Tariffs, Emergency Powers, and a Supreme Court Countdown: Why the Next Ruling Matters Beyond Trade

President Trump’s argument for tariffs is blunt and consistent: he says tariffs are a net positive for the United States—supporting national security and prosperity—and that losing the ability to impose them on countries he views as treating America unfairly would harm the country. That posture matters not only because tariffs affect prices and supply chains, but because they function like a policy shortcut: a way to apply pressure quickly, without waiting for the slower choreography of Congress.

Now the U.S. Supreme Court is weighing a case that could determine how far that shortcut can go. The dispute is not merely whether tariffs are “good” or “bad.” It is whether the federal government can use emergency authorities as a durable foundation for broad tariffs. If that sounds like a technical legal question, it’s because the most consequential power shifts often arrive wearing procedural clothing.

Tariffs as a Multi-Tool: Revenue, Leverage, and Signaling

Tariffs are often discussed as a consumer-price story, but in modern policymaking they behave more like a multi-tool. They can raise revenue, protect domestic industries, and—most importantly in today’s geopolitical context—create negotiating leverage. A tariff threat can be a bargaining chip, a deterrent, or a forcing function designed to change another country’s behavior without deploying military or financial sanctions.

That helps explain why political leaders can sincerely see tariffs as “security policy,” not just “trade policy.” If a government believes key supply chains (energy, semiconductors, critical minerals, defense inputs) are strategic vulnerabilities, then tariffs become one instrument among many to reshape incentives. The argument is not subtle: if dependence is dangerous, then friction can be a feature.

• Revenue logic: tariffs generate government income, though typically not enough to replace broad-based taxes in practice.

• Leverage logic: tariffs can pressure trading partners into concessions, especially when access to the U.S. consumer market is essential.

• Industrial logic: tariffs may accelerate domestic investment in specific sectors, but can also raise input costs for downstream firms.

The Real Legal Question: Who Controls the “Emergency Dial”?

The Supreme Court dispute centers on tariffs imposed under the International Emergency Economic Powers Act (IEEPA), where lower courts have questioned whether the statute authorizes tariffs at this scale. In plain language, the case tests how elastic “emergency” authority can be when used as an ongoing tool of economic statecraft.

That’s why the case matters even to people who don’t track trade policy: it’s a separation-of-powers story. The U.S. Constitution assigns tariff power to Congress, but Congress has also passed laws that delegate specific authorities to the executive branch in certain circumstances. The legal fight is about where delegation ends and invention begins—especially when the executive can move faster than the legislative process.

• If the Court narrows IEEPA-based tariffs: it could force tariff programs to rely more on explicit statutes or congressional action.

• If the Court upholds broad authority: it could cement a precedent that emergency frameworks can support wide trade measures.

• Either way: the ruling clarifies the boundary between “rapid response” and “permanent tool.”

Why Timing Matters: Policy Uncertainty Is Its Own Cost

Legal uncertainty doesn’t only create headlines—it creates operational drag. Businesses plan inventory cycles, supplier contracts, and pricing strategies months ahead. When tariff authority is contested, firms often hedge: building buffers, shifting suppliers, and delaying commitments. Even if a company ultimately adapts, the adaptation has a cost, and that cost can echo through supply chains as higher friction and lower confidence.

