Morgan Stanley’s Bitcoin Filing Isn’t Just “Another ETF”: It’s a Distribution Power Play

When a household Wall Street name shows up with a Bitcoin wrapper, the reflex is to treat it like a price catalyst: “new demand is coming, charts go up.” That framing is tempting—and often wrong. The more durable impact isn’t the first-day candle. It’s how the product rewires who can buy, how they buy, and what “owning Bitcoin” starts to mean inside traditional portfolios.

A Form S-1 cover page circulating online, dated January 6, 2026, references a “Morgan Stanley Bitcoin Trust.” We should treat this as an early signal rather than a finished product: filings evolve, timelines slip, and the final structure (trust vs. ETF-like wrapper, fees, custody, creation/redemption mechanics) can look meaningfully different from the first draft.

A filing is a signal, not a product

In traditional finance, an S-1 is the start of a conversation with regulators and the market—not the conclusion. It’s the document posture that says: “We intend to offer a security to the public; here is what it is, how it works, and what can go wrong.” It’s also where risk factors get written down in plain English, which is precisely why serious institutions care about it: not because it guarantees upside, but because it forces clarity.

That clarity matters because crypto headlines compress nuance into a single word—“ETF”—as if every wrapper behaves the same. In reality, wrappers differ in tax handling, liquidity profile, operational rails, and even how advisors are allowed to discuss them with clients. An S-1 doesn’t promise approval or timing; it simply begins the process of turning an idea into a regulated, distributable instrument.

What the market often misses: the first-order question is not “will this pump Bitcoin?” It’s “which channels does this unlock?” A wrapper that is eligible for certain brokerage platforms, model portfolios, retirement accounts, or internal advisory guidelines can change the buyer mix—even if price barely reacts on day one.

Why that buyer mix matters: institutional demand is usually slower, rules-based, and allocation-driven (rebalance, not chase). That behavior can reduce some types of volatility while increasing others (for example, periodic flows into or out of exposure around quarter-end or risk-parity re-optimizations).

Why Morgan Stanley would want a house-branded Bitcoin wrapper

There’s a simple rule in modern finance: distribution is destiny. If you control the shelf space—private banks, advisory networks, model portfolios—you don’t just “offer” products. You decide what becomes normal. For Bitcoin, “normal” is the whole game. The asset doesn’t need a new story every week; it needs repeatable pathways for compliant allocation.

Morgan Stanley has scale, and scale changes incentives. Even within its Investment Management segment alone, the firm reports total assets under management or supervision in the trillions (about $1,647B as of March 31, 2025). :contentReference[oaicite:1]{index=1} A Bitcoin wrapper inside a platform like that isn’t primarily a speculation vehicle. It’s a capability—something an advisor can point to, document, rebalance, and defend in committee.

Fee capture is only part of the story: yes, a house product can keep economics in-house. But the deeper advantage is risk governance. When a firm approves its own wrapper, it can standardize custody, execution venues, reporting, disclosures, and suitability checks. That reduces operational surprises—one of the biggest reasons institutions hesitate with crypto, even when they’re bullish.

There’s also brand mathematics: some clients don’t want “a Bitcoin ETF.” They want “Morgan Stanley’s Bitcoin allocation tool,” even if the underlying exposure is similar. In wealth management, trust is a product feature. A familiar logo can be a larger adoption lever than a new technical innovation.

The real battlefield is the pipes, not the price

By 2026, the concept of “spot Bitcoin exposure in a wrapper” is no longer novel. What changes is the plumbing: which broker-dealers allow proactive recommendations, which platforms bake Bitcoin into model allocations, and which compliance departments move from “only if the client insists” to “allowed within defined limits.” That shift is quiet—and it’s where adoption actually happens.

So the competitive question isn’t just “who has the lowest fee?” It’s “who owns the distribution relationship and the workflow?” A wrapper connected to research notes, internal portfolio guidance, and advisor training can win flows even if it’s not the cheapest. This is the same dynamic that made index funds a commodity but made distribution platforms the kingmakers.

Think of the ETF as a shipping container: standardized, stackable, and boring. The value is not the container; it’s the ports, cranes, insurance rules, and shipping lanes that move it cheaply and safely. A large bank entering with its own container signals it wants to control more of the shipping lane for Bitcoin exposure—not just rent it from others.

One subtle implication: as more incumbents launch or bless wrappers, the center of gravity moves from “crypto-native rails” to “portfolio-native rails.” Bitcoin becomes less of a trade and more of a line item—something measured against equities, bonds, gold, and cash management rather than against the latest alt narrative.

