Jobs Data After a 43-Day Blackout: Can One Report Decide the Fed’s December Rate Cut?

In normal times, a monthly US jobs report is important, but rarely existential. Markets may swing on a surprise, strategists update slide decks, and the Federal Reserve folds the numbers into its broader data mosaic. Then life goes on.

The situation you describe for the morning of 20 November is very different. After a 43-day government shutdown that effectively froze the flow of US macro statistics, this would be the first meaningful labor-market release in weeks. Nonfarm payrolls, the unemployment rate and initial jobless claims are all due to reappear at once after a long silence. At the same time, inflation figures have been delayed or may even go unpublished entirely, leaving policymakers and traders flying partly blind.

Against that backdrop, expectations for a third Fed rate cut in December have lurched violently. Only a week ago, the market was pricing that move with better than a 90% probability. Now, after the extended shutdown and fading clarity on inflation, those odds have dropped toward the mid-40s. The jobs data have been promoted from "just another release" to a potential pivot point for monetary policy.

Before going further, an important caveat: this article works within the scenario you provided. The specific details of the shutdown duration, release timing and market-implied probabilities are taken as given for the sake of analysis and may not match any real-world timeline exactly. Our goal here is not to forecast an actual upcoming report, but to unpack how such a situation would be interpreted by a data-dependent Fed and by markets hungry for clarity.

1. Why this particular jobs report carries outsized weight

Every Fed meeting is framed as "data dependent", but data dependence only means something when data are available. A prolonged shutdown that delays or cancels key publications changes the calculus in three important ways:

• Information compression. Instead of a steady stream of payrolls, inflation, claims and surveys, policymakers receive a burst of information all at once. The first fresh labor report after a blackout becomes a focal point because there is so little else to cross-check it against.

• Higher sensitivity to noise. Any single month of data is normally treated with caution: seasonal quirks, strikes, weather and sampling error can distort the signal. After a long gap, the temptation to over-interpret that one print grows sharply.

• Policy bottleneck. The Fed’s early-December meeting looms as the first opportunity to adjust rates after the shutdown. With few other credible datapoints in hand, the jobs report naturally takes on disproportionate influence.

Overlay this with an inflation backdrop that is being "defaulted" to around 3% in the absence of fresh official releases, and you end up with a simple decision tree: if growth and jobs appear to be slowing while inflation is believed to be contained, the case for cutting again in December re-opens. If jobs remain hot or accelerate, the Fed has every reason to stay cautious, even without seeing the latest CPI print.

2. What exactly will the market be looking at at 07:00?

In the scenario you lay out, the suite of data scheduled for 07:00 a.m. on 20 November is unusually dense. Beyond the headlines, each component sends a different message:

• Nonfarm payrolls (NFP). The month-over-month change in total employment outside the farm sector. This is the most visible gauge of labor demand. A sharply lower number than the pre-shutdown trend—say, a drop from 200k+ to something closer to (or below) 100k—would be read as clear evidence of cooling.

