October Fed Minutes Hint at No December Cut: Higher-for-Longer Becomes the Base Case

The Federal Reserve’s latest meeting minutes have done what minutes are not supposed to do: they have become front-page market-moving news in their own right.

Released at 10:00 a.m. on 19 November, the minutes from the October policy meeting show a Federal Open Market Committee (FOMC) that is much more cautious about further easing than markets had assumed. While investors had been leaning toward one more rate cut by the December meeting, many Fed officials now appear comfortable leaving interest rates unchanged for the rest of 2025, arguing that the United States economy remains surprisingly resilient and that inflation risks have not fully disappeared.

The shift in tone was immediately visible in market pricing. The implied probability of a December rate cut, which had been sitting above 51% before the release, dropped quickly to roughly 33% afterwards. In other words, what had been a slightly more-likely-than-not scenario suddenly became an underdog. The narrative has moved away from a near-term pivot toward a renewed higher-for-longer stance.

This article unpacks what the minutes actually say, why many Fed officials are pushing back against additional cuts this year, how markets are repricing the path of policy, and what it all means for risk assets. Because we cannot access live data here, we treat the specific dates, probabilities and events you described as scenario inputs, and focus on the structural logic behind the Fed’s behaviour and the market reaction.

1. What the October minutes really told us

The minutes are not a transcript; they are a curated window into the discussion that took place around the FOMC table. In this case, three themes stand out.

1.1. A clear majority: no urgency to cut again in 2025

First and most important, the minutes make it clear that many FOMC participants do not see a compelling case for another rate cut this year. The language, as you summarised it, suggests that a sizeable group of officials believes current policy is already restrictive enough and that further easing could be premature as long as the economy is holding up and inflation is not definitively back at target.

That does not mean the Committee is united in favour of a prolonged freeze. But it does tell us that the burden of proof has shifted. Earlier in the year, the question was, "How soon can we safely cut?" After the October meeting, the question has become, "What new evidence would we need in order to justify cutting again?" That nuance matters because it moves the Fed from an easing bias toward a more neutral or even mildly hawkish stance.

1.2. A cautious minority: cuts are possible, but only if the data cooperate

The minutes also acknowledge that a smaller group of officials is still open to a December cut, but only under specific conditions. Those members argue that if the incoming data between the October and December meetings evolve in line with the Fed’s internal forecasts—namely, a gradual cooling in activity and further progress on inflation—then another modest reduction in the policy rate could be justified.

In other words, the door to a December cut is not locked. It is simply no longer wide open. The Committee is telling markets: "We might ease again if the economy slows as we expect and if inflation behaves. But we are not pre-committed, and we are in no rush to take risks with our inflation credibility."

1.3. The core message: resilience and inflation risk still matter

Across both camps, the minutes emphasise two ideas:

