A Hawkish Rate Cut: Reading the Fed’s 0.25% Move Beyond the Headline

The Federal Reserve has cut interest rates by 0.25% for the third time in this cycle. On the surface, that sounds like a straightforward step toward easier policy. Yet the details tell a very different story. The vote was unusually divided, the path of future cuts is slower than many hoped, inflation remains above target, and the Fed has decided to supplement its rate move with targeted purchases of short-term Treasuries.

This is why many observers describe the decision as a hawkish cut: the policy rate moved down, but the overall stance of policy remains tight by historical standards, and the central bank is clearly signalling that it is in no rush to deliver a rapid series of reductions.

1. What the Fed Actually Did

The headline decisions at this meeting can be summarised in four points:

- The target range for the policy rate was reduced by 0.25 percentage points, marking the third cut in the current cycle.

- The vote was 9 in favour and 3 against, the most dissent within the committee since 2019. One policymaker preferred a larger reduction, while two wanted to leave rates unchanged.

- The updated dot plot projects only one more cut in 2026 and one in 2027, with the longer run policy rate stabilising around 3%.

- The Fed announced a programme to buy back 40 billion USD of short-dated Treasury securities, aimed at easing pressures in money markets and smoothing liquidity conditions.

Each of these items sends a slightly different signal. The rate cut recognises that policy can no longer sit indefinitely at peak levels without creating unnecessary pressure on growth and employment. The split vote, however, reveals that there is no consensus inside the Fed about how quickly to move. The dot plot and commentary emphasise that borrowing costs are likely to remain relatively high even after the final cuts. And the bond-buying programme targets plumbing issues in funding markets rather than attempting to generate a broad surge in asset prices.

2. Why This Is Called a Hawkish Cut

In monetary policy, labels such as dovish and hawkish are always approximations. A dovish action usually means more accommodation than markets expected; a hawkish action usually means less. What makes this meeting interesting is that the rate move itself looks dovish, while the surrounding guidance looks hawkish.

Several aspects justify the hawkish interpretation:

• Unusual dissent. A 9 to 3 split is rare for the modern Fed. Two officials opposed the cut because they believe policy is already doing enough. One wanted a bigger cut, arguing that the economy can only handle the current real rate for so long. The fact that the centre of the committee ultimately opted for the smallest available step suggests caution.

• Slower path of cuts. The dot plot pointing to only one reduction in 2026 and one in 2027 is slower than many investors had pencilled in earlier this year. Instead of a rapid slide back toward pre-pandemic levels, the path looks more like a long glide with pauses.

• Persistent positive real rates. With inflation running at 2.8% and policy rates only drifting down gradually, real interest rates remain clearly positive. That is not the posture of a central bank racing to stimulate demand at all costs.

• Explicit openness to no cuts in the near term. Some Fed officials have indicated they would be comfortable with no additional reduction next year if inflation does not behave as forecast. That type of conditional language is a reminder that the easing path is not guaranteed.

Put differently, if one only looked at the rate change, this meeting would be filed under the label of easing. Once the vote, projections and commentary are added, the picture is that of a central bank dipping its toe into lower rates while keeping its armour on.

3. Inflation at 2.8% and the Long Road Back to 2%

Behind the Fed's cautious tone is a simple fact: inflation remains above target. The latest projections place core inflation at 2.8%, and the Fed does not expect a return to its 2% goal until 2028. That timeline is uncomfortably long for an institution whose credibility depends on keeping prices stable over the medium term.

From an analytical standpoint, several points stand out:

• Progress is real but incomplete. Inflation has come down significantly from its peak, but the last leg back toward the target is proving stubborn. Services prices and wages in some sectors are still rising at a pace that is inconsistent with a stable 2% environment.

• Forecast risk is asymmetrical. If inflation surprises on the upside, the Fed may feel compelled to pause or even reverse cuts. If it surprises on the downside, it has more room to ease, but the costs of moving too slowly are smaller than the costs of losing control of inflation again. That asymmetry encourages caution.

• Real rate strategy. By keeping the policy rate above the inflation rate, the Fed maintains a positive real rate that gradually cools demand. The current path implies that real rates will normalise only slowly, giving the central bank time to react if inflation fails to fall as projected.

The upshot is that the Fed is trying to thread a narrow path: avoiding unnecessary damage to the economy from holding rates at peak levels for too long, while also not declaring victory prematurely. That naturally leads to a slow easing trajectory and a hawkish tone, even when the policy rate is moving down.

4. Growth, the Dot Plot and the New Long Run Rate

Alongside its inflation outlook, the Fed also updated its growth and long run rate projections. The GDP forecast for 2026 was nudged higher, reflecting a slightly more optimistic view of productivity, labour markets and global conditions. Yet this more positive growth outlook did not translate into a faster pace of easing. Instead, the long run policy rate is expected to stabilise around 3%.