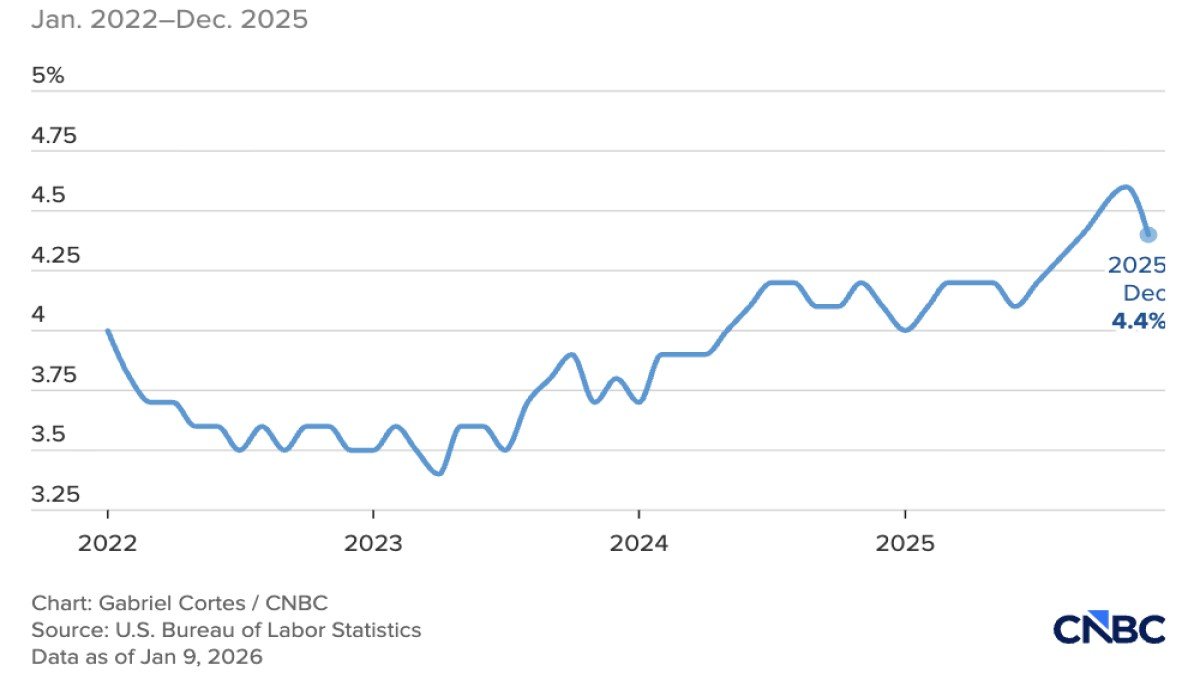

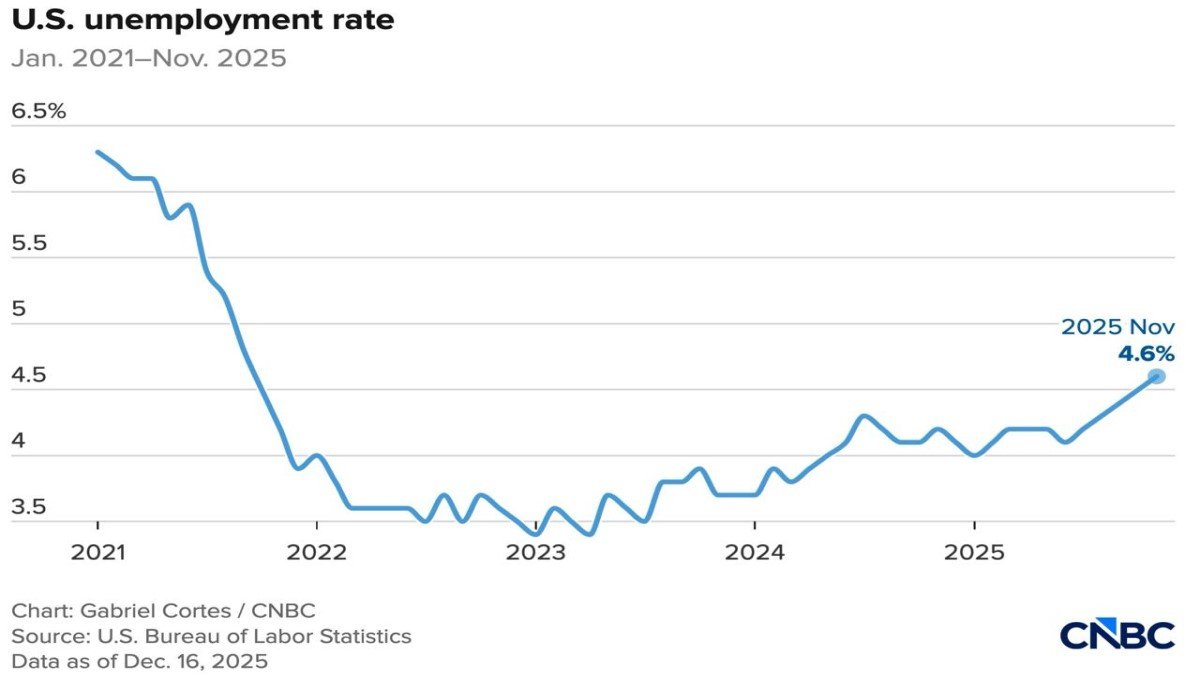

• Unemployment rate. Derived from the household survey, this measures the share of the labor force without work but actively seeking a job. A rise of 0.1–0.2 percentage points might be shrugged off; a sustained climb would be harder to ignore.

• Initial jobless claims. Weekly filings for unemployment benefits, now being published again after the freeze. These are a more timely gauge of layoffs and corporate stress.

Because inflation data are missing or heavily delayed in your scenario, average hourly earnings and broader wage measures inside the jobs report will also be treated as a rough proxy for price pressure. If wages are decelerating even as employment slows, it strengthens the dovish case. If wages are still running hot, the Fed faces a more complex trade-off.

Importantly, markets will not just read the headline numbers in isolation. They will ask:

- Were there strong revisions to pre-shutdown months once statisticians updated their models?

