Year-End 2025 Fed Liquidity: Plumbing Fix or Quiet Tailwind for Bitcoin?

Every time the Federal Reserve adds liquidity to the system, financial headlines quickly jump to one conclusion: “money printing is back.” For crypto investors, that phrase often translates into a simple narrative – more dollars in circulation mean a friendlier backdrop for assets with limited supply such as Bitcoin.

But reality is more nuanced. At the end of 2025, the Fed is indeed injecting liquidity, yet it is doing so through two different channels with very different purposes:

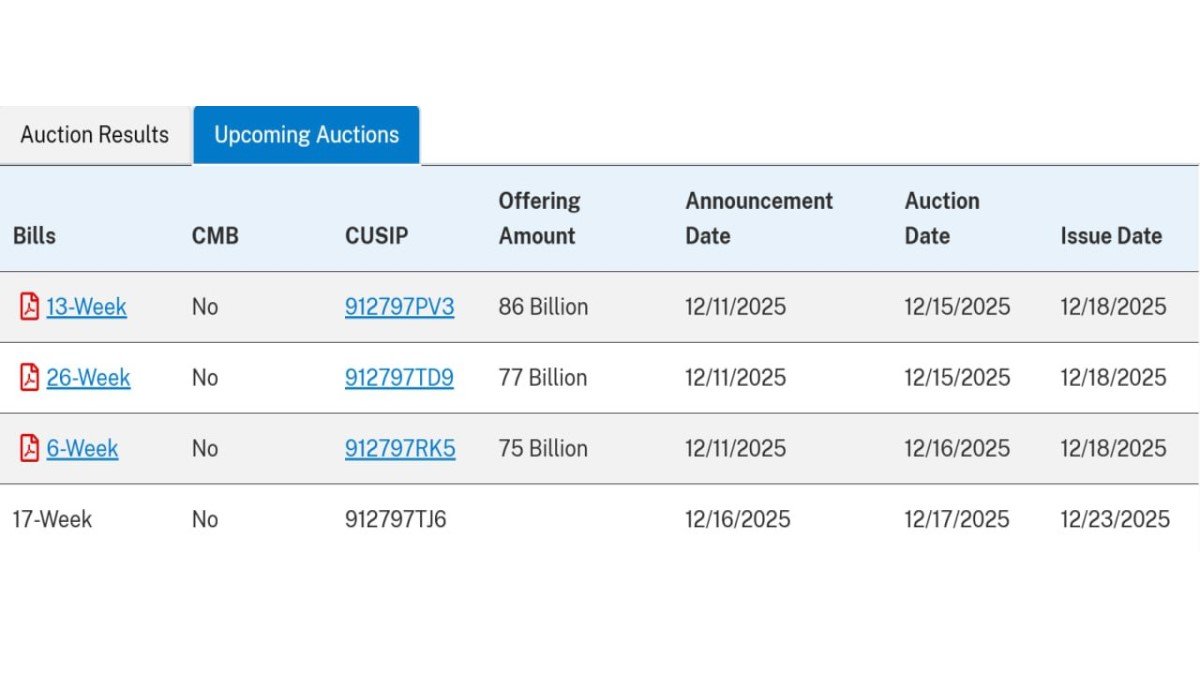

- Channel 1 – Treasury reserve management: roughly 40 billion USD of short-term U.S. Treasuries per month starting 12 December, a structural purchase program aimed at keeping bank reserves plentiful after the end of quantitative tightening (QT).

- Channel 2 – Overnight repos: a series of short-term funding operations worth tens of billions of dollars, including about 6.8 billion USD on 22 December and roughly 38 billion USD over the prior 10 days, to ease year-end funding stress in money markets.

On the surface, both look like fresh liquidity injections. Under the hood, one is a long-term adjustment to the Fed’s balance sheet, the other is a temporary technical tool to keep short-term interest rates stable. Neither is a copy-paste of the pandemic-era quantitative easing (QE) programs. Yet both still matter for risk assets, including Bitcoin, because they shape the background level of U.S. dollar liquidity in the global system.

This article unpacks what the Fed is doing, how it differs from previous cycles, and why the current environment is best viewed as a mild macro tailwind rather than an aggressive stimulus wave.

1. Channel One: Permanent Treasury Purchases After QT Ends

The first component of the year-end liquidity story is the Fed’s decision to begin buying around 40 billion USD of short-term Treasury bills each month. These purchases are not branded as QE; they sit under the umbrella of reserve management.

1.1 From draining to stabilizing reserves

During quantitative tightening, the Fed allowed portions of its bond portfolio to mature without reinvesting the proceeds, shrinking its balance sheet and draining reserves from the banking system. That process cannot run forever. At some point, reserves risk dropping to a level where money markets become unstable and short-term interest rates spike unexpectedly.