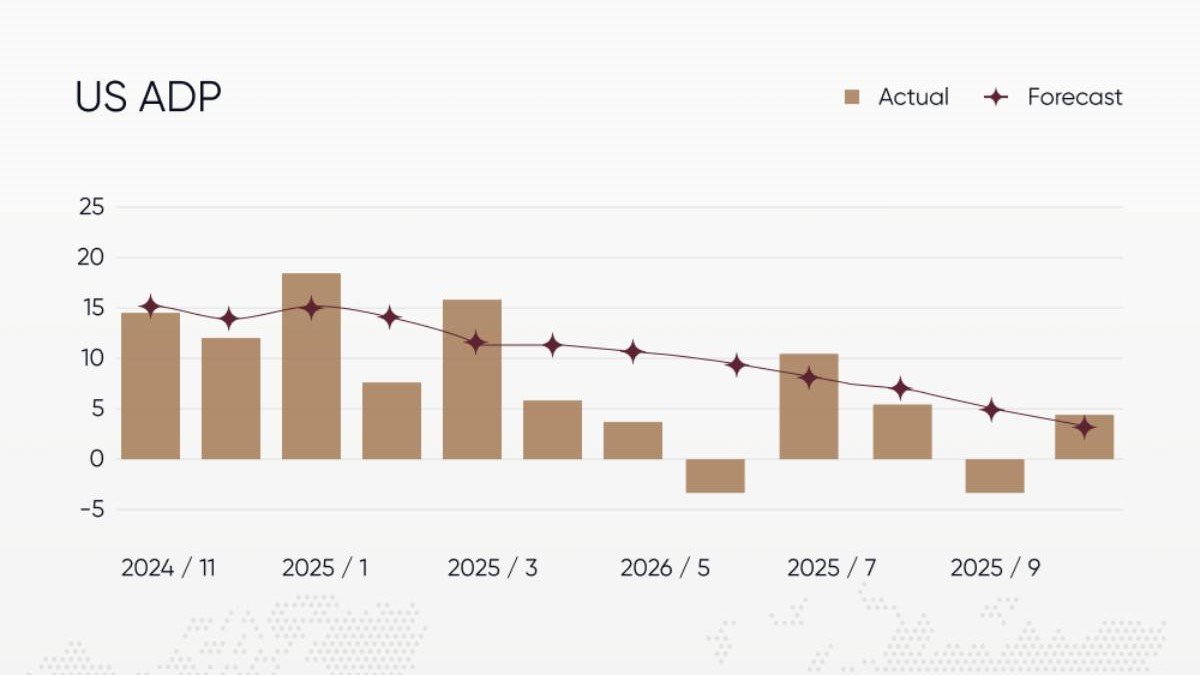

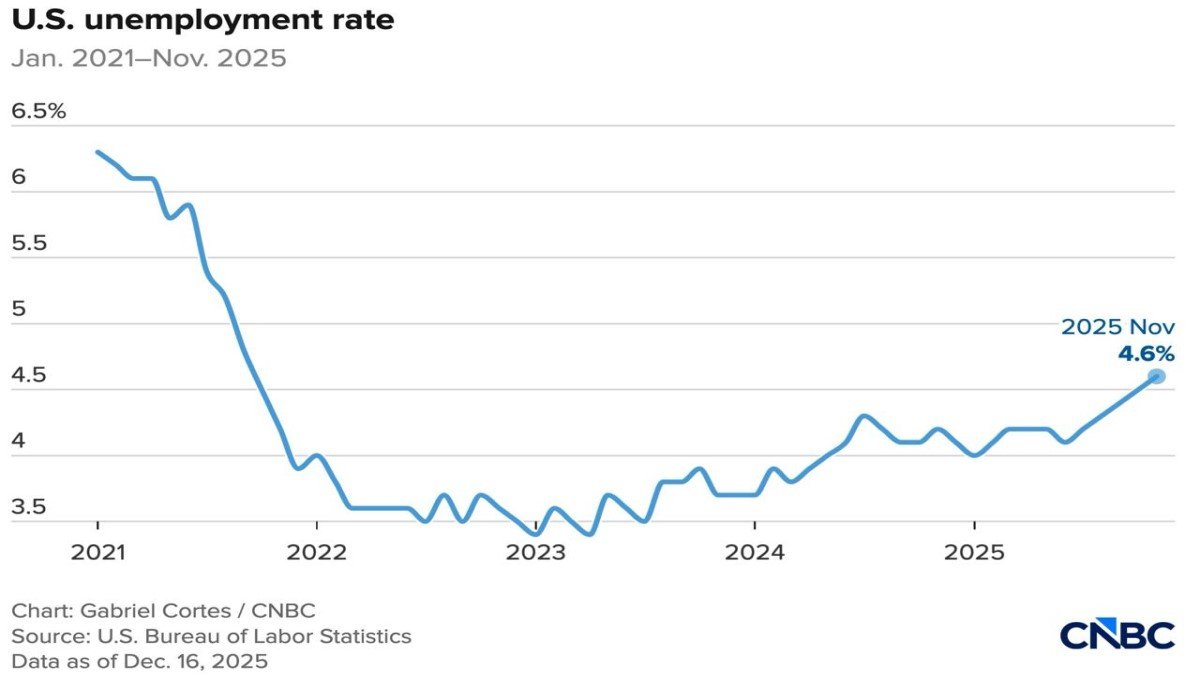

- Economic resilience. The US economy has weathered higher rates better than many had predicted. Growth has cooled from peak levels, but it has not fallen off a cliff. Labour-market indicators may be softening at the margin, but they still do not scream recession.

- Lingering inflation risk. Headline inflation has come down, but underlying measures, particularly in services, still sit above the Fed’s 2% target. Several officials argue that declaring victory too early would be a repeat of the central bank mistakes of the 1970s, when stop–go policy allowed inflation to become entrenched.

Combine those two points and the logic is straightforward: if the economy is not breaking and inflation is not yet safely tamed, why rush to cut? That is the question driving the majority view inside the Fed.

2. Why many Fed officials do not want a December cut

To understand the reluctance, you have to step into the Fed’s mindset. Central bankers are not trying to maximise next quarter’s stock-market performance; they are trying to preserve long-term price stability and institutional credibility. Three concerns dominate their thinking in this environment.

2.1. Avoiding a premature victory lap over inflation

Even with inflation cooling, the scars of the post-pandemic spike remain fresh. The Fed faced intense criticism for being late to acknowledge the persistence of inflation, and then for tightening aggressively. Having finally brought headline readings closer to target, officials are understandably wary of easing too quickly and risking a re-acceleration.

In that context, a December cut would only be attractive if:

- Core and services inflation continue to decline in a convincing, broad-based way.

- Inflation expectations in surveys and markets remain firmly anchored.

- There are no new supply shocks or geopolitical events that might threaten price stability.

