When Law Becomes Liquidity: Trump’s Tariffs, Potential Refunds, and the Quiet Risk Behind a “Strategic Bitcoin Reserve”

Markets like stories, but they trade plumbing. A dramatic headline can move prices for an hour; a change in cash flows can move them for a quarter. That’s why the real plotline behind the current tariff debate isn’t whether tariffs are “good” or “bad” politics—it’s whether a legal decision could force a refund pipeline large enough to show up in Treasury financing, corporate margins, and (by extension) the appetite for speculative and non-sovereign assets.

In parallel, crypto is dealing with its own version of “policy as plumbing.” A U.S. Strategic Bitcoin Reserve sounds like a narrative victory, but it also introduces operational questions: who holds the keys, who can sell, who must compensate victims first, and what happens when different agencies interpret the same directive differently. If you want to understand why Bitcoin can rally on good news and still wobble on administrative rumor, this is the lens.

1) The tariff case is not a morality play—it’s a cash-flow question

There’s a common misunderstanding that courts only change “sentiment.” In reality, courts sometimes change settlement. If tariffs imposed under emergency authority are curtailed or invalidated, the market isn’t just repricing a policy preference. It’s repricing the possibility that importers may receive refunds—and that the federal government may need to finance those refunds.

That distinction matters because tariffs are already embedded in corporate cost structures. They influence pricing decisions, inventory cycles, and hedging behavior. A legal reversal can unwind those expectations unevenly: some firms benefit quickly through cash recovery, others face delayed relief, and many are left in a temporary fog where they don’t know what their “true” landed cost will be in six months.

Why markets care: a refund scenario is effectively a surprise transfer—money that was previously paid to the government may flow back to private balance sheets. Whether that behaves like “stimulus” or “stress” depends on timing, funding mechanics, and the macro backdrop.

2) If refunds happen, the first shock may be in bonds—not Bitcoin

In crypto circles, the reflex is to ask: “Is this bullish or bearish for Bitcoin?” But the first-order impact is usually in the risk-free corner of the world. If the government must return a large sum, the question becomes: where does the cash come from?

There are only a few realistic channels. The Treasury can draw down cash, issue more debt, or reallocate spending. Each has different market fingerprints. A large, sudden need for cash can increase near-term bill issuance, shift auction sizes, and move yields—even if equities appear calm. This is how you can get the seemingly strange outcome of stocks holding steady while rates or the dollar do something “out of character.”

Three transmission paths investors often overlook:

• Balance-sheet timing: refunds don’t land everywhere at once. Companies with clean documentation may recover sooner; others may wait through administrative processes. Markets can price the aggregate headline while cash arrives in a lumpy, sector-specific way.

• Margin vs. pricing: some firms may use tariff relief to rebuild margins rather than cut prices. That can look inflationary (prices don’t fall) even if cost pressure eases. In other words, a tariff unwind doesn’t automatically mean a CPI unwind.

• Financing optics: if refund obligations are perceived as deficit-widening, the bond market may demand a higher term premium—especially if growth is still resilient.

That’s why the tariff story can be “risk-on” in equities and “risk-off” in bonds at the same time. It’s not contradictory; it’s just different plumbing.

3) So where does crypto fit? Think collateral, not ideology

Crypto’s reaction to macro legal events is often misdiagnosed because the community tells itself a simpler story: Bitcoin is either a tech stock or digital gold. In practice, it’s also a collateral asset—used directly or indirectly to express risk, hedge, and rotate liquidity.

In a refund scenario, some traders will treat the event as a net liquidity release (private sector receives cash), while others will treat it as a net fiscal stress (government needs more financing). The result can be a two-phase move: an initial rally on the headline of “money returning to the economy,” followed by choppiness if rates rise or if the dollar strengthens.

Why Bitcoin can dip even if the long-term story improves:

• If yields jump, leveraged positions become more expensive to carry.

• If the dollar firms, global risk assets often de-rate mechanically.

• If volatility rises, desks reduce exposure to assets with higher VaR, regardless of narrative.

None of this invalidates the long-term “hard asset” thesis. It simply explains why timing can be messy—and why headlines that sound pro-crypto can still coincide with drawdowns.

