If Congress Can’t Trade Stocks: The Real Market Question Is What Happens Next (And Whether Crypto Becomes the Side Door)

At first glance, the idea sounds almost boring: restrict members of Congress from trading individual stocks. It polls well, it fits neatly into the public’s frustration with conflicts of interest, and it comes with a simple moral headline—lawmakers shouldn’t be able to profit from information ordinary investors never see.

But markets rarely move on morals. They move on incentives, loopholes, and the unintended consequences of rules that were designed for yesterday’s plumbing. The more interesting question for 2026 isn’t whether a stock-trading ban is “good” or “bad.” It’s whether the ban meaningfully closes the conflict-of-interest loop—or just pushes it into different assets, different vehicles, and different shadows.

What’s Actually Being Proposed (And Why the Fine Print Matters More Than the Slogan)

In recent legislative discussions, the core concept is straightforward: members of Congress—and often their immediate family—would be prohibited from owning and trading individual stocks and bonds. At the same time, many frameworks still allow diversified exposure through mutual funds and ETFs, essentially saying: “You can invest, but you can’t pick winners and losers one ticker at a time.”

This design choice is not cosmetic. It tells you what the reform is trying to solve. It’s less about banning wealth-building and more about removing the sharpest edge of informational advantage: concentrated bets that can align suspiciously well with committee hearings, regulation timelines, or national security briefings. The real debate begins when you ask: what counts as a concentrated bet in 2026?

Why markets should care: reforms like this live or die on definitions (what assets are covered), enforcement (who audits, who penalizes), and timing (how quickly divestment must happen). In practice, the “ban” is not a single lock; it’s a set of doors with different keys.

Why Crypto Is in the Room—Even When It’s Not Named on the Bill

It’s tempting to treat congressional stock-trading reform as a self-contained ethics story. Crypto traders, builders, and institutional allocators might shrug: “That’s Washington housekeeping.” But crypto’s relationship with policy is unusually reflexive—regulation shapes adoption, and adoption shapes regulation. That means the incentives created by ethics reform can spill into digital assets faster than many people expect.

Here’s the simple mental model: if you close the front door (individual stocks), money doesn’t vanish. It looks for the nearest open window that still offers flexibility, upside, and personal discretion. For most lawmakers, that “window” is probably diversified funds and cash-like instruments. For a minority—especially those with higher risk tolerance—alternative assets become more attractive. And crypto is the most liquid, high-volatility alternative asset class that can be accessed quickly without private-market gatekeeping.