By shifting to regular bill purchases, the Fed is essentially saying: “QT has done its job; now we want to keep reserves comfortably above the stress threshold.” Buying short-term bills instead of long-dated bonds is important for two reasons:

- Limited impact on long-term yields: Bills mature quickly and do not anchor the long end of the yield curve the way large-scale bond purchases did during QE. The signal to markets is about liquidity, not about forcing long-term borrowing costs lower at all costs.

- Operational flexibility: Short-term holdings can be rolled or allowed to run off if conditions change, giving the Fed more agility than a heavy portfolio of long-dated securities.

1.2 Why this still counts as a “permanent” injection

Even though individual bills mature, this program is designed to be ongoing. As older bills expire, the Fed reinvests into new ones, keeping the overall level of reserves high. In practice that means:

- The banking system has more central-bank money sitting on its balance sheet than it would under continued QT.

- Money market rates are less likely to spike, because banks have a cushion of reserves to lend out in overnight markets.

From the perspective of Bitcoin and other risk assets, this structural shift from draining to stabilizing reserves is key. It does not guarantee bullish price action, but it removes a persistent headwind. Instead of competing with a central bank that is constantly pulling dollars out of circulation, markets now face a Fed that is trying to keep the reservoir of liquidity full, even while policy rates remain elevated.

2. Channel Two: Year-End Repo Operations as Market “Plumbing”

The second channel is less glamorous but equally important: overnight repurchase agreements (repos). In these operations, the Fed lends cash to primary dealers and other eligible institutions against high-quality collateral such as U.S. Treasuries. The loans are typically reversed the next day, when the borrower repays the cash plus a small amount of interest and receives back the collateral.

2.1 Why repos surge at year-end

The end of the calendar year is traditionally a period of funding stress. Banks shrink their balance sheets to meet regulatory ratios, dealers are reluctant to hold extra inventory, and demand for cash spikes as institutions re-position portfolios. If nothing is done, short-term interest rates can jump sharply above the Fed’s target range, signaling that the central bank has temporarily lost control of money market conditions.

To prevent this, the Fed steps in as a backstop lender. The December operations you highlight—6.8 billion USD on 22 December and about 38 billion USD over ten days—are textbook examples. By offering overnight loans, the Fed calms the scramble for cash and anchors rates near the policy target.

2.2 Why repos are not QE

It is easy to think: the Fed is handing out tens of billions of dollars, so it must be reviving QE. The crucial difference is the time horizon and risk transfer:

- In QE, the Fed permanently buys bonds, taking duration and interest-rate risk onto its own balance sheet for years. That simultaneously injects reserves and signals a commitment to keep financial conditions loose.

- In repos, the Fed temporarily lends cash against safe collateral, with the clear expectation that the transaction will be reversed within days. Its balance sheet expands and then shrinks again as loans mature.

From a macro perspective, repos are best understood as maintenance for the financial plumbing. They reduce the probability of sudden funding squeezes, but they do not represent a long-term shift in policy stance.

Still, the psychological impact matters: when traders see the Fed willing to act quickly to stabilize funding markets, risk premiums can compress, benefiting a wide range of assets, including those outside traditional finance.

3. What This Means for the Broader Liquidity Environment

Putting both channels together, the year-end story looks like this:

- QT has effectively paused and been replaced by a steady stream of short-term Treasury purchases that keep reserves at an ample level.

- Temporary repo operations are smoothing over year-end stress, ensuring that short-term interest rates stay near the target range rather than spiking higher.

Two implications follow:

3.1 Less pressure on funding markets

Banks and dealers operate with more confidence when they know the Fed stands ready with both permanent and temporary tools. The risk of a sudden funding squeeze—a spike in overnight rates or a scramble for collateral—is lower. That stability trickles outwards:

- Corporate borrowers face a more predictable short-term cost of capital.

- Leveraged strategies in fixed income and foreign exchange see less volatility in funding costs.

- Investors are less likely to de-risk purely because of plumbing worries.

3.2 A subtle shift in the balance between tightening and support

Policy rates remain restrictive in real terms, and the Fed has not signaled a full pivot toward aggressive easing. However, the move from balance-sheet contraction to balance-sheet stabilization, plus the willingness to use repos proactively, sends a message: the central bank wants to manage downside risks to financial stability.

For markets, that is a familiar transition phase. We are no longer in the phase where liquidity is being drained every month, but not yet in a full-blown easing cycle. It is a middle ground where valuations can start to respond to the prospect of future cuts, while still being sensitive to data and policy surprises.