4) The “Strategic Bitcoin Reserve” is a promise—execution is the real risk

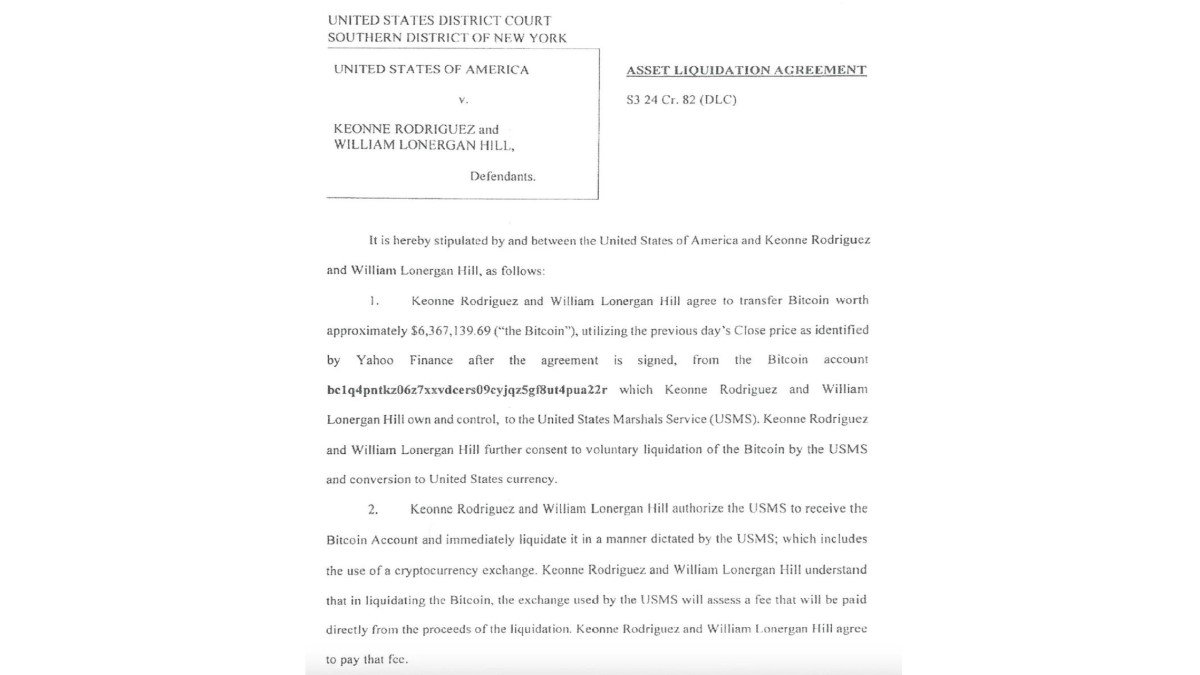

The idea of a Strategic Bitcoin Reserve signals legitimacy: the state is treating Bitcoin as something worth holding rather than something to auction away at the first opportunity. But legitimacy has a bureaucratic cost. When multiple agencies touch the same asset class—law enforcement, courts, custodians, Treasury—tiny procedural differences can produce large market rumors.