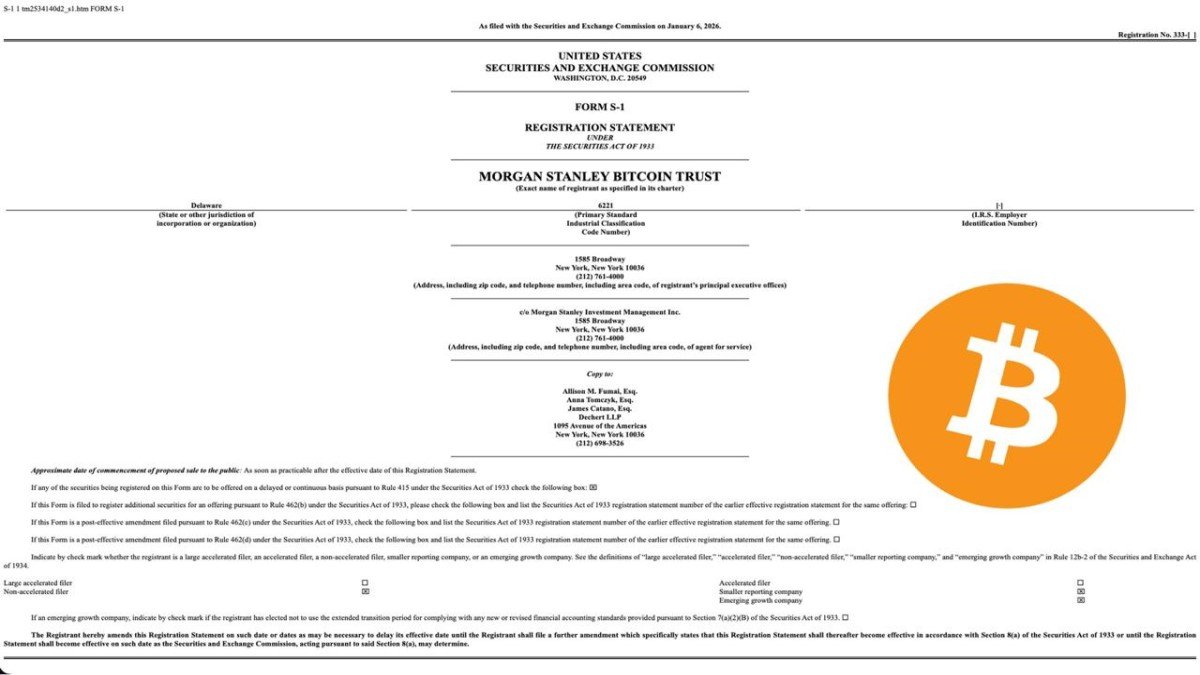

Important nuance: “Crypto” is not one thing. Bitcoin exposure via regulated products is very different from actively trading small tokens. Stablecoins function more like settlement rails than speculative assets. And tokenized treasuries blur the line between traditional fixed income and on-chain finance. If lawmakers are restricted in one bucket, which of these buckets—if any—becomes the pressure valve?

The Substitution Effect: If Stocks Are Restricted, Where Do Incentives Drift?

Most commentary assumes a simple substitution: ban individual stocks and lawmakers shift into ETFs. That will likely happen, but it’s only the first layer. The second layer is behavioral: concentrated bets are not just about returns; they’re about agency. People who like picking individual names don’t always feel satisfied owning a broad index.

When agency is constrained in public markets, it often reappears in assets that are either harder to monitor or easier to rationalize as “not the same thing.” In prior eras, that might have meant sector-specific funds, options, or the quiet build-up of exposure through spouses or affiliated entities. In 2026, it can also mean: commodities, privately held vehicles, and digital assets—especially those with narrative momentum.

So will lawmakers “pour money into crypto” if stocks are banned? It’s possible for some, but the more realistic outcome is messier: a gradual reallocation at the margin, followed by public backlash, followed by attempts to close the new loophole. In other words, crypto may not be the destination—crypto may be the next debate.

The Transparency Paradox: Crypto Is Public… and Still Easy to Hide

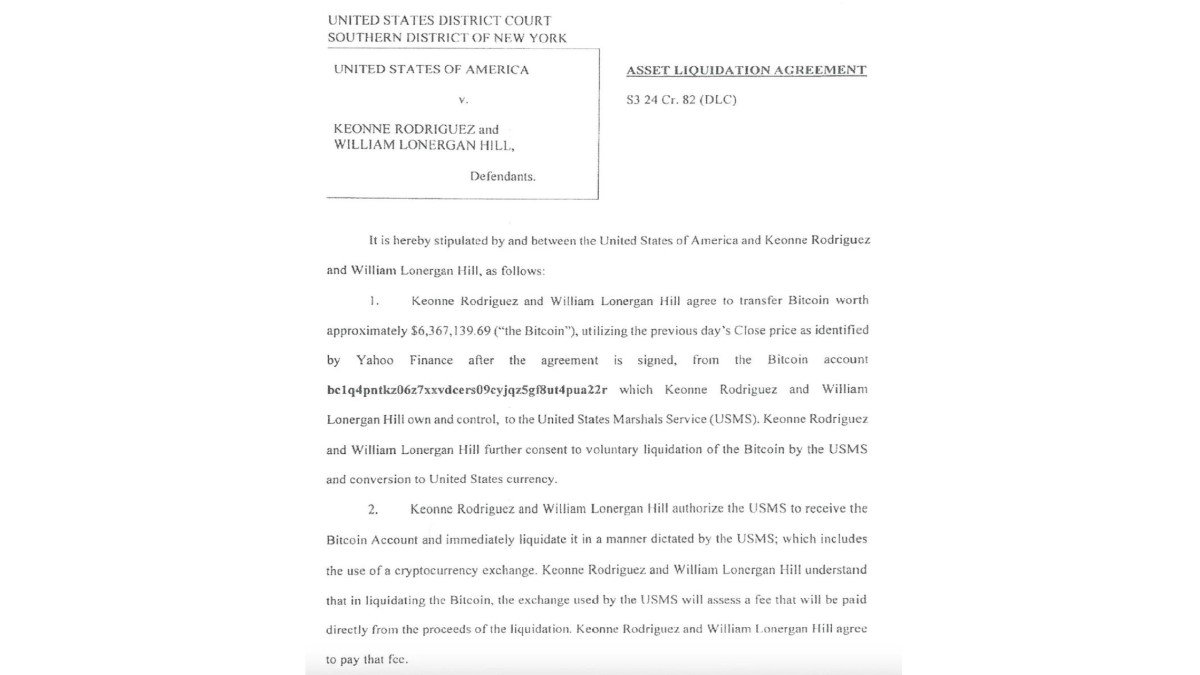

Crypto likes to market itself as transparent: transactions are on-chain, addresses can be tracked, and flows can be analyzed in real time. That’s not wrong—but it’s incomplete. On-chain transparency is strongest when beneficial ownership is clear. In politics, beneficial ownership is rarely clear by default.