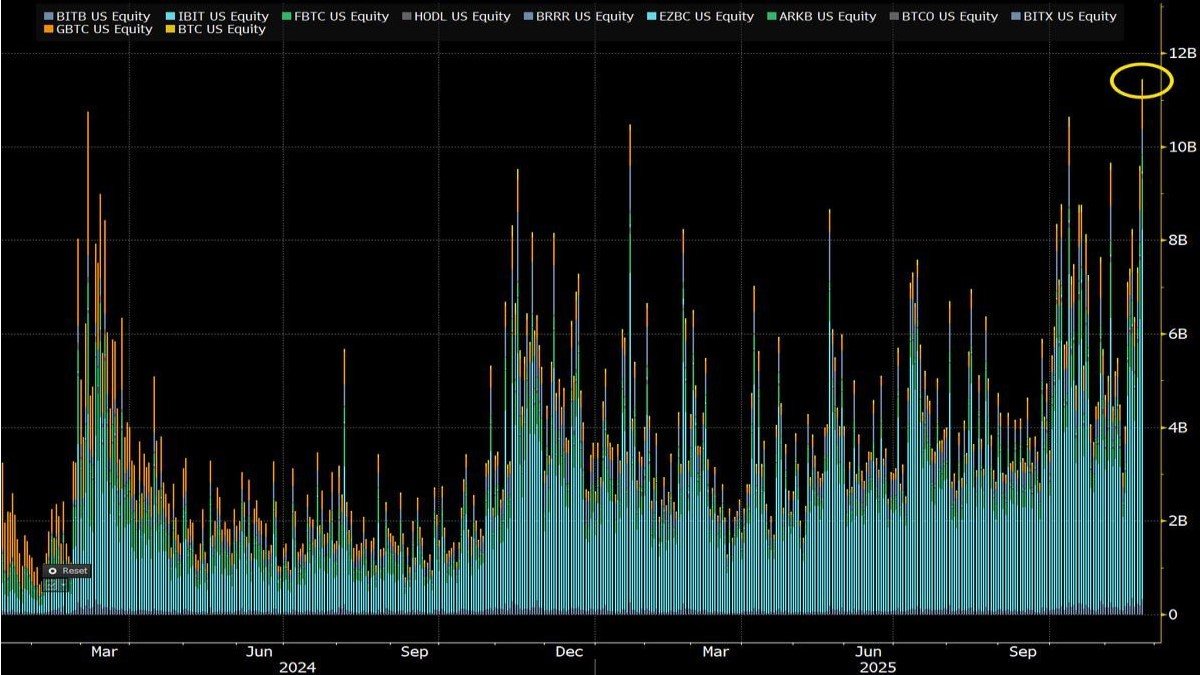

Market structure: how ‘advisory flows’ behave differently than ‘trader flows’

When traders dominate, the market’s tempo is leverage, liquidations, and reflex. When advisors and institutional allocators dominate, the tempo becomes policy: risk bands, rebalancing schedules, and committee constraints. That doesn’t eliminate volatility, but it changes its texture. You get fewer “because vibes” rallies and more “because model portfolios updated their weights” moves.

This is where a Morgan Stanley-style wrapper could matter even without headline-grabbing inflows. Wealth flows are sticky when they’re embedded into policy. A 1–3% allocation in a diversified model portfolio isn’t a bet on next month; it’s an institutional decision that survives drawdowns because it’s justified as diversification, not as a punt.

Potential second-order effects: (1) tighter liquidity expectations because advisors care about tracking, spreads, and execution quality; (2) greater focus on custody and auditability because operational risk becomes the real battleground; (3) more demand for hedging instruments (options, futures) used prudently—not to gamble, but to control exposure bands.

But don’t romanticize it: institutionalization can also concentrate risk. When many portfolios share similar risk models, they can sell together—especially in macro shocks when correlations spike. The “adult money” narrative is comforting, but adults can panic too; they just fill out more paperwork while doing it.

What to watch next: a practical checklist (without the hype)

If Morgan Stanley follows through, the most important details will be boring—and that’s good. Boring details determine whether a product is a toy, a tool, or infrastructure. The market will argue about price targets; you should watch the mechanics that decide who can buy, how safely, and under what rules.

Here’s the checklist that actually matters once more information emerges from subsequent amendments and disclosures. :contentReference[oaicite:2]{index=2}

1) Structure: Is it a grantor trust, an ETF-like vehicle, or something hybrid? Structure drives tax handling, redemption mechanics, and platform eligibility.

2) Fees and tracking: Not “low vs high” in abstract, but whether total friction (fees + spreads + slippage) is competitive for large allocations.

3) Custody model: Which custodians, what insurance posture, what segregation model, and what operational controls? Institutions won’t compromise here.

4) Creation/redemption plumbing: Authorized participants, cash vs. in-kind flows, and the role of prime brokers determine how efficiently the wrapper absorbs demand.

5) Advisory posture: Will the product be accompanied by official allocation guidance and training? That’s the difference between “available” and “adopted.”

Conclusion

If the Morgan Stanley Bitcoin Trust filing progresses, it should be read less as a one-off headline and more as a signal that Bitcoin is being pulled deeper into the existing machinery of wealth management. The story isn’t “a new buyer arrived.” The story is “an old buyer found a compliant habit.” Habits beat hype in finance.

And that’s the real thesis: in the long run, Bitcoin’s institutional era won’t be announced by fireworks. It will arrive the way most structural shifts arrive—through forms, committees, and distribution rails that quietly turn an exotic asset into a default option.

Frequently Asked Questions

Is an S-1 filing the same as SEC approval?

No. An S-1 begins the registration process; approval/effectiveness can take time and may require amendments. :contentReference[oaicite:3]{index=3}

Does this guarantee big inflows into Bitcoin?

No. Even large platforms roll out new products gradually, often with cautious suitability rules. The bigger impact is enabling repeatable allocation pathways.

Trust or ETF—does it matter?

Yes. Structure influences taxes, liquidity, operational rails, and which accounts/platforms can access the product.

Could institutional participation reduce Bitcoin volatility?

It can change volatility’s shape (more allocation-driven flows, more hedging), but it doesn’t eliminate risk—especially during macro shocks when correlations rise.

What’s the single most important detail to watch?

Distribution policy: whether advisors can proactively recommend it with clear internal guidance. That is often the difference between “a product exists” and “a product becomes standard.”

Disclaimer: This article is for educational and informational purposes only and does not constitute investment advice, a solicitation, or a recommendation to buy or sell any asset. Crypto assets are volatile and carry significant risk, including loss of principal. Product details discussed here may change as filings are amended or reviewed.