If those conditions are not clearly met, the safer choice—from the Fed’s perspective—is to wait. Holding rates steady sends the message that the central bank is prepared to tolerate some short-term pain in growth or markets in order to secure a durable victory over inflation.

2.2. The economy has bent but not broken

The minutes also reflect an uncomfortable truth for rate-cut hopefuls: the US economy has been more resilient than many models predicted. While we cannot quote current figures here, the broad pattern going into this scenario is familiar: consumer spending has slowed but not collapsed, corporate balance sheets are not in crisis, and the labour market, though less exuberant, still shows demand for workers.

For Fed officials, that resilience changes the calculus. If output is growing modestly, unemployment remains relatively low and financial conditions have loosened somewhat as markets priced in cuts earlier in the year, the case for adding more accommodation right now is weaker. Cuts are tools for when demand falters and unemployment rises in a sustained way, not for fine-tuning every wobble in sentiment.

2.3. Fear of re-creating a stop–go cycle

Finally, the October minutes hint at a deep institutional memory: the Fed does not want to repeat the stop–go cycles of the 1970s and early 1980s, when it alternated between tightening to fight inflation and easing to support growth, only to see inflation flare up again. That pattern damaged the central bank’s credibility and forced an eventual, severe tightening to restore control.

Today’s officials are determined to avoid that trap. For them, maintaining policy at a restrictive level a bit longer—even at the cost of disappointing markets—is preferable to cutting now and risking a scenario where inflation re-accelerates, forcing them to hike again later. That is the essence of higher for longer.

3. Market reaction: from pivot hopes to patience

Going into the minutes, markets were leaning toward a relatively dovish interpretation of the Fed’s trajectory. Implied odds of a December rate cut were a touch above 51%, reflecting the belief that the slowdown in activity, combined with moderating inflation, would push the FOMC to deliver one more insurance cut before year-end.

The October minutes have punctured that confidence. With many officials signalling comfort with the current level of rates and only a minority open to cutting under specific conditions, the probability of a December cut has fallen toward 33% in your scenario. That repricing matters across several asset classes.

3.1. Bonds: front-end reprice, curve dynamics shift

In the rates market, the most immediate impact is on the front end of the yield curve, where expectations for near-term Fed policy are priced. A lower probability of a December cut pushes short-dated yields higher than they otherwise would have been, tightening financial conditions at the margin.

Further out, in the belly and the long end, the story is more nuanced. If investors interpret the minutes as a sign that the Fed will successfully keep inflation under control, the long-term inflation risk premium could fall, limiting the rise in longer-dated yields. On the other hand, if the market worries that higher for longer will eventually tip the economy into a harder landing, term premia could increase as uncertainty about the future path of growth and policy widens.

3.2. Equities: valuation under pressure, sector rotation in play

Equities feel the minutes through two channels:

- Discount rates. Higher expected policy rates raise the discount rate applied to future earnings, putting pressure on valuations, particularly for long-duration growth stocks and speculative names that depend on cheap capital.

- Macro narrative. A Fed that is less eager to cut reinforces the idea that policymakers are prioritising inflation control over short-term growth support. That can weigh on sentiment in cyclical sectors, at least initially.

At the same time, some segments of the market may welcome the message. Financials can benefit from a steeper yield curve if one emerges. Companies with strong balance sheets and pricing power may be seen as more attractive in a world where policy rates stay elevated but inflation risk is contained.

3.3. Crypto and other risk assets: liquidity story gets harder

Although the minutes make no mention of digital assets, they matter for crypto because they shape the global liquidity backdrop. A Fed that is less likely to cut in December means less confidence in an imminent wave of cheaper dollar funding. That, in turn, can take some of the shine off risk assets that have benefited from the "liquidity is coming" narrative.

However, the impact is not mechanical. Crypto markets are driven by a mix of macro, on-chain dynamics, regulatory news and internal leverage cycles. The main contribution of the Fed minutes is to remind investors that the macro tailwind they were hoping for may arrive more slowly and in a less linear fashion than they expected.

4. Three policy paths from here to December

With the October minutes in hand, investors are now forced to reassess the Fed’s likely path over the next few weeks. A professional way to think about this is through scenarios rather than single-point forecasts.

4.1. Base case: no December cut, data-dependent forward guidance

In light of the minutes, the most plausible base case is that the Fed keeps rates unchanged in December, while reinforcing its commitment to data dependency. In this scenario:

- Economic data between now and the meeting are mixed but not disastrous.

- Inflation continues to trend toward target but does not collapse.

- The Fed argues that it has already delivered sufficient easing and needs more time to observe the effects.

The Committee might tweak its statement or projections to acknowledge that further cuts remain possible in 2026 if disinflation and cooling growth continue. But the headline message would be clear: no rush.