- Is weakness (or strength) broad-based across sectors or concentrated in specific areas like manufacturing, hospitality or tech?

- Do participation rates and hours worked confirm the same story as the unemployment rate?

In a data-starved environment, every sub-series becomes a clue in a larger puzzle.

3. How the Fed is likely to read the numbers

The Federal Reserve’s challenge is more nuanced than the market’s. It is not only trying to guess where the economy is today, but also where it will be six to twelve months from now, when the full effect of previous rate changes has fed through.

In the scenario you describe, two forces are in tension:

- On one side, a labour market that may be losing momentum after a prolonged tightening cycle and an extended government shutdown.

- On the other, an inflation picture that is incomplete, with the last clean reading sitting around 3% but no fresh confirmation after weeks of disruption.

For a central bank that spent years fighting inflation above target, it is politically and institutionally hard to cut aggressively on the basis of assumed inflation readings. That is why, in your scenario, the market’s confidence in a December cut could so easily fall from over 90% to near 44% once the data blackout extended and inflation releases were delayed.

Against that backdrop, the incoming jobs data play three roles at once:

- Cross-check for inflation. If employment growth and wage pressures are clearly cooling, the Fed can infer that underlying inflation is unlikely to be re-accelerating sharply, even without seeing the latest CPI report.

- Gauge of policy tightness. A sharp weakening in hiring and a meaningful rise in joblessness would be read as a sign that policy may already be too restrictive.

- Signal for financial conditions. Markets will react instantly to the data; tighter or looser financial conditions feed back into the Fed’s assessment of whether it needs to lean against the move.

In practice, that means the Fed is likely to frame its December decision as a conditional choice:

- If the jobs data clearly signal deterioration in employment and wages, and if market-implied inflation expectations remain anchored, the case for a third cut becomes stronger again.

- If the report is mixed or stronger than feared, policymakers can point to lingering inflation uncertainty and argue for patience, keeping rates unchanged while promising flexibility in early 2026.

Either way, the shutdown has done damage: instead of a gradual, data-rich glide path, the Fed is forced into a high-stakes decision based on incomplete information and a single, politically charged set of releases.

4. Three scenarios: what the jobs data could show and how markets might react

Rather than obsess over a single forecast, serious investors think in scenarios. Based on your context, at least three broad paths stand out.

4.1. The "soft-landing friendly" print

In this scenario, the jobs report shows:

- Nonfarm payrolls slowing but not collapsing.

- A small uptick in the unemployment rate, consistent with cooling rather than a sudden recession.

- Wage growth easing toward a pace compatible with 2–3% inflation.

Markets would likely interpret this as a confirmation that the economy is decelerating towards balance rather than falling off a cliff. The probability of a December rate cut would probably drift higher again—perhaps not back to 90%, but certainly above the 44% area you mentioned—as investors conclude that inflation is unlikely to re-accelerate in such an environment.

Risk assets (equities, high-yield credit, even crypto) could find support on the idea that the Fed has room to ease gently, while long-term yields would likely fall as growth expectations are trimmed.

4.2. The "too hot to cut" surprise

Here, the data come in stronger than anticipated:

- Payrolls remain robust, with little sign of slowdown.

- Unemployment is flat or even lower.

- Wages are still pressing higher, complicating the inflation story.

In this case, the Fed’s December cut odds could fall further. With inflation data still hazy and the labour market apparently resilient, policymakers would find it hard to justify easing again so soon after the last move. The market might re-price toward a "one-and-done" or "pause" narrative, pushing yields higher and tightening financial conditions.

Risk assets would likely wobble. Parts of the equity market that had been banking on an imminent return to cheaper money—small caps, speculative tech, high-duration growth stocks—could come under pressure. Crypto, which tends to trade as a high-beta expression of liquidity expectations, might also struggle.

4.3. The "hard-landing" scare

The most uncomfortable scenario is one where the jobs data reveal a sharper-than-expected deterioration:

- Payroll growth collapses or turns negative.

- Unemployment jumps meaningfully in a single month.

- Hours worked and participation fall, pointing to broad weakness.

At first glance, this would seem to all but guarantee a December rate cut. If the labour market is clearly rolling over while inflation is assumed to be around 3%, the Fed would come under intense pressure to cushion the blow.

But markets might not celebrate immediately. A truly weak report after a long data blackout could trigger a classic "bad news is bad news" moment: equities sell off on fear of recession, credit spreads widen, and liquidity tightens even as investors price more cuts into the curve.