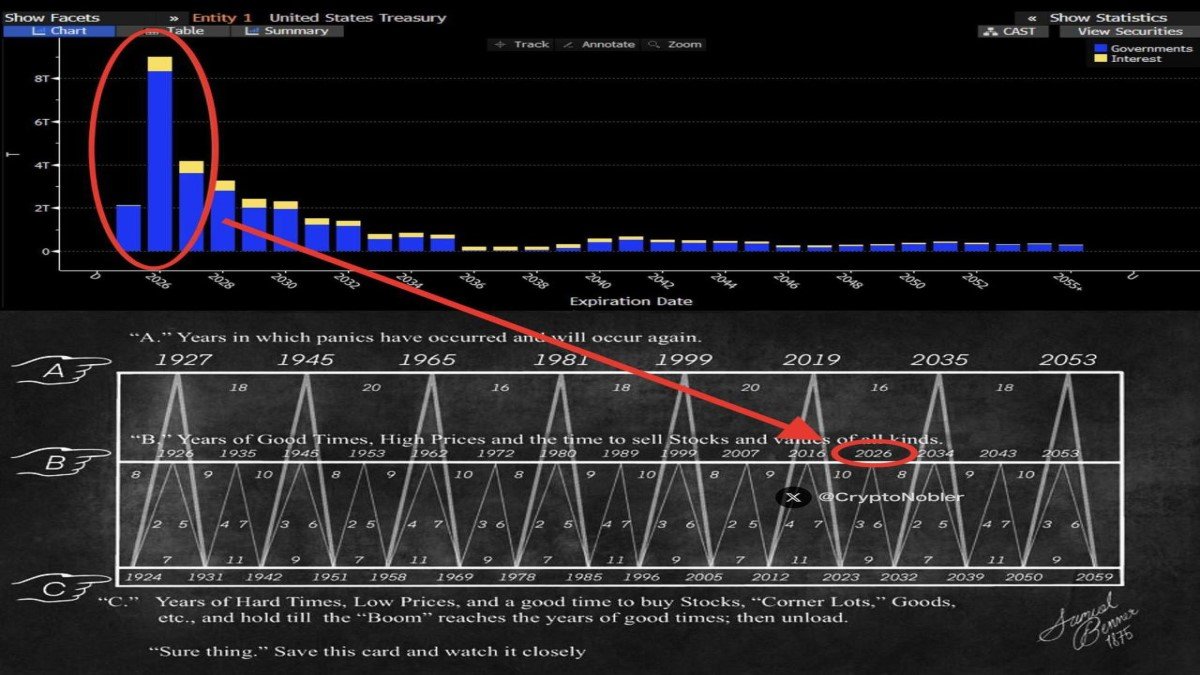

Public reporting indicates the case is on an expedited track, with oral arguments heard in November 2025 and a decision expected by the end of 2025 or early 2026. That schedule concentrates attention because it compresses planning windows: many firms set annual procurement and pricing frameworks around the turn of the year. A ruling landing in early 2026 could quickly reshape expectations for the rest of the year.

Three Plausible Outcomes—and the Second-Order Effects That Matter Most

It’s tempting to turn Supreme Court cases into binary predictions. A better approach is scenario thinking—because markets and businesses respond less to “who wins” and more to “what rules will exist afterward.” Here are three plausible outcome shapes, and why each matters beyond politics.

1) The Court significantly limits emergency tariff authority. If the Court rules that IEEPA does not support sweeping tariffs, the immediate consequence is procedural: future tariff programs would need a different legal foundation. The second-order consequence is strategic: economic pressure tools may become slower to deploy and more dependent on Congress or narrower statutes.

2) The Court allows the tariffs (fully or mostly) under the emergency framework. This outcome would validate a fast-moving model of economic statecraft. The second-order effect is precedent: future administrations—of either party—could inherit a wider playbook for trade pressure under emergency declarations. That may increase policy agility, but it can also increase policy volatility from the perspective of global businesses.

3) A mixed ruling with guardrails. The Court could uphold some tariffs while requiring clearer findings, narrower tailoring, or stronger procedural constraints. This outcome often looks “messy” in the news cycle, but it can be the most stabilizing over time: it clarifies what is permitted, what is not, and what must be documented.

How This Translates to Macro Conditions Without Becoming a Political Rorschach Test

Tariffs feed into macro narratives through a few channels: import prices, corporate margins, and business confidence. Whether the net effect is inflationary or disinflationary can depend on context (exchange rates, demand conditions, supply chain flexibility). But one channel is consistently important: uncertainty itself. When firms can’t predict landed costs, they either raise prices preemptively, reduce promotions, or hold more inventory—all of which can weigh on efficiency.

This is also where the story intersects with broader market sentiment. Even outside equities and FX, risk assets tend to dislike policy instability. That doesn’t mean one ruling is “bullish” or “bearish.” It means clarity often matters more than direction. A predictable rulebook—even a restrictive one—can be easier for markets to price than an open-ended authority that may change month to month.

What to Watch (Educationally) After the Ruling

If you want to understand the impact without turning it into partisan commentary, focus on implementation details. Legal decisions set boundaries; policymakers decide how to operate inside them. The meaningful follow-through will show up in how tariffs are structured, how exemptions are handled, and how the administration frames objectives (revenue, reciprocity, security, or industrial policy).

• Statutory pivot: does policy shift toward other tariff authorities with clearer procedural requirements?

• Refund and compliance mechanics: if tariffs are invalidated, how are duty refunds processed and over what timeline?

• Negotiation posture: do trade talks become more formal and slower—or more transactional and rapid?

• Business behavior: are supply chains restructured as a long-term trend, or do firms treat this as a temporary episode?

Conclusion

President Trump’s claim that tariffs deliver security and prosperity is a policy worldview: tariffs are not merely a tax, but leverage—and leverage is power. The Supreme Court’s review of emergency tariff authority is therefore not just about trade. It’s about how the United States allocates power to impose economic pressure quickly, and what safeguards exist when the tool can reshape global commerce at speed.

For markets and businesses, the most practical takeaway is not “pick a side.” It’s “prepare for a new rulebook.” Whether the Court narrows, validates, or conditions emergency tariff power, the ruling will clarify how much economic statecraft can be executed by executive action alone—and that clarity will shape planning, pricing, and global confidence long after the headline fades.

Frequently Asked Questions

Is this Supreme Court case only about trade policy?

No. While tariffs are the subject, the deeper issue is presidential authority under emergency powers and how that authority interacts with Congress’s constitutional role in setting tariffs.

Why does timing matter so much?

Because policy uncertainty changes business behavior. On an expedited schedule, a decision in early 2026 can affect annual procurement, pricing plans, and supply-chain contracts set around the start of the year.

If the Court limits tariffs, does that mean tariffs go away?

Not necessarily. The executive branch can use other statutory tariff authorities, and Congress can legislate. A limiting decision would mainly change the legal pathway and constraints for imposing broad tariffs under emergency powers.

Does a ruling in favor of tariffs mean higher inflation?

Not automatically. Tariff impacts depend on scope, exemptions, exchange rates, demand, and how companies absorb or pass through costs. Markets often respond strongly to clarity and predictability, not just to the presence or absence of tariffs.

Disclaimer: This article is for educational purposes only and does not constitute legal, financial, or investment advice. Legal outcomes and policy implementation can change rapidly. For decisions affecting your business or investments, consult qualified legal and financial professionals.