A lawmaker can disclose that they “hold digital assets” without revealing active trading patterns, wallet structures, DeFi positions, or exposure routed through funds, relatives, or entities. Even if disclosure rules are robust, enforcement is another layer: regulators and ethics bodies must have the mandate and tooling to interpret modern crypto exposure, not just a checkbox on a form.

This is why a stock-trading ban that is silent on crypto can still increase crypto’s political risk premium. Silence does not mean exemption forever. Silence often means: “We’ll deal with this later, after the first headline.”

How This Connects to Market Structure: The Ethics Story Bleeds Into the Rules Story

Crypto market structure debates usually focus on the big questions: Which regulator has authority? What is a security? How should stablecoins be supervised? But ethics reform changes the tone. Once lawmakers vote to restrict themselves in one market, the public naturally asks: why not in other markets too?

That’s where the market should pay attention. If crypto is perceived as the untouched loophole, political pressure can mount for expansions: broader asset coverage, stricter disclosures, tighter rules around family members, and more aggressive auditing. This doesn’t automatically mean “anti-crypto.” It means “anti-loophole.” And in Washington, anti-loophole energy tends to become anti-ambiguity energy—which can accelerate clearer definitions and enforcement mechanisms.

In practical terms: a stock ban can be a catalyst for more explicit digital-asset language later—either because reformers want consistency, or because opponents want to weaponize the “crypto loophole” as a reason to block the original bill unless it’s broadened.

Three Scenarios for 2026: A Market Map Instead of a Prediction

No one should treat this as a single binary outcome (“ban passes” vs “ban fails”). Policy rarely moves that cleanly. A better approach is to think in scenarios, because each scenario affects crypto through a different channel: sentiment, regulatory clarity, and institutional comfort.

Below are three plausible paths, framed as a map—not a forecast. The goal is to help readers recognize which world they are drifting into based on concrete signals such as bill language, committee statements, and enforcement details.

Scenario A: A narrow stock-and-bond ban passes, crypto remains undefined. This can initially feel “positive” for crypto in a superficial way because it avoids explicit restriction. But it also sets up a second wave: criticism that lawmakers can still trade digital assets. The medium-term risk is follow-on legislation, not the first bill.

Scenario B: A broader ban passes that explicitly includes digital assets (direct holdings and active trading). This reduces loopholes and could actually lower reputational risk for the asset class by removing the “insider advantage” headline. The tradeoff is complexity: definitions must distinguish between long-term holdings, retirement-type exposure, and active trading behavior.

Scenario C: No meaningful ban passes (or it stalls again). This is the highest-volatility political outcome. Markets may not react immediately, but the trust deficit grows—and trust deficits invite populist policy swings later. For crypto, that can mean less predictable regulation, because frustration becomes the fuel for abrupt rulemaking.

What to Watch Without Turning This Into Political Theater

The healthiest way to follow this story is to ignore the loudest takes and track the boring artifacts: legislative text, disclosure requirements, and enforcement mechanisms. The market impact is not in the headline—it’s in the definitions. If a bill says “securities,” does it define digital assets? If it says “commodities,” does it capture on-chain commodities exposure? If it says “family,” does it include dependent adults and trusts?

Also watch for the enforcement engine. A ban without credible auditing becomes symbolic; a ban with credible auditing becomes behavioral. Markets care about behavioral constraints, because they change incentives—and incentives change flows, lobbying intensity, and the probability of future rule expansion.

A grounded takeaway: even if crypto is not mentioned, the direction of travel is toward higher scrutiny of personal trading in public life. If crypto wants to be perceived as financial infrastructure rather than a loophole playground, clarity and compliance will increasingly matter as much as innovation.

Conclusion: This Isn’t “Stocks vs. Crypto.” It’s Trust vs. Loopholes.

It’s easy to turn this into a tribal story: stocks are “legacy,” crypto is “new,” and lawmakers are simply rotating from one to the other. Reality is more structural. The push to ban congressional stock trading is a trust repair project. Trust repair projects rarely stop at the first patch; they expand until the public feels the leak is sealed.

For crypto, the opportunity is not that it might remain an untouched asset class. The opportunity is that, as the financial system modernizes, digital assets can be integrated into clearer frameworks that reduce ambiguity and lower reputational drag. The risk is the opposite: if crypto becomes the obvious loophole, it becomes the obvious target. In 2026, the market isn’t trading ethics. It’s trading what ethics reform does to incentives—and what incentives do to the next set of rules.

Disclaimer: This article is for informational and educational purposes only and does not constitute investment, legal, or tax advice. References to assets or policies are not recommendations to buy, sell, or hold any instrument.