For longer-term allocators, that kind of scare sometimes marks the beginning of a real bottoming process: it forces the Fed to show its hand, clears out weak hands in risk assets and sets the stage for a more durable recovery. In the very short run, however, volatility tends to spike rather than subside.

5. The hidden complication: data quality after a shutdown

An underappreciated risk in your scenario is data quality. Statistical agencies returning from a 43-day shutdown face multiple challenges:

- They may have gaps in survey responses that need to be imputed or adjusted with model-based techniques.

- Seasonal adjustment factors may be distorted by the shutdown itself and by the unusual timing of releases.

- Backlogs of processing and verification can increase the risk of larger-than-normal revisions in subsequent months.

That means both markets and the Fed should treat this first post-shutdown jobs report as noisier than usual. The temptation will be to treat it as a definitive verdict on the state of the economy. In reality, it will likely be an imperfect snapshot, with asterisks and revisions baked in from the start.

Professional macro desks will therefore pay close attention not only to the headline numbers, but also to the statistical agencies’ commentary: how much of the data was imputed, which sectors suffered from low response rates, and whether any one-off factors may have influenced the print.

6. What sophisticated investors will watch beyond the headline

While retail traders fixate on the payrolls print, more experienced investors will watch a wider set of signals in the days around the release:

• Market-implied inflation expectations. If breakeven inflation rates in the bond market stay anchored near target despite a weak jobs number, the Fed has more leeway to cut. If breakevens jump higher, even a soft labour report may not be enough.

• Financial-conditions indices. Measures that blend yields, credit spreads, equity prices and FX can tell the Fed how "tight" policy feels to the private sector after the report.

• Fed communication. Speeches, interviews and off-the-record briefing patterns in the days after the data drop will be scrutinised for clues about which scenario the FOMC sees as dominant.

• Cross-asset behaviour. Whether the dollar strengthens or weakens, how yield curves move, and how defensive sectors in equities behave all help validate or challenge the initial reaction.

In other words, this jobs release is not the end of the story; it is the beginning of a new, compressed communication cycle between data, markets and policymakers following the shutdown.

7. How to think about risk in such an unusual environment

For a professional news and analysis outlet, the value here is not in declaring that "the Fed will definitely cut" or "the bottom is in". It is in helping readers understand how uncertainty itself has changed.

After a long shutdown and a data blackout, macro risk is less about the exact number in the jobs report and more about:

- How much confidence policymakers and markets can reasonably place in any single release.

- How quickly both will be willing to reverse course if later data contradict the first signal.

- How sensitive risk assets have become to policy surprises now that the implied path of rates has swung so dramatically from near-certainty of a December cut to coin-flip territory.

For investors, that argues for humility and flexibility. The temptation, especially after weeks of waiting, is to speculative position heavily on one outcome: a soft print that "forces" the Fed to cut, or a strong print that "kills" the easing story. A more robust approach recognises that, in this environment, regime shifts can be reversed quickly as new information arrives.

Positioning size, diversification and scenario planning matter more than usual. The goal is not to predict the next 25-basis-point move, but to avoid being structurally misaligned with the broader trajectory of policy and growth over the next year.

Conclusion: one report, many narratives

The jobs data release you describe for the morning of 20 November is a perfect example of how context can transform a routine statistic into a macro event. After a 43-day government shutdown, delayed inflation releases and a violent repricing of December rate-cut odds from above 90% to around 44%, nonfarm payrolls and unemployment have been drafted into a role they were never meant to play: sole arbiter of the economic outlook.

In reality, no single report can carry that weight. The Fed will read it through the lens of incomplete information, statistical noise and political pressure. Markets will react first to the headline, then to the revisions, and finally to how policymakers themselves choose to frame the numbers.

If the report hints at a cooling labour market with inflation assumed near 3%, the door to a third December cut swings back open—though not as widely as before the shutdown. If the data are stronger than expected, the Fed has an excuse to pause and wait for cleaner inflation prints. If the numbers are truly ugly, we could be looking at both a renewed easing cycle and a much more volatile path for risk assets.

What is certain is that, after a long period of silence, the conversation between data, policy and markets is about to restart at full volume. The smartest investors will listen not just for the headline number, but for the deeper signals hidden in behaviour, communication and cross-asset pricing in the days that follow.

Disclaimer: All shutdown durations, release dates, probabilities and macro assumptions in this article are based on the scenario provided by the user and may not reflect actual current events. This analysis is for informational and educational purposes only and does not constitute investment, trading, legal or tax advice. Economic conditions and policy decisions can change rapidly. Always conduct your own research and consider consulting a qualified professional before making financial decisions.