4. Reading the Signal for Bitcoin and Other Risk Assets

Bitcoin has slowly evolved from a niche experiment into an asset class that reacts to macro conditions. In earlier halving cycles, price action could be modeled largely around internal crypto dynamics. In the current environment, however, liquidity and interest-rate expectations play a growing role.

4.1 Why liquidity still matters for Bitcoin

Several mechanisms connect central-bank liquidity to digital assets:

• Wealth and risk appetite: When financial conditions are extremely tight and reserves scarce, investors tend to prioritize cash and short-term government securities over volatile assets. A move toward more abundant reserves can ease that pressure and make diversified portfolios—including a small allocation to digital assets—more acceptable.

• Stablecoin and funding flows: Many participants enter and exit Bitcoin markets through stablecoins, which themselves are intertwined with the broader U.S. dollar system. A calmer funding backdrop helps issuers and market makers manage liquidity more efficiently.

• Correlation with global liquidity indicators: While the relationship is far from perfect, Bitcoin has historically performed better during periods when global liquidity is expanding or at least not being aggressively withdrawn.

In that sense, the Fed’s year-end moves provide a modestly supportive backdrop. Liquidity is no longer being pulled away from the system in the same way it was during the peak of QT.

4.2 Why this is not an automatic “risk-on” trigger

At the same time, it would be an oversimplification to declare that Fed operations automatically lead to a sustained rally in Bitcoin or other risk assets. There are at least three reasons for caution:

• Policy rates remain high: Even with stable reserves, the opportunity cost of holding non-yielding assets depends on the level of short-term interest rates. As long as those rates stay elevated, some investors will prefer safe income over volatility.

• Macro uncertainty: Growth data, inflation trends, and political developments all shape expectations for future policy. Any renewed concern about inflation could lead markets to price fewer rate cuts, offsetting the supportive effect of liquidity injections.

• Asset-specific factors: For Bitcoin, regulatory developments, market structure changes, and the behavior of large holders can have as much impact as Fed policy in the short run.

In other words, the Fed’s year-end liquidity operations are best interpreted as a removal of a strong headwind, not the launch of a new rocket booster. They make it easier for risk assets to perform well if other conditions line up, but they do not guarantee any particular price path.

5. How Investors Can Monitor Fed Liquidity Going Forward

For market participants seeking to understand the next phase of this cycle, a few practical indicators are worth tracking:

• Size and composition of the Fed’s balance sheet: Are holdings of Treasury bills and reserves still rising, or has the central bank shifted again toward tightening?

• Usage of repo facilities: Persistent, large-scale reliance on repos can signal deeper stress, while occasional usage around known calendar points (like year-end) is more consistent with normal operations.

• Short-term funding rates: Spreads between key money-market benchmarks and the Fed’s target range offer a real-time view of how comfortable the system is with current reserve levels.

• Market expectations for rate cuts: Futures pricing and yield-curve movements reveal whether investors see the current liquidity measures as a prelude to easier policy or simply as a stabilizing action.

By combining these signals, it is possible to move beyond the simplistic question of “Is the Fed printing?” and instead ask a more precise one: “Is the Fed making it easier or harder for dollars to move through the system?”

6. Conclusion: A Gentle Tailwind, Not a Flood

The end of 2025 finds the Federal Reserve in a delicate balancing act. On the one hand, it is committed to keeping inflation under control and maintaining policy rates at levels that are still restrictive in real terms. On the other, it recognizes that the financial system functions best when bank reserves are ample and funding markets are stable.

By introducing regular purchases of short-term Treasuries and deploying targeted repo operations around year-end, the Fed is attempting to walk that line. The result is a world where liquidity conditions are more supportive than during peak QT, but far from the aggressive stimulus of earlier QE eras.

For Bitcoin and other risk assets, this environment can be described as a gentle tailwind. The central bank is no longer leaning as forcefully against risk-taking as it did when shrinking its balance sheet, and it is actively preventing funding stress that could force rapid deleveraging. However, valuations still need to be justified in a setting of higher real yields and ongoing macro uncertainty.

For long-term investors, the key takeaway is not to chase every headline that mentions liquidity, but to understand the underlying mechanisms. Not all balance-sheet expansions are the same; some are structural, some are technical. The more clearly we distinguish between them, the better we can interpret how macro policy interacts with digital assets.

Disclaimer: This article is for educational and analytical purposes only. It is not investment advice, trading guidance, or a recommendation to buy or sell any asset, including Bitcoin. Financial markets involve significant risk, and readers should conduct their own research and consider consulting qualified professionals before making financial decisions.