dated exposure to US debt.

In equities, easier policy is often associated with higher valuations, particularly for sectors that are sensitive to discount rates such as technology and growth-oriented companies. Corporate earnings still need to deliver over time, but lower funding costs and a more supportive policy tone can improve sentiment.

For digital assets, the picture is more nuanced. Historically, major cryptocurrencies have often performed well in environments where real interest rates are falling, the dollar is softening and investors are more willing to allocate to alternative assets. Lower yields can reduce the relative appeal of holding large cash balances and may encourage some investors to explore a broader opportunity set.

However, it would be a mistake to infer a simple one-way relationship. Crypto markets are influenced by many factors: regulatory developments, technology upgrades, network usage, and idiosyncratic events specific to individual projects. Monetary policy is an important background condition, but not the sole driver. A shift toward easier policy under a future Hassett-led Fed could create a friendlier macro backdrop, yet digital assets would still need fundamental progress to sustain any long-term advance.

6. Three Scenarios to Watch

Because Powell’s term does not end until 2026, and because economic data can change quickly, it is helpful to frame the discussion in scenarios rather than predictions.

Scenario 1: Gradualism and Continuity

In this path, Powell serves out his full term and the economy broadly evolves in line with the Fed’s current outlook. Inflation continues to edge lower, allowing for measured rate cuts over time but not a dramatic pivot. The dollar fluctuates within historical ranges and global markets adapt to a world of moderate growth and moderate rates.

For crypto participants, this would resemble the environment that has slowly taken shape since the most aggressive phase of tightening ended: policy remains relevant, but no single headline dominates the narrative.

Scenario 2: Hassett or a Like-Minded Successor

In this scenario, Hassett or someone with similar views is appointed when Powell’s term expires. The new chair places strong emphasis on labour-market outcomes and is prepared to move rates lower relatively quickly, especially if growth slows or unemployment rises.

Under such leadership, real interest rates could fall faster than in Scenario 1, especially if inflation stabilises only slowly near target. The dollar might face more persistent downward pressure, particularly against currencies whose central banks remain cautious. Asset valuations could stretch further as investors adjust to a world where policy support arrives quickly during downturns.

Digital-asset markets in this environment might benefit from sustained interest in alternatives to traditional cash and bonds. Yet they would also be operating in a world where policymakers are willing to respond aggressively to weakness, which can both support and occasionally unsettle risk assets depending on the circumstances.

Scenario 3: Sticky Inflation Forces a Rethink

A third scenario is that inflation proves more persistent than expected, regardless of who is in charge. If price pressures were to re-accelerate meaningfully, any Fed chair — including Hassett — would face intense pressure to tighten policy again. In that case, the current debate about who favours quicker easing would matter less than the fundamental need to restore credibility.

For investors, this scenario underscores an important point: personalities shape policy at the margins, but the underlying data and the institution’s legal mandate still place strong constraints on what any individual can do.

7. How Crypto Investors Can Approach the Debate

For people focused on Bitcoin, Ethereum and other digital assets, it can be tempting to treat the prospect of a more accommodative Fed chair as a simple green light. History suggests a more measured approach is wise.

First, it is helpful to distinguish between cyclical boosts and structural trends. Easier monetary policy can create cyclical tailwinds for assets that thrive on liquidity and risk appetite. Yet long-term adoption and resilience in digital-asset networks depend on technology, governance and real-world integration. Those factors evolve on timelines that are only loosely connected to quarterly decisions in Washington.

Second, macro narratives can shift quickly. Today’s expectation of rapid cuts could become tomorrow’s concern about renewed inflation, or vice versa. Building a decision process that relies on a single individual’s policy preferences leaves little room for surprise.

Third, a world in which the dollar faces more persistent downward pressure is not automatically a world in which every alternative benefits equally. Some assets may be perceived as robust stores of value; others may be seen as highly speculative. Within crypto, projects with clear use cases, transparent governance and prudent risk management are more likely to attract durable interest than short-lived themes that depend solely on abundant liquidity.

8. Conclusion: Personality, Policy and the Long View

The speculation around Kevin Hassett’s potential future role as Fed chair highlights how sensitive modern markets have become to macro policy. His supportive stance toward rate cuts, combined with his criticism of earlier inflation missteps, paints a picture of a central-bank leader who would likely move quickly to support growth when faced with economic softness.

Such an approach could, in some circumstances, put downward pressure on the US dollar and encourage investors to explore a wider set of assets, from equities and real estate to digital assets such as Bitcoin and Ethereum. At the same time, the Fed’s institutional framework, its dual mandate and the discipline imposed by global markets all limit the extent to which any individual can reshape policy unilaterally.

For participants in the crypto space, the most constructive reaction may be to follow the debate closely while keeping it in perspective. Changes at the top of the Fed can influence the backdrop against which digital-asset markets evolve, but they do not replace the need to understand network fundamentals, regulatory trends and technological progress. Macro conditions matter — yet they are only one piece of a much larger puzzle.

Disclaimer: This article is provided for informational and educational purposes only. It does not constitute financial, investment, legal or tax advice, and it should not be interpreted as a recommendation to buy, sell or hold any currency, security or digital asset. Monetary policy and market conditions can change rapidly. Readers should conduct their own research and, where appropriate, consult qualified professionals before making decisions related to investments or financial strategy.