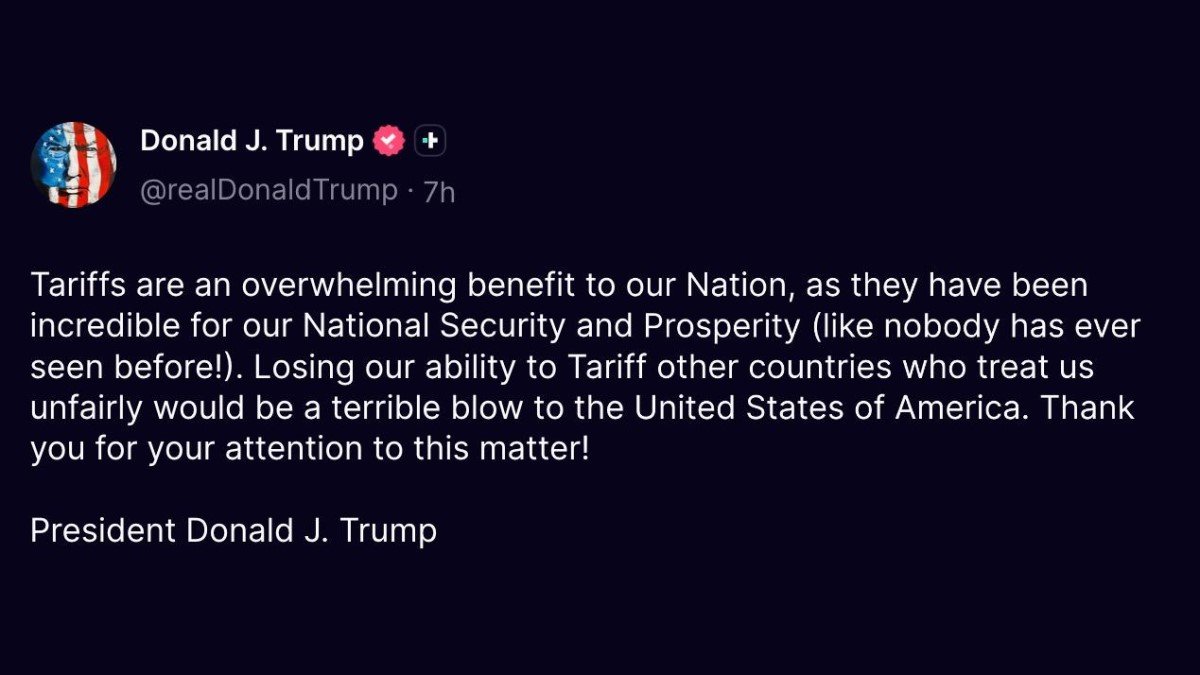

This is where recent chatter matters: claims that seized Bitcoin was sold “despite” a directive to hold it. Whether any specific allegation is accurate is less important than what it reveals: the market is waking up to the reality that policy is not a switch—it’s a system. Systems have handoffs, exceptions, legacy contracts, and human error.

A useful mental model: a reserve announcement changes the strategic intent, but day-to-day asset handling still depends on (1) court orders, (2) victim restitution rules, (3) agency procedures, and (4) custody rails. If any one of those layers conflicts, you get noise—and traders trade noise.

That’s why, even in a broadly supportive environment, “administrative risk” becomes a new volatility source. The irony is that mainstream adoption doesn’t eliminate uncertainty; it changes its shape—from existential risk (bans) to operational risk (process).

5) What to watch next: the calendar that actually moves markets

The next few days won’t be decided by hot takes. They’ll be decided by the sequence of official signals—court timing, Treasury commentary, auction schedules, and how quickly agencies clarify operational rules. If you want an edge that isn’t just copying headlines, watch the order of events, not the emotional volume.

Practical indicators to monitor (educational framing):

• Legal clarity: whether the ruling (or guidance) creates a clean outcome or a long remand process. Markets hate ambiguity more than they hate bad news.

• Treasury financing tone: any hints that refund risk changes near-term issuance expectations.

• Rates sensitivity: if yields rise while equities remain green, it’s a sign the market is pricing fiscal mechanics, not growth fear.

• Crypto microstructure: stablecoin issuance/flows and exchange liquidity often tell you whether a move is “real demand” or just leverage recycling.

Conclusion

The tariff story is a reminder that the most important market events are often legal and administrative, not purely economic. A Supreme Court decision can behave like a macro data release. A refund pipeline can behave like a fiscal program. And a Strategic Bitcoin Reserve can be both a legitimacy milestone and a new source of operational uncertainty.

If you zoom out, there’s a single theme tying everything together: 2026 is increasingly about governance—how fast institutions can translate intent into execution without creating new fragility. Markets don’t trade morality, and they don’t trade slogans. They trade settlement, collateral, and cash flow.

Frequently Asked Questions

Would tariff refunds be bullish for markets?

They can be, but not uniformly. Refunds may support certain corporate balance sheets, while the financing mechanics can pressure rates. The net effect depends on timing and scale.

Does a Strategic Bitcoin Reserve mean the U.S. will never sell seized Bitcoin?

The intent can be “hold,” but execution may still involve court-ordered restitution, administrative processes, and inter-agency coordination. In practice, clarity improves over time as procedures are standardized.

Why might Bitcoin drop on seemingly positive policy news?

Because Bitcoin trades as a high-volatility collateral asset. If rates jump, liquidity tightens, or leverage unwinds, Bitcoin can dip even when the long-run narrative strengthens.

What’s the biggest mistake people make when interpreting these headlines?

Assuming every macro event has a single-direction impact. Most are multi-stage: headline reaction first, then the bond/liquidity reaction, then sector-by-sector repricing.

Disclaimer: This article is for informational and educational purposes only and does not constitute financial, legal, or investment advice. Digital assets and derivatives involve risk, and market outcomes can change rapidly as new information emerges.