This has several implications:

• A higher neutral rate. The long run rate near 3% suggests that the Fed believes the neutral real rate of interest is higher than in the decade after the global financial crisis. Structural changes such as higher public debt, a more fragmented global trading system and the need for large investment in energy transition and digital infrastructure may all play a role.

• No return to the zero-rate world. Investors hoping for a quick reversion to near-zero rates are likely to be disappointed. The Fed's projections imply an environment where money has a real cost over the long term.

• Resilience of the economy. The fact that growth can remain acceptable even with higher rates suggests the Fed sees the economy as more robust than before. That, in turn, reduces the pressure to cut quickly in response to moderate slowdowns.

From a macro perspective, this combination of slightly stronger growth, elevated but declining inflation and a higher long run rate amounts to a regime shift compared with the pre-2020 period. The hawkish cut is one step in adapting policy to that new regime.

5. The 40 Billion USD Treasury Buyback: Liquidity, Not Classic Quantitative Easing

In addition to cutting rates, the Fed announced a plan to buy back around 40 billion USD of short-term Treasury securities. At first glance, this may sound like a return to large-scale asset purchases. In reality, the programme is more technical and targeted.

The objectives can be summarised as follows:

• Support for money markets. By purchasing short-dated Treasuries, the Fed can ease specific pockets of stress in funding markets, helping to keep short-term rates aligned with the policy target and avoiding unwanted spikes in overnight funding costs.

• Smoother balance sheet management. The buybacks allow the Fed to adjust the composition of its portfolio without expanding it dramatically. This differs from earlier rounds of quantitative easing, which aimed to compress long-term yields across the entire curve.

• Signal of responsiveness. The central bank is demonstrating that it is paying attention to the plumbing of the system. Even as it normalises the overall stance of policy, it remains willing to step in when specific markets show strain.

For investors, it is important not to overstate this programme. Forty billion USD is meaningful but small relative to the size of the Treasury market and the Fed's balance sheet. The intent is to stabilise money markets, not to engineer a broad rally in risk assets. Nevertheless, by reducing short-term funding stress, the programme can indirectly make it easier for banks, dealers and institutional investors to manage their own portfolios.

6. Bond Market Takeaways: Front End Relief, Long End Questions

Bonds are the most direct channel through which Fed decisions are transmitted. A hawkish cut has a distinctive footprint on the curve.

At the front end, the immediate 0.25% reduction brings some relief. Yields on very short-term instruments adjust quickly, and the combination of a lower policy rate and targeted Treasury purchases tends to compress funding spreads. This can be positive for sectors that rely on short-term borrowing, from banks to highly rated corporates.

Further out on the curve, however, the picture is more complicated. A slower path of future cuts and a higher long run rate anchor expectations for term yields. If investors believe that the Fed will keep real rates positive for an extended period, they demand higher compensation for holding long-dated bonds. That pushes against the kind of sustained rally that characterised earlier cycles of aggressive easing.

In simple terms:

- Short maturities are influenced mostly by the current policy rate and the next one or two meetings.

- Long maturities are influenced by beliefs about inflation, growth and the long run rate over several years.

A hawkish cut improves the outlook at the front end without fully relaxing the constraints at the long end. That split can affect portfolio allocations, liability management strategies and the relative appeal of different types of fixed income instruments.

7. Implications for Equities and Digital Assets

Equity and digital asset markets react not only to the level of rates but also to the direction and pace of change. A slow, cautious easing cycle with persistent positive real rates has nuanced effects.

For equities, especially in sectors that are sensitive to discount rates such as high-growth technology and infrastructure, the move can be seen as a mixed signal. On the positive side, the Fed is no longer pressing down aggressively on the brake pedal. Borrowing costs will gradually become more manageable, and the risk of an overly tight policy causing a sharp downturn is reduced. On the more cautious side, valuations still need to reflect a world where capital has a real cost, and earnings growth matters more than pure multiple expansion.

For digital assets, the story is similar. Aggressive easing and negative real rates have historically coincided with strong periods for assets that benefit from abundant liquidity and risk appetite. A hawkish cut, by contrast, implies a more balanced environment. Liquidity is not being drained, but it is not being flooded into the system either. In such a setting, long term narratives, adoption trends and technological developments play a larger role than short term policy surprises.

From an educational perspective, one key insight is that the relationship between central bank policy and asset prices is not linear. The same 0.25% move can have very different implications depending on the starting point, the inflation backdrop and the future path signalled by projections and communication.

8. What to Watch Next

This meeting is not the end of the story. It sets up several important questions for the coming quarters:

• Inflation prints. Do monthly inflation readings continue to drift lower toward the target, or do they plateau above 2%? The answer will determine whether the Fed can deliver the limited set of cuts in the dot plot, or whether it needs to adjust course.

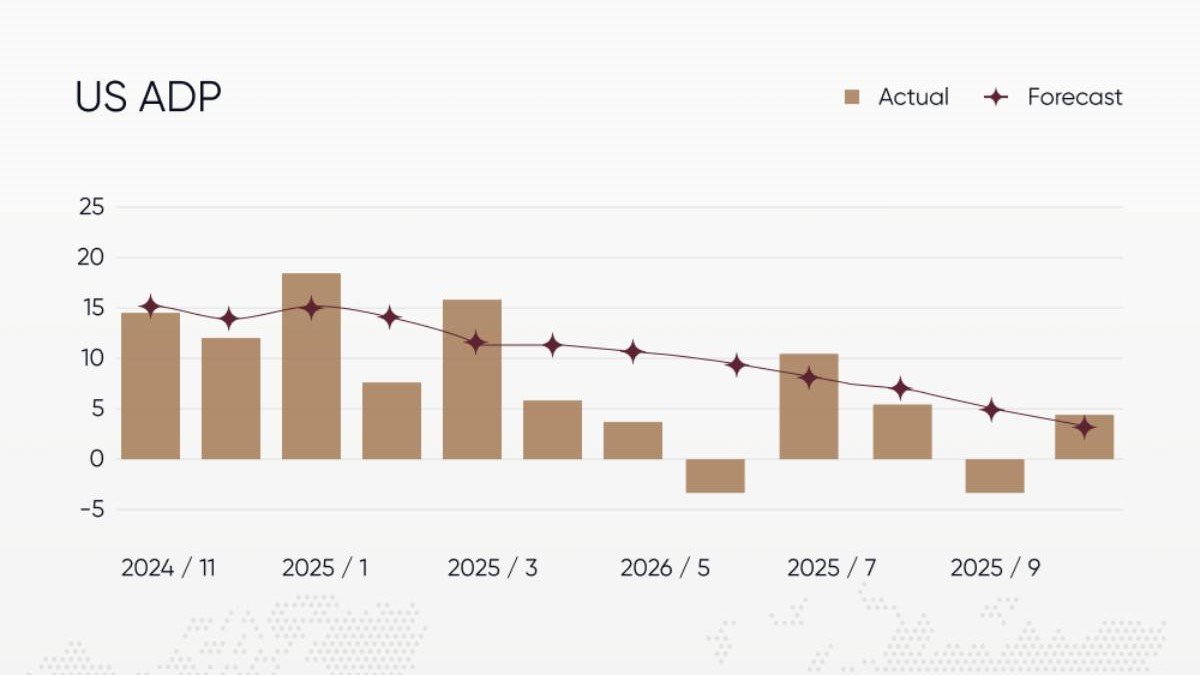

• Labour market data. If employment remains robust and wage growth stabilises at a moderate level, the Fed can sustain its gradual easing plan. If the labour market weakens sharply, pressure for faster cuts will increase.

• Money market conditions. The impact of the 40 billion USD Treasury buyback on funding rates and liquidity will be closely monitored. If stresses persist, additional technical measures may be needed.

• FOMC communication. Speeches and interviews from Fed officials in the weeks ahead will reveal how deep the internal divisions really are, and whether the 9 to 3 split is a one-off or the beginning of a more extended period of disagreement.

For analysts and investors, tracking these indicators helps convert a single meeting into a dynamic framework: the Fed is not simply cutting or hiking, it is continuously updating its view of how restrictive policy needs to be in an environment of moderate but persistent inflation and structural shifts in the economy.

Conclusion: A Small Step Down, Still a Long Way From Easy Money

The latest Fed decision is easy to summarise and hard to interpret. It is a 0.25% cut with a divided vote, a slower-than-expected path of future easing, an inflation profile that does not reach target until 2028 and a technical bond-buying programme aimed at money market stability. It is both a signal that the era of peak rates is over and a warning that the era of near zero rates is not coming back.

Calling this move a hawkish cut captures that tension. The central bank has acknowledged that keeping policy frozen at the top of the range carries its own risks. At the same time, it insists on keeping real rates positive, on limiting the number of future cuts and on treating inflation as an unresolved issue rather than a battle already won.

For market participants, the most productive response is to lean into analysis rather than slogans. Understanding this meeting means paying attention to the vote, the dot plot, the inflation path and the bond purchase details together, instead of isolating any single element. Policy is now in a transition phase, and the quality of decisions will depend on how well central bankers, investors and businesses read the feedback loops between rates, inflation, growth and financial conditions.

Educational note: This article is for informational and analytical purposes only. It does not constitute financial, investment, legal or tax advice, and it should not be used as the sole basis for any financial decision. Economic conditions and policy choices can change rapidly. Readers should conduct their own research and, where appropriate, consult qualified professionals before taking action.