4.2. Dovish scenario: data soften enough to revive a December cut

A second scenario, still possible but less likely after the minutes, is that incoming data turn sharply softer:

- Job growth slows materially and unemployment edges up.

- Wage growth cools further, easing concerns about a wage–price spiral.

- Inflation prints come in below expectations, alleviating fears of a re-acceleration.

In that world, the minority within the FOMC that is open to another cut could gain the upper hand. A small December reduction in policy rates could be framed as an insurance cut to support the labour market while preserving the overall restrictive stance. Markets would likely respond with a relief rally in risk assets and a further rally in bonds.

4.3. Hawkish scenario: upside surprises keep the Fed on hold for longer

The third scenario is that the economy and inflation come in stronger than the Fed’s current forecasts:

- Activity data remain robust, with no clear slowdown in demand.

- Labour markets tighten again or fail to cool as expected.

- Inflation readings surprise on the upside, especially in services.

Under those conditions, the Committee could not only skip a December cut but also use its communication to hint that further easing in early 2026 is not guaranteed. That would embed a more persistent higher-for-longer stance in markets, likely raising volatility across bonds, equities and currencies.

5. What the minutes reveal about the Fed’s reaction function

Beyond the immediate question of December, the October minutes offer a deeper insight into the Fed’s reaction function—how it turns data into decisions.

Three elements stand out:

• Asymmetric risk management. The Fed currently sees more danger in cutting too soon and re-igniting inflation than in holding steady a little too long. That asymmetry is driving its reluctance to promise further near-term easing.

• Data over market pricing. While officials watch financial conditions and market-based probabilities, they are clearly signalling that futures-implied odds of a cut will not dictate policy. The Committee is reclaiming narrative control.

• Higher tolerance for modest growth pain. The Fed appears willing to accept some slowdown in growth and cooling in the labour market as the necessary cost of securing price stability.

For investors, that means macro trades based purely on the assumption of rapid, aggressive easing are inherently fragile. The Fed has told you what will move it: sustained changes in inflation, labour-market tightness and real economic activity—not day-to-day swings in risk sentiment.

6. How professional investors can use this information

From the perspective of a professional analysis platform, the goal is not to guess the next basis-point move, but to help readers frame risk intelligently. The October minutes support several practical conclusions.

6.1. Treat rate cuts as conditional, not guaranteed

The market’s journey from more than 51% to around 33% probability for a December cut illustrates how fragile assumptions can be when they are not firmly grounded in the Fed’s own communication. Policy easing remains possible, but it is conditional on data, not pre-scheduled. Portfolio strategies that embed a high-conviction view of rapid cuts need to be stress-tested against a world where rates stay put for longer.

6.2. Expect more volatility around data releases

With the Fed placing more weight on realised data and less on pre-commitment, each major release—jobs, inflation, spending—gains importance. That implies more event-driven volatility. For traders, that means opportunity and risk. For longer-term allocators, it argues for patience: avoid over-reacting to the first price move after a print and focus on the evolving trend.

6.3. Focus on balance-sheet strength and pricing power

In an environment where policy is likely to stay restrictive until the Fed is absolutely sure about inflation, businesses with solid balance sheets and genuine pricing power are better positioned than those dependent on cheap financing or speculative narratives. The minutes reinforce that macro filter.

6.4. For crypto and other high-beta assets: macro still matters

For digital-asset investors, the temptation is to treat on-chain trends as fully divorced from macro. The October minutes are a reminder that they are not. The pace and scale of Fed easing influence global liquidity, risk appetite and the willingness of large allocators to move out the risk curve. While crypto has its own cycles, ignoring the rate backdrop is a luxury few can afford.

Conclusion: the Fed is not closing the door, but it is narrowing the corridor

The October Fed minutes have delivered a clear, if uncomfortable, message to markets: do not assume another rate cut in December. Many officials now see no need to ease further this year, given the combination of a resilient economy and lingering inflation risks. A smaller group remains open to a cut, but only if the data unfold exactly as the Fed hopes.

The immediate result has been a sharp repricing of expectations, with the odds of a December cut sliding from above 51% to around 33% in your scenario. Beyond that, the minutes tell us something more fundamental about the Fed’s priorities. It is prepared to disappoint markets in the short term to safeguard its inflation-fighting credibility, and it will not pre-commit to a dovish path while uncertainty about the true state of the economy remains high.

For investors, the message is not to abandon risk or assume a permanent tightening bias. It is to recognise that the era of automatic, calendar-based easing cycles is over. From here, each step will be earned—not by market hopes, but by the data.

Disclaimer: All probabilities, dates and specific events referenced in this article are based on the scenario described by the user and could not be independently verified here. This article is for informational and educational purposes only and does not constitute investment, trading, legal or tax advice. Economic conditions and central-bank policy can change rapidly. Always conduct your own research and consider consulting a qualified professional before